2012 - Foundation Center

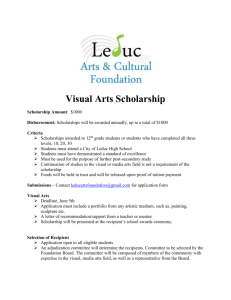

advertisement