December 2004

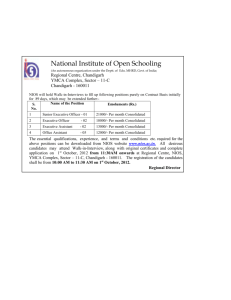

advertisement