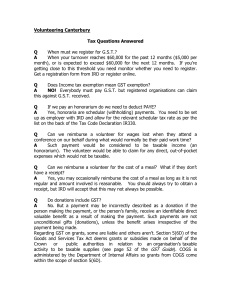

Employer's Guide for Taxable Benefits/Allowances

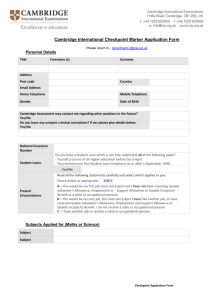

advertisement