Pre and Post Incorporation This situation arises when a promoter of

advertisement

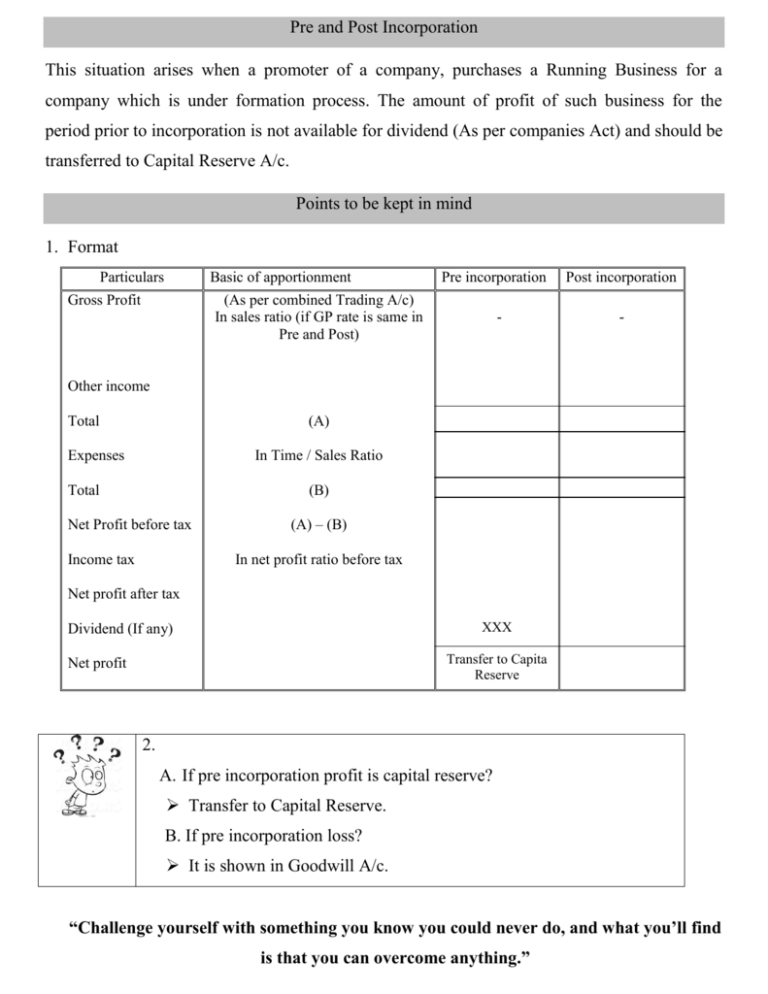

Pre and Post Incorporation This situation arises when a promoter of a company, purchases a Running Business for a company which is under formation process. The amount of profit of such business for the period prior to incorporation is not available for dividend (As per companies Act) and should be transferred to Capital Reserve A/c. Points to be kept in mind 1. Format Particulars Gross Profit Basic of apportionment (As per combined Trading A/c) In sales ratio (if GP rate is same in Pre and Post) Pre incorporation - Post incorporation - Other income Total (A) Expenses In Time / Sales Ratio Total (B) Net Profit before tax Income tax (A) – (B) In net profit ratio before tax Net profit after tax XXX Dividend (If any) Transfer to Capita Reserve Net profit 2. A. If pre incorporation profit is capital reserve? Transfer to Capital Reserve. B. If pre incorporation loss? It is shown in Goodwill A/c. “Challenge yourself with something you know you could never do, and what you’ll find is that you can overcome anything.” 3. If certificate of commencement of Business date is given, if company is a public company? Ignore date of commencement and considerer date of incorporation because business commencement certificate effective from back date. 4. Basic of apportionment Time Ratio? Fixed Expenses, Rent, Salary, Depreciation, office expenses, shop expenses, Trade expenses, Electricity expenses, printing and stationary, Telephone, Interest on loan, Rates and taxes (other than Income Tax like Municipal tax etc.) Sales Ratio? Variable expenses, Packing and forwarding expenses, Sales Promotion, Advertisement, Bad Debts, Discount Allowed, Commission, Carriage outward. Expenses of Pre Period only? Interest on capital, Partners’ salary, salary of manager who became director. Expenses of Post Period only? Interest on Debenture, Director’s fee, Meeting fee, Director’s Remuneration, Preliminary Expenses Written off, Goodwill Written off, other Written off (Like Discount on Issue, Share issue expenses, Underwriting Commission written off.) Interest on purchase consideration? Special Time Ratio. Number of months from Date of business purchase to date of incorporation : Date of incorporation to date of payment of PC Audit Fees? Always Confusing If there is need of tax audit If company Audit As per study material? :- In Sales Ratio :- only Post Period In my opinion apply sales ratio and put a note that (that there is a requirement of tax audit as per Income Tax Act.) “All our dreams can come true–if we have the courage to pursue them.” Share transfer fees? Income of Post only. Bad debts recovered? Income of the Period in which it was recovered actually. Profit and Loss on sales of assets / investment? If sold in pre period then full loss or Profit is to be taken in pre period. If sold in post period full profit or loss is to be taken in post period. Depreciation? 1. Generally, it is in time ratio. 2. If any fixed assets is purchased in post period then Total Depreciation On New F.A. On Old F.A.(B.F.) In Post Period only In Time Ratio Travelling Expenses? 1. If given for sales promotion separately? In Sales Ratio and Balance in Time. 2. If no separation is given? Assume that it is for sale and distribute in sales ratio. Direct Expenses? 1. Freight inward/Direct wages/ Carriage inward / Other Direct Expenses It is to be debited in Trading A/c so there is no need of distribution in any ratio. Income tax / provision for income tax? 2. It was taken to post period only. (In study module question number 2(Inder, Vishnu) In my opinion it should be distributed in net profit (Before tax ratio) “Life is 10% what happens to me and 90% how I react to it.” Gross Profit? If Gross Profit rate is same (uniform) in pre and post period? Gross Profit is distributed in sales ratio. Unless otherwise stated we have to assume that Gross Profit rate is same in entire period. Sales Ratio? 1. Sales of Pre and Post are given. 2. Sales volume PM is given.(Like sales of July and December is double.) 3. If neither sales nor sales volume PM is given (means no information of sales is given) Time Ratio will be taken as sales ratio (Assuming evenly sales) Debtors and Creditor Suspense A/c? When a company takes over business of another company, business consist all assets liabilities including debtor. Sometime purchasing company is not interested in takeover of debtors of vendor company keeping in view risk of Bad Debts (As credit was allowed by vendor company to parties which are unknown for purchasing company) but it is also true that now it is difficult for vendor company itself to collect money from debtors after sale of business to purchasing company. So to resolve above difficulty purchasing company may take work of collection only (Neither takeover of debtors nor responsibility of collection) on commission basis. Now journal entries in the basis of purchasing company of taking work of collection of debtors. 1. For bringing account of all debtors in Sundry debtors A/c the books. Dr. (Mr. A, Mr. B etc.) To Debtor suspense A/c If money is collected, it will be payable to vender company after deduction. Commission of purchasing company but it is not sure that amount will be collected so it is put to debtors suspense rather than crediting to vendor company. 2. On collection of Debtor Cash / Bank A/c Dr. To Debtor A/c (Mr. A, Mr. B etc.) 3. Above collecting money is payable to Debtor suspense A/c vendor (now there is no suspense.) Dr. To vendor company A/c To commission 4. For Bad debts Debts suspense To Debtor A/c A/c A/c Questions to be practiced Module Page No. 3.19, Question No. 6 (XYZ) Module Page No. 3.60, Question No. 2 (Also in NPA Class Work) Module Page No. 3.90, Question No. 3 (Also in NPA Class Work) Module Page No. 3.11, Question No. 4 “You miss 100% of the shots you don’t take.” “All the Best” Your comment and feedback are needed….. Dr.