2. The Ledger and the Trial Balance

advertisement

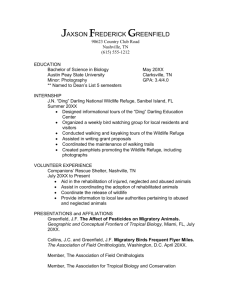

2. The Ledger and the Trial Balance Following themes are discussed in this chapter 2.1 Posting transactions to the ledger 2.2 Balancing off ledger accounts 2.3 Preparation of the trial balance 48 For free distribution Introduction The transactions which were recorded in prime entry books using source documents are posted to the ledger accounts under the double entry system. The collection of these accounts can be identified as the ledger. It includes various types of accounts. As the changes of transactions are recorded in the ledger accounts we can see a summary of such transactions in a ledger account. Using the balances of ledger accounts for a specific day, the trial balance is prepared to ensure the arithmetic accuracy of transactions recorded under the double entry system. The trial balance is very useful for the preparation of remaining accounting records in a business. Accordingly, the preparation of accounts and the trial balance will be discussed in this chapter. 1 Your attention is drawn on the following basic terms in this chapter. _ Assets accounts _ Income accounts _ Expenditure accounts _ Equity accounts _ Liability accounts _ Blancing off ledger accounts _ Ledger _ Trial balance 49 For free distribution 2.1 Posting Transactions to the Ledger You have already studied that the source documents (such as receipts, vouchers, invoices, debit notes, credit notes) provide us the information of transactions in a business. Based on these source documents, prime entry books are prepared. Now let us study the next step of the accounting process. After recording transactions in the prime entry books they should be entered in the accounts according to double entry system. The basis of the double entry system is a dual economic effect of a transaction. It means that each transaction has a dual effect and it is recorded as debit and credit according to the principle of the double entry system. An account is an accepted format that summarizes the data of transactions of a certain period of time. The place where all the accounts are included is called the ledger. There are a number of accounts to record transactions in the business and it is clear that there are various kinds of accounts in the ledger. These accounts can be classified as follows. ¯ Assets accounts ¯ Expenditure accounts ¯ Liability accounts ¯ Income accounts ¯ Capital / Equity accounts Income accounts Liability accounts Expenditure accounts Capital account Assets accounts The way of forming the ledger 50 For free distribution Ledger Assets Accounts The resources of a business can simply be identified as assets. The changes in assets are recorded in assets accounts. Examples : building account debtors account ¤ cash account ¤ ¤ Asset account has a debit balance Expenditure Accounts Expenses should be incurred to generate the income of the business. The accounts in which the day to day expenses are recorded can be defined as expenditure accounts. Expenditure account has a debit balance. Examples : ¤ ¤ ¤ insurance account salaries account electricity account Liabilities Accounts The obligations for out side parties are known as liabilities. The changes in such liabilities are recorded in liability accounts. Liability account has a credit balance. Examples : ¤ ¤ creditors account bank loan account Income Accounts Income accounts are used to record the details of income earned by the business from various sources. Specially, the income generated from selling goods and providing services to the customers are recorded in this account and it has a credit balance. Examples : ¤ ¤ ¤ ¤ sales Account interest received account rent received account discount received account Capital Accounts The accounts which show the values of the resources that belong to owners of the business can be identified as capital accounts. Capital account has a credit balance. 51 For free distribution Accordingly, you have already realized that a ledger has various types of accounts. and the transactions recorded in prime entry books are posted to the ledger under double entry system. Revise your knowledge on how the transactions recorded in prime entry books are posted to the ledger. As the cash book and petty cash book act as a ledger accounts, only one effect is recorded in the ledger accounts out of the transactions recorded in cash book and petty cash book. The dual effect of transactions recorded in other prime entry books are recorded in ledger accounts. Let us study the following example to revise your knowledge on double entry system which you have studied in Grade 10. Date Transaction Debit account 01'01.xx Introduction of capital Rs. 75,000 04.01.xx Purchase of office equipment worth of Rs. 8,000 paying cash Cash book Credit account Capital account Office equipment account Cash book 05.01.xx Payment of rent Rs. 1,500 Rent account Cash book 07.01.xx Purchase of Rs. 24,000 goods under cash basis for re-sale' Purchases account Cash book 12.01.xx Cash sales of goods Rs. 9,700' Cash book Sales account 14.01.xx Bank loan obtained Rs. 15,000 Cash book Bank loan account Cash Book Date Description 01'01.xx Capital account 12.01.xx Sales account 14.01.xx Bank loan account L Amount F Rs. 75"000 9"700 15"000 Date Description L Amount F Rs. 04.01.xx Office equipment Ac. 8"000 05.01.xx Rent account 1"500 07.01.xx Purchases account 52 For free distribution 24"000 Capital Account Debit L. Amount F. Rs. Date Description Date Description 04.01.xx Cash 07.01.xx Debit Date 01.01.xx Cash L. Amount F. Rs. Date Description Rent Account Description L. Amount F. Rs. 75"000 Credit L. Amount F. Rs. L. Amount F. Rs. Credit Date Description L. Amount F. Rs. Description Credit L. Amount F. Rs. 1"500 Cash Purchases Account Debit Date Description 8"000 Debit 05.01.xx Date Office Equipment Account Debit Date Credit Description Cash L. Amount F. Rs. Date 24"000 Bank Loan Account Description L. Amount F. Rs. Date Credit Description 14.01.xx Cash L. Amount F. Rs. 15"000 53 For free distribution Debit Credit Date Description Sales Account L. Amount F. Rs. Date Description Amount Rs. Cash 12.01.xx 2.2 L. F. 9"700 Balancing off Ledger Accounts After recording transactions in ledger accounts, the balances of credit and debit sides of them should be calculated at the end of a certain period of time. This process is called balancing off the ledger accounts. Following three ledger accounts show five transactions occurred in a business during the month of March 20XX. Stationery Account Debit Date 15.03.xx Description Cash Date Description Description L. Amount F. Rs. 3"200 Creditors Account Debit Date L. Amount F. Rs. Credit L. Amount F. Rs. Date Description 12.03.xx Purchases account 24.03.xx Purchases account 54 For free distribution Credit L. Amount F. Rs. 13"500 9"200 Bank Loan Account Debit Date Description 20'03.xx Cash L. Amount F. Rs. Date Description 02'03.xx 2"000 Credit Cash L. Amount F. Rs. 25"000 Study how the above accounts have been balanced as they are shown below. Stationery Account Debit Date 15'03.xx Description Cash L. Amount F. Rs. 3"200 Date Credit Description L. Amount F. Rs. 31'03.xx Balance c/d 3"200 01'04.xx Balance b/f Date 31'03.xx 3"200 3"200 Creditors Account Debit Description Balance c/d L. Amount F. Rs. Date 22"700 12'03.xx 24'03.xx Credit Amount Description L. F. Rs. Purchase A/c Purchase A/c 22"700 Bank Loan Account Date 20'03.xx 31'03.xx L. Amount Description F. Rs. Cash Balance c/d 13"500 9"200 22"700 01'04.xx Debit 3"200 Date 2"000 02'03.xx Balance b/f 22"700 Credit L. Amount Description F. Rs. Cash 25"000 23"000 25"000 25"000 01'04.xx Balance b/f 23"000 Accordingly, understand how the ledger accounts are balanced after recording the transactions. 55 For free distribution Activity 01 Record the following transactions in the ledger accounts and balance them as at 31.01.20XX 05.01. 08.01. 10.01. 15.01. 20.01. 30.01. Introduction of capital Cash purchases Bank loans obtained Cash sales Cash purchases Payment of salaries Rs. 74,000 Rs 15,000 Rs 35,000 Rs 24,000 Rs 16,000 Rs. 5,000 2.3 Trial Balance A business prepares a statement including all the balances of ledger accounts at the end of certain accounting period. This statement is called Trial Balance. The balances of assets and expenditure accounts are recorded in the debit column of the trial balance and the balances of income, liabilities and equity accounts are recorded in the credit column of the trial balance. If there are credit entries corresponding to the debit entries of the period, the totals of the debit and credit columns of the trial balance will be equal. It is important to emphasize that the trial balance is not a ledger account. It is a statement only. If the total of debit and credit column of the trial balance are equal, it indicates that there are no mathematical errors in the accounting system. Now let us study how to prepare a trial balance. Following are the balances brought down by Sepala’s Business as at 31.12.20xx after balancing the ledger accounts. Rs. Purchases 20,000 Cash 5,000 Sales 110,000 Insurance 4,000 Electricity 3,000 Rates 1,000 Furniture 45,000 56 For free distribution Discount allowed Debtors Discount received Bank loan Bank loan interest Commission received Buildings Lands Creditors Capital 3,000 15,000 2,000 10,000 2,000 6,000 45,000 30,000 25,000 20,000 The following trial balance has been prepared using the above balances provided by Sepala’s Business as at 31.12.20xx Sepala’s Business Trial Balance as at 31.12.20xx Description L. P. Purchases Cash Sales Insurance Electricity Tax Furniture Discount allowed Discount received Bank loan Bank loan interest Commission receiveda Buildings Lands Creditors Debtors Capital Debit Rs. Credit Rs. 20"000 5"000 110"000 4"000 3"000 1"000 45"000 3"000 2"000 10"000 2"000 6"000 45"000 30"000 25"000 15"000 173"000 20"000 173"000 57 For free distribution Following advantages can be obtained by preparing a trial balance ¯ The mathematical accuracy of the accounting process can be ensured. ¯ Financial statements can be prepared easily, as the trial balance summarizes the ledger. (Trial balance is a summarized statement of the ledger) ¯ The aggregate value of an item can be identified quickly. Example : ¤ Total value of debtors ¤ Total value of creditors Let us prepare a trial balance with the transactions occurred in a business Following are the transactions extracted from the books of Dayananda Lokuge who started the business in January 20XX. 09.01 10.01 14.01 15.01 19.01 22.01 24.01 25.01 27.01 29.01 30.01 31.01 Introduction of capital Purchase of office equipment paying cash Cash purchases of goods Purchase of a motor bike paying Payment of insurance charges Cash sales of goods Bank loans obtained Payment of salaries Cash sales of goods Payment of building rent Cash purchases of goods Cash drawings Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs Rs 125,000 18,000 45,000 50,000 1,500 30,000 40,000 8,000 24,000 3,500 20,000 2,500 Following cash book, ledger accounts and trial balance have been prepared using the above transactions extracted from the Business of Dayananda Lokuge. 58 For free distribution Cash Book Date Description L. Amount Date F. Rs. Description L. Amount F. Rs. 09'01'20xx Capital account 125"000 10'01'20xx Office equipment account 18"000 22'01'20xx Sales account 30"000 14'01'20xx Purchases account 45"000 24'01'20xx Bank loan account 27'01'20xx Sales account 15'01'20xx Motor vehicles account 40"000 19'01'20xx Insurance charges account 24"000 25'01'20xx Salaries account 50"000 29'01'20xx Building rent account 3"500 20"000 31'01'20xx Drawings account 2"500 31'01'20xx Balance c/d 70"500 Date 31'01'20xx 219"000 70"500 Capital Account Debit Description Balance c/d L. Amount F. Rs. Date Credit Description 125"000 125"000 125"000 Office Equipment Account Date Description 10'01'20xx Cash Book 01'02'20xx Balance b/f L. Amount F. Rs. 125"000 09'01'20xx Cash Book 01'02'20xx Balance b/f Debit 8"000 30'01'20xx Purchases account 219"000 01'02'20xx Balance b/f 1"500 L. Amount F. Rs. Date Description 125"000 Credit L. Amount F. Rs. 18"000 31'01'20xx Balance c/d 18"000 18"000 18"000 18"000 59 For free distribution Motor Vehicles Account Debit Date Description 15'01'20xx Date L. Amount F. Rs. Description 50"000 31'01'20xx Cash Book Credit L. Amount F. Rs. 50"000 Balance c/d 50"000 50"000 01'02'20xx 50"000 Balance b/f Purchases Account Debit Date Description Credit L. Amount Description F. Rs. Date L. Amount F. Rs. 14'01'20xx Cash Book 45"000 31'01'20xx 30'01'20xx Cash Book 20"000 65"000 Balance c/d 65"000 65"000 01'02'20xx Insurance Charges Account Debit L. Amount Description F. Rs. Date 19'01'20xx 01'02'20xx 65"000 Balance b/f Cash Book Balance b/f 31'01'20xx Credit Description Description Balance c/d L. F. Amount Rs. 1"500 31'01'20xx Balance c/d 1"500 1"500 1"500 1"500 Sales Account Debit Date Date L. Amount F. Rs. Date Credit Description L. Amount F. Rs. 54"000 22'01'20xx Cash Book 30"000 27'01'20xx Cash Book 24"000 54"000 54"000 01'02'20xx 60 For free distribution Balance b/f 54"000 Bank Loan Account Debit Date 31'01'20xx Description Balance c/d L. Amount F. Rs. Date 40"000 24'01'20xx Credit L. Amount Description F. Rs. Cash Book 40"000 40"000 01'02'20xx Date 25'01'20xx Balance b/f Salaries Account Debit Description Cash Book L. Amount F. Rs. Date 8"000 31'01'20xx Balance b/f Description Balance c/d Date 29'01'20xx Description Cash Book Balance b/f Debit Date L. Amount F. Rs. Date 3"500 31'01'20xx Description Balance c/d 31'01'20xx Cash Book Balance b/f L. Amount F. Rs. 3"500 3"500 L. Amount F. Rs. Date 2"500 31'01'20xx 2"500 01'02'20xx Credit 3"500 Credit Drawings Account Description 8"000 8"000 3"500 01'02'20xx L. Amount F. Rs. 8"000 Building Rent Account Debit 40"000 Credit 8"000 01'02'20xx 40"000 Description Balance c/d L. Amount F. Rs. 2"500 2"500 2"500 61 For free distribution Dayananda Lokuge's Business Trial Balance as at 31st.January 20XX Description L. P. Cash book Capital account Office equipment account Motor vehicles account Purchases account Insurance charges account Sales account Bank loan account Salaries account Bulding rent account Drawings account Debit Rs. 70"500 Credit Rs. 125"000 18"000 50"000 65"000 1"500 54"000 40"000 8"000 3"500 2"500 219"000 219"000 Activity 02 Assume, you started a business and following types of transactions occurred in the business during a certain month of its operations. ¯ ¯ ¯ ¯ ¯ ¯ ¯ Investment of capital Arising of liabilities Payments for expenses Receipts of income Purchase of assets Settlement of liabilities Decrease in capital Required : ¯ Write down transactions with values, that can be classified under each areas mentioned above. ¯ Prepare the cash book and ledger accounts for the transactions identified by you. ¯ Balance the ledger accounts as at the last date of the month. ¯ Prepare the trial balance based on the closing balances. 62 For free distribution Activity 03 Following are the transactions extracted from the books of Sirimal's Business during the month of January 20XX. Rs. 01'01 Introduction of capital 45"000 02'01 Cash purchases 12"000 04'01 Opened a bank current account 15"000 06'01 Obtained a bank loan 75"000 08'01 Purchase goods issuing a cheque 13"000 10'01 Cash deposited in the bank 20"000 11'01 Cash purchases 16"000 13'01 Credit sales to Gunapala (Invoice No. 01) 10"000 15'01 Credit sales to Karunapala (Invoice No. 02) 7"000 20'01 Purchase of equipment 20"000 23'01 Gunapala sent a cheque to settle his account 9"800 26'01 Cheque sent by Gunapala was deposited in the bank 29'01 Payment of bank loan interest 500 30'01 Payment of bank loan installment 2"000 31'01 Karunapala Paid Rs.3,000 discounts allowed to him was Rs.200 Required : Using above transactions, a. i. Prepare prime entry books ii. Post the transactions to the ledger iii. Prepare the trial balance as at 31.01.20XX b. Classify the ledger accounts in the trial balance prepared by you. c. State whether there are credit or debit balances in each of the accounts classified by you. 63 For free distribution Activity 04 Following is the trial balance prepared by a trainee accounts assistant of Sujeewa's Business as at 31.12.20XX. Description L. P. Stock Purchases Sales Drawings Discount allowed Discount received Miscellaneous income account Carriage outwards Creditors Debtors Capital Equipment Furniture and fittings Rent expense Bank loan Bank loan interest Commission received Salaries Debit Rs. Credit Rs. 25,000 65,000 95,000 4,000 4,000 3,000 16,000 18,000 17,000 15,000 50,000 25,000 35,000 5,000 25,000 1,000 2,000 11,000 208,000 208,000 Required : i. Identify the errors in the above trial balance. ii. Prepare the adjusted trial balance as at 31.12.20XX. iii. Drawings account is not an asset or expenditure account. If so, state as to why it is recorded in the debit side of the trial balance. 64 For free distribution