sip (per application) incentive structure

advertisement

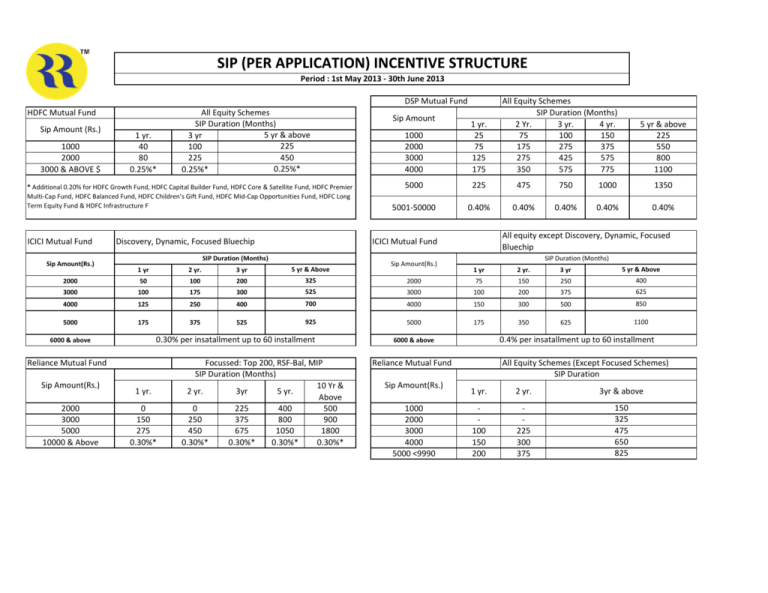

SIP (PER APPLICATION) INCENTIVE STRUCTURE Period : 1st May 2013 - 30th June 2013 DSP Mutual Fund HDFC Mutual Fund Sip Amount (Rs.) 1000 2000 3000 & ABOVE $ 1 yr. 40 80 0.25%* All Equity Schemes SIP Duration (Months) 5 yr & above 3 yr 225 100 450 225 0.25%* 0.25%* * Additional 0.20% for HDFC Growth Fund, HDFC Capital Builder Fund, HDFC Core & Satellite Fund, HDFC Premier Multi-Cap Fund, HDFC Balanced Fund, HDFC Children’s Gift Fund, HDFC Mid-Cap Opportunities Fund, HDFC Long Term Equity Fund & HDFC Infrastructure F ICICI Mutual Fund Sip Amount(Rs.) Discovery, Dynamic, Focused Bluechip SIP Duration (Months) 2 yr. 3 yr 5 yr & Above 2000 50 100 200 325 3000 100 175 300 4000 125 250 5000 175 375 Sip Amount(Rs.) 2000 3000 5000 10000 & Above 1 yr. 0 150 275 0.30%* 1 yr. 25 75 125 175 5000 225 475 750 1000 1350 5001-50000 0.40% 0.40% 0.40% 0.40% 0.40% Sip Amount(Rs.) 5 yr & above 225 550 800 1100 All equity except Discovery, Dynamic, Focused Bluechip SIP Duration (Months) 1 yr 2 yr. 3 yr 5 yr & Above 2000 75 150 250 400 525 3000 100 200 375 625 400 700 4000 150 300 500 850 525 925 5000 175 350 625 1100 0.30% per insatallment up to 60 installment Reliance Mutual Fund 1000 2000 3000 4000 ICICI Mutual Fund 1 yr 6000 & above Sip Amount All Equity Schemes SIP Duration (Months) 2 Yr. 3 yr. 4 yr. 75 100 150 175 275 375 275 425 575 350 575 775 Focussed: Top 200, RSF-Bal, MIP SIP Duration (Months) 10 Yr & 2 yr. 3yr 5 yr. Above 0 225 400 500 250 375 800 900 450 675 1050 1800 0.30%* 0.30%* 0.30%* 0.30%* 0.4% per insatallment up to 60 installment 6000 & above Reliance Mutual Fund Sip Amount(Rs.) 1000 2000 3000 4000 5000 <9990 All Equity Schemes (Except Focused Schemes) SIP Duration 1 yr. 2 yr. 3yr & above 100 150 200 225 300 375 150 325 475 650 825 Tepleton Mutual Fund All Equity Schemes SIP Installment Amount SIP Duration (Rs.) 2 Yr. 3 Yr. 1000-1999 100 150 2000-4999 200 300 5000-7499 500 800 7500-9999 140 1200 10000 & Above 900 1600 5 Yr. 250 500 1300 2000 2500 All Equity Schemes (Except Kotak Arbitrage Fund & Kotak Equity FOF) Kotak Mutual Fund Sip Amount(Rs.) Birla SL Mutual Fund Sip Amount 1 yr 1000 50 2000 100 3000 150 4000 200 5000 250 10000 & above 500 SBI Mutual Fund 3 yr. 2 yr 100 200 300 400 500 1000 5 yr & above 1 yr. 2 yr. 3 yr. 4 yr. 5 yr & above 1000 75 150 225 325 400 1000 125 225 2000 125 250 400 525 675 2000 275 450 3000 150 350 575 750 950 4000 225 450 750 975 1225 3000 5000 375 675 650 1150 5000 & above 250 500 800 1075 1350 10000 & above 1125 1800 1 yr. 50 100 150 250 500 2 yr. 100 200 300 500 1000 Tata Mutual Fund Sip Amount(Rs.) 1000 2000 3000 5000 5000 to 25000 Sip Amount(Rs.) All Equity Schemes 3 yr 4 yr 5yr & above 150 200 275 325 425 550 500 650 800 650 875 1100 850 1100 1350 1650 2150 2500 Eligible Schemes:Magnum Equity Fund, Magnum Global Fund, MSFU-Emerging Businesses Fund, FMCG Fund, Pharma Fund, IT Fund, Magnum Multiplier Plus 93, SBI Magnum Contra Fund, Magnum Taxgain Scheme 93, Magnum Midcap Fund, Magnum Multicap Fund, SBI PSU Fund, Magnum COMMA Fund, SBI Infrastructure Fund & Magnum Balanced Fund All Equity & Balanced Schemes 3 yr. 4 yr. 5 yr & Above 150 200 250 325 425 550 475 650 800 800 1100 1350 1650 2150 2700 Term & conditions: 1 The brokerage is applicable for AMFI /NISM certified associates registered with R R investors. 2 Associates are required to strictly adhere to code of conduct prescribed by SEBI /AMFI. 3 Inducement to investors in cash or any other form is strictly prohibited is not allowed 4 RR reserves the right to change/amend the above mentioned brokerage structure without notice. 5 The above incentive shall be paid for fresh SIP on receivable basis after 3 successful installments. In case of SIP being discontinued / terminated ,payment default or broker change including that to direct ;the payment on incentives on such SIP will be recovered from the channel 6 partner’s future brokerage payment. 7 Data provided by registrar will be final and binding for brokerage calculation. 8 The upfront brokerage will be paid as per term & conditions for upfront brokerage. Upfront on SIP may /may not be similar to lump sum investments, Pls refer to RR branch. 9 All application must bear R R ARN code and associate’s sub code. The data from registrar will be final for calculation. 10 The associates governed by all regulation of the financial market of India including SEBI, AMFI, RBI and stock exchange and to do all business within those regulation. The associated is aware of all regulation of all the regulations and shall be liable to all the violation of any regulation , laws and undertaken to keep R R ,its employees and any affiliates 11 and liabilities what so ever which may arise due to the non compilance of MF Regulations 12 Incentive paid shall be inclusive of all taxes. 13 Mutual fund investments are subject to market risk, Read all scheme related documents.