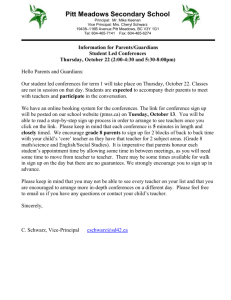

Archived Document Information identified as archived on the Web is

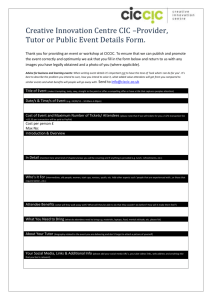

advertisement