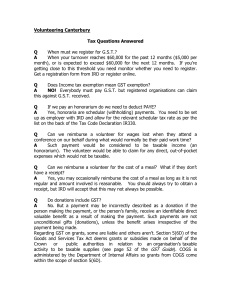

Employer's Guide for Taxable Benefits/Allowances

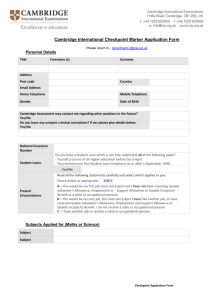

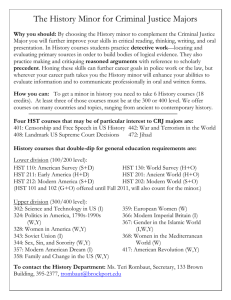

advertisement