Microeconomics Study Sheet

advertisement

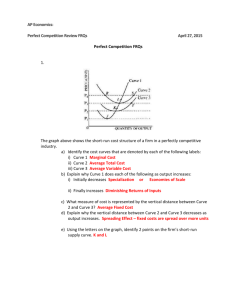

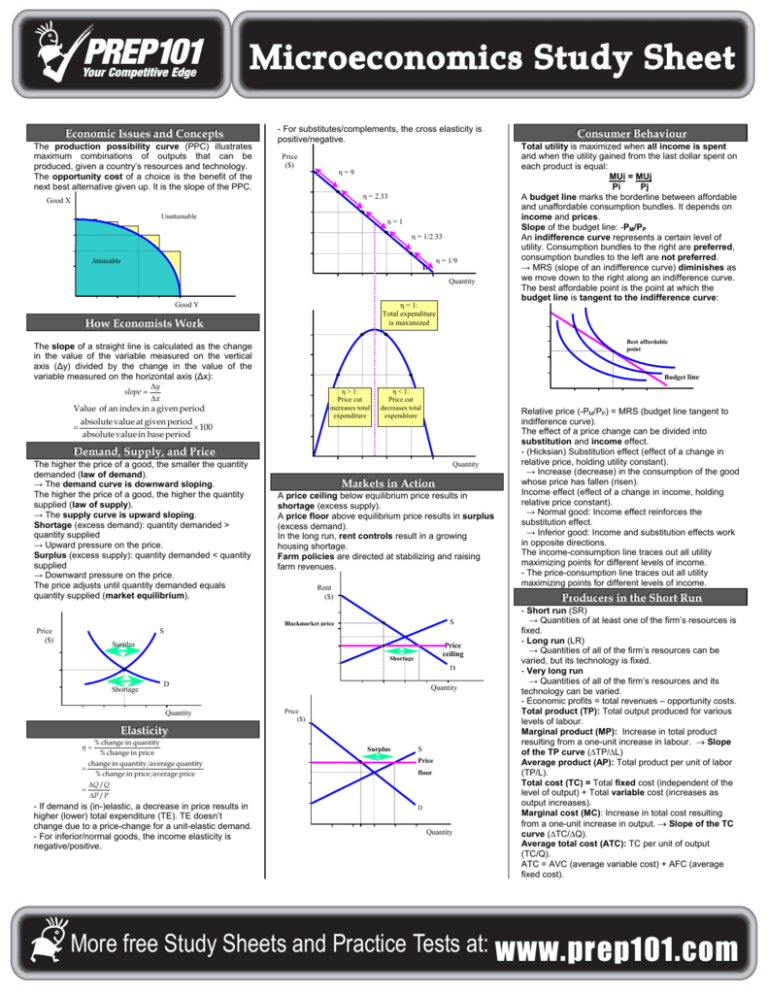

Microeconomics Study Sheet EEEcccooonnnooom C m Cooonnnccceeeppptttsss miiicccIIIssssssuuueeesssaaannndddC The production possibility curve (PPC) illustrates maximum combinations of outputs that can be produced, given a country’s resources and technology. The opportunity cost of a choice is the benefit of the next best alternative given up. It is the slope of the PPC. - For substitutes/complements, the cross elasticity is positive/negative. Price ($) η=9 η = 2.33 Good X Unattainable η=1 η = 1/2.33 η = 1/9 Attainable D Quantity η = 1: Total expenditure is maximized Good Y H W m w H Wooorrrkkk miiissstttsssW wEEEcccooonnnooom Hooow Best affordable point The slope of a straight line is calculated as the change in the value of the variable measured on the vertical axis (∆y) divided by the change in the value of the variable measured on the horizontal axis (∆x): slope = Budget line ∆y ∆x η > 1: Price cut increases total expenditure Value of an index in a given period = absolute value at given period × 100 absolute value in base period η < 1: Price cut decreases total expenditure D m D maaannnddd,,,SSSuuupppppplllyyy,,,aaannndddPPPrrriiiccceee Deeem The higher the price of a good, the smaller the quantity demanded (law of demand). → The demand curve is downward sloping. The higher the price of a good, the higher the quantity supplied (law of supply). → The supply curve is upward sloping. Shortage (excess demand): quantity demanded > quantity supplied → Upward pressure on the price. Surplus (excess supply): quantity demanded < quantity supplied → Downward pressure on the price. The price adjusts until quantity demanded equals quantity supplied (market equilibrium). Quantity M A M Accctttiiiooonnn MaaarrrkkkeeetttsssiiinnnA A price ceiling below equilibrium price results in shortage (excess supply). A price floor above equilibrium price results in surplus (excess demand). In the long run, rent controls result in a growing housing shortage. Farm policies are directed at stabilizing and raising farm revenues. Rent ($) Relative price (-PM/PP) = MRS (budget line tangent to indifference curve). The effect of a price change can be divided into substitution and income effect. - (Hicksian) Substitution effect (effect of a change in relative price, holding utility constant). → Increase (decrease) in the consumption of the good whose price has fallen (risen). Income effect (effect of a change in income, holding relative price constant). → Normal good: Income effect reinforces the substitution effect. → Inferior good: Income and substitution effects work in opposite directions. The income-consumption line traces out all utility maximizing points for different levels of income. - The price-consumption line traces out all utility maximizing points for different levels of income. PPPrrroooddduuuccceeerrrsssiiinnnttthhheeeSSShhhooorrrtttR R Ruuunnn S Blackmarket price S Price ($) C B m C Beeehhhaaavvviiiooouuurrr meeerrrB Cooonnnsssuuum Total utility is maximized when all income is spent and when the utility gained from the last dollar spent on each product is equal: MUi = MUj Pi Pj A budget line marks the borderline between affordable and unaffordable consumption bundles. It depends on income and prices. Slope of the budget line: -PM/PP An indifference curve represents a certain level of utility. Consumption bundles to the right are preferred, consumption bundles to the left are not preferred. → MRS (slope of an indifference curve) diminishes as we move down to the right along an indifference curve. The best affordable point is the point at which the budget line is tangent to the indifference curve: Surplus Price ceiling Shortage - Short run (SR) → Quantities of at least one of the firm’s resources is fixed. - Long run (LR) → Quantities of all of the firm’s resources can be varied, but its technology is fixed. - Very long run → Quantities of all of the firm’s resources and its technology can be varied. - Economic profits = total revenues – opportunity costs. Total product (TP): Total output produced for various levels of labour. Marginal product (MP): Increase in total product resulting from a one-unit increase in labour. → Slope of the TP curve (∆TP/∆L) Average product (AP): Total product per unit of labor (TP/L). Total cost (TC) = Total fixed cost (independent of the level of output) + Total variable cost (increases as output increases). Marginal cost (MC): Increase in total cost resulting from a one-unit increase in output. → Slope of the TC curve (∆TC/∆Q). Average total cost (ATC): TC per unit of output (TC/Q). ATC = AVC (average variable cost) + AFC (average fixed cost). More free study sheet and practice tests at: D Shortage D Quantity EEElllaaassstttiiiccciiitttyyy η= % change in quantity % change in price change in quantity average quantity = % change in price average price = Quantity Price ($) Surplus S Price floor ∆Q /Q ∆P / P - If demand is (in-)elastic, a decrease in price results in higher (lower) total expenditure (TE). TE doesn’t change due to a price-change for a unit-elastic demand. - For inferior/normal goods, the income elasticity is negative/positive. D Quantity More free Study Sheets and Practice Tests at: www.prep101.com More free study sheets and practice tests at Because of initially increasing returns and eventually decreasing returns, the average total cost curve is u-shaped MP & AP (units) Point of diminishing marginal return Point of diminishing average returns AP MP www.prep101.com marginal revenue = average revenue = market price. MR = AR = p Short run economic profits (losses) induce firms to enter (exit) the industry. Industry supply increases (decreases), the market price falls (rises) and in the long run, economic profits return to zero. Shutdown point: p = AVCMIN The marginal cost curve above the shutdown point traces out the firm’s short run supply curve. The short run industry supply is simply the sum of the quantities supplied by all firms at each given price. Long run equilibrium - Economic profits are zero. Labour Price PPPrrroooddduuuccceeerrrsssiiinnnttthhheeeLLLooonnngggR R Ruuunnn ($) In the long run, all factors are variable (“plant size is variable”). The long run average cost curve traces out the lowest attainable average total cost at each output when both capital and labour inputs can be varied. Profit maximization is equivalent to cost minimization. - Firms choose the combination of capital and labour such that MPK = MPL pK Economic profit Diminishing returns occur for any given quantity of capital (labour) as the quantity of labour (capital) increases. → MPK (MPL) decreases as more capital (labour) is employed. Economies of scale - Fall in ATC as firm’s scale of production increases. (increasing returns to scale). Diseconomies of scale - Rise in ATC as firm’s scale of production increases. (decreasing returns to scale).. Constant returns to scale - Constant ATC as firm’s scale of production increases. (constant returns to scale). Minimum efficient scale - Smallest quantity of output at which LRAC reaches its lowest level. Isoquant - Whole set of technically efficient factor combinations for producing a given level of output. Marginal rate of substitution between two factors is equal to the ratio of their marginal products. - Slope of an isoquant at a particular point. Isocost line shows alternative combinations of factors that a firm can buy for given total cost. - Slope = - (factor price ratio). Cost minimization ($) P* = TC* M D Quantity In oligopoly, firms are aware of interdependence among the decisions made by the various firms in the industy → strategic behaviour. Barriers to entry ensure that economic profits can persist in the long run. EEEcccooonnnooom m miiicccEEEffffffiiiccciiieeennncccyyyaaannndddPPPuuubbbllliiicccPPPooollliiicccyyy Quantity pL Price M M Mooonnnooopppooolllyyy A single price monopolist maximizes profit by producing the output level at which marginal revenue = marginal cost. → Note that marginal revenue < market price. → Compared to perfect competition, equilibrium output is lower and equilibrium price is higher (inefficient). Efficiency loss (deadweight loss). Productive efficiency requires that total cost in an industry is minimized. Allocative efficiency → p = MC for each product. Industries in which firms have a certain degree of market power result in allocative distortion (inefficiency), because p > MC. There exists income distortion when profits/losses occur. Imposing marginal cost pricing on a natural monopoly results in allocative efficiency, but the monopolist generally incurs economic profits or losses. Imposing average cost pricing on a natural monopoly results in zero economic profits, but the outcome is generally allocatively inefficient. Price ($) Price MC ($) ATC Economic profit ATC Loss with MC pricing MC M D Quantity Price-discriminating monopoly: Producer charges different prices for different units of the same product for reasons not associated with differences in cost. A (perfectly) price discriminating monopolist converts consumer surplus into profit by charging each buyer the maximum amount that he is willing to pay. → The outcome is efficient, with smaller consumer surplus and larger producer surplus. Monopoly profits can persist in the long run if there are effective barriers to entry. Cartels as monopolies: Organization of producers who agree to cooperate and act as a single seller. Cartels are unstable due to incentive to cheat for each firm. D Quantity Price ($) MC More free study sheet and practice tests at: pL MPL = pK MPK Cost ($) IIIm m C m mpppeeetttiiitttiiiooonnn Cooom mpppeeerrrfffeeeccctttC AT Minimum efficient scale Economies of scale Constant returns to scale AT Diseconomies of scale Output C M m C Maaarrrkkkeeetttsss mpppeeetttiiitttiiivvveeeM Cooom The profit maximizing output level is the quantity at which marginal revenue = marginal cost. (MR = MC) In monopolistic competition there may be economic profits in the short run. Each firm supplies its differentiated product to a small segment of the market. However, free entry/exit assures that in the long run, economic profits are zero (at the quantity where MC = MR, p = ATC). ATC Profit with MC pricing D Quantity FFFaaaccctttooorrrPPPrrriiiccciiinnngggaaannndddFFFaaaccctttooorrrM M Mooobbbiiillliiitttyyy Factors of production are capital, land, an labour. Factor demand is derived from the demand of the final good or service that the factor produces. A profit maximizing firm hires up the point where: marginal cost(MC) = Marginal revenue product (MRP) = MR*MP Total factor income = factor price * level of employment. = transfer earnings + economic rent. Helping students since 1999 Microeconomics Study Sheet is equal to the economy’s capital stock. - Accumulation of capital leads to a decrease in the equilibrium interest rate. - Technological improvements lead to an increase in the equilibrium interest rate. Present value of a single future payment PV = MRP/(1 + i)t Present value of a stream of payments that continues forever PV = MRP/i Hotelling’s rule: The socially optimal rate of extraction of any non-renewable resource is such that its price increases at a rate equal to the interest rate. Wage ($) S Unaffordable Transfer earning D Price ($) Elastic demand S + tax S tax rev. Excess burden M m G M meeennntttIIInnnttteeerrrvvveeennntttiiiooonnn Gooovvveeerrrnnnm MaaarrrkkkeeetttFFFaaaiiillluuurrreeesss///G Rent ($) Markets fail to achieve allocative efficiency in presence of market power, externalities, public goods, asymmetric information, and missing markets. With a positive externality, a competitive market will produce too little of the good. With a negative externality, a competitive market will produce too much of the good. MSC: Marginal social cost MSC = external cost imposed on the beach resort). Coase theorem: If property rights exist and transaction costs are low, private transactions are efficient, regardless of who has the property right. Non-rivalrous goods: consumption by one person does not reduce consumption by another person. → Marginal cost of an additional user is zero. → To reach allocative efficiency, the price should be zero. Non-excludable goods: impossible/extremely costly to prevent someone from consuming a good. Public goods (those which are non-rivalrous and nonexcldable) give rise to free-rider problem S Unaffordable Econ. rent D Wage S ($) Unaffordable Econ. rent Transfer D earning Cost & benefit ($) LLLaaabbbooouuurrrM M Maaarrrkkkeeetttsss Wage differentials in competitive markets may result from differences in working conditions, in inherited skill, in human capital, or from some form of discrimination. Two general cases that give rise to noncompetitive labor markets are the presence of a union (monopoly in selling labor) and / or of a monopsony (single buyer of labor). A binding minimum wage reduces employment in competitive labor markets; however, it may lead to an increase in employment in case employers have some monopsony power. Monopsony: a single buyer in the market Wage rate ($/h) External cost MC Competitive eqm. Quantity Price ($) S + tax tax rev. S Excess burden D Quantity T T m G T Trrraaadddeee mIIInnnttteeerrrnnnaaatttiiiooonnnaaalllT Gaaaiiinnnsssfffrrrooom ThhheeeG Gains from trade arise from different opportunity costs. → Specialization in the activity in which opportunity costs are lowest. Countries export goods for which they have a comparative advantage. Countries import goods for which they have a comparative disadvantage. Terms of trade: Ratio of the (average) price of a country’s exports to the (average) price of its imports. Index of Export Prices Terms of Trade = × 100 Index of Import Prices Good X D = MB Inelastic demand Country A Quantity EEEnnnvvviiirrrooonnnm m meeennntttaaalllPPPooollliiicccyyy Consumption possibilities … with trade Profit maximizing firms produce too much relative to the allocatively efficient level of output if MC < MSC (due to negative externality). The allocatively efficient level of pollution is the level where MC of further pollution abatement = MB of pollution reduction. Policies used to regulate pollution are direct controls, emissions taxes, and tradable pollution permits. More free study sheet and practice tests at: MC S T T TaaaxxxaaatttiiiooonnnaaannndddPPPuuubbbllliiicccEEExxxpppeeennndddiiitttuuurrreee w2 Profit Competitve eqm w0 w1 Efficient outcome D Monopsony eqm qM qPC MRP = D Labour C R N C Reeesssooouuurrrccceeesss NaaatttuuurrraaalllR CaaapppiiitttaaalllaaannndddN Profit maximizing firms purchase new capital up to the point where the present value of the stream of future MRPs is equal to the purchase price of that unit. The interest rate is determined in the capital market and adjusts such that the quantity of capital demanded The most important taxes in Canada are personal income tax, corporate income tax, excise and sales taxes, and property taxes. Progressive tax: marginal tax rate increases as income increases. Proportional tax: marginal tax rate is the same for all levels of income. Regressive tax: marginal tax rate decreases as income increases. Efficiency and equity are often competing goals. … without trade; Good Y Good X Country B Consumption possibilities … with trade … without trade; Good Y Law of one price: When a product which can be cheaply transported is traded throughout the entire world, it will tend to have a single world price. More free Study Sheets and Practice Tests at: www.prep101.com