TR 2014/4

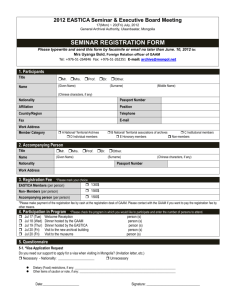

advertisement