MASTER MINDS

No.1 for CA/CWA & MEC/CEC

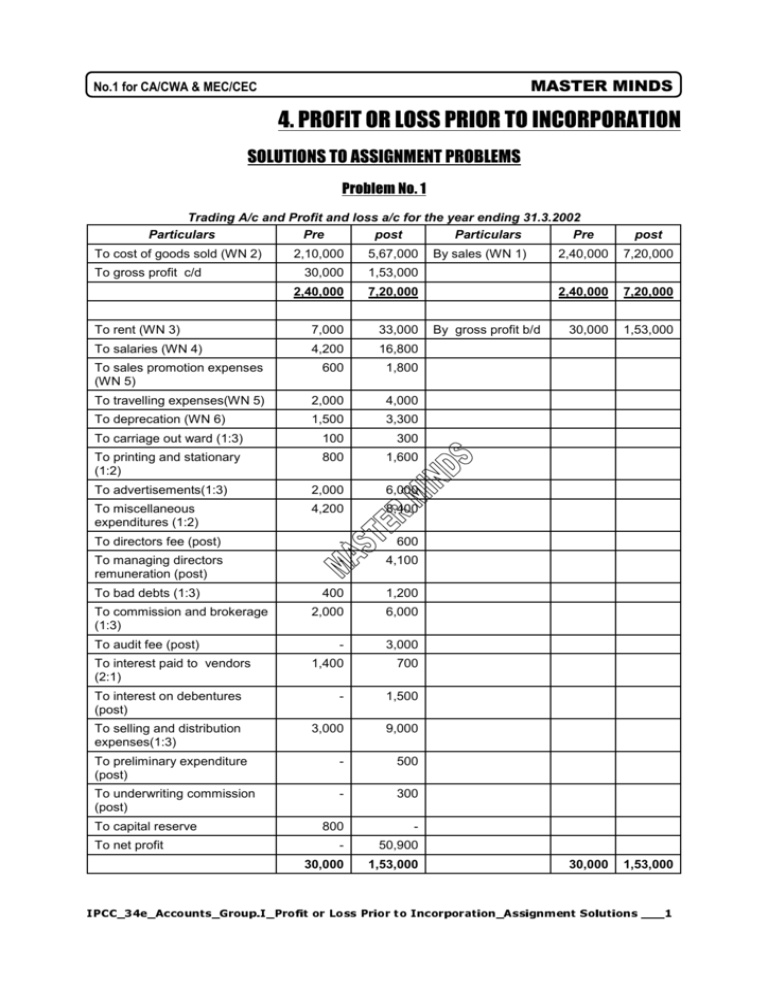

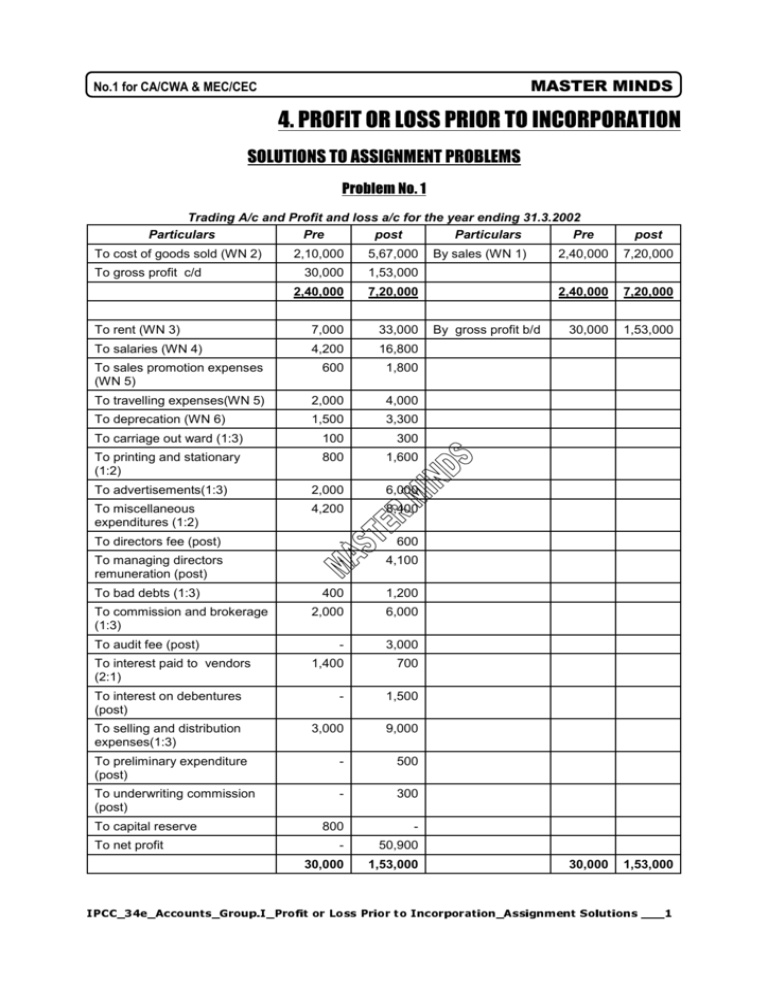

4. PROFIT OR LOSS PRIOR TO INCORPORATION

SOLUTIONS TO ASSIGNMENT PROBLEMS

Problem No. 1

Trading A/c and Profit and loss a/c for the year ending 31.3.2002

Particulars

Pre

post

Particulars

Pre

To cost of goods sold (WN 2)

2,10,000

5,67,000

30,000

1,53,000

2,40,000

7,20,000

To rent (WN 3)

7,000

33,000

To salaries (WN 4)

4,200

16,800

To sales promotion expenses

(WN 5)

600

1,800

To travelling expenses(WN 5)

2,000

4,000

To deprecation (WN 6)

1,500

3,300

To carriage out ward (1:3)

100

300

To printing and stationary

(1:2)

800

1,600

To advertisements(1:3)

2,000

6,000

To miscellaneous

expenditures (1:2)

4,200

8,400

To directors fee (post)

-

600

To managing directors

remuneration (post)

-

4,100

400

1,200

2,000

6,000

-

3,000

1,400

700

To interest on debentures

(post)

-

1,500

To selling and distribution

expenses(1:3)

3,000

9,000

To preliminary expenditure

(post)

-

500

To underwriting commission

(post)

-

300

800

-

-

50,900

30,000

1,53,000

To gross profit c/d

To bad debts (1:3)

To commission and brokerage

(1:3)

To audit fee (post)

To interest paid to vendors

(2:1)

To capital reserve

To net profit

By sales (WN 1)

By gross profit b/d

post

2,40,000

7,20,000

2,40,000

7,20,000

30,000

1,53,000

30,000

1,53,000

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___1

Ph:

98851 25025/26

www.mastermindsindia.com

Working Notes :

1. Computation of sales ratio :

Let the average monthly sales be ‘x’

Pre

Post

April -X

Aug-X

May-X

sep –X

June -X

Oct, Nov, Dec, Jan, Feb, Mar. X +

2

5X

X=

× 6 =10X

3

3

July-X

4X

2X+10X =12X

4

12

1

3

Sales Ratio = 1:3

2. Computation of cost of goods ratio :

Pre

Post

Cost per unit X

X – 0.1X = 0.9X

No. of units 1

3

X

2.7X

10

27

Cost of goods Ratio =

10:27

3.

40,000

Original Space

13,000

Additional Space

27,000 (3,000 X 9m)

Pre

Post

Rs. 4,000

Rs. 9,000

Pre - July 3,000

Post - Aug. to

March 24,000

Pre

Post

April

–X

August

–X

May

–X

September

-X

June

-X

October

-X

July

-X

November to March = 1.2x X 5 = 6X

4X

3X + 6X = 9X

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___2

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Rent Ratio = 4:9

Copy Rights Reserved

Rent for pre

= 4,000+3,000 =7,000

Rent for post

= 9,000+24,000 =33,000

To

MASTER MINDS, Guntur

4. Computation of salaries ratio :

Pre

April

–X

May

-X

June

-X

July

– 3X

Post

August to March = 3x X 8 = 24x

6X

Salaries Ratio = 6:24 = 1:4

5. Travelling expenses :

Travelling Expenses – 8,400

Selling 2,400 (1:3)

600 Pre

6,000 (1:2)

2,000 Pre

1,800 Post

4,000 Post

6.

Depreciation

300 (Post)

4,500 (1:2)

1,500 (pre)

3,000 post

7. Interest paid to vendors:

6M

Apr. to July 4M

Aug. to Sept 2M

4:2 = 2:1

8. Audit fees assumed to be belongs to company audit, hence charged to post period.

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___3

Ph:

98851 25025/26

www.mastermindsindia.com

Problem No. 2

Pre-incorporation period is for four months, from 1st January, 2010 to 30th April, 2010. 8 months’ period

(from 1st May, 2010 to 31st December, 2010) is post-incorporation period.

Statement showing calculation of profit/losses for pre and post incorporation periods

Particulars

Gross Profit (9:19)

Pre

Post

3,42,000

7,22,000

36,000

-

7,000

-

3,85,000

7,22,000

30,000

60,000

Manager’s salary (WN g)

23,000

62,000

Other salaries (WN g)

82,000

1,64,000

Printing and stationery (1:2)

6,000

12,000

-

45,000

Carriage outwards (9:19)

4,500

9,500

Sales commission (9:19)

9,900

20,900

Interest on Investments

Bad debts Recovery

Less : Rent and Taxes(1:2)

Salaries :

Audit fees (post)

Bad Debts (91,000 + 7,000) (9:19)

31,500

66,500

Interest on Debentures (finance costs)

-

25,000

Underwriting Commission (post)

-

26,000

Preliminary expenses (post)

-

28,000

11,200

−

1,86,900*

2,03,100

Loss on sale of investments (pre)

Net Profit

* Pre-incorporation profit is a capital profit and will be transferred to Capital Reserve.

Working Notes:

a. Calculation of ratio of Sales

Let average monthly sales be x.

Pre

Jan

– 1.5X

Post

May, June, July, Aug & Sep – 5X

Feb

-X

Mar

-X

Nov

- X

April

– 3X

Dec

- 2X

4.5X

Oct

- 1.5X

9.5X

Thus Sales from January to April are 4½ x and sales from May to December are 9½ x. Sales are in

the ratio of 9/2x : 19/2x or 9 : 19.

b. Gross profit, carriage outwards, sales commission and bad debts written off have been allocated in

pre and post incorporation periods in the ratio of Sales i.e. 9 : 19.

c. Rent, salaries, printing and stationery, audit fees are allocated on time basis.

d. Interest on debentures, underwriting commission and preliminary expenses are allocated in post

incorporation period.

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___4

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

e. Interest on investments, loss on sale of investments and bad debt recovery are allocated in preincorporation period.

f.

Audit fees assumed to be relating to company audit, hence charged to post period. Hence charged

to post period.

g. Total salaries paid

Rs.3,31,000

Total Salaries Paid Rs. 3,31,000

Managers Salary Rs.85,000

23,000 (pre)

Others Salary Rs.2,46,000

82,000 (pre)

62,000 (post)

1,64,000 (post)

Problem No.3

Time ratio:

Pre incorporation period (01.04.2009 to 01.08.2009)

= 4 months

Post incorporation period (01.08.2009 to 31.03.2010)

= 8 months

Time Ratio

= 4 : 8 or 1 : 2

Sales ratio: Average monthly sales before incorporation was twice the average sale per month of the

post incorporation period. If weightage for each post-incorporation month is x, then

Weighted sales ratio

=

4 X 2x : 8 X 1x

=

8x : 8x or 1 : 1

Copy Rights Reserved

To

Problem No.4

MASTER MINDS, Guntur

Statement showing calculation of profits for pre and post incorporation periods for the year

ended 31.3.2010

Pre-incorporation

Post-incorporation

Particulars

period (Rs.)

period (Rs.)

Gross profit (1:3)

80,000

2,40,000

Less: Salaries (1:2)

16,000

32,000

Stationery (1:2)

1,600

3,200

Advertisement (1:3)

4,000

12,000

Travelling expenses (W.N.3)

4,000

8,000

Sales promotion expenses (W.N.3)

1,200

3,600

Misc. trade expenses (1:2)

12,600

25,200

Rent (office building) (W.N.2)

8,000

18,400

Electricity charges (1:2)

1,400

2,800

-

11,200

800

2,400

Director’s fee (post)

Bad debts (1:3)

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___5

Ph:

98851 25025/26

www.mastermindsindia.com

Selling agents commission (1:3)

4,000

12,000

Audit fee (1:3)(note 6)

1,500

4,500

-

3,000

Interest paid to vendor (2:1) (W.N.4)

2,800

1,400

Selling expenses (1:3)

6,300

18,900

Depreciation on fixed assets (W.N.5)

3,000

6,600

12,800

-

-

74,800

Debenture interest (post)

Capital reserve (bal. Fig.)

Net profit (Bal.Fig.)

Working Notes:

st

st

Pre incorporation period = 1 April , 2009 to 31 July, 2009

i.e. 4 months

1. Time Ratio = 4 months : 8 months i.e. 1 : 2

2. Sales ratio:

Let the monthly sales for first 6 months (i. e. from 1.4..2009 to 30.9.09) be = x

Then, sales for 6 months = 6x

2

5

Monthly sales for next 6 months (i.e. from 1.10.09 to 31.3.2010) = x + x = x

3

3

5

x X6 = 10 x

3

Total sales for the year = 6x + 10x = 16x

Then, sales for next 6 months =

Monthly sales in the pre incorporation period

= Rs.19,20,000 / 16

= Rs.1,20,000

Total sales for pre-incorporation period

= Rs.1,20,000 X 4

= Rs.4,80,000

Total sales for post incorporation period

= Rs.19,20,000 – Rs.4,80,000

= Rs.14,40,000

Sales Ratio = 4,80,000 : 14,40,000 = 1 : 3

3. Rent:

Particulars

Rs.

Rs.

Rent for pre-incorporation period (Rs. 2,000 X 4)

8,000

(pre)

Rent for post incorporation period

August, 2009 & September, 2009 (Rs.2,000 X 2)

October, 2009 to March, 2010 (Rs.2,400 X 6)

4,000

14,400

18,400

(post)

4. Travelling expenses and sales promotion expenses:

Particulars

Pre (Rs.)

Post (Rs.)

Traveling expenses Rs.12,000 (i.e. Rs.16,800 – Rs.4,800)

distributed in 1:2 ratio

4,000

8,000

Sales promotion expenses Rs.4,800 distributed in 1:3

ratio

1,200

3,600

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___6

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

th

5. Interest paid to vendor till 30 September, 2009:

Particulars

Interest for pre-incorporation period

Pre (Rs.)

Rs.4,200

6

Post (Rs.)

2,800

X 4

Interest for post incorporation period i.e. for August, 2009

Rs.4,200

& September, 2009 =

X 2

6

1,400

6. Depreciation:

Particulars

Pre

(Rs.)

Rs.

Total depreciation

Less: Depreciation exclusively for post incorporation period

Depreciation for pre-incorporation period 9,000 X

4

12

Depreciation for post incorporation period 9,000 X

8

12

Post

(Rs.)

9,600

-

-

600

-

600

9,000

-

-

-

3,000

-

-

-

6,000

-

3,000

6,600

Audit fees is assumed to be Tax audit fees, hence allocated on Sales ratio. i.e. 1 : 3

Problem No.5

st

Statement showing pre and post incorporation profit for the year ended 31 March, 2012

Particulars

Total

Amount

(Rs.)

Gross Profit(Wn 3)

5,40,000

Less: Depreciation

Basis of

Allocation

PostIncorporation

Rs.

Pre

incorporation

Rs.

2:7

1,20,000

4,20,000

1,08,000

1:2

36,000

72,000

Director’s Fees

50,000

Post

-

50,000

Preliminary Expenses

12,000

Post-

-

12,000

Office Expenses

78,000

1:2

26,000

52,000

5,000

Actual

4,000

1,000

54,000

2,33,000

Interest to vendors

Net Profit (Rs.54,000 being

pre incorporation profit is

transferred to capital reserve

Account)

2,87,000

Working Notes:

1. Sales ratio: The sales per month in the first half year were half of what they were in the later half

year. If in the later half year, sales per month is Re.1 then it should be 50 paise per month in the

st

st

first half year. So sales for the first four months (i.e. from 1 April, 2011 to 31 July, 2011) will be 4

X .50 = Rs.2. Thus sales ratio is 2:7. Post period sales Aug. to Sep=1x , Oct to mar=6x , Total=7x.

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___7

Ph:

98851 25025/26

www.mastermindsindia.com

2. Time ratio:

st

st

st

st

1 April, 2011 to 31 July, 2011:1 August, 2011 to 31 March, 2012

= 4 months : 8 months = 1:2

Thus, time ratio is 1:2

Copy Rights Reserved

To

3. Gross profit:

MASTER MINDS, Guntur

Gross profit = Net profit + All expenses

= Rs.2,00,000 + Rs.(1,08,000 + 15,000 + 50,000 + 12,000 + 78,000 + 72,000 + 5,000)

= Rs.2,00,000 + Rs.3,40,000 = Rs.5,40,000

4.

Particulars

Dividend

Basis

Pre (Rs.)

Post (Rs.)

sales ratio

5,40,000 X 2 / 9

1,20,000

5,40,000X 7/9

4,20,000

5.

Particulars

Audit fees

Basis

Pre (Rs.)

Post (Rs.)

Time ratio

5,000

5,000

6.

Particulars

Selling expenses

Basis

Pre (Rs.)

Post (Rs.)

sales ratio

16,000

56,000

Problem No.6

(a) Sales of first 6 months = Rs.4,80,000. Average sale of first 6 months = Rs.4,80,000/6 = Rs.80,000

per month. Pre-incorporation period consist of 3 months (i.e., April, May and June). The sales of

those 3 months = Rs.80,000 x 3 = Rs.2,40,000. Sales of remaining 9 months = Rs.24,00,000 –

Rs.2,40,000 = Rs.21,60,000.

Therefore, the ratio of sales = Rs.2,40,000 : Rs.21,60,000 or 1: 9.

(b) Let the average of monthly sales = X. The sales of different months can be shown as follows:

Month

Jan

Feb

Mar.

April

May

June

July

Aug

Sept

Oct

Nov

Dec

Sales

1x

0.5x

1x

0.5x

1x

1x

1x

1x

1x

1x

1.5x

1.5x

Date of incorporation is May, 2013

Pre incorporation period is from January to April i.e. 3 x

Post - incorporation period is from May to December i.e 9x

The ratio of Sales = 3x : 9x or 1:3.

(c) Let the average monthly sales be x. The sales of different months can be shown as follows:

Month

April

May

June

July

Aug

Sept

Oct

Sales

2x

1x

1x

1x

1x

1x

1x

Date of incorporation is 1 July, 2013

Pre incorporation period is from April to June i.e. 4 x

Post - incorporation period is from July to March i.e. 11x

Nov

Dec

Jan

Feb

Mar.

1x

1x

1x

2x

2x

The ratio of Sales = 4x : 11x or 4:11

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___8

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Problem No.7

Statement showing the calculation of Profits for the pre-incorporation and post incorporation

Periods:

Total

Basis of

PrePostParticulars

Amount

Allocation incorporation incorporation

300

100

Sales

400

Gross Profit (25% of Rs.1,600)

Less: Salaries

46

23

Time

69

16

8

Time

24

Rent, rates and Insurance

44

22

Time

66

Sundry office expenses

12

4

Sales

16

Travellers’ commission

9

3

Sales

12

Discount allowed

3

1

Sales

4

Bad debts

25

Post

25

Directors’ fee

6.75

2.25

Sales*

9

Audit Fees

8

4

Time

12

Depreciation on tangible assets

11

Post

11

Debenture interest

Net Profit

152

32.75

119.25

Working Notes:

1. Sales ratio

Particulars

Sales for the whole year

st

Sales upto 31 July, 2012

st

st

Therefore, sales for the period from 1 August, 2012 to 31 March, 2013

(Rs.in lakh)

1,600

400

1,200

Thus, sale ratio

= 400:1200 = 1:3

2. Time ratio

st

st

st

st

1 April, 2012 to 31 July, 2012 : 1 August, 2012 to 31 March, 2013

= 4 months: 8 months = 1:2 , Thus, time ratio is 1:2.

Verified By: Amaranth Garu

Executed By: Mr. Uday

THE END

Copy Rights Reserved

To

MASTER MINDS, Guntur

IPCC_34e_Accounts_Group.I_Profit or Loss Prior to Incorporation_Assignment Solutions ___9