PDF:324KB

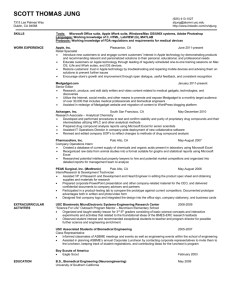

advertisement