chapter 21 - Town of Buchanan

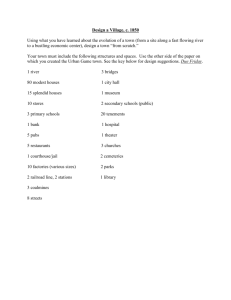

advertisement