Accounting 101 Course Title: Financial Accounting

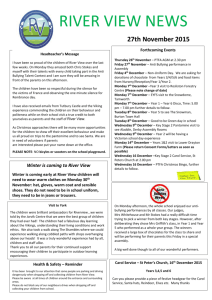

advertisement

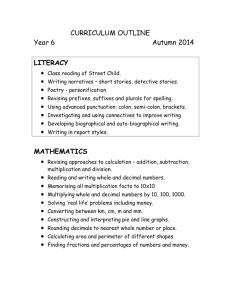

ACC 101 M/W Spring 2015 - 1 Orange Coast College Syllabus Course Number: Accounting 101 Course Title: Financial Accounting SCHEDULE: 6:30pm – 9:05 pm. Monday and Wednesday CALENDAR: Spring 2015 INSTRUCTOR: Arabian Morgan, CPA, MST CONTACT INFO: Telephone 714-432-0202 x23107 Office: Computing Center: Room “C” Email: amorgan@occ.cccd.edu (subject line: ACC 101 MW) OFFICE HOURS: Monday Tuesday Wednesday Thursday 5:15pm – 6:15pm 5:15pm – 6:15pm 5:15pm – 6:15pm 5:15pm – 6:15pm ACCOUNTING 101 Financial Accounting: A course covering the fundamentals of financial accounting of the corporate entity. Involves the analysis, recording, and summarizing of accounting transactions on the accrual basis. Emphasis on accounting as an information system meeting the demands of users for decision making. STUDENT LEARNING OUTCOMES: The student will be able to: 1. 2. 3. 4. 5. Demonstrate ability to prepare financial statements for a corporation. Prepare accounting entries required for a service versus merchandising business. Identify ethical issues in financial accounting. Demonstrate knowledge of an accounting cycle by performing appropriate accounting functions. Demonstrate knowledge of financial reporting rules and disclosure, including international standards, such as International Financial Reporting Standards (IFRS). COURSE OBJECTIVES: 1. Explain the nature and purpose of generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS). Explain and apply the components of the conceptual framework for financial accounting and reporting, including the qualitative characteristics of accounting information, the assumptions underlying accounting, the basic principles of financial accounting, and the constraints and limitations on accounting information. 2. Define and use accounting and business terminology. 3. Explain what a system is and how an accounting system is designed to satisfy the needs of specific businesses and users; summarize the purpose of journals and ledgers. 4. Apply transaction analysis, input transactions into the accounting system, process this input, and prepare and interpret the four basic financial statements. 5. Distinguish between cash basis and accrual basis accounting and their impact on the financial statements, including the revenue recognition and matching principles. 6. Identify and illustrate how the principles of internal control are used to manage and control the firm’s resources and minimize risk. ACC 101 M/W Spring 2015 - 2 7. Explain the content, form, and purpose of the basic financial statements (including footnotes) and the annual report, and how they satisfy the information needs of investors, creditors, and other users. 8. Explain the nature of current assets and related issues, including the measurement and reporting of cash and cash equivalents, receivables and bad debts, and inventory and cost of goods sold. 9. Explain the valuation and reporting of current liabilities, estimated liabilities, and other contingencies. 10. Identify and illustrate issues relating to long-term asset acquisition, use, cost allocation, and disposal. 11. Distinguish between capital and revenue expenditures. 12. Identify and illustrate issues relating to long-term liabilities, including issuance, valuation, and retirement of debt;(including the time value of money). 13. Identify and illustrate issues relating to stockholders’ equity, including issuance, repurchase of capital stock, and dividends. 14. Explain the importance of operating, investing and financing activities reported in the Statement of Cash Flows. 15. Interpret company activity, profitability, liquidity and solvency through selection and application of appropriate financial analysis tools. 16. Identify the ethical implications inherent in financial reporting and be able to apply strategies for addressing them. ILLEGAL MATERIALS OR SUBSTANCE Students will not be allowed to remain in class if they bring illegal materials or substances of any kind to class. Examples of such include: Federal illegal narcotics, illegally downloaded material (music, videos, games, etc.), photocopies of copy written material (class workbook included), etc. AUDIO/VIDEO No audio, video or still pictures are allowed to be captured of the instructor or his/her lessons. CAMERA POLICY You are not allowed to have any devices that take pictures or capture images in your possession when quizzes, exams or tests are being conducted. If you have these items in a book bag or purse (do not take them out). You will receive zero points on that particular exam if the instructor/proctor or another student observes the device. The goal of this policy is to protect the integrity of the test items. ACC 101 M/W Spring 2015 - 3 TEXTS: ISBN: 9780989406819 Morgan, All Dogs Eat Financial Accounting, 2nd Edition. Approx 452 pages. (A bonus 20 points will be added to points earned by students who have completed workbook assignments on time. This book is only available in the OCC bookstore. The other editions are no longer used. Please do not be fooled with online sellers. Check the ISBN number.) Kimmel / Weygandt / Kieso ISBN-10: 0471730513 ISBN-13: 9780471730514 Financial Accounting; Tools for Business Decision Making, 4th Edition (Instructor has copies that can be used for the semester for a $20 refundable deposit. Purchases can be made online at many book resellers [i.e. Amazon.com, Half.com] for a reasonable cost ($5 plus shipping). Don’t pay more than $20. This book will not be available in the OCC bookstore.) REQUIRED IN CLASS TOOLS: Four function calculator. You are not allowed to use the following calculators during tests: Scientific, graphing, financial and the like. If your calculator does more functions than add, multiply, subtract and divide, get a simpler one. Phones will not be allowed. REQUIRED OUT OF CLASS TOOLS: Internet access; computer with working audio ports (speakers or headphones); A computer with audio (speakers or headphones) ports connected to the internet with the following software: Java, Flash Player 6.0.79 or later (http://www.adobe.com/go/getflash) (Flash Player 7 or later recommended), and one of the following browsers: Windows o o o Internet Explorer 7 or greater Netscape 7.2 and 8.1 Firefox 1.5.0.1 and 1.0.7 Macintosh o OS 9 Netscape 7.0 o OS X v10.3 Netscape 7.2 Mozilla 1.7.12 Firefox 1.5.0.1 Safari 1.3.9 o OS X v10.4 Netscape 7.2 Firefox 1.5.0.1 Safari 2.0 BIOGRAPHY: ACC 101 M/W Spring 2015 - 4 Arabian Morgan has taught for OCC and several other local area universities and colleges. Arabian was a consultant for five years with one of the world’s largest public accounting firms, PricewaterhouseCoopers LLP, specializing in tax consulting and financial planning. He is a licensed Certified Public Accountant. Over the past 20 years Arabian has provided tax and financial planning consulting services to individuals and businesses of all net worth’s. Arabian earned his Masters in Business Taxation from the University of Southern California (USC) and also possesses a Bachelor of Science degree in Accounting from USC. ATTENDANCE: Class attendance is mandatory. PARTICIPATION: Class participation is mandatory. Examples of things that cause one not to earn the maximum amount of class points: Not reading assigned material Not doing homework Not coming to class Not accurately responding to quiz questions Being disruptive Arriving late, leaving early Cell phone/pagers usage during class ILLEGAL MATERIALS OR SUBSTANCE Students will not be allowed to remain in class if they bring illegal materials or substances of any kind to class. Examples of such include: Federal illegal narcotics, illegally downloaded material (music, videos, games, etc.), photocopies of copy written material (class workbook included), etc. COMPUTERS and LAPTOPS and the like are not allowed to be used during class. CELL PHONES AND PAGERS: Out of consideration for others, please turn your cell phone and pagers to the silent mode. If they do not have a silent or vibratory mode, please turn them off. These items tend to distract the other students when they ring during class discussions or learning activities. Cell phones must be turned off and put away during all tests and quizzes. A student will not receive points should he/she not abide by this rule. ACC 101 M/W Spring 2015 - LATE WORK: WRITTEN ASSIGNMENTS: CHEATING POLICY: 5 No late work will be accepted. All work is to be type written. No hand written assignments will be accepted unless indicated by the instructor. Cheating on any assignment will earn student zero points for the assignment. Student will be subject to the policies of Orange Coast College for further disciplinary action. Academic dishonesty will not be tolerated. GRADING SCALE POINTS STRUCTURE A B C D F 900 to 1000 points 800 to less than 900 points 700 to less than 800 points 600 to less than 700 points less than 600 points -4 Exams totaling 910 points* (each chapter is worth approx. 70 points) -90 points for attendance** * Make up exam can be arranged, however, students points on the exam will be reduced by 20% of the points earned on the first make up and 30% on additional makeups. Makeup exams are designed to be more difficult and are only for students who did not take an exam on the designated day for a legitimate reason. Makeup exams are not for students who want to replace a grade on an exam they have taken. ** Do not miss more than 3 classes to receive the 90 points. No points will be earned for missing more than 3 classes. Attendance is taken at random times during the class session. Not being present at that time results in an absence. ACC 101 M/W Spring 2015 - Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 Week 9 Week 10 Week 11 Week 12 Week 13 Week 14 Week 15 Week 16 Week 17 Monday, February 02, 2015 Wednesday, February 04, 2015 Monday, February 09, 2015 Wednesday, February 11, 2015 Monday, February 16, 2015 Wednesday, February 18, 2015 Monday, February 23, 2015 Wednesday, February 25, 2015 Monday, March 02, 2015 Wednesday, March 04, 2015 Monday, March 09, 2015 Wednesday, March 11, 2015 Monday, March 16, 2015 Wednesday, March 18, 2015 Monday, March 23, 2015 Wednesday, March 25, 2015 Monday, March 30, 2015 Wednesday, April 01, 2015 Monday, April 06, 2015 Wednesday, April 08, 2015 Monday, April 13, 2015 Wednesday, April 15, 2015 Monday, April 20, 2015 Wednesday, April 22, 2015 Monday, April 27, 2015 Wednesday, April 29, 2015 Monday, May 04, 2015 Wednesday, May 06, 2015 Monday, May 11, 2015 Wednesday, May 13, 2015 Monday, May 18, 2015 Wednesday, May 20, 2015 Monday, May 25, 2015 Wednesday, May 27, 2015 Schedule and point system subject to change. Chapter 1 Chapter 1 Chapter 2 Chapter 2 Holiday Chapter 3 Chapter 3 Exam 1 (210 points) Chapter 4 Chapter 4 Chapter 5 Chapter 5 Chapter 6 Chapter 6 Chapter 7 Exam 2 (280 points) Spring Break Spring Break Chapter 8 Chapter 8 Chapter 9 Chapter 9 Chapter 11 Chapter 11 Exam 3 (210 points) Chapter 10 Chapter 10 Chapter 12 Chapter 12 Chapter 13 Chapter 13 Exam 4 (210 points) Holiday Reflection Assignment 6 Intro to Financial Statements Intro to Financial Statements Classified Balance Sheet Classified Balance Sheet Journal Entries Journal Entries Adjusting Entries Adjusting Entries Merchandise Inventory Merchandise Inventory Inventory Costing Inventory Costing Internal Controls Receivables Receivables Non-Current Assets / Depreciation Non-Current Assets / Depreciation Stockholders' Equity Stockholders' Equity Liabilities Liabilities Cash Flow Statement Cash Flow Statement Financial Statement Analysis Financial Statement Analysis