121526 Tanjong PG18-41 B9 17/5

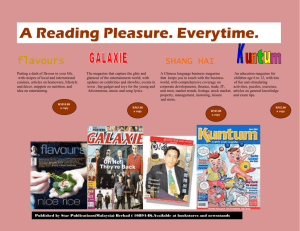

advertisement

Business Review TA N J O N G p u b l i c l i m i t e d c o m p a n y Lembaga Lembaga Pengarah Pengarah 18 ANNUAL REPORT 2003 Business Review POWER GENERATION BUSINESS It was another year of sustained growth for our Power Generation business. The period under review saw a 58% increase in turnover to RM933 million as compared to RM589 million previously. The improved performance is largely attributable to the successful commissioning and commercial operations of the open cycle phase of the power plant owned by Panglima Power Sdn Bhd (“Panglima”) which is wholly owned by our principal subsidiary, Powertek Berhad (“Powertek”). The Panglima power plant uses a Siemens V94.3A (Series F) model which is currently one of the most efficient power plants in the industry. This has positioned Powertek favourably and will enable it to pass the benefit of the increased efficiency to its customer. Whilst addressing the construction challenges at Panglima, Powertek continued to maintain its focus on the operation of its two existing plants, namely the 440 MW open cycle power plant at Teluk Gong and the 330 MW combined cycle power plant in Tanjong Kling, in line with its prudent utility practices. These have enabled a 48% increase in Power Generation’s operating profit from RM229 million to RM339 million. plant. The facility, which comprises RM830 million Redeemable Secured Serial Bonds, RM306 million Commercial Papers/Medium Term Notes Programme and RM84 million Standby Revolving Credit facility, was assigned an enhanced long-term rating of AA2 and a short-term rating of P1 by the Rating Agency Malaysia Berhad. This has enabled Powertek to not only secure project financing at a competitive cost, it has also given Powertek the ability to optimise its capital structure to enable a more efficient management of the Group’s cash resources. On 31 March 2003, Panglima’s open cycle power plant was successfully converted into a 720 MW combined cycle power plant when it achieved commercial operations. This was accomplished within Panglima’s contracted schedule and project budget. The TA N J O N G p u b l i c l i m i t e d c o m p a n y During the year, Panglima secured a financing facility totalling RM1.22 billion to finance the construction, development and operation of its 720 MW combined cycle power successful completion of Panglima’s power plant marks another major milestone for the Group, which now has a total nominal generating capacity of 1,490 MW, making it the second largest Independent Power Producer in Malaysia. ANNUAL REPORT 2003 19 Business Review (continued) NUMBERS FORECAST TOTALISATOR BUSINESS (“NFO”) Turnover for the NFO business has increased by 1.7% to RM1,422 million on the back of five additional draws during the year. However, the underlying demand for NFO products has remained soft due to increasing competition from unauthorised gaming operators whose activities have continued to grow unabated. During the year, several measures were taken as part of our plan to increase our market share. One key initiative was to step up our branding activity through various sponsorships and programmes on the electronic media. We also introduced the Telelink Mobile Service enabling Telelink account holders to make their investments via mobile phones. In addition, through strategic partnerships with financial institutions, we have enhanced our services for our Telelink account holders who are now able to make investments and top-up their Telelink accounts from their bank accounts. They can also top-up their Telelink accounts via the PMP website which is linked to selected banking institutions. We expect our efforts to promote Telelink to yield positive returns in the medium term. For the year under review, NFO operating profit increased by RM9 million to RM201 TA N J O N G p u b l i c l i m i t e d c o m p a n y million on the back of improved operating margins mainly attributable to the revision of 20 Betting and Sweepstake Duties in September 2001. However, effective 1 January 2003, the Government standardised the pool betting duty for the numbers forecast operators to 6%, and at the same time, the operators have been required to raise the first prize payout for the 4-digit forecasts by RM500. Whilst the increase in prize payouts is expected to generate higher turnover, the overall revision in duties and prize payouts will have an adverse impact on our operating margins in the coming financial year. Apart from the increase in prize payouts, other options are being explored to enhance the competitiveness of the authorised gaming operators. ANNUAL REPORT 2003 TA N J O N G p u b l i c l i m i t e d c o m p a n y Lembaga Lembaga Pengarah Pengarah ANNUAL REPORT 2003 21 TA N J O N G p u b l i c l i m i t e d c o m p a n y Lembaga Lembaga Pengarah Pengarah 22 ANNUAL REPORT 2003 Business Review (continued) RACING TOTALISATOR BUSINESS (“RTO”) The higher dividend payout ratio following the revision in Betting and Sweepstake Duties has enabled the RTO business to maintain its growth momentum and gross proceeds have improved by 57% from RM498 million in the previous year to RM781 million. This was achieved through 1,275 races which were conducted by the Malayan Racing Association over 139 race days as compared to 1,120 races over 128 race days in the previous year. As a result of the higher totalisator turnover, the operating loss for RTO has reduced significantly from RM29.5 million to RM2.2 million this year. The attendance at the turf clubs and off-course centres increased by 17.4% from 1.44 million punters to 1.69 million punters, while the spending per punter increased by 34% from RM345 per race day to RM462 per race day this year. The National Stud Farm (“NSF”) held its eleventh National Premier Sale where 52 two-year old horses, comprising 28 local breds and 24 imports, were successfully auctioned for RM2.24 million. The Sale along with the NSF-sponsored incentive races are part of the NSF’s efforts towards developing and promoting the thoroughbred breeding and equine TA N J O N G p u b l i c l i m i t e d c o m p a n y industry in Malaysia. ANNUAL REPORT 2003 23 Business Review (continued) PROPERTY INVESTMENT BUSINESS Despite an oversupply of office space in the property market, we have managed to improve our occupancy rate and maintained our rental structure due mainly to the exceptional quality of our building and its related facilities. As at 31 January 2003, tenancies for a total of 477,786 sq. ft. or 90.5% of the net lettable area in Menara Maxis have been secured, representing an increase of 5.2% from the previous year. Our anchor tenant, Maxis Communications Berhad took up an additional floor while new tenants include Cahya Mata Sarawak Berhad and Binariang Satellite Systems Sdn Bhd. A new integrated security services management system was implemented in February 2002 to enhance the overall security of the building. LIQUEFIED PETROLEUM GAS (“LPG”) BUSINESS The adverse operating conditions for the LPG business have, as anticipated, persisted TA N J O N G p u b l i c l i m i t e d c o m p a n y without prospect of an immediate turnaround. Measures are being taken to ensure that 24 the operating losses are contained within the existing business constraints. We continue to explore avenues for exiting the LPG business and are addressing the information requirements of parties who have expressed interest in acquiring the business. ANNUAL REPORT 2003 TA N J O N G p u b l i c l i m i t e d c o m p a n y Business Review (continued) FILM EXHIBITION BUSINESS A higher number of blockbusters and the better than expected performance of the Malay titles during the year led to a 15% increase in admissions at Tanjong Golden Village (“TGV”), from 5.3 million patrons to 6.1 million patrons. Gross box office receipts increased in tandem by 22% from RM41 million to RM50 million. Overall occupancy for 2002 also improved, averaging about 31% as compared to 28% previously. There was a corresponding increase in our share of the pre-tax profit of TGV from RM200,000 last year to RM3.7 million. During the year, TGV added two new features to its ticket reservation facilities, namely M-cinema and eTicketing, as part of its continuous customer service enhancement programmes. M-cinema uses the STK/WAP platform to enable ticket reservations to be made over the mobile telephone. With eTicketing, moviegoers are able to reserve cinema TA N J O N G p u b l i c l i m i t e d c o m p a n y seats through the internet via TGV’s website at www.tgv.com.my. ANNUAL REPORT 2003 27 Corporate Social Responsibility Corporate social responsibility is an integral part of our business as we believe that our actions should not only benefit our shareholders, but also our employees, society and the environment. Our Statement of General Business Principles guides our actions on the health and safety of our employees, conservation of resources and environmental protection, as well as our contributions to the communities within which we operate. We are committed to safe and healthy working conditions for all employees. Our Occupational Safety and Health committees implemented various programmes throughout the year to entrench safety and health consciousness among employees. Fire fighting courses, first aid and cardiopulmonary resuscitation training, fire drills and building evacuation exercises as well as safety and health talks were among the activities carried out. At our power plants, we constantly review plant procedures on safety and health to improve our standards. Our vigilance has been rewarded with another accident-free year. At Menara Maxis, safety system checks and drills are regularly conducted on all safety related equipment. Environmental management, especially at our power plants, continues to be given close attention. The Group ensures strict compliance with the environmental laws governing plant operation and maintenance in areas relating to environmental standards, emission standards, TA N J O N G p u b l i c l i m i t e d c o m p a n y noise level management and treatment of plant effluents and waste water. In addition, our Teluk Gong power plant has successfully maintained for the third consecutive year, the ISO 14001 Certification for Environmental Management systems. Our work for the betterment of the community remains the cornerstone of our corporate social responsibility agenda. We offer educational scholarship awards to talented and deserving students each year to pursue their tertiary education at public universities in Malaysia. There are two scholarship award schemes offered by the Group, the Tanjong Scholarship Award and the Powertek Berhad Scholarship Award. In addition, our Student Aid programme channels over RM1 million each year to poor students at primary schools for their educational needs. We have also organised and sponsored the annual Tanjong Heritage art competition for students from tertiary level institutions to encourage the development of their artistic talent with a simultaneous aim of inculcating appreciation for Malaysian heritage among our youth. Our Staff-in-the-Community projects were implemented throughout the year providing opportunities for our staff to perform volunteer work for persons with disabilities, the elderly and orphans. In keeping with our tradition of "Caring & Sharing", we continue to celebrate the major festivals in Malaysia with the needy in the community. As a part of the Festival Charity Programme, we have contributed towards the development and upkeep of selected charities and voluntary organisations nationwide. We also support the development of rural communities through substantial contributions to the Electricity Supply Industry Trust Fund, which was established to develop rural electrification and conduct research and development for the benefit of the electricity supply industry. 28 ANNUAL REPORT 2003