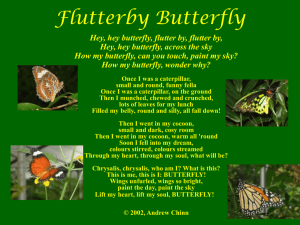

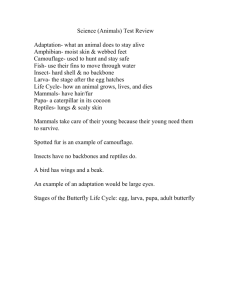

From Caterpillar to Butterfly

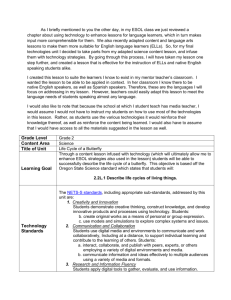

advertisement