Captive re/insurance in Ireland

advertisement

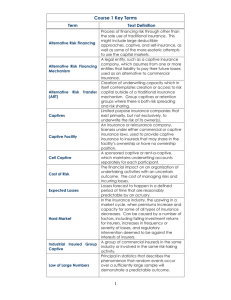

Captive re/insurance in Ireland March 2014 www.dima.ie Captive re/insurance in Ireland 1 What is a captive? A captive is defined by the Central Bank of Ireland (CBI)* as: “An insurance or reinsurance undertaking, owned either by a financial undertaking other than an insurance or reinsurance undertaking or a group of insurance or reinsurance undertakings within the meaning of point (c) of Article 212(1) of Directive 2009/138/EC (the Solvency II Directive) or by a non-financial undertaking, the purpose of which is to provide insurance or reinsurance cover exclusively for the risks of the undertaking or undertakings to which it belongs or of an undertaking or undertakings of the group of which it is a member.” Captive re/insurance companies are used as a risk management tool by their parent companies and can assist parent companies by: reducing insurance costs; gaining access to reinsurers; providing solutions for risks that may not be easily insurable in the traditional risk transfer market; and providing greater risk management control, as well as control of own loss data. *The Central Bank of Ireland (CBI) is responsible for financial regulation in Ireland Types of captives in Ireland There are more than 100 insurance and reinsurance captives in Dublin. The types of risks underwritten by captives in Ireland include traditional risks such as: accident sickness aircraft property damage business interruption goods in transit motor vehicle liability credit employers’ liability general liability Classes 1-18 as defined by the CBI are covered by captives and the full list of classes can be viewed here. www.dima.ie Captive re/insurance in Ireland 2 Captive insurers and reinsurers also cover non-traditional risks such as: employee benefits, including US employee benefits through US-domiciled branches of Irish captives product liability miscellaneous financial loss workers’ compensation retentions Captives and DIMA DIMA (Dublin International Insurance & Management Association) was founded in 1990 to represent the emerging international re/insurance industry in Ireland, including self-managed captives and captive management companies. Captives remain a key element of DIMA’s membership. DIMA engages continuously with Irish, European and other authorities globally to best represent its members’ interests, and has been highly active in the development of captive-related provisions within Solvency II, the new regulatory framework for the European re/insurance industry. DIMA has been awarded “Solvency II initiative of the year” in both 2013 and 2014 for its work on developing corporate governance and risk assessment programmes. DIMA’s CEO Sarah Goddard is ranked #25 in the list of Power 50 global influencers for the captives industry. DIMA promotes high business and ethical standards within the Irish international re/insurance community through education and training, and the provision of relevant market information. DIMA is an observer member of the IAIS (International Association of Insurance Supervisors), a founder member of the GFIA (Global Federation of Insurance Associations) and is represented on the executive committee of IFSC Ireland and on the IFSC Insurance Working Group, under Ireland’s Clearing House Group. www.dima.ie Captive re/insurance in Ireland 3 Why Ireland? A captivating place for business Many different factors have contributed to Ireland’s success as a captive re/insurance centre. These include: Ireland is a recognised leading captive domicile centre with 25 years’ history and expertise; the market has a deep pool of experienced and emerging talent with a wealth of re/insurance expertise ranging from operations, underwriting, accounting, auditing, tax and actuarial to legal and compliance, with specific captive market expertise; Ireland is ranked #1 in Forbes magazine’s “best countries for business” 2013; Ireland is ranked #1 for foreign direct investment and technology transfer, according to the World Economic Forum’s Global Competitiveness Report 2012-2013; DIMA offers a collegiate environment for captives via its sub-committee structure, as well as representing the interests of the captive community; geographically, Ireland is an excellent location to access EU/European, US, Middle Eastern and Asian markets; captives can avail of EU FOE (freedom of establishment) or FOS (freedom of services) from a base in Ireland without the need for local representation in EU/EEA countries; under FOS provisions, a captive insurer can cover pan-European insurance programmes on a direct basis; the CBI provides a robust and predictable supervisory function which incorporates the principle of proportionality for the captive market. An example of this is the corporate governance code for captive insurance and reinsurance entities; double taxation treaties with 70 countries; Federal Excise Tax (FET) exemption is in place under the US-Ireland double taxation treaty (subject to certain conditions being met); 12.5% corporation tax rate; no general thin capitalisation rules; no capital duty; no stamp duty or insurance premium tax where a risk is located outside Ireland. www.dima.ie Captive re/insurance in Ireland 4 Authorisation process All captive insurance and reinsurance undertakings are regulated by the Central Bank of Ireland (CBI) and are required to undergo an authorisation process in order to obtain a license. Non-life insurance captive undertakings should access the Checklist for completing and submitting a captive non-life insurance application for more details on making an application to the CBI. Non-life reinsurance captive undertakings should access the Checklist for completing and submitting a captive non-life reinsurance application for more details on making an application to the CBI. Alternatively, interested parties can contact any of the captive management companies in Ireland. See the DIMA members listing on www.dima.ie for a list of captive management companies in Ireland. For entities seeking to set up a special purpose reinsurance vehicle (SPRV) in Ireland, the CBI’s checklist for completing and submitting special purpose reinsurance vehicle applications under the reinsurance regulations (S.I. 380 of 2006) can be found here. Application fees and annual levies Currently the CBI does not charge a fee for re/insurance license applications. Where a company is subject to regulation by the CBI, fees are aligned with the regulated entity’s PRISM* rating. The table below shows the most recent fee levels for re/insurers in each of the PRISM impact categories: 2013 Funding Levy fee table Impact Category Low Medium Low Medium High High Ultra High Levy €8,369** €25,233 €126,929 €555,122 €1,223,409*** * PRISM is the CBI’s “Probability Risk and Impact SysteM” which is a systemic risk-based framework against which the CBI assesses supervisory requirements. ** Most Irish regulated captives fall within the low or medium/low categories *** This rating is aimed at major Irish retail insurers and banks www.dima.ie Captive re/insurance in Ireland 5 The CBI introduced its Probability Risk and Impact SysteM (PRISM) framework in late 2011. The ratings are set according to the systemic risk posed by regulated entities, and firms are assigned one of the following categories: Super High ‒ Firms that pose the greatest systemic risk and require the highest levels of supervision. High ‒ Firms that pose a high systemic risk and require a high level of supervision. Medium/High ‒ Firms that pose some systemic risk and require quite a high level of supervision. Medium/Low ‒ Firms that pose a small amount of systemic risk and require a moderate amount of supervision. Low ‒ Firms that pose little or no systemic risk. Pure captives come under this rating and they require minimal supervision. (It is worth noting that due to the level of trust implicit in this category, if “Low” firms are in breach of regulations, the resulting penalties are proportionately higher.) Capital requirements Under the current Solvency I regime the minimum guarantee fund and solvency margin are as follows: Minimum guarantee fund: €2.5-€3.7m for captive insurance undertakings €1.2m for captive reinsurance undertakings Solvency margin: 125% for captives writing pure property (classes 8 and 9) and ancillary business services (class 16) 150% for all other classes www.dima.ie Captive re/insurance in Ireland 6 CBI regulatory requirements Captive insurance and captive reinsurance undertakings are required to comply with the CBI’s Corporate Governance Code for Captive Insurance and Captive Reinsurance Undertakings and the Fitness and Probity standards. Full details of the Captive Corporate Governance Code and FAQs can be accessed here. Full details of the Fitness and Probity standards along with FAQs can be accessed here. The following guidelines are applicable for captive non-life insurance undertakings: Operational guidance applicable to captive insurance undertakings The following guidelines may apply to some captive non-life insurance undertakings: General good requirements for insurance and reinsurance companies Guidelines for insurance companies on the risk management of derivatives Guidelines for insurance companies on asset management Guidelines on the actuarial certification of the technical reserves of non-life companies Further information on the various non-life insurance guidelines can be accessed here. The following guidelines are applicable for captive non-life reinsurance undertakings: Requirements for non-life reinsurance undertakings The following guidelines may apply to some captive non-life reinsurance undertakings: General good requirements for insurance and reinsurance companies Guidelines for insurance companies on asset management Guidelines on the reinsurance cover of primary insurers and the security of their reinsurers Further information on the various non-life reinsurance guidelines can be accessed here. www.dima.ie Captive re/insurance in Ireland 7 Legislation These are some of the main pieces of legislation applicable to captive insurance and reinsurance undertakings. Legal requirements for captive insurance undertakings Insurance Act, 1936, Insurance (Amendment) Act, 1938 Central Bank and Financial Services Authority of Ireland Act 2004 The Criminal Justice (Money Laundering and Terrorist Financing) Act 2010 A more exhaustive list of relevant Acts and statutory instruments is available from the CBI website here. Legal requirements for captive reinsurance undertakings Central Bank Act 1942 Insurance Act 1989, 2000 S.I. 380 of 2006 ‒ European Communities (Reinsurance) Regulations 2006 A more exhaustive list of relevant Acts and statutory instruments is available from the CBI website here. Other Acts of importance to captive insurance and reinsurance undertakings Companies Acts 1963-2012 http://www.cro.ie/en/downloads-legislation-company.aspx Data Protection Act 1988-2003 http://dataprotection.ie/docs/LAW-ON-DATA-PROTECTION/795.htm The data protection website also has links to EU data protection legislation. www.dima.ie Captive re/insurance in Ireland 8 Solvency II Solvency II is a new risk-based regulatory regime for the EU’s re/insurance industry. It is anticipated that Solvency II will commence on 1 January 2016 and existing minimum capital requirements will be modified as part of the far-reaching changes to be implemented under the Solvency II programme. In light of EIOPA's* request for national regulatory authorities to implement interim measures in advance of Solvency II, the CBI has produced Guidelines on Preparing for Solvency II. Proportionality has been applied and CBI has aligned the guidelines with PRISM. The Guidelines on Preparing for Solvency II include: System of governance (including risk management systems) Forward looking assessment of own risks Submission of information Pre-application for internal models The guidelines apply from 1 January 2014 until the implementation of Solvency II. The CBI guidelines and additional information on preparing for Solvency II can be accessed here, and updates from the CBI on Solvency II can be accessed here. EIOPA’s guidelines on preparing for Solvency II can be accessed here. The Solvency II Directive can be accessed here. * EIOPA is the European Insurance and Occupational Pensions Authority, which is part of the European System of Financial Supervision. It is an independent advisory body to the European Parliament, the Council of the European Union and the European Commission. www.dima.ie Captive re/insurance in Ireland 9 Useful links Regulation Central Bank of Ireland The Central Bank of Ireland (CBI) regulates financial institutions based in Ireland, as well as being responsible for the stability of Ireland’s financial system, resolution of financial difficulties in credit institutions, protection of consumers of financial services, and providing independent economic advice and high quality financial statistics. http://www.centralbank.ie The Data Protection Commissioner Companies are required to ensure they are compliant with the Data Protection Act. http://www.dataprotection.ie/ Financial Ombudsman The Financial Services Ombudsman is a statutory officer who deals independently with unresolved complaints from consumers about their individual dealings with financial service providers. http://financialombudsman.ie/ National Consumer Agency The National Consumer Agency (NCA) is a statutory body established by the Irish Government to enforce consumer law and promote consumer rights. http://www.consumerhelp.ie EIOPA EIOPA is part of the European System of Financial Supervision. Its core responsibilities are to support the stability of the financial system, transparency of markets and financial products as well as the protection of insurance policyholders, pension scheme members and beneficiaries. https://eiopa.europa.eu/ International Association of Insurance Supervisors The International Association of Insurance Supervisors (IAIS) represents insurance regulators and supervisors of more than 200 jurisdictions in nearly 140 countries. Its objectives are to promote effective and globally consistent supervision of the insurance industry in order to develop and maintain fair, safe and stable insurance markets for the benefit and protection of policyholders, and to contribute to global financial stability. http://www.iaisweb.org/ www.dima.ie Captive re/insurance in Ireland 10 General legislation Irish Statute Book A directory of all Acts and statutory instruments from 1922 to present day. http://www.irishstatutebook.ie Company Law Companies Registration Office The Companies Registration Office is the central repository of public statutory information on Irish companies and business names. http://www.cro.ie Office of the Director of Corporate Enforcement The Office of the Director of Corporate Enforcement (ODCE) ensures company law is upheld. http://www.odce.ie/ Taxation Revenue Commissioners The Revenue Commissioners are responsible for the collection of personal and company tax. http://www.revenue.ie/en/index.html Government departments and semi-state bodies Department of An Taoiseach The office of the Taoiseach (Irish Prime Minister) is responsible for Ireland’s state policy. http://www.taoiseach.gov.ie/eng Department of Finance The Department of Finance is responsible for financial administration and financial strategy. http://www.finance.gov.ie/ Department of Jobs, Enterprise & Innovation The Department of Jobs, Enterprise & Innovation is responsible for job creation and a competitive business environment. http://www.enterprise.gov.ie/ IDA Ireland IDA Ireland is an Irish government-backed agency which provides information and advice on setting up and investing in Ireland. http://www.idaireland.com/ www.dima.ie Captive re/insurance in Ireland 11