Entry and growth strategies in Brazilian construction equipment market

advertisement

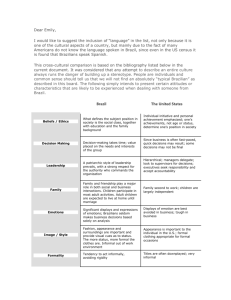

Entry and growth strategies in Brazilian construction equipment market Market study April 2011 2011-04-14_Market_Entry_Strategy Brazil.pptx 1 Contents A. Brazilian construction equipment industry is growing strongly and offers attractive growth options – Brazil is among the World's fastest growing construction equipment markets growing at 15% p.a. – Strong market dynamics offering a window of opportunity to enter and expand while Chinese players are still in a niche position B. To meet the challenges of the Brazilian construction equipment industry, several key aspects need to be addressed – Public financial credit support FINAME offers attractive financing conditions that favor local production in Brazil – Production location heavily impacts taxes, labor costs/quality and logistics aspects – Even if different sourcing strategies are possible, FINAME support depends heavily on degree of national sourcing – Additional aspects to consider are distribution channel strategy, rental business and export strategy C. Brazilian market is unique and has to be approached with a tailored strategy and business model – Six key levers identified to successfully enter and expand in the Brazilian construction equipment market This document was created for our client. The client is entitled to use it for its own internal purposes. It must not be passed on to third parties except with the explicit prior consent of Roland Berger Strategy Consultants. This document is not complete unless supported by the underlying detailed analyses and oral presentation. © 2011 Roland Berger Strategy Consultants GmbH 2011-04-14_Market_Entry_Strategy Brazil.pptx 2 A. Growth potentials in the Brazilian construction equipment market 2011-04-14_Market_Entry_Strategy Brazil.pptx 3 Brazil is among the most attractive construction markets worldwide because of its strong and lasting growth perspectives Brazilian construction industry market positioning and development GROWTH RATES CONSTRUCTION INDUSTRIES1) World Asia (excl. Japan) Brazil Middle East + Africa South America EU - Eastern North America EU - Western -0.5% BRAZILIAN CONSTRUCTION INDUSTRY [USD bn] 2.3% 7.1% 5.1% 3.5% 3.2% 2.5% 2.0% CAGR +5.1% 0% 52.1 +7% 52.1 55.5 58.1 61.4 64.2 67.8 2008 2009 2010e 2011e 2012e 2013e 2014e > Strong growth of the Brazilian construction industry compared to most other regions worldwide > Continuing and stable growth in the construction industry driving demand for construction equipment 1) CAGR 2008-2013 Source: WMI; Roland Berger 2011-04-14_Market_Entry_Strategy Brazil.pptx 4 The construction equipment market also experiences strong growth that is expected to continue to grow at 15% per year Development of the construction equipment sales 2008-2014 ['000 units]1) MAIN DRIVING FACTORS + 15% CAGR 38.6 33.8 -16% +23% 29.3 25.5 22.1 21.4 18.0 2008 2009 1) Without cranes & tractors Source: Yengst; Roland Berger 2010e 2011e 2012e 2013e 2014e > Government investment program PAC2) ("Growth Acceleration Plan") > Regulations and governmental support schemes favor local investment > Strong long term demand driven especially by residential and infrastructural construction > Megaevents FIFA World Cup 2014 and Olympic Games 2016 drive further investments in infrastructure and civil construction 2) PAC: " Programa de Aceleração do Crescimento" (Growth Acceleration Plan) 2011-04-14_Market_Entry_Strategy Brazil.pptx 5 Backhoe loaders, excavators and wheel loaders have the strongest growth in sales prospected because they are all-purpose vehicles Product segments of the CE market in Brazil 2009/20141) [sales units/share] Dozers 693 CAGR (4%) 13% Boom lifts 1.200 CAGR (7%) 22% 3.200 (8%) Scissor lifts 1.035 CAGR (6%) 24% Compactor rollers 1.115 CAGR (6%) 7% 3.500 (4%) Skid steer loaders 1.219 CAGR 78%) 23% 3.500 (9%) Motor graders 1.320 CAGR (7%) 16% 2.800 (7%) Wheel loaders 2.621 CAGR (15%) 18% 1.275 (3%) Asphalt pavers 135 CAGR (1%) 13% 3.000 (8%) Haulers 92 CAGR (1%) 29% 18,027 6.000 (16%) 250 (1%) Backhoe loaders 5.190 CAGR (29%) 13% Excavators 3.407 CAGR (19%) 16% 360 (1%) 9.600 (25%) 7.020 (18%) 1) Without cranes & tractors Source: Yengst; Roland Berger 2011-04-14_Market_Entry_Strategy Brazil.pptx 6 Window of opportunity to enter the Brazilian market is now, while Chinese players are still in a niche in terms of volume Sales of construction equipment in Brazil by company1) (2009) [units] SALES VOLUME 3,870 Randon Dynapac 3,180 Bobcat AGCO 2,880 1,540 1,320 1,130 1,100 830 800 790 600 Proton Haulotte Liebherr Ciber (Wirtgen) Terex Roadbuilding (Cifali) Ingersoll-Rand > Large global players dominate the market with market leaders Caterpillar and Case > Recent market entries, especially of Chinese players (XCMG, Sany, Liugong) have increased competition in the market, however they are not yet strong enough to compete with the big players Others2) Fiat Allis (CNH-Group) (CNH-Group) (CNH-Group) Window of opportunity to enter/ expand in the Brazilian market 1) Without cranes & tractors 2) Contains only players with less than 1% market share Source: Yengst; Roland Berger 2011-04-14_Market_Entry_Strategy Brazil.pptx 7 B. Strategic aspects of the Brazilian market for construction equipment 2011-04-14_Market_Entry_Strategy Brazil.pptx 8 Eight major strategic aspects need to be addressed in order to develop a successfully growth strategy for Brazil The Brazilian construction equipment market is unique > Complex tax legislation and strong impact of tax negotiations > Protectionist market through customs/import restrictions > Public financing programs > Strong regional differences in labor skills and competition on the labor market > Significant distances to bridge >… Source: Roland Berger FINAME and uncertainty about import tariffs are the main drivers for local production 1 Incentives and barriers 2 Taxes 3 Labor costs and quality 4 Logistics 5 Sourcing strategy Sourcing strategy needs to optimize cost, while fulfilling FINAME criteria 6 Distribution channels Four different distribution models possible and used in the industry 7 Rental business Rental business is growing and needs to be specifically addressed 8 Export strategy Brazil can be a hub for Latin America, but also other strategies are successful Production location must be evaluated with special attention to taxes, labor costs and logistics 2011-04-14_Market_Entry_Strategy Brazil.pptx 9 1 INCENTIVES AND BARRIERS FINAME offers attractive financing conditions that favor local production in Brazil Public financial credit support by FINAME scheme FINAME – MAIN CHARACTERISTICS IMPLICATIONS > Financing product from BNDES (Brazilian Development Bank) for production and acquisition of new machinery and equipment, domestically manufactured, accredited by BNDES > The financing is granted for products with nationalization index, in value and weight, superior to 60% > Every 2 years company has to update data with BNDES > Possibility to apply to more than 1 credit line > No maximum value to be financed > All major players use FINAME as financing solution > High share of leasing in the market leads to high financing costs – FINAME offers low financing rates and creates an advantage against players that don't participate in the program (e.g. competitors that import) > FINAME: acquisition of new equipments – Annual Interest rate: 7.9%1) – Maximum financing: 80% - 100% of the financeable items > FINAME Leasing: acquisition of new machineries and equipments destined to renting/leasing – Annual Interest rate: 9.8%1) – Maximum financing: 100% of the financeable items 1) Compared to > 20% market rate Source: BNDES; Roland Berger 2011-04-14_Market_Entry_Strategy Brazil.pptx 10 1 INCENTIVES AND BARRIERS Incentives for imports of equipment become uncertain after major players localize production to Brazil Import barriers and tariffs Equipment WITHOUT national production Import tariff > Import duty exemption (Ex-tarifárias) exist policy for the for specific equipments defined by the government Equipment WITH national production TARIFFS CAN (AND OFTEN DO) CHANGE UPON THE START OF LOCAL PRODUCTION > Import tariffs exist for equipment that is locally produced Government > Facilitating the availability of equipment to interest the national market that is not produced nationally > Protecting the national supply chain, including equipment manufacturers and suppliers Product examples > Excavators, backhoe loaders > Most aerial work platforms Source: Roland Berger 2011-04-14_Market_Entry_Strategy Brazil.pptx 11 2 TAXES Any set-up in Brazil (especially local production) needs to consider the complex tax system Taxation in Brazil More than 90 DIFFERENT KINDS the country on three federal levels OF TAXES in More than 200,000 TAX LAWS issued since 1990, making it more than one per hour Ranking 150th OF 183 COUNTRIES in the World Bank's ease of paying taxes ranking TAX BENEFITS through NEGOTIATION with states is very promising > Great annual savings in the range of millions USD > Tax benefits highly depend on the state Source: Interviews, tax laws, Roland Berger analysis 2011-04-14_Market_Entry_Strategy Brazil.pptx 12 2 TAXES Taxes are the primary criterion for site location decisions in Brazil – Exemplary sites provide tax incentives of up to 6% of sales volume CASE EXAMPLE: Tax benefits – EBIT impact as percentage of total sales > Upon first localization short-listing, the primary decision criteria includes tax incentives EBIT impact of tax incentives1) 6.1% > Tax incentives can be negotiated with state governments > The negotiation process is conducted individually for each company > Legal frameworks exist but are not exhaustive 5.1% 11 22 33 0.0% Exemplary areas Area Area Area 1 2 3 1) Rough estimate based on volume of 2,000 units, average gross sales price of USD 200,000 and other assumptions Source: Interviews, tax laws, Roland Berger analysis 2011-04-14_Market_Entry_Strategy Brazil.pptx 13 3 LABOR Within Brazil labor costs and skill level of workers differ strongly – Location selection is key in Brazil CASE EXAMPLE: Annual labor cost variance for selected sites in Brazil1) Labor costs1) White-collar +7% 11 22 33 -5% Blue-collar +39% Exemplary areas 1) Variance from average compared labor costs incl. benefits Source: Interviews, Roland Berger analysis White-collar 1 > Leadership -2% 2 positions are, relatively easy to recruit 2 > Leadership -25% -14% 1 Labor quality and availability 3 positions need to be recruited from outside the region 3 > Leadership positions need to be recruited from outside the region Blue-collar > High competition among many companies causes lack of skilled bluecollar workers (e.g. welders) and engineers > Experienced workforce with previous jobs in the construction equipment or automotive industry > Unskilled workforce, mostly without any previous jobs in the industry – Skilled labor barely available > Workforce without any training in the manufacturing industry > Some people recruited from farther away > Local recruitment of civil engineer is easy 2011-04-14_Market_Entry_Strategy Brazil.pptx 14 4 LOGISTICS Most established players have selected a manufacturing location close to the main customer base Site locations of the strongest players in the construction equipment market in Brazil Key criteria for decision on site location Minas Gerais Paraná Rio Grande do Sul Source: Interviews, Roland Berger analysis São Paulo > > > > > > > Tax benefits and total taxes Local supplier market Market access Labor costs and availability Land and construction costs Local infrastructure, transportation and logistics costs Utility prices Sao Paulo area advantages/disadvantages > Suppliers are closeby > Main customers are closeby > Big construction works are closeby > Good labor quality is available > Area is saturated with competitors > No/Low tax incentives given 2011-04-14_Market_Entry_Strategy Brazil.pptx 15 5 SOURCING STRATEGY Different sourcing strategies are possible along the dimensions of outsourcing and national sourcing Sourcing strategy portfolio of main players in the Brazilian CE market Competitor 2 NATIONAL SOURCING SHARE > Different strategies – Just matching FINAME requirements (~60% national sourcing) – Sourcing most available parts locally in Brazil (~80% national sourcing) > Typical locally sourced products include engine, transmission, steel, track system/axle, etc. > Steel purchase can be used to optimize the national sourcing share to 60% at the time of high steel prices in Brazil Competitor 1 Competitor 3 Bubble size correlates with sales (2009) Competitor 4 Competitor 5 DEGREE OF OUTSOURCING > Players' strategies vary from having a mere assembly to in-house production of parts Source: Interviews, Roland Berger 2011-04-14_Market_Entry_Strategy Brazil.pptx 16 6 DISTRIBUTION STRATEGY 4 different distribution models are present along the top players with distinct split of responsibilities along the distribution channel Distribution models present in the Brazilian construction equipment market Decentralized A dealer mgmt Manufacturer Distributor Centralized B dealer mgmt Dealer Manufacturer Distributor Importer's C model Dealer Manufacturer Distributor Centralized D distribution Dealer Manufacturer Distributor Dealer Marketing/Brand mgmt. Dealer mgmt. Key account mgmt. Logistics Distribution center Shops / Sales After sales / Repair > For sales to key clients, manufacturers enter negotiations > Brand control via branding policy and alignment with distributor Source: Company websites, interviews, Roland Berger > For sales to key clients, manufacturers enter negotiations > Dealer's with few shops that exclusively trade the manufacturers brand > Distributors do the national brand management for the manufacturer > Key accounts negotiate with national distributor > No distributors or dealers in the country > Distribution process entirely centralized 2011-04-14_Market_Entry_Strategy Brazil.pptx 17 7 RENTAL BUSINESS Trend towards rental urges the need for a specific rental strategy – An approach synchronized with the distributor needs to be taken Reasons and implications of the strong rental business in the Brazilian CE market The rental business suits the needs of the Brazilian market very good > Easier financing > Good and regular service > Rental offers flexibility, because the operator is not responsible for the transport along the long distances between construction sites > Some of the biggest construction projects are operated by syndicates for which rental is less complicated than buying (valuation issues, attribution of wear on handover etc.) Source: Ministry of Development, interviews, Roland Berger Rental business within construction equipment market is increasing in attractiveness Fleet to rent is currently est. at 14.5k units, growing at 15% p.a. High level of fragmentation exists A strategy on how to approach the rental market has to be incorporated in the business model 1 INTEGRATED DISTRIBUTION (The distributor is also active in rental) 2 RENTAL ONLY (Specialized rental companies carry product) 2011-04-14_Market_Entry_Strategy Brazil.pptx 18 EXPORT STRATEGY 8 Most CE manufacturers use Brazil as hub for exports to other Latin American countries – Global/National strategies possible Main export countries of Brazilian construction equipment industry1) Construction equipment exports [units] 150 to USA 30 590 to Others 80 90 Peru Exports are expected to grow strongly from 1,425 in 2009 to 2,905 in 2010 (+104%) 120 Chile Total production: 18,030 Local usage: 16,650 360 Argentina 1 Global manufacturing 2 Regional production hub 3 National manufacturing > Manufacturing certain models in Brazil for the global market > Using Brazil as the manufacturing base for Latin or South America > Producing in Brazil for the national market only Most companies use Brazilian plants as manufacturing hubs for Latin America only > Exporting to Argentina makes sense due to exemption of import tariffs (Mercosul) and relatively low logistics cost > Depending on market drivers such as exchange rate and logistics cost, exportation to Colombia, Mexico or even the US may make sense > In the case of Chile and Peru, we recommend to compare logistics cost and import tariffs for import from Brazil or other production countries – Komatsu is catering for these markets from its Brazilian plant 1) Without cranes and tractors Source: Ministry of Development, interviews, Roland Berger 2011-04-14_Market_Entry_Strategy Brazil.pptx 19 C. Six steps to successfully enter and succeed in the Brazilian market for construction equipment 2011-04-14_Market_Entry_Strategy Brazil.pptx 20 Roland Berger offers wide support to construction equipment makers to successfully enter and grow in Brazil (1/2) Potential areas of Roland Berger support 1 Understanding of local market landscape > Local market size and developments (e.g., by product, segment, region, etc.) > Local competition and new market entrants > Market characteristics, regulations and customer requirements 2 Development of a business plan > Development of business model (production set-up, sourcing strategy, etc) > Expected cost of production in Brazil > Necessary investments and required start-up cost 3 Selection of production location > Short-listing and pre-selection of attractive site locations > Detailed review of selected short-list locations (taxes, labor cost and availability, logistics cost, etc.) > Negotiation support Source: Roland Berger 2011-04-14_Market_Entry_Strategy Brazil.pptx 21 Roland Berger offers wide support to construction equipment makers to successfully enter and grow in Brazil (2/2) Potential areas of Roland Berger support 4 Localization of supply chain > Identification of local suppliers per critical component (available and capable) > Cost structure of locally produced parts > Negotiation support with suppliers 5 Development of a clear sales and distribution strategy > Define/optimize dealer network (incl. rental) > Develop product and service portfolio for dealers > Define internal sales & distribution structure 6 Support of operational ramp-up > Necessary steps to take (must-haves, checklist) > Key milestones and quality gateways > Implementation organization and timeline Source: Roland Berger 2011-04-14_Market_Entry_Strategy Brazil.pptx 22 Your contacts for further questions Our experts Norbert Dressler Paul Sloman Stuttgart Office +49 (711) 3275-7420 London Office +44 (20) 3075-1116 Partner norbert_dressler@de.rolandberger.com Partner Stephan Keese András Tóth Sao Paulo Office +55 (11) 3046-7111 Partner stephan_keese@br.rolandberger.com paul_sloman@uk.rolandberger.com Munich Office +49 (89) 9230-8634 Project Manager andras_toth@de.rolandberger.com 2011-04-14_Market_Entry_Strategy Brazil.pptx 23 It's character that creates impact! 2011-04-14_Market_Entry_Strategy Brazil.pptx 24