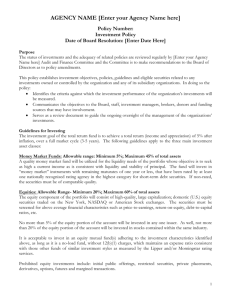

Unit II

advertisement