Morning Glance

advertisement

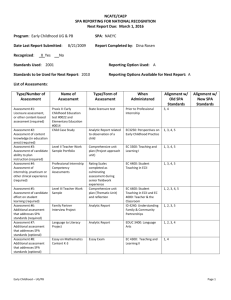

February 26, 2016 Morning Glance Equity Research Desk Indices Value SENSEX 22976.00 (112.93) (0.49) 6970.60 (48.10) (0.69) NIFTY Pts Chg (%) SGX NIFTY* 7072.50 60.50 0.86 DOW Jones 16697.29 212.30 1.29 S&P 500 1951.70 21.90 1.13 Nasdaq 4582.20 39.59 0.87 FTSE 6012.81 145.63 2.48 CAC 4248.45 93.11 2.24 DAX 9331.48 163.68 1.79 Shanghai Composite* 2765.35 24.10 0.88 Nikkei* 16332.97 192.63 1.19 Hang Seng* 19219.30 330.55 1.75 Strike Price OI *As at 8.30 am Most Active Call & Put Symbol Chg (%) NIFTY 7000 CE 5636325 80.37 NIFTY 7000 PE 1381650 (80.17) Commodity Value Pts NYMEX Crude (USD) 32.92 (0.15) (0.45) Brent Crude (USD) Chg (%) 35.00 (0.29) (0.82) Gold (INR) 29760.00 209.00 0.71 Silver (INR) 37155.00 (85.00) (0.23) Copper (INR) 315.50 (3.20) (1.00) ZInc (INR) 118.90 (2.55) (2.10) 15960.00 70.00 0.44 Currency Value Pts USD/Rupee 68.71 0.15 0.22 Euro/Rupee 75.85 0.51 0.68 Pound/Rupee 95.93 0.65 0.68 1.11 0.00 0.31 Dollar Index 97.25 (0.04) (0.04) Volatility Value Pts CBOE VIX 19.11 (1.61) (7.77) India VIX 22.75 (0.20) (0.87) Cotton (INR) Euro /USD Interest Rates Value Chg (%) Chg (%) 7.87% 5 US 10-Yr Yield 1.72% (3) Turnover (INR Crs) BSE NSE F&O 2319.38 18482.58 601736.89 Advance (Nos) 877 (33%) 487 (32%) NA Declines (Nos) 1598 (61%) 983 (65%) NA 158 (6%) 41 (3%) NA Unchanged The market ended on a negative note on Thursday. The market breadth was negative with almost 2 losers for every gainer on BSE. 877 shares advanced whereas 1598 shares declined and 158 shares were unchanged on BSE. BSE Sensex was down 113 points or 0.5% to close at 22976. Nifty 50 declined 48 points or 0.7% to settle at 6971. BSE Mid-Cap index was down 110 points or 1.1% to end at 9544. BSE Small-Cap index lost 88 points or 0.9% to settle at 9598. Top gainers in BSE Sensex were ONGC (2.9%), Sun Pharma (2.4%), HDFC (1.9%), Coal India (1.3%) and Hindalco (1.2%) whereas top losers were SBI (3.1%), Tata Motors (2.9%), GAIL (2.9%), Larsen (2.4%) and ICICI Bank (2.0%). US markets were positive, Dow Jones Industrial Average closed at 16697, advancing 212 points (1.3%), S&P 500 was up 22 points (1.1%) to close at 1952 and Nasdaq gained 40 points (0.9%) to close at 4582. European markets were also positive, FTSE was up 146 points (2.5%) to close at 6013, CAC advanced 93 points (2.2%) to close at 4248 and DAX gained 164 points (1.8%) to close at 9331. Macro News • Railway has increased plan outlay to INR 1.21 lacs crs from ~INR 1 lacs crs in the previous budget. • Railway proposes to setup 3 more DFC a) North-South connecting Delhi to Chennai, b) East-West connecting Kharagpur to Mumbai and c) East Coast connecting Kharagpur to Vijayawada. • 4 new category of trains introduced- (a) Humsafar- Full 3AC train (b) Tejas- Speed of 130 Kmph (c) Uday- Capacity enhanced by 40%, operate on busiest routes (d) Antyodaya Express- Fully unreserved long distance train. • Railway Ministry will set up 2 locomotive factories at the cost of INR 48000 crs. • Railway is targeting operating ratio of 92% for FY17 against 90% likely to be achieved in FY16. Eyeing revenue growth of 10.1% in FY17 at INR 1.85 lakh crs. • Government has released INR 1931 crs YTD under its solar programme to encourage use of the renewable source of power. • Indian companies raised ~INR 23000 crs through retail issuance of NCDs in FY16 to meet business requirement. This is much higher than INR 9713 crs garnered by firms in FY15. Bps change India 10-Yr Yield Trade Statistics Market Summary 1 February 26, 2016 Morning Glance Equity Research Desk Institutional Activity Key News Cash 25-Feb Feb 2016 IDBI Bank prices share offering to LIC at INR 53.44 a share FIIs (INR Crs) Buy 4960 63134 Sell 6425 72934 Net (1466) (9800) Buy 2569 35229 Sell 1762 26967 Net 807 8262 DII (INR Crs) FII Derivative Statistics (NSE) Particulars Buy (INR Crs) Sell (INR Crs) OI (Nos) Chg (%) INDEX FUTURES 145164.00 7787.62 378211 8.05 INDEX OPTIONS 57017.29 57085.29 1424749 (2.27) STOCK FUTURES 398396.00 16453.40 1235144 1.57 2183.74 2265.98 91837 (0.58) 602761.03 83592.29 IDBI Bank has priced its equity shares to be issued to the Life Insurance Corporation of India on preferential basis at INR 53.44 per share. The size of the equity offer is INR 1500 crs. Bank is raising money through fresh issue of equity shares to meet capital requirements for business growth. It will also help to maintain capital adequacy ratio especially after making provision for non-performing assets and stressed loans. Its capital Adequacy Ratio was 13% with tier I of 8.71% at end of December 2015. Post offering, LIC will hold 19.18% stake in IDBI Bank, up from 7.24%. Government of India's shareholding will decline to 69.84% from 80.16%. Vijay Mallya resigns as Chairman of USL ONGC 215.90 2.88 Vijay Mallya and Diageo have reached an agreement that Mallya will resign from the post of Chairman of the company and will become the Chairman Emeritus. The move will end all the allegations and uncertainties about the financial irregularities committed by Mallya. Mallya will receive USD 75 mn over the five year period in return for the deal. Sun Pharma 874.85 2.38 Top telecom companies partner for 5G technology STOCK OPTIONS Total Gainers & Losers Price Chg (%) Gainers (INR) HDFC 1041.90 1.85 Coal India 299.50 1.32 Hindalco 67.20 1.20 SBI 151.90 (3.06) Tata Motors 298.00 (2.90) Videocon Telecom targets INR 10000 crs revenue by 2020 GAIL 304.95 (2.90) 1086.90 (2.37) 183.35 (1.98) Videocon Telecom aims to generate a revenue of INR 10000 crs by 2020 from its newly carved out vertical of emerging businesses. The company will be making investments in non-spectrum businesses going forward as the life of smaller players like it is very short in the GSM telecom business. Losers (INR) Larsen ICICI Bank Sectoral Performance Value Pts Chg (%) S&P BSE Small Cap 9598.11 (87.75) (0.91) S&P BSE Mid-Cap 9544.37 (110.15) (1.14) S&P BSE Auto 16037.88 (226.20) (1.39) S&P BSE BANKEX 15415.07 (261.24) (1.67) S&P BSE Capital Goods 11340.90 (221.40) (1.91) 7032.43 (7.47) (0.11) S&P BSE Healthcare 15220.07 15.91 0.10 S&P BSE IT 10399.43 (85.96) (0.82) S&P BSE FMCG S&P BSE Metals 6638.67 26.84 0.41 S&P Oil & Gas 8317.04 (60.95) (0.73) Global telecom operators including China Mobile, Vodafone, Bharti Airtel and SoftBank have joined hands to launch five-year programme GTI 2.0, which aims to advance existing 4G technology and industrialization of 5G technologies. International Data Country Data Forecast Previous UK Second Estimate GDP 0.50% 0.50% US Core Durable Goods Orders 0.20% (1.00%) US Unemployment Claims 271000 262000 2 February 26, 2016 Morning Glance Equity Research Desk Sharad Avasthi Head - Equity Research sharad.avasthi@spagroupindia.com Tel.: +91-33-4011 4800 Ext.832 Analyst Certification of Independence: The analyst(s) for this report certifies that all the views expressed in this report accurately reflect his or her personal views about the subject company(ies) or issuers and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. The research analysts are bound by stringent internal regulations and also legal and statutory requirements of the Securities and Exchange Board of India (hereinafter "SEBI") and the analysts' compensation are completely delinked from all the other companies and/or entitie s of SPA Securities Limited, and have no bearing whatsoever on any recommendation that they have given in the Research Report. Disclaimer and Disclosures as required under SEBI (Research Analyst) Regulations, 2014: SPA Securities Limited (hereinafter refer as SPA Securities) and its affiliates are engaged in investment banking, investment advisory, stock broking, institutional equities, Mutual Fund Distributor and insurance broking. SPA Securities is a SEBI registered securities broking Company having membership of NSE, BSE & MCX for Equity, Future & Option, Currency Derivatives segment and Wholesale Debt Market. The Company is focused primarily on providing securities broking services to institutional clients and is empanelled as an approved securities broker with all the major Nationalised, Private and Co-operative banks, Corporate houses, Insurance Companies, Financial Institutions, Asset Management Companies and Provident Fund Trusts. Details of affiliates are available on our website i.e. www.spasecurities.com. SPA Securities Limited is registered as a Research Analyst under SEBI (Research Analyst) Regulations, 2014. SEBI Reg. No. INH00002615. We hereby declare that our activities were neither suspended nor we have defaulted with any stock exchange authority with whom we are registered in the last five years. We have not been debarred from doing business by any Stock Exchange/SEBI or any other authorities, nor has our certificate of registration been cancelled by SEBI at any point of time. General Disclosures: This Research Report (hereinafter called "report") has been prepared by SPA Securities and is meant for sole use by the recip ient and not for circulation. This Report does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. The recommendations, if any, made herein are expression of views and/or opinions and should not be deemed or construed to be neither advice for the purpose of purchase or sale of any security, (as defined under section 2(h) of securities Contracts (Regulation) Act.1956, through SPA Securities nor any solicitation or offering of any investment /trading opportunity on behalf of the issuer(s) of the respective security (ies) referred to herein. Recipients of this Report should rely on information/data arising out of their own investigations. Readers are advised to seek independent professional advice and arrive at an informed trading/investment decision before executing any trades or making any investments. This Report has been prepared on the basis of publicly available information, internally developed data and other sources bel ieved by SPA Securities to be reliable, although its accuracy and completeness cannot be guaranteed. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or correctness. Any review, retransmission or any other use is prohibited. The information, opinions, views expressed in this Research Report are those of the research analyst as at the date of this Research Report which are subject to change and do not represent to be an authority on the subject. While we would endeavour to update the information herein on a reasonable basis, we are under no obligation to update the information. Also, there may be regulatory, compliance or other reason s that prevent us from doing so. Hence all such information and opinions are subject to change without notice. Our salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that may be inconsistent with the recommendations expressed herein. This Research Report should be read and relied upon at the sole discretion and risk of the recipient. If you are dissatisfied with the contents of this complimentary Research Report or with the terms of this Disclaimer, your sole and exclusive remedy is to stop using this Research Report. Neither SPA Securities nor its affiliates or their respective directors, employees, agents or representatives shall be responsible or liable in any manner, directly or indirectly, for the losses or the damages sustained due to the investments made or any action taken on basis of this report, including but not re stricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. SPA Securities may have issued other reports in the past that are inconsistent with and reach different conclusion from the information presented in this report. SPA Securities, its affiliates and employees may, from time to time, effect or have effected an own account transaction in, or deal as principal or agent in or for the securities mentioned in this document. They may perform or seek to perform investment banking or other services for, or solicit investment banking or other business from, any company referred to in this report. The user should consult their own advisors to determine the merits and risks of investment and also read the Risk Disclosure Documents for Capital Markets and Derivative Segments as prescribed by Securities and Exchange Board of India before investing in the Indian Markets. A graph of daily closing prices of securities is available at www.nseindia.com and http://economictimes.indiatimes.com/markets/stocks/stock-quotes. (Choose a company from the list on the browser and select the "three years" icon in the price chart). Disclaimers in respect of jurisdiction: This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject SPA Securities or its affiliates to any registration or licensing requirement within such jurisdiction. If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or published for any purposes without prior written approval of SPA Securities. List of Associates as per SEBI (Research Analyst) Regulations, 2014 Statements on ownership and material conflicts of interest, compensation - SPA and Associates Disclosure of interest statement SPA Securities/its Affiliates/Analyst/his or her Relative financial interest in the company SPA Securities/its Affiliates/Analyst/his or her Relative actual/beneficial ownership of more than 1% in subject company at the end of the month Immediately preceding the date of the publication of the research report or date of public appearance. Investment banking relationship with the company covered Any other material conflict of interest at the time of publishing the research report Receipt of compensation by SPA Securities or its Affiliated Companies from the subject company covered for in the last twelve months: • Managing/co-managing public offering of securities • Investment banking/merchant banking/brokerage services • products or services other than those above • in connection with research report Whether Research Analyst has served as an officer, director or employee of the subject company covered Whether the Research Analyst or Research Entity has been engaged in market making activity of the Subject Company; For statements on ownership and material conflicts of interest, compensation, etc. for individual Research Analyst(s), please refer to each specific research report. Yes/No No No No No No No No SPA Securities Ltd: Mittal Court, A-Wing, 10th Floor, Nariman Point, Mumbai - 400 021, Tel. No. : +91-022-4289 5600, Fax: +91 (22) 2657 3708/9 For More Information Visit Us At : www.spasecurities.com SPA CAPITAL SERVICES LIMITED Investment Advisory services, AMFI Reg. No. ARN-0007 SPA COMTRADE PRIVATE LIMITED Member of NCDEX & MCX. NCDEX TMID-00729, NCDEX FMC No.NCDEX/TCM/CORP/0714 SPA Capital Advisors Limited SEBI registered Category-1 Merchant Bankers SEBI Regn. No. INM000010825 SPA INSURANCE BROKING SERVICES LTD. Direct Broker for Life and General Insurance Broking IRDA Lic. Code No. DB053/03 SPA Securities Ltd NSE Cash NSE Future & Option NSE Currency Derivatives BSE Cash BSE Currency Derivatives MCX-SX Cash MCX-SX Future & Option MCX-SX Currency Derivatives Mutual Fund CDSL DP NSDL DP SEBI Research Analyst 3 SEBI Reg. Nos. INB231178238 INF231173238 INE231178238 INB011178234 INE011178234 INB261178231 INF261178231 INE261178238 ARN 77388 IN-DP-CDSL-485-2008 IN-DP-NSDL-316-2009 INH100002615