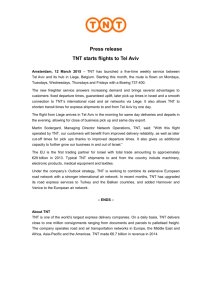

Prospectus TNT Express NV

advertisement