EY Indonesia

Tax Insight

01/2013

Notification about VAT Invoice

Signer (Socialization for DGT Regulation

No. PER-24/PJ/2012 about VAT Invoice)

As you may be aware, the Directorate General of Taxes (“DGT”) has issued a new regulation

regarding VAT invoices, i.e. DGT Regulation Number PER-24/PJ/2012 dated 22 November

2012 and its implementing regulation DGT Circular number SE-52/PJ/2012 which will come

into effect on 1 April 2013.

This regulation provides new guidance on the preparation of VAT invoices. The significant

changes are in the numbering procedures of the VAT invoices and the format of the serial

numbers. With the enactment of this regulation, the serial numbers of VAT invoices will be

issued by the Tax Office.

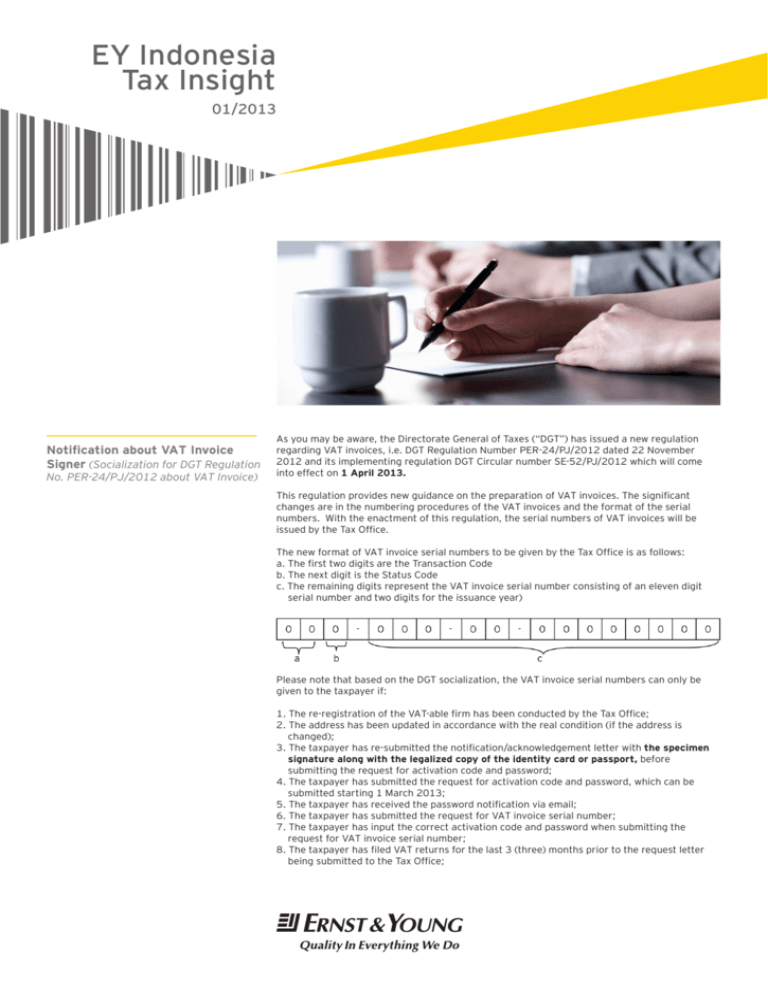

The new format of VAT invoice serial numbers to be given by the Tax Office is as follows:

a. The first two digits are the Transaction Code

b. The next digit is the Status Code

c. The remaining digits represent the VAT invoice serial number consisting of an eleven digit

serial number and two digits for the issuance year)

Please note that based on the DGT socialization, the VAT invoice serial numbers can only be

given to the taxpayer if:

1. The re-registration of the VAT-able firm has been conducted by the Tax Office;

2. The address has been updated in accordance with the real condition (if the address is

changed);

3. The taxpayer has re-submitted the notification/acknowledgement letter with the specimen

signature along with the legalized copy of the identity card or passport, before

submitting the request for activation code and password;

4. The taxpayer has submitted the request for activation code and password, which can be

submitted starting 1 March 2013;

5. The taxpayer has received the password notification via email;

6. The taxpayer has submitted the request for VAT invoice serial number;

7. The taxpayer has input the correct activation code and password when submitting the

request for VAT invoice serial number;

8. The taxpayer has filed VAT returns for the last 3 (three) months prior to the request letter

being submitted to the Tax Office;

Following this, it is advisable for you to submit the notification letter of the signer of the VAT

invoices with the specimen of the signature along with the legalized copy of the identity card

or passport at the latest by 31 March 2013. Without this notification and the legalized copy of

the identity card or passport, the VAT invoice is considered an Incomplete VAT Invoice (and will

be subject to an administration sanction of 2% of the VAT base. In addition, such VAT invoice

cannot be credited as Input VAT by the Buyers.

Collection of tax information

(MOF Regulation Number 16

PMK.03/2013 dated 04 January 2013)

MOF has issued the implementing regulation for Government Regulation No. 31 Year 2012,

which provides the framework for collection of data and information related to taxation. In

addition to the detailed instruction of mechanism in collecting the data, the regulation provides

a list of the first batch of thirteen (13) government organizations, private organizations,

associations, and other parties required to provide the data and information to the DGT, which

includes: (1) Direktorat Jenderal Anggaran (Directorate General of Budget); (2) Direktorat

Jenderal Perbendaharaan (Directorate General of Treasury); (3) Direktorat Jenderal Bea

dan Cukai (Directorate General of Customs and Levy); (4) Direktorat Jenderal Perimbangan

Keuangan (Directorate General of Revenue Distribution); (5) Badan Kebijakan Fiskal (Fiscal

Policy Agency); (6) PT Pelabuhan Indonesia 1 (Persero); (7) PT Pelabuhan Indonesia II

(Persero); (8) PT Pelabuhan Indonesia III (Persero); (9) PT Pelabuhan Indonesia IV (Persero);

(10) BKPM (Investment Coordinating Board); (11) Kementerian Dalam Negeri (Ministry of

Internal Affair); (12) Otoritas Pelabuhan Kementerian Perhubungan (port authorities of the

Ministry of Transportation); and (13) Bank Indonesia (the Indonesian central bank).

The regulation contains the format and detail type of data and information and schedule

to be provided to the DGT in its attachment. The appointed officer should give the data

and information in electronic media to the appointed tax officer starting 1 May 2013. The

regulation defines the data and information as collection of number, letter, word, and/or image,

which can be in the form of a letter, document, book, or note and written description, which

provides indication of income and/or assets of an individual or an entity, including business

activity or independent personal services from an individual or an entity. The regulation is

effective from the date of issuance, i.e. 4 January 2013.

Amendment of several tax notices

under Article 16 of KUP Law

(MOF Regulation Number 11/

PMK.03/2013 dated 02 January 2013)

The regulation provides the procedures to amend several tax notices as governed under Article

16 of the Law on General Tax Rules and Administration (“UU KUP” or KUP Law) for mistakes

in writing, calculation and application of certain provisions of the Tax Laws. This regulation is

issued to synchronize the existing procedures with provisions in Government Regulation No. 74

Year 2011. Highlights of the new procedures are:

• The regulation provides detailed classification of errors that can be corrected.

• It is now possible to electronically submit the application through the DGT website (www.

pajak.go.id) or an Application Service Provider (ASP). Taxpayer will receive an Electronic

Receipt upon the submission. This procedure of submission is called “e-Filing”.

• The application letter is in a standard format as provided in the regulation.

• There is a 6 (six) months time limit for the DGT to issue a Decision Letter on the Correction. If

passed, the application is deemed approved by the DGT.

• Taxpayer can simultaneously apply for a correction and an objection on a tax assessment

letter. Decision on the request for correction is to be issued separately from the tax objection

decision.

• The DGT can issue amendment on an ex-officio basis based on the result of a Mutual

Agreement Procedure (MAP).

• Taxpayer can apply for objection on amendment that is issued on an ex-officio basis within

three (3) months from delivery date of amendment letter.

• For Fiscal Year 2007 and prior years, the DGT is allowed to issue amendment on the Objection

Decision Letter ex-officio if the decision is obviously not correct. In this case, taxpayer is

not allowed to submit an appeal on the Objection Decision Letter; otherwise the appeal

application should be decided as not acceptable.

This regulation revokes MOF Regulation No. 19/PMK.03/2008 and will enter into force on 1

March 2013. Since the new procedures are more detailed than the previous one, it is critical

that readers understand the new procedures.

Procedures for refund of tax that

should not have been paid (MOF

Regulation Number 10/PMK.03/2013

dated 02 January 2013)

MOF has issued a regulation regarding the new refund procedure of tax that should not have

been paid. The regulation is to synchronize the procedure in accordance with the Government

Regulation No. 74 Year 2011. For example, the refund application will now be processed

through the Verification procedure. We note that there are some improvements compared to

the previous regulation, such as: an entity or an individual who is not required to have a Tax

Identification Number (“NPWP”) can apply for refund from withholding taxes and obtain the

Tax Overpayment Assessment Letter. Also, it is clear now that foreign taxpayer who has a

Permanent Establishment in Indonesia should apply for the refund of withholding taxes through

EY Indonesia Tax Insight | 01/2013

its Permanent Establishment. The regulation provides more specific requirements to obtain the

refund of the taxes. Unfortunately, the regulation does not regulate the time limit to respond

to the application as of the previous regulation. Readers seeking for a refund of tax that should

not have been paid are recommended to identify their specific circumstance and adopt the

appropriate refund procedure as governed by this regulation to ensure the ability to claim back

the tax. The regulation entered into force on 1 February 2013 and revoked the previous MOF

Regulation.

Procedures to apply for tax

objection (MOF Regulation Number 9/

PMK.03/2013 dated 02 January 2013)

MOF has issued a new regulation providing procedures for application of tax objection. The

regulation is intended to provide procedures that are in line with Government Regulation No.

74 Year 2011. Highlights of changes in the procedures are:

• The regulation introduces an on-line submission for objection application called “e-Filing”.

• ►Taxpayer can only object on the content of the Tax Assessment Letter, which includes the loss

amount, the tax amount, or on the content from tax withholding. Any objection reason other

than those mentioned will not be considered.

• ►Taxpayer must use the format of objection application letter as provided in the regulation.

• ►Any amendment to a tax assessment letter issued before a taxpayer submit an objection

against the original tax assessment will cause an extension on the time limit to submit the

objection letter and this will be considered as one of the “force majeure”.

• ►If the objection letter does not fulfill the formal requirement, the objection will not be

considered and the DGT will not issue the Decision Letter on Objection. The notification letter

that the objection application letter does not fulfill the formal requirement is not a decision

and cannot be appealed to the tax court.

• ►Taxpayer can withdraw an objection request using the format as provided in the regulation.

The DGT is obligated to give its approval or refusal to the withdrawal in writing with the

format as described in the regulation.

• ►If the taxpayer withdraws the objection application, it cannot apply for reduction or

cancellation of the tax assessment letter.

• ►The DGT can request explanation or proof related to the tax dispute content to a third party.

• ►Taxpayer should provide the original tax withholding proofs in the objection process.

• ►If a taxpayer apply for objection and Mutual Agreement Procedure (MAP) at the same time

and the Mutual Agreement has not been obtained when the objection is due, the DGT will

issue the Objection Decision Letter based on the tax findings in the tax assessment letter.

Otherwise, the MAP should be accounted for the Objection Decision Letter.

• ►The administrative penalty of 50% of tax that is not paid prior to an objection will not apply if:

• Taxpayer withdraws the objection application.

• The objection application is not considered because it does not fulfill formal

requirement.

• Taxpayer applies for appeal to the Tax Court on the Objection Decision Letter.

This regulation revokes the previous regulation and enters into force from 1 March 2013. Since

the procedures are more detailed and sophisticated than the previous one, it is critical that

readers understand the new procedures.

Procedures to reduce or cancel

administrative penalty and to

amend or cancel Tax Assessment

Letters and Tax Collection

Letters (MOF Regulation Number 8/

PMK.03/2013 dated 02 January 2013)

The regulation provides new procedures for reduction or cancellation of administrative

sanction, or for amendment or cancellation of Tax Assessment Letters and Tax Collection

Letters as governed under Article 36 of the Law on General Tax Rules and Administration

(“UU KUP” or KUP Law). The regulation is to align the existing procedures with Government

Regulation No. 74 Year 2011. Highlights of the regulation are provided below:

•

•

•

•

►The application letter can be submitted electronically through the DGT website (www.pajak.

go.id) or an Application Service Provider (ASP). Taxpayer will receive an Electronic Receipt

upon the submission. This procedure of submission is called “e-Filing”.

►Taxpayer can only apply for one request and it cannot be done simultaneously with others.

Thus, it is critical that taxpayer who is seeking for cancellation or reduction under Article

36 of KUP Law reviews the options available for the most appropriate procedure.

►The application does not defer payment of tax and/or penalty requested for reduction /

cancellation.

►The DGT must issue a decision letter on the application within 6 (six) months from when

the application letter is received. If the DGT does not issue a decision letter after the

six month time-frame, the application is deemed accepted and the DGT must issue the

decision letter.

EY Indonesia Tax Insight | 01/2013

•

►

►The reduction on administrative sanction is applied retroactively from 31 December 2011

until 31 December 2013.

This regulation revokes the previous regulations and will enter into force on 1 March 2013.

Since the procedures are more detailed and sophisticated than the previous, it is critical that

readers understand the new procedures.

Facility of Import Duty Borne

by the Government for Year

2013 (MOF Regulation Number 7/

PMK.011/2013 dated 02 January 2013)

Natural Gas is not Subject to

VAT (MoF Regulation Number 252/

PMK.011/2012 dated 28 December

2012)

New Technical Guidance on Article

21 Withholding Tax (DGT Regulation

Number PER-31/PJ/2012 dated 27

December 2012)

The regulation provides an incentive of import duty borne by the Government on importation

by certain industries for the purpose to fulfill goods and/or services for the public interest,

consumed by the public, and/or to protect consumer, to increase certain industries’ local

competitive advantage, to increase labor absorption and to increase the country’s income.

The regulation also provides the detail procedures in obtaining the incentive from the

Government. This import duty facility is only valid until 31 December 2013.

The regulation defines the types of natural gas that are not subject to VAT on the basis that

VAT does not apply to mining or drilling products directly taken from their sources. This

includes natural gas supplied through pipeline; Liquified Natural gas (“LNG”); and Compressed

Natural gas (“CNG”). Liquefied Petroleum Gas (“LPG”) in canisters ready for consumption is

not included as natural gas that is not subject to VAT.

On 27 December 2012, the DGT issued new technical guidance to withhold income tax article

21 which came into force on 1 January 2013. The change is triggered by the adjustment on

Non-Taxable Threshold as governed under MOF Regulations No. 162/PMK.011/2012 and No.

206/PMK.011/2012. The changes on non-taxable income are summarized below:

•

•

•

The tax free threshold for taxpayer it is now IDR 24.300.000/year (or IDR 2.025.000/

month) and for each dependant and wife, it is IDR 2.025.000/year (or IDR168.750/

month);

The maximum limit of non-taxable income on wages paid to non permanent employees

is raised to IDR 200.000/day from IDR 150.000/day, or IDR 2.025.000/month from IDR

1.320.000/month;

The threshold for the application of the progressive income tax rates on wages is increased

to IDR 7 million/month from IDR 6 million/month. This means that wages below IDR 7

million per month will be subject to a flat tax rate of 5%.

This regulation revokes the DGT Regulation No. PER-31/PJ/2009 as amended by PER-57/

PJ/2009.

Change on Withholding Income

Tax Article 22 on Import or Other

Business Activity (MOF Regulation

Number 224/PMK.011/2012 dated

26 December 2012 and DGT Circular

Letter Number SE-02/PJ/2013 dated 31

January 2013)

MOF has issued a new regulation as an amendment to MOF Regulation No. 154/PMK.03/2010

regarding the collection of income tax under Article 22 of the Income Tax Law (“Income Tax

Article 22”) on import or other business activities. State Owned Enterprises where all or most

of their shares are directly owned by the Government are now appointed as collector of Income

Tax Article 22 on purchases of goods. The regulation also adds pharmaceutical companies,

sole distributors of cars (ATPM), brand holder agents (APM), and general importers of motor

vehicles as entities that are required to collect Income Tax Article 22 on their local sales.

Certain exceptions from collection of Income Tax Article 22 are provided to entities appointed

by the Ministry of Defense or the Army to provide boundary data and aerial photographs for

national defense, import of certain vessels by national companies for port services, rivers and

lakes transport services and crossing.

The regulation enters into force after sixty days of its issuance.

Timing for issuance of tax invoices

for Taxable Goods with specific

characteristics (MoF Regulation

Number 238/PMK.03/2012 dated 26

December 2012)

The regulation provides specific exceptions for certain taxpayers delivering taxable goods with

specific characteristics, as follows:

• having sales price that are subject to fluctuation in accordance with index / standard price in domestic or international market;

• quality or content of the products can be changed upon delivery or transportation process under normal condition; and/or;

• quantity of the products can be changed upon delivery or transportation process under normal condition

The regulation provides that concentrate of mining products containing minerals and chemical

products fall under the category of taxable goods with specific characteristics as governed

under this regulation.

EY Indonesia Tax Insight | 01/2013

It would appear that the regulation accommodates the potential change of sales value caused

by certain factors. For this reason, the regulation requires that the sales contract clearly defines

agreements between the seller and the purchaser on such potential price changes.

Tax invoices relating to delivery of taxable goods with specific characteristic are, at the latest,

to be issued when the revenue from the delivery can be completely calculated in final. However,

if payment is received before that, the tax invoice must be issued upon receipt of payment.

This regulation comes into effect 30 (thirty) days after its enactment.

Tax Deductibility of Bad Debt

Provision (MOF Regulation Number

219/PMK.011/2012 dated 21 December

2012)

Restructuring of Large Tax Offices,

Jakarta Special Tax Offices, and

Middle Tax Offices (DGT Regulation

Number PER-28/PJ/2012 dated 17

December 2012)

MOF amended Regulation No. 81/PMK.03/2009 regarding tax deductibility of bad debt

provision. Based on the new regulation, Lembaga Pembiayaan Ekspor Indonesia, PT

Perusahaan Pengelola Aset and infrastructure funding companies that provide funding to

infrastructure projects are allowed to claim tax deduction on bad debt provision. The regulation

amends determination of the tax deductibility of their bad debt provision for PT Permodalan

Nasional Madani (Persero). This regulation is effective from Fiscal Year 2012.

The DGT rearranges the structure of the Large Tax Offices, Jakarta Special Tax Offices, and

Middle Tax Offices. The Large Tax Offices now consist of four tax offices, two for private

companies and two for State Owned Companies. The Jakarta Special Tax Offices now consist

of 8 tax offices; one for Listed Public companies, six for Foreign Investment companies, one for

permanent establishments and foreigners in Jakarta area and one for taxpayers in the Oil and

Gas sectors.

The above tax regulation came into force on 1 January 2013.

VAT for First Generation Coal

Contract of Work (Berita Negara

Republik Indonesia No. 1255 Year

2012 – MoF Regulation Number 194/

PMK.03/2012 dated 6 December 2012)

On 6 December 2012, MoF issued Regulation Number 194/PMK.03/2012 regarding the

Procedures for Collection, Payment, and Reporting of Sales Tax and VAT and/or Luxury Sales

Tax Treatment for First Generation of Coal Contract of Work. This regulation takes effect from

1 January 2013. The contractors under the First Generation Coal Contract of Work are PT.

Arutmin Indonesia, PT. BHP Kendilo Coal Indonesia, PT. Kaltim Prima Coal, PT. Kideco Jaya

Agung, PT. Adaro Indonesia and PT. Berau Coal (“the Contractors”).

The regulation provides a significant change to the current VAT practice of the Contractors,

whereas under this regulation, the Contractors have the obligation to self collect, pay, and

report Sales Tax relating to services provided by vendors of the Contractors. Specifically for PT

Berau Coal, it is also obliged to self collect, pay and report Sales Tax on purchases of goods. The

rates of Sales Tax range from 1% to 5%. For the purpose of reporting, the regulation introduces

a Sales Tax Return for the Contractors, which are to be submitted at the end of the month

following the event triggering the Sales Tax. The Sales Tax itself is to be paid at the latest by the

15th of that month following the event triggering the Sales Tax.

Under this regulation, Value Added Tax and Luxury Sales Tax on the delivery of goods and

services provided to the Contractors are not collected. Thus, vendors to the Contractors are still

required to issue tax invoices on deliveries of taxable goods and/or services, but the tax invoices

are to be issued with the stamp describing “VAT AND/OR LUXURY SALES TAX (PPnBM) IS NOT

COLLECTED BASED ON MoF REGULATION NUMBER ……”

Annual Income Tax Return

Submission Procedures (DGT

Regulation Number PER-26/PJ/2012

dated 05 December 2012 and DGT

Circular Letter number SE-55/PJ/2012

dated 05 December 2012)

Starting 1 January 2013, the DGT changed its procedures for the submission of Annual Income

Tax Return. A summary of the major changes in the new procedures compared to the previous

procedures is as follows:

•

•

•

•

•

►Taxpayer who submits the Annual Income Tax Return directly to the Tax Office, Tax

Counter (“Pojok Pajak”), Tax Car (“Mobil Pajak”) or Drop Box is not required to use a closed

envelope or other packaging.

►The Annual Income Tax Return in the form of e-SPT should be directly submitted to the

Tax Office where the taxpayer is registered. The same procedure has previously applied

for Tax Return that showed an overpayment of tax, a Tax Return Revision, or a Tax Return

submitted after the deadline.

►Taxpayer that submits Tax Return in the form of e-SPT must ensure that the e-SPT is

completely filled in and consistent with the hardcopy and it must be submitted along

with the hardcopy. Otherwise, the Tax Return will be considered not complete and not

submitted.

►The Tax Office will issue the Correction Letter on the Annual Income Tax Return Receipt if

the Tax Office finds that the taxpayer has put the wrong Tax Identification Number in the

Annual Income Tax Return.

►The regulation also provides the procedures for the Tax Office to collectively receive the

Tax Return through Drop Box services, either at the taxpayer’s site or at the Tax Office.

PER-26/PJ/2012 has included the list of documents/information required to be attached to the

Annual Income Tax Return. These regulations revoke the previous tax regulations.

EY Indonesia Tax Insight | 01/2013

Our Values

Who we are :

What we stand for:

At Ernst & Young, everything starts with our people

Achieving Potential – Making A Difference

• People who demonstrate integrity, respect and teaming

• People with energy, enthusiasm and the courage to lead

• People who build relationships based on doing the right thing

We are committed to helping our people,

our clients and our wider communities

achieve their potential.

Sectors we serve in Indonesia

• Banking & capital markets

• Asset management

• Insurance

• Power & utilities

• Mining & metal

• Oil & gas

• Media & entertainment

• Telecommunications

• Technology

• Public infrastructure

•Transportation

• Real estate

• Consumer products

• Pharmaceuticals

• Plantation

• Industrial & manufacturing

• Automotive

• Government & public sector

• Not-for-profit organizations

Contact us

Name

Ben Koesmoeljana

Title

Phone

Mobile

E-mail

Leader, Tax Services

Technical Advisor

+62 21 5289 5030

+62 819 0569 8899

Title

Phone

Mobile

ben.koesmoeljana@id.ey.com

A. Business Tax

Name

E-mail

Dodi Suryadarma

Partner

+62 21 5289 5236

+62 815 10000 490

dodi.suryadarma@id.ey.com

Yudie Paimanta

Partner

+62 21 5289 5585

+62 816 893 687

yudie.paimanta@id.ey.com

Santoso Goentoro

Partner

+62 21 5289 5584

+62 816 893 648

santoso.goentoro@id.ey.com

Bambang Suprijanto

Partner

+62 21 5289 5060

+62 811 326 597

bambang.suprijanto@id.ey.com

Nathanael Albert

Executive Director

+62 21 5289 5265

+62 811 950 926

nathanael.albert@id.ey.com

B. Transaction Tax

Name

Lam Prasetya Halim

Title

Partner

Phone

Mobile

E-mail

+62 21 5289 5591

+62 813 8880 0668

Phone

Mobile

prasetya.h.lam@id.ey.com

C. Indirect Tax

Name

Title

E-mail

Iman Santoso

Partner

+62 21 5289 5250

+62 811 884 267

iman.santoso@id.ey.com

Elly Djoenaidi

Partner

+62 21 5289 5590

+62 816 893 689

elly.djoenaidi@id.ey.com

D. Human Capital

Name

Title

Phone

Mobile

E-mail

Kartina Indriyani

Executive Director

+62 21 5289 5240

+62 811 868 336

kartina.indriyani@id.ey.com

Henry Tambingon

Executive Director

+62 21 5289 5033

+62 899 229 0009

henry.tambingon@id.ey.com

E. International Tax/ Transfer Pricing

Name

Title

Phone

Mobile

E-mail

Peter Ng

Technical Advisor

+62 21 5289 5228

+62 815 1800 790

peter.ng@id.ey.com

Carlo Navarro

Technical Advisor

+62 21 5289 5029

+62 816 872 777

carlo.navarro@id.ey.com

+62 21 5289 5587

+62 816 829 074

rachmanto.surahmat@id.ey.com

Rachmanto Surahmat Senior Advisor

Assurance | Tax | Transactions | Advisory

About Ernst & Young

Ernst & Young is a global leader in assurance, tax, transaction and

advisory services. Worldwide, our 167,000 people are united by

our shared values and an unwavering commitment to quality. We

make a difference by helping our people, our clients and our wider

communities achieve their potential.

Ernst & Young refers to the global organization of member firms of

Ernst & Young Global Limited, each of which is a separate legal entity.

Ernst & Young Global Limited, a UK company limited by guarantee,

does not provide services to clients.

For other services contact:

For more information about our organization, please visit

www.ey.com/id

© 2013 Ernst & Young Indonesia

All Rights Reserved.

Business Development Program Office

Tel. +62 21 5289 5672/ 5136/ 5138

indonesia.bdpo@id.ey.com