Local Tax Code and the Quezon City Experience

advertisement

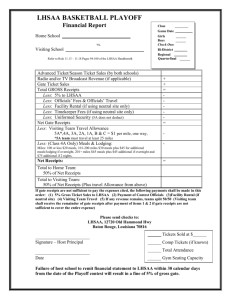

Local Government Taxation in the Philippines • Local Government Taxation in the Philippines is based on Republic Act 7160, otherwise known as Local Government Code of 1991 which was signed into law on 10 October 1991 and took effect on 1 January 1992. 1 Power to Create Sources of Revenue (Sec. 129) • Each local government unit (LGU) has the power to create its own sources of revenue and to levy taxes, fees, and charges • The grant of power to create sources of revenue is consistent with the basic policy of local autonomy • The taxes, fees and charges shall accrue exclusively to the LGUs Sec. 133 - Common Limitations on the Taxing Powers of Local Government Units a. Income tax, except when levied on banks and other financial institutions; b. Documentary stamp tax; c. Taxes on estates, inheritance, gifts, legacies and other acquisitions mortis causa, except as otherwise provided herein; d. Customs duties, registration fees of vessel and wharfage on wharves, tonnage dues , and all other kinds of customs fees, charges and dues except wharfage on wharves constructed and maintained by the local government unit concerned; 2 e. Taxes, fees and charges and other impositions upon goods carried into or out of, or passing through, the territorial jurisdictions of local government units in the guise of charges for wharfage, tools for bridges or otherwise, or other taxes, fees and charges in any form whatsoever upon such goods or merchandise; f. Taxes, fees and charges on agricultural and aquatic products when sold by marginal farmers or fisherman. g. Taxes on business enterprises certified to by the Board of Investments as pioneer or nonpioneer for a period of six (6) and four (4) years, respectively from the date of registration. h. Excise taxes on articles enumerated under the National Internal Revenue Code, as amended, and taxes, fees or charges on petroleum product i. Percentage or value-added tax (VAT) on sales, barters or exchanges or similar transactions on goods or services except as otherwise provided herein; 3 j. Taxes on the gross receipts of transportation of passengers of freight by hire and common carriers by air, land or water, except as provided in this code. k. Taxes on premiums paid by way of reinsurance or retrocession l. Taxes , fees and charges for the registration of motor vehicles and for the issuance of all kinds of licenses or permits for the driving thereof, except tricycles; m. Taxes, fees and other charges on Philippine products actually exported, except as otherwise provided herein; n. Taxes, fees and charges, on Countryside and Barangay Business Enterprises and cooperative duly registered under R.A. No. 6810 and Republic Act Numbered Sixty-nine hundred thirty eight (R.A. No. 6938) otherwise known as the “cooperative code of the Philippines” respectively; and o. Taxes, fees or charges of any kinds on the National Government, its agencies and instrumentalities, and Local Government Units. 4 1.) GENERAL FUND – USED TO ACCOUNT FOR SUCH MONIES AND RESOURCES AS MAY BE RECEIVED BY AND DISBURSED FROM THE LOCAL TREASURY. 2.) SPECIAL EDUCATION FUND – SHALL CONSIST OF THE RESPECTIVE SHARES OF PROVINCES, CITIES , MUNICIPALITIES, AND BARANGAYS IN THE PROCEEDS OF THE ADDITIONAL TAX ON REAL PROPERTY. 3.) TRUST FUND – SHALL CONSIST OF PRIVATE AND PUBLIC MONIES WHICH HAVE OFFICIALLY COME INTO THE POSSESSION OF THE LGU OR OF A LOCAL GOVERNMENT OFFICAIL AS TRUSTEE, AGENT OR ADMINISTRATORR, WHICH HAVE BEEN RECEIVED AS A GUARANTY FOR FULFILLMENT OF SOME OBLIAGATION. 5 SOURCES OF INCOME FOR LOCAL GOVERNMENT UNITS I. LOCAL SOURCES a) Real Property Taxes b) Business Taxes c) Non-tax Revenues II. EXTERNAL SOURCES a) Internal Revenue Allotment b) National Aids c) National Wealth III. BORROWINGS 6 REAL PROPERTY TAX The province or city or municipality within the Metropolitan Manila area shall fix a uniform rate of basic real property tax. A. Province - at rate not exceeding 1% of the assessed value of the real property. Province 35% Municipality 40% Barangay 25% B. City or Municipality within Metropolitan Manila Area - at rate not exceeding 2% of the assessed value of real property. City 70% Barangay 30% Formula in Computing Real Property Tax FMV x AL = AV AV x Rate = RPT Assessment level Residential Where : Commercial FMV = Fair Market Industrial Value Machinery AL = Assessment Level Commercial AV = Assessed Value Industrial LGC Q.C. 20% 15% 50% 40% 50% 40% 80% - 70% - 50% 7 REAL PROPERTY TAX Special Levy on Real Property for Special Educational Fund A. province or city or a municipality within the Metropolitan Manila area may levy and collect an annual tax of 1% on the assessed value of real property in addition to the basic real property tax. Additional ad Valorem Tax on Idle Lands B. Manila area may levy an annual tax on idle lands at the rate not exceeding 5% of the assessed value of the property in addition to the basic real property tax. Real Property for Assessment Purpose Classes 1) Residential 2) Agricultural 3) Commercial 4) Industrial 5) Mineral 6) Timberland Types 1. Land 2. Building 3. Machineries Local Business Taxes • Revenues Taxes - enforced contribution Kinds: 1. Property taxes 2. Business and other taxes • Receipts Fees – imposed on the exercise of regulatory powers Charges – cost recovery impositions for services delivered or use of facilities 8 BUSINESS TAXES TAXING POWERS OF LOCAL GOVERNMENT UNITS PROVINCES - They may collect taxes, fees and charges on: 1) Tax on Transfer of Real Property Ownership - at rate not more than 50% of 1% of total consideration 2) Franchise Tax - at rate not exceeding 50% of 1 % of the gross receipts for the preceding calendar year 3) Tax on Sand, Gravel and Other Resources - at rate not more than 10% of fair market value 4) Tax on Business of Printing and Publication -at rate not exceeding 50% of 1% 5) Professional Tax - at rate not more than P 300.00 annually 6) Amusement Tax - at rate not more than 30% of gross receipts from admission fees 7) Annual fixed Tax for every Delivery Truck, or Van of Manufacturers or Producers, Wholesalers of, Dealers, or Retailers in, Certain Products - at rate not exceeding P 500.00 annually. 9 TAXING POWERS OF LOCAL GOVERNMENT UNITS MUNICIPALITIES - They may collect taxes, fees and charges not otherwise levied by provinces. 1.) Manufacturer - at rate not exceeding 37 1/2 % of 1% of gross sales or receipts for the preceding calendar year. 2.) Wholesalers - at rate not exceeding 50% of 1 % of gross sales or receipts for the preceding calendar year. 3.) On Exporters, Manufacturers, Wholesalers or Retailers of essential commodities - at rate not exceeding 1/2 of the rate prescribed under letters A, B, and D. 4.) Retailers -at rate with gross sales or receipts for the preceding calendar year or P 400,000 or less 2% per annum More than P 400,000 1% per annum 5.) Contractors – at rate not exceeding 50% of 1% on the gross sales or receipts for the preceding calendar year. 6.) Banks and other financial Institution – at rate not exceeding 50% of 1% on the gross receipts of the preceding calendar year derived from interest, commissions and discounts from lending activities. 7.) Peddlers – at rate not exceeding P 50.00 annually. 8.) On any business, not otherwise specified – at rate not exceeding 2% of gross sales or receipts of the preceding calendar year. 10 TAXING POWERS OF LOCAL GOVERNMENT UNITS CITIES - They may levy taxes, fees and charges which the province or municipalities may impose and may exceed the maximum rates allowed for provinces or municipalities by not more than 50% except the rates for professional and amusement taxes. BARANGAY - They may levy taxes, fees and charges which shall exclusively accrue to them. 1) Taxes - on stores or retailers with gross sales or receipts of the preceding calendar year of P 50,000 or less in the case of cities and P 30,000 or less in the case of municipalities. 2) Service Fees and Charges - they may collect reasonable fees or charges for services rendered. 3) Barangay Clearance - no city or municipality may issue any license or permit unless a clearance is first obtained from the barangay at reasonable rate. 4) Other Fees and Charges - reasonable fees and charges. •BARANGAY INCOME SOURCES I. Internal Revenue Allotment (IRA) II. Real Property Tax (RPT) III. Barangay Taxing Power IV. Community Tax 11 SHARES OF LOCAL GOVERNMENT UNITS IN THE PROCEEDS OF NATIONAL TAXES A. INTERNAL REVENUE ALLOTMENT - Local government units shall have a share in the national internal revenue taxes based on the collection of the third fiscal year preceding the current fiscal year at 40% allocated in the following manner. 1) Provinces 23% 2) Cities 23% 3) Municipalities 34% 4) Barangays 20% The share of each province, city and municipality shall be determined on the bases of the following formula. a) Population 50% b) Land Area 25% c) Equal Sharing 25% 12 B. SHARES OF LGU IN THE PROCEEDS OF NATIONAL WEALTH - Local government units shall have an equitable share in the proceeds derived from the utilization and development areas at 40% of the gross collection derived by the national government from the preceding year from mining taxes, royalties, forestry and fishery charges in addition to the internal revenue allotment. 13 Tax on Transfer of Real Property • Tax subject: sale, donation, barter or any mode of transfer of ownership or title of real property • Tax rate: not to exceed Tax Base Provinces Fair market value, 50% of 1% or total consideration whichever is higher Cities 75% of 1% Tax on Transfer of Real Property • payment must be made within 60 days from date of execution of deed or from date of owner’s death • proceeds not shared • exemption: disposition of real property under CARP (Republic Act No. 6657) 14 Tax on Business of Printing and/or Publication • Tax subject: printing and/or publication of books, cards, posters, leaflets, handbills, certificates, receipts, pamphlets, and printed materials of similar nature • Tax rate: not to exceed Tax Base Provinces Cities Gross receipts 50% of 1% 75% of 1% Capital investment For start-ups 1/20 of 1% 3/40 of 1% Tax on Business of Printing and/or Publication • Capital Investment The capital which a person employs in any undertaking, or which he contributes to the capital of a partnership, corporation, or any other judicial entity or association in a particular taxing jurisdiction. • proceeds not shared • exemptions: receipts from printing and/or publishing of books and reading materials prescribed by DECS as text and references 15 Franchise Tax • Franchise Right or privilege, affected with public interest conferred upon private person or corporation, under government- imposed terms and conditions in interest of public welfare, security and safety • Tax rate: not to exceed Tax Base Provinces Cities Gross receipts 50% of 1% 75% of 1% Capital investment For start- ups 1/20 of 1% 3/40 of 1% Franchise Tax •proceed not shared •exemption: holders of certificates of public convenience for operation of public utility vehicle 16 BLGF Opinion dated 06 February 2003 • The province should impose the tax on business enjoying a franchise within its territorial jurisdiction, excluding the territorial limits of any city located therein. FRANCHISE TAX • Meralco, Globe, Smart, Manila Water Maynilad and PLDT are subject to franchise tax on the receipts derived within the LGU 17 Tax on sand, gravel and other quarry resources • Tax subject: extraction of ordinary stones, sand, gravel, earth. Etc. from public lands or beds of public waters within LGU • Tax rate: not to exceed Tax Base Fair market value Of extract at site Provinces Cities 10% 15% Tax on sand, gravel and other quarry resources • proceeds shared (Sec. 10 of P.D. No. 426): • Provinces province component city/municipality barangay • Cities highly urbanized city barangay 30% 30% 40% 60% 40% 18 Tax on Professionals • Tax subject: persons engaged in the practice of profession requiring government exams • Tax rate: Provinces- maximum of Php 300/ profession Cities- maximum of Php 300/ profession • Payment: on or before January 31 in the province/city where practice is done, or principal office is located • proceeds not shared • exemption: practice of profession exclusively as government employee BLGF Opinion dated 29 April 2003 • The municipality is authorized to impose reasonable fees and charges on professionals which do not require govt. examination in the exercise of their profession. The imposition, however, shall be denominated as fee not tax. 19 Amusement Tax • Tax subject: patrons of shows and entertainment activities; collected and remitted by proprietors, lessees and operators • Tax rate: Provinces-not to exceed 30% of paid admission fees. Cities- not to exceed 30% of paid admission fees • “no admission fee, no tax” Amusement Tax • proceeds shared: 50-50 between province and municipality • exemptions: operas, concerts, dramas, recitals, painting and art exhibition, flower shows, musical and literary presentations except rock and similar concerts 20 Annual fixed tax on delivery trucks and vans • Tax subject: trucks, vans or any motor vehicle used by manufacturers, producers, wholesalers, dealers or retailers within LGU territory • Tax rate: maximum of Province - Php 500/vehicle City - Php 750/vehicle • collected with other business taxes . proceeds not shared • potential source of avoiding payment of other business taxes, when vehicle used as sales outlet Computation of Business-related Taxes • Exclusions to gross sales/receipts 1. Discounts, at the time of sales, if determinable 2. Sales return 3. Excise tax 4. Value-added tax 21 Computation of Businessrelated Taxes • Three-step process Step 1. Classify the business Step 2. Determine gross receipts Step 3. Determine tax due - locate tax due on tax schedule then compute • Tax due= tax base x tax rate +/penalty/discount BLGF Opinion dated 05 August 2002 • Where Pepsi-Cola Products Phils. Inc. (PCPPI) maintains sales offices and warehouse in certain municipalities or cities for purposes of selling to retailers, wholesalers and distributors the softdrinks products it manufacture, such municipalities or cities should classify PCPPI for business tax purposes as a manufacturer, not as a wholesaler, distributor, dealer, or contractor. 22 BLGF Opinion dated 26 September 2002 • The tax on contractors is NOT imposed on the project itself but on the business of constructing the project, irrespective of whether those are exempt from the real property taxes. BLGF Opinion dated 27 November 2002 • Bistro Americano (Q.C.) Corporation as restaurant operators and caterers shall be subject to the business tax pursuant to Section 143(h) of the LGC (others). 23 Sec. 193. Withdrawal of Tax Exemption Privileges • Unless otherwise provided in this Code, tax exemptions or incentives granted to, or presently enjoyed by all persons, whether natural or judicial, including government- owned or controlled corporations are hereby withdrawn upon the effectivity of this Code except: • 1. Local water districts 2. Cooperatives registered under R.A. No. 6938 3. Non - stock non - profit hospitals and educational institutions 4. Business enterprises certified by BOI as pioneer or non - pioneer 5. Business entity, association or cooperatives registered under R.A. No. 6810 6. Printer and/or publisher of books and other reading materials prescribed by DECS 24 Administrative Procedures Requirements for Existing Business •Mayor’s Permit must be renewed within January 1-20 of every year •Renewal of existing business permit is not automatic 25 Sec. 191. Authority of Local Government Units to adjust Rates of Taxes. • Local government shall have the authority to adjust the tax rates as prescribed herein not oftener than once every five (5) years, but in no case shall such adjustment exceed ten (10) percent of the rates fixed under this code. Sec. 196 Claim for Refund of Tax Credit - No case or proceeding shall be maintained in any court for the recovery of any tax, fee, or charge erroneously or illegally collected until a written claim for refund or credit has been filed with the local treasurer. No case or proceeding shall be entertained in any court after the expiration of two(2) years from the date of the payment of such tax, fee, or charge, or from the date the taxpayer is entitled to a refund or credit. 26 ART. 242 - RELATED OR COMBINED BUSINESS (a) The conduct or operation of two or more related businesses provided in Article 232 of this Rule by any one person, natural or juridical, shall require the issuance of a separate permit or license to each business (b) If a person conducts or operates two (2) or more related businesses which are subject to the same rate of imposition, the tax shall be computed on the basis of the combined total gross sales or receipts of the said two (2) or more related businesses. 27 (c) If, however, the businesses operated by one person are governed by separate tax schedules or the rates of the taxes are different, the taxable gross sales or receipts of each business shall be reported independently and the tax thereon shall be computed on the basis of the appropriate schedule. SITUS OF THE TAX • Taxable 100% where the sale is made or effected 30% of all sales recorded in the principal • office shall be taxable by the city or municipality where the principal office is located. • 70% of all sales recorded in the principal office shall be taxable by the city or municipality where the factory, project office, plant or plantation is located. • In cases where 2 or more factories, project offices, plants or plantation located in different localities, the 70% sales allocation shall be prorated among the localities. 28 Assessment • Assessment is the inherent function of the local treasurer. • Securing/applying business permit is under the Office of the City Mayor. • EDP for Billing functions. • Acceptance of payment is again a function of the Treasurer’s Office. Community Tax • Should be paid in the place of residence of the individual or in the place where the principal office of the juridical entity is located. • Branches are not required to secure community tax. 29 Manufacturers • Manufacturers sales office which distributes its product should also be classified as manufacturers and taxable as such and not as distributor/wholesaler/retailer. Retailer • Car dealers should not be classified as wholesalers/dealers simply because they are commonly known as car dealers. • They should be classified as retailers since they sell directly to end-user or customers. 30 Real Estate Dealers • Real Estate dealers/developers/lessors are subject to the 70-30 allocation of sales. • Principal office – 30% of gross sales. • Project office or location of the real estate is subject to 70% of gross sales. Non Profit, Non Stock Corporation • Only hospitals and educational institutions are exempt from paying business tax. • Income derived from non-members who use or rent the facilities are subject to business taxes. • Required to pay regulatory fees and charges. 31 Retirement of Business • Should be retired on or before the 20th day of January. • Should pay for the entire year after January 20. • Sales realized from January up to the time of retirement should likewise be paid. Security Agency • Security agency are subject to business tax as contractor and subject to situs of tax at 70% - 30% 32 Educational Institutions • Canteens and bookstore operated by the school are exempted from the payment of business tax. • Concessionaires operating canteen and bookstores are subject to business taxes. Contractors • Contractors doing business in an LGU are subject to business tax at 70%. • Main or Principal office are subject to 30%. • Sub-contractors are not subject to contractors tax. Only main contractors are liable to pay the tax. Tantamount to double taxation if collected from sub-contractors. • Income derived from abroad are not taxable. 33 Examination of Books of Accounts • Function of the Provincial, City, Municipal or Barangay Treasurer or their duly authorized representatives. • Books of Accounts and records of business establishments could only be examined for a maximum period of 5 years. Liquefied Petroleum Products LPG is not subject to local tax. However, said LPG business shall still be liable to pay the Mayor’s permit and other regulatory fees or service charges. 34 RE-EXPORTATION Re-exportation of finished product should not be classified as exporter or local/domestic sale but should be classified as rendering service ”contractor” FRANCHISE TAX ON ELECTRIC COOPERATIVE BLGF Ruling Dated May 12, 2006 Electric cooperative shall be subject to or liable to the payment of franchise tax imposed by the province or city. Base on the Ordinance approved by the province or city. Before the EPIRA Law (1997-2001) Gross receipts less: NPC Basic Power Cost Allowance for system loss Reinvestment fund Amortization Cost 35 Upon the effectivity of the EPIRA Law (2002) Gross receipts less: NPC Charges TransCo charges Reinvestment fund Universal Charges Remedies for Collection of Taxes • Civil Remedies • Administrative Remedies – thru distraint of goods or other personal properties. • Closure of business establishments by the office of the mayor. • Judicial Action • Filing of Tax evasion case 36 VICTOR B. ENDRIGA, Ph.D. Quezon City Treasurer QUEZON CITY • Former Capital of the Philippines • Largest City in Metro Manila in terms of population and land area with 2.17 Million residents occupying over 16,000 hectares of land area • Was known as the most financially distressed Local Government Unit in Metro Manila and probably nationwide in 2001 37 THE FINANCIAL RECOVERY OF QUEZON CITY • Cash Balance in the General Fund of Quezon City was negative P10.35 million when Mayor Belmonte assumed office on July 1, 2001 • Inherited claims for payment amounting to P1.4 billion, including GSIS, Phil Health, BIR, Meralco etc. • Bank Loan of P1.25 billion left by previous administration with the Land Bank of the Philippines 1. Auction Sale of real property instead of Tax Amnesty every quarter. 38 PERIOD OF DELINQUENCY TO BE INCLUDED IN THE AUCTION SALE 1. For residential – 5 years 2. For commercial and industrial – 3 years 3. For machineries – 3 years This is an internal rule promulgated by the auction committee 2.) Reassignment of permanent employees to avoid familiarization with Taxpayer. 3.) Prepared at least 20 delinquency letters per day per employee assigned in the Real Estate Division. 4.) Computerization of systems and processes. 39 5.) Issued new Official Receipts with security features to identify and curb the proliferation of fake receipts. 6.) Constructed the taxpayers assessment and payment lounges (free Coffee & Ice Tea). 7.) Recognized the 10 outstanding Taxpayers for Business and Real Property. 8.) Increased the discount given to Real Property Taxpayers paying annually from 10% to 20%, and from 5% to 10% for those paying promptly quarterly. 9.) Conducted Auction Sale of Government Owned and Controlled Corp. such as Heart Center, Lung Center, Kidney Center and MWSS. 10.) Hired an independent and private encoding company to encode all RPT payment records and Tax Declarations. 11.) Automatically Generated and issued Computerized Delinquency Letters amounting to P10.7 Billion Pesos. 40 12.) Filed anti-graft cases with the office of the Ombudsman against employees issuing fake RPT Receipts, that resulted to the dismissal of 6 employees. 13.) Declared Tax Amnesty on Machinery and Equipment from Oct. to Dec. 2002. 14.) Created a special Task Force on Machinery composed of representatives from the Treasury, Assessor’s and Engineering Departments to conduct physical inventories of all machinery and equipment which failed to avail of the Tax Amnesty. 15.) Posted 300 Billboards in major thoroughfares informing the date of the Auction Sale and the increased discount from 10% to 20%, if RP Tax is paid annually. 16.) Allowed staggered payment of Delinquent Real Property Taxes upon payment of a minimum of 30% down and the balance payable within 6 months. 41 17.) Verified the total value of machinery as appearing in the Tax Declaration issued by the Assessor’s Office and counter checked this ,with that appearing in the financial statements. 18.) Instruct the Building Official to forward to the City Assessor the building / occupancy permit, stating the total value of the construction cost, for issuance of a new tax declaration. 19.) Instruct the City Engineer to forward to the City Assessor all application for mechanical permit for issuance of a new tax declaration on machineries. 20.) Implemented the Geographic Information System (GIS) for future tax mapping of Real Property. 42 Parcels with No Tax Declaration Record 43 Undeclared Buildings Map 44 Misclassification of Land Use All Tax Payments records Analysis By pointing and clicking to a parcel, payment history can be displayed and delinquent tax payers can be easily identified. 45 1.) Required taxpayers with gross receipts of over P500,000.00 to submit BIR stamped 2005 financial statements and records of monthly payments of VAT and NON-VAT for the year 2006; for comparison against declared gross receipts for 2006 before renewing their Mayor’s Permit for 2007. 2.) Utilized the presumptive income level approach (implementing a schedule of minimum gross) to make gross tax declarations more realistic and current. 46 3.) Alignment of Business Taxes with Metro Manila Rates 4.) Consultation and Dialogue with the Business Sector particularly QCCCI 5.) SEC / BIR gross-sales data versus declared gross sales with LGU’s. 6.) Census and listing of tax payers. 7.) Adequate and competent staffing. 8.) Examinations of books of account and pertinent records by the Treasurer or his authorize representative. 9.) Revenue target setting 47 10.) Required contractors to pay business tax prior to the release of the building, excavation and occupancy permits. 11.) Required dealers, sellers, and developers of real estate, such as land, building, condominium units and the like, especially corporations and other juridical entities, to present their Mayor’s Permit and proof of payment of Business Taxes before processing the Transfer Tax. 48 12.) Instructed the City Accountant to deduct from the voucher the amount owing to the payment of Business Tax for contractors and suppliers doing business with the City. 13.) Instructed the BPLO to conduct a door to door, street by street, inspection and verification of all unlicensed establishments. 14.) Identified establishments having decreased current declared gross receipts compared to previous years and examined their Books of Accounts for verification of actual sales. 49 15.) Used (ink) color coding in signing the tax bills and stamp pad with my picture on it, and other official documents during renewal period. 16.) Employed the raffle system in the assignment of Letters of Authority to revenue examiners. 50 17.) Grounded a number of revenue examiners with low collection outputs every month. 18.) Rewarded top collector revenue examiner with a free trip to Hong Kong and other incentives. 19.) Created a special team to compare Treasury records of Transfer Tax payments with those found in the Land Registration Authority. (Transfer Tax Records in 2001 revealed that 58% of those recorded in the LRA were fake receipts and only 42% were valid and legitimate.) 51 20.) Maintained a photo gallery of all permanent and casual employees with corresponding assignments, for easier identification. 21.) Required advertising agency to pay contractors tax prior to the release of the billboard permit. 52 22.) Update local business tax ordinances by 10% once every 5 years. 23.) Adjust existing fees and charges. 24.) Require payment of community tax on all transaction with LGU’s. QUEZON CITY IS THE RICHEST CITY NOT ONLY IN METRO MANILA BUT IN THE ENTIRE COUNTRY AS WELL, AS AUTHENTICATED BY THE COMMISSION ON AUDIT, BEATING MAKATI AND MANILA IN TERMS OF REVENUE COLLECTION FOR THE YEAR 2002,2003,2004 AND 2005 53 FMV along EDSA • • • • • Caloocan Quezon City Mandaluyong Makati Pasay P55,000 P 5,500 P12,000 P48,000 P25,000 The highest FMV in Quezon City is only P5,500 Report Collection for CY 2002 2001-2002 Nature of Collection 2001 2002 Real Estate % 722,437,380 847.964,965 17.38 1,209,965,603 2,467,209,132 103.91 Fees and Charges 149,224,960 231,964,478 93.51 Transfer Tax 107,510,561 200,013,469 86.04 Amusement Tax Business Taxes 146,400,840 131,480,835 -10.19 LOCAL SOURCES 2,335,539,344 3,878,632,879 66.07 BIR Allotment 1,300,485,734 1,290,701,951 -0.75 MMDA Contribution 97,716,000 126,564,000 29.52 Other Income 47,929,204 106,091,335 121.35 3,781,670,287 5,401,990,168 42.85 330,991,390.01 364,308,924 10.07 626,228,233 721,696,806 15.25 39,564,876 65,517,016 65.59 4,778,454,787 6,553,512,915 37.15 GENERAL FUND Barangay Share RPT SEF Other Trusts GROSS COLLECTION 54 Report of Collection for CY 2005 as of January to December 31, 2006 2005 2006 Increase (decrease) % Real Estate 1,017,808,956 1,337,428,919 319,619,963 Business Taxes 2,633,377,989 2,899,388,991 266,011,001 10.01 Other Regulatory/Misc Fees 265,051,332 352,074,538 87,023,205 32.83 Transfer Tax 237,212,000 235,725,565 (1,486,434) (0.63) Amusement Tax 143,141,648 131,262,836 (11,878,812) (8.30) Community Tax 59,941,629 66,833,390 6,891,761 218,481,333 526,562,216 308,080,882 Other Income 31.40 11.50 141.01 SUBTOTAL 4,575,014,890 5,549,276,458 974,261,568 21.30 IRA 1,325,076,782 1,295,641,743 (29,435,039) (2.22) 19.09 IRA Contribution to MMDA 213,845,000 252,528,000 38,683,000 6,113,936,804 7,097,446,201 983,509,529 16.09 Special Education Fund 826,935,804 1,038,674,677 211,738,872 25.61 Bgy. Share 437,656,191 550,756,457 113,100,266 25.84 7,378,528,668 8,686,877,336 1,308,348,668 17.73 81,957,537 143,021,796 61,064,258 74.51 7,460,486,205 8,829,899,133 1,369,412,927 18.36 GENERAL FUND Total City Collection Other Trusts GROSS COLLECTION GENERAL FUND as of December 31, 2006 BUDGET 6,250,000,000 ACTUAL 7,097,446,201 SURPLUS 847,446,201 55 Top 10 in terms of highest total income generated for CY 2004 as compared to 2001 (NCR) CLASS RANK RANK 2004 2001 CITY QUEZON CITY S 1ST MAKATI MANILA PASIG 6,496,282,210 3RD 4,276,721,410 1 2ND 6,247,252,757 1ST 5,122,321,279 S 3RD 6,029,451,082 2ND 4,422,171,694 2,220,682,718 1 4TH 2,969,849,218 4TH KALOOKAN 1 5TH 1,681,228,300 6TH 1,493,125,921 MANDALUYONG 1 6TH 1,601,355,056 7TH 1,165,955,784 PARANAQUE 1 7TH 1,590,065,300 5TH 1,533,439,002 MUNTINLUPA 1 8TH 1,250,547,925 8TH 1,087,802,228 1 9TH 1,246,598,000 9TH 1,075,895,000 1 10TH 1,1,73,179,686 10TH 872,868,370 SAN JUAN 1 1ST 519,580,000 2ND 430,370,000 NAVOTAS 1 2ND 276,671,818 3RD 292,835,782 PATEROS 3 3RD 72,952,324 4TH 62,188,114 PASAY VALENZUELA MUNICIPALITY GEN. FUND S.E.F. TRUST FUND TOTALS 83,216,459 107,266,365 154,191,123 345,001,948 Time Deposits 1,423,966,330 431,777,055 431,925,255 2,287,668,641 Cash on Hand & in Bank 1,512,560,010 539,043,420 586,444,378 2,638,047,810 FUNDS Funds Available Today 56 FINANCIAL PERFORMANCE OF LOCAL GOVERNMENT UNITS COA REPORT / National Capital Region – CY 2002 Internal Sources 3,946,465.3 External Sources 1,339,568.0 Grand Total 5,286,033.3 3,816,458.7 403,992.6 4,220,451.3 3. Manila City 3,116,507.8 1,047,027.1 4,163,534.9 4. Pasig City 1,677,114.8 388,438.6 2,065,553.3 5. Caloocan City 640,142.2 740,218.3 1,380,360.5 6. Mandaluyong City 778,135.5 280,363.8 1,058,499.3 7.) Paranaque City 708,046.2 345,447.7 1,053,493.8 8. Pasay City 639,536.0 306,163.3 945,699.3 9. La Pinas City 467,153.0 373,755.2 840,908.2 10. Muntinlupa City 533.984.0 304,334.4 838,318.3 11. Valenzuela City 434,465.2 375,762.2 810,227.3 12. Marikina City 382,179.0 318,950.7 701,129.7 13. Taguig 337,956.7 226,678.0 564,634.7 14. Malabon City 139,776.2 289,257.2 429,033.4 15. San Juan 314,598.4 66,611.7 381,210.9 16. Navotas 91,122.0 116,296.9 207,418.9 17. Pateros 23,734.1 37877.1 61,611.2 Cities/Municipalities 1. Quezon City 2. Makati 2004 INCOME STATEMENT GENERAL FUND INCOME Tax revenues QUEZON CITY MANILA MAKATI 3,932,060,660 3,017,485,962 3,422,250,392 897,657,280 608,287,258 1,405,161,315 2,753,350,830 2,234,148,853 1,826,109,950 281,052,550 175,049,851 190,379,126 Non-Tax Revenues 390,022,310 593,099,926 337,607,540 Regulatory fees Real property tax Business tax Other tax 213,071,460 178,841,429 214,303,596 Service/User charges 53,899,860 161,887,878 45,243,634 Economic Enterprise 20,302,230 154,474,482 37,601,206 102,748,770 96,871,990 40,459,102 Shares from national tax collection/Grants/Aids 1,472,766,930 1,100,610,001 629,435,809 Loans and borrowings ------- Inter-Local Transfers ------- Other receipts TOTAL INCOME 5,794,829,900 -------830,345,778 5,541,541,667 108,866,054 ------- 4,489,159,795 57 STATEMENT OF INCOME AND EXPENDITURES CY - 2005 INCOME EXPENDITURES EXCESS/DEFICIT 1.Quezon City 7,376,391,780.00 4,769,022,210.00 2,580,389,570.00 2.Manila City 7,119,823,858.00 5,902,084,336.00 1,217,739,522.00 3.Makati City 6,320,342,864.75 4,416,865,605.91 1,903,477,258.84 4.Pasig City 2,969,849,218.46 2,897,677,927.86 72,171,290.60 5.Parañaque City 1,997,001,967.15 1,892,401,933.02 104,599,764.13 6.Kalookan City 1,681,228,300.25 1,456,825,963.54 224,402,336.71 7.Mandaluyong City 1,601,355,056.00 1,422,370,155.00 178,984,901.00 8.Muntinlupa City 1,364,082,104.90 1,329,592,287.06 34,489,817.84 9.Valenzuela City 1,173,179,685.75 942,242,676.82 230,937,008.93 10.Marikina City 1,123,019,340.00 778,312,420.00 344,706,920.00 11.Las Piñas City 1,098,864,570.00 1,011,286,870.00 87,577,700.00 12.Taguig 831,014,000.00 812,357,000.00 18,657,000.00 13.Malabon City 570,243,044.42 463,194,670.88 107,048,373.54 14.San Juan 519,580,000.00 459,200,000.00 60,380,000.00 15.Navotas 276,671,818.05 253,653,320.10 23,018,497.95 16.Pateros 83,297,713.42 79,738,124.59 3,559,588.83 37,352,537,051.15 29,852,591,500.78 7,499,945,550.37 TOTAL PARTICULARS QUEZON CITY MANILA MAKATI INCOME 7,376,391,780.00 7,119,823,858.00 6,320,342,864.75 LOCAL SOURCES 5,828,214,960.00 5,103,606,479.00 5,810,054,849.16 TAX REVENUE 5,240,530,690.00 4,438,344,332.00 5,264,943,985.16 Real Property 2,299,519,760.00 1,889,166,686.00 2,462,986,843.28 Business Taxes 2,635,229,130.00 2,351,070,156.00 2,513,988,823.49 305,781,800.00 198,107,490.00 287,968,318.39 NON-TAXES REVENUE 587,684,270.00 665,262,147.00 545,110,864.00 Regulatory Fees 304,124,060.00 269,796,183.00 187,575,606.84 Service/User Chrages 122,166,900.00 166,311,490.00 66,601,993.32 30,658,620.00 185,458,341.00 105,744,778.21 Other Taxes Receipts from Eco. Ent. Toll Fees Other Receipts SHARES FROM NATIONAL TAX COLLECTIONS 0.00 9,913.00 0.00 130,734,690.00 43,686,220.00 185,188,485.63 1,548,176,820.00 1,156,140,434.00 431,979,800.00 EXTRAORDINARY RECEIPTS/GRANTS/AIDS 0.00 500,000.00 26,608,118.85 LOANS AND BORROWINGS 0.00 0.00 51,700,096.74 INTER-LOCAL TRANSFER 0.00 859,576,945.00 0.00 58 5,820,000,000.00 5,707,509,556 5,600,000,000.00 5,304,608,683 5,200,000,000.00 5,286,033,298 4,700,000,000.00 3,641,861,948 4,072,000,000.00 2,000,000,000 3,286,396,701 3,000,000,000 3,870,000,000.00 4,000,000,000 3,788,687,846 5,000,000,000 5,175,000,000.00 6,000,000,000 6,122,034,764.55 1999-2005 Estimate VS. Actual Comparative 1,000,000,000 Estimate Actual 1999 2000 2001 2002 2003 2004 2005 Report of Collection as of Feb. 27, 2007 2006 Real Estate Business Taxes Other Reg./Misc Fees 2007 Increase (decrease) % surf (def) 274,682,517 284,534,710 9,852,192 1,201,456,187 1,279,649,917 78,193,729 6.51 61,844,723 152,218,191 90,473,467 146.29 Transfer Tax 31,631,495 39,779,550 8,148,054 Amusement Tax 22,340,412 13,099,296 (9,241,116) 3.59 25.76 (41.37) Community Tax 45,190,061 53,389,517 8,199,456 18.14 Other Income 42,060,602 102,179,426 60,118,823 142.93 8,572,061 23,980,793 15,480,732 179.76 1,687,778,062 1,948,931,403 261,153,341 15.47 IRA 88,485,716 133,847,738 45,362,022 51.26 IRA Contribution to MMDA 18,407,000 21,923,000 3,516,000 19.10 Special Accounts SUBTOTAL 1,794,670,778 2,104,702,141 310,031,363 17.28 Special Education Fund 230,823,737 239,292,657 8,468,920 3.67 Barangay Share 116,380,658 121,933,264 5,552,605 4.77 2,141,875,175 2,465,928,063 324,052,888 15.13 16,319,502 31,341,864 15,022,361 92.05 2 158 194 678 2 497 269 928 339 075 250 15 71 GENERAL FUND TOTAL City collection Other Trusts GROSS COLLECTION 59 Cash Report as of Feb. 27, 2007 FUNDS GEN. FUND S.E.F. TRUST FUND TOTALS Funds Available Today 432,716,682 174,710,097 446,251,976 1,053,678,955 Time Deposits 5,086,775,946 230,654,885 184,794,997 5,502,225,829 Cash on Hand & in Bank 5,539,826,738 405,364,982 631,046,973 6,576,238,694 60 OTHER TREASURY FUNCTIONS: 1.GASOLINE CALIBRATION 2.INSPECTION OF WEIGHTS AND MEASURES 3.BILLBOARDS GASOLINE CALIBRATION Increase penalty of defective gasoline pumps: 1. 1st Offense - from P200 to P4,000 2. 2nd Offense - from P500 to P5,000 3. 3rd Offense - cancellation/revocation of mayor’ permit to operate a business * Calibration of gas pump from annually to quarterly. Note: The court may impose 3 months to 1 year imprisonment or both fine and imprisonment at the discretion of court 61 CALIBRATING BUCKET 62 TEST WEIGHTS 63 Ordinance 1508, S-2005 An Ordinance authorizing the city treasurer to accept as an alternative mode of payment for taxes and fees from taxpayers through the use of over the counter payments in accredited banks, internet banking and automated teller machines. 64 ACCREDITED BANKS REPRESENTED BY 1. LANDBANK OF THE PHILIPPINES – MS. GILDA E. PICO – Pres.& CEO 2. DEVELOPMENT BANK OF THE PHILS. - MR. REYNALDO DAVID – Pres. & CEO 3. PHILIPPINE NATIONAL BANK - MR. OMAR BRYON T. MIER – Pres.& CEO 4. PHILIPPINE VETERANS BANK - MR. RICARDO A. BALBIDO, JR. –Pres.& CEO 5. UNION BANK OF THE PHILS. - MR. EDWIN R. BAUTISTA – Exec. Vice-Pres. 6. PHILIPPINE POSTAL SAVINGS BANK - MR. ROLANDO L. MACASAET – Pres. & CEO ORDINANCE NO. 1663, S-2006 An Ordinance authorizing the city Mayor to require the city treasurer or his duly authorized representatives to apprehend persons, corporations and entities doing business in Quezon City not issuing receipts and/or sales invoice. 65 66 VICTOR B. ENDRIGA, Ph.D. Cel. NO. 0920-9555444 Tel. No. (02) 928-8336 67 68