marine market report - Arthur J. Gallagher

advertisement

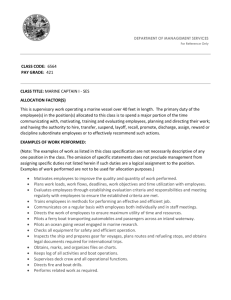

MARINE MARKET REPORT MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE MARCH 2015 Founded by Arthur Gallagher in Chicago in 1927, Arthur J. Gallagher & Co has grown to become one of the largest insurance brokerage and risk management companies in the world. With significant reach internationally, the group employs over 20,000 people and its global network provides services in more than 140 countries. Outside the US, we use the brand name Arthur J. Gallagher. CONTENTS Market Report March 2015 2 Market Moves 2 Casualty Reports 3 General Average Disbursements Facility 6 Latest Maritime News 7 Oil Price Fluctuations: A Marine Hull Insurer’s Perspective10 War & Piracy 15 Sources18 ARTHUR J. GALLAGHER AJGINTERNATIONAL.COM MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2015 1 MARKET REPORT MARCH 2015 Welcome to the March 2015 edition of the Arthur J. Gallagher Hull & Machinery and War Risks Market Report. New in this issue is a section for maritime news alongside the usual casualty and war/ piracy incident reports. We also have our first contribution to the report from Underwriters. David Hughes and Jonathan Holmes from Catlin Syndicate have kindly written a very informative article on the impact of fluctuations in the oil price on the insurance market. We believe such contributions from Underwriters will be a valuable resource for our clients and hope they will become a regular feature in this publication in the future. MARKET MOVES There has been a flurry of recent merger activity on the Underwriting side. A well-documented merger between XL and Catlin was finally confirmed on Friday 9th January. It is understood that XL acquired Catlin for around USD 4.2bn. The combined entity is expected to have a leading presence in global specialty insurance and reinsurance markets. This was followed in February by the announcement that Canadian property and casualty insurer Fairfax has purchased Brit Insurance for around USD 1.9bn. Fairfax already owns two other Lloyd’s Syndicates (Advent and Newline) but has ruled out merging them insisting they will continue to operate independently. Analysts continue to speculate on further M&A activity with Amlin, Beazley, Novae and Lancashire regularly featuring in the financial gossip columns. Debbie Shilabeer has resigned from Atrium and will join Brit Syndicate in May. Peta Kilian has resigned from Brit Syndicate and will re-join Amlin. In further Amlin-related news, Alex Becker has moved to the Dubai office where he has commenced Underwriting marine risks locally in the Middle East. 2 MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2015 AJGINTERNATIONAL.COM ARTHUR J. GALLAGHER CASUALTY REPORTS The 186 meter long, 7800 dwt passenger ro-ro ferry “Norman Atlantic” caught fire in the Adriatic Sea off the coast of Albania, while en route to Ancona, Italy from Patras via Igoumenitsa, in difficult sea conditions. The vessel was carrying some 128 trucks among some 200 vehicles. It is believed that one of the trucks had scraped against the vessel causing sparks and ignited the fire. The blaze engulfed the length of the vessel as black smoke forced the 477 persons on board outside. Passengers reported that the deck with lifeboats were hot enough to cause shoes to melt. Eventually flames would reach the lifeboats destroying them. On 3rd February 2015, 5 weeks after the incident a body was discovered on the vessel’s garage. The discovery of the body brings the total death toll to 12–10 passengers and two Albanian tug crew have been confirmed dead - and the number of missing passengers to approximately 18-20. ARTHUR J. GALLAGHER AJGINTERNATIONAL.COM The same day a collision between the Turkish general cargo “Gokbel” and The “Lady Aziza” off the port of Ravenna, led to the sinking of the first. “Gokbel” was carrying a crew of 11 Turkish nationals, of which 5 managed to survive the wreck. Among the two confirmed victims was the captain who reportedly did not leave his ship until the last minute. The 101 meter long, 8919 dwt general cargo vessel “Better Trans” sank in the Philippine Sea in an area of 19 25 N 127 40 E between Taiwan and the Philippines. All 19 crew escaped into the life rafts. Four hours later the crew were rescued. However, only 18 men were later rescued and one man was listed as missing. On another ferry accident, three have died and a further 12 went missing after ro-ro ferry “Vicente” sank in heavy weather off Cape Verde, Africa, on 2nd January. The vessel, built in 1965, was carrying 26, as well as a cargo of vehicles and containers en route from Praia, with some local news reports indicating the vessel was dangerously overloaded. MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2015 3 The Cypriot-registered “Cemfjord”, a 2,500 tonne cargo ship carrying cement, sank15 miles north east of Wick, carrying a crew of 8 passengers. According to the vessel’s management company it is most likely that the incident was caused by severe storms. No survivors were found, and after three days the rescue operations were halted The “Cemfjord” had previously run aground in July off the island of Laeso off the north coast of Denmark. According to police reports the 57-year-old Russian captain was drunk at the helm when they came aboard and had a blood alcohol count over twice the legal limit. 4 Six people were killed and four are missing following an explosion on 11 February 2015 in a Brazilian offshore oil and natural gas field run by Petroleo Brasileiro SA, said Norway’s BW Offshore Ltd, which owns the production ship on which the accident occurred. According to reports the explosion occurred after a natural gas leak on the “Cidade de Sao Mateus”, a floating production, storage and offloading (FPSO) ship that was contracted to Petrobras. The FPSO is anchored in the Camarupim oil field in the Espirito Santo Basin about 75 kilometers northeast of Vitoria, Brasil The death toll rose from three on Wednesday, according to Petrobras, as the oil company is commonly known, and Brazilian oil regulator ANP. All the workers killed on the platform were BW Offshore employees, BW said. The FPSO was shut down after the explosion, halting about 2,200 barrels a day of oil output and 2.25 million cubic meters of natural gas production. On Tuesday 3rd March 2014 BW Offshore stated that the last of the remaining three crew missing have been recovered. MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2015 AJGINTERNATIONAL.COM ARTHUR J. GALLAGHER BULK JUPITER SINKING PROMPTS BAUXITE LIQUEFACTION WARNINGS By Mike Schuler The recent loss of the Bulk Jupiter off Vietnam has once again prompted insurers to warn over the carriage bauxite aluminum ore cargoes and the potential for liquefaction. The MV Bulk Jupiter unexpectedly sank after departing from Kuantan, Malaysia on December 30 fully laden with 46,400 metric tons of bauxite, a clay-like substance that is the primary ore used in the production of aluminum. All but one of the 19 crewmembers onboard were lost in the accident. Liquefaction is a phenomena in which a dry cargo becomes liquified, which can cause a ship to lose stability quickly and unexpectedly due to the internal movement of the cargo. Liquefaction has long been known to be a major source of marine casualties. While the exact causes of loss of the Bulk Jupiter are not known at this time, the circumstances surrounding the loss of the vessel are similar to those of previous cases involving cargo liquefaction, prompting some insurers to once again issue warnings over bauxite liquefaction. Bauxite is typically listed in the International Maritime Solid Bulk Cargoes Code (IMSBC) as a ‘Group C’ cargo, meaning it is not known to liquefy or possess a chemical hazard, although it is noted that the ‘Group C’ categorization with a moisture content between 0% and 10%, consists of 70% to 90% of lumps with a size between 2.5 mm and 500 mm, and is 10% to 30% of powder. In some cases, however, bauxite cargoes have been known to exhibit liquefaction characteristics similar to high-risk ‘Group A’ cargoes, such as high-profile nickel ore, aka the world’s most dangerous cargo, under certain circumstances. A joint statement issued this week by the Britannia P&I and the Norwegian Hull Club to members noted that in the last month Malaysia has experienced extremely heavy monsoon rain, causing stock piles of bauxite at ports such as Kuantan to become very wet. “Clients proposing to load or in the process of loading a cargo of bauxite in Kuantan, Malaysia or any other port with prevailing or recent wet weather conditions are therefore advised to contact the Managers promptly to assess the requirement for appointing a suitable surveyor, and to treat these cargoes as potential Group A cargoes, i.e. cargoes which may liquefy if shipped at a moisture content in excess of their transportable moisture limit,” the joint statement warned. A statement from the American Club, a P&I club based out of New York, raised similar concerns. “The liquefaction of bauxite cargo specifically has, indeed, occurred in the past. Such cargoes have been those which, for the most part, have contained a large proportion of very fine material,” the American club statement said. “Members intending to carry cargoes of bauxite should be aware of the above and, in particular, that such cargoes are prone to liquefaction in certain circumstances. In any event, should Members have any concerns over the carriage of cargoes of bauxite, they are urged to contact the Managers for further advice and assistance.” Last year, a statement from the North P&I Club warned shipowners carrying bauxite cargoes of the potential for bauxite cargoes to liquefy at sea, citing a number of instances where bauxite cargoes pecifically from Brazil and Indonesia exhibited the liquefaction characteristics of Group A cargoes. According to the statement issued in February 2013: “Fortunately none of the incidents have resulted in losses to vessels or crew members. However, as seen in highprofile incidents involving liquefaction of nickel and iron ore cargoes, the resulting loss of vessel stability can be fatal,” said North’s Risk Management Executive Colin Gillespie. “Conditions which take the cargo outside the Group C specification, such as excessive moisture due to heavy rainfall allied to a high fines content may mean the cargo displays the characteristics of a Group A cargo,” said Gillespie. Source: www.gcaptain.com ARTHUR J. GALLAGHER AJGINTERNATIONAL.COM MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2015 5 GENERAL AVERAGE DISBURSEMENTS FACILITY We have a new General Average Disbursements Facility supported 100% by Underwriters in Lloyds for a limit of USD 10,000,000. This offers Ship Owners the opportunity to cover an increase, decrease or shortfall in cargo’s contribution to general average disbursements, in the event that the vessel and/or cargo suffer a partial or total loss between the port of refuge (following the initial casualty), and the final discharge port for the cargo. This facility offers unparalleled access to immediate coverage at competitive rating and terms. FOR ANY ENQUIRIES PLEASE CONTACT EDWARD REMNANT ASSOCIATE DIRECTOR | AJG MARINE EDWARD_REMNANT@AJG.COM TEL: +44 (0)20 7204 6033 6 MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2015 AJGINTERNATIONAL.COM ARTHUR J. GALLAGHER LATEST MARITIME NEWS Largest Container Ship Delivered The “MSC Oscar”, delivered in January, is the first of a series to be acquired by MSC through a long-term charter agreement. The vessel’s carrying capacity is 19,924 TEUs and she is just slightly larger than China Shipping’s CSCL Globe, which was officially declared at 19,100 TEUs. The vessel’s construction took only eleven months to be completed from steel cutting to delivery, which included extensive commissioning and sea trials. MSC Oscar is the first of the series of six ultra large containerships (ULCS) of Olympic Series. The remaining sister vessels of the series are expected to be completed by November 2015. According to a bulletin by DNV that welcomed the “MSC Oscar” into class: “not only does MSC Mediterranean Shipping Company’s newest vessel set a size benchmark for containerships in terms of capacity, but it has also been designed with a number of efficiency enhancing features. For example, the engine has been optimized so that fuel consumption can be automatically controlled to take into account both speed and weather conditions and she has a broad optimal speed range for enhanced operational flexibility”. ARTHUR J. GALLAGHER AJGINTERNATIONAL.COM China Lifts Ban On Valemaxes Chinese Ministry of Transport has issued a circular on the design of 400,000 DWT bulk carries entering Chinese ports amending its previous design layout. In line with the circular, the eligible vessels must not exceed a deadweight tonnage of 403,844 dwt and need to be 362m long, 65.6m wide, 30.5m deep and feature a draught of 23m. The previous design code covered ships up to 350,000 DWT, the South China Morning post writes. As all bulkers of Brazilian iron ore producer, Vale, meet the set out criteria, the circular is seen as lifting of Chinese three-year old ban on 400,000 bulkers, known as Valemaxes. Vale introduced the leviathan cargo ships with an aim of cutting transportation costs from Brazil to China. Valemaxes were banned from mooring in the country’s mainland ports in 2012 amid safety concerns. However, the ban was seen as an attempt to shield national carriers such as China Ocean Shipping Group (COSCO). Easing of the ban comes in the wake of Vale’s deal with COSCO from last September on the lease of ten very large ore carriers to be built by China Merchants. The VLOCs will be used to transport Vale’s iron ore from Brazil to China. Worldmaritimenews.com MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2015 7 Capesize Chartering Joint Venture John Fredriksen’s Golden Ocean and Petros Pappas’s Star Bulk - are involved alongside Golden Union Shipping, CTM and Bocimar in the formation of a new joint venture company, Capesize Chartering Ltd. According to a press statement the new company will combine and coordinate the chartering services of all the parties. For the customers this represents the benefit of a wider geographic area in which vessels can be made available and with shorter spread between loading dates. For the shipowners the major benefit is achieving a reduction in costs, since always the best positioned vessel can be offered for a fixture of a cargo. This will reduce ballast voyages and associated running costs, notably in respect of bunkers. A reduction of waiting time and time spent in positioning the vessels will benefit the industry as a whole, in the form of reduction of ballast bonuses and demurrage payable by charterers/cargo owners, and a reduction of deviation, waiting time and idle time for the account of the shipowners. Capesize Chartering Ltd was expected to commence operations in the second half of February 2015 from the existing offices of each of the five parties involved. Tanker merger General Maritime (Genmar) and Navig8 Crude Tankers have confirmed a tie-up that will run 46 ships, including 28 VLCCs. The new entity will be called Gener8 Maritime and be based in New York, the companies said. The fleet will include 21 VLCC newbuildings, plus 25 existing ships: seven VLCCs, 11 suezmaxes, four aframaxes, two panamax tankers and a handymax tanker. These have a capacity of more 11m dwt and an average age of less than five and half years when all the vessels are delivered. Peter Georgiopoulos said: “We are pleased to have reached this agreement with Navig8 Crude, which we believe will combine an established owner and highly-respected commercial operator on an unprecedented scale.” The deal is an all-share affair whereby a newly-formed subsidiary of Genmar will acquire all of the issued and outstanding common stock of Navig8 Crude. Navig8 Crude shareholders will receive 0.8947 shares of the combined company for each Navig8 share. Existing Genmar investors will control 52.55% of the new company. Peter Georgiopoulos will remain as chairman and CEO, while John Tavlarios will become chief operating officer and Leo Vrondissis will stay as CFO. Navig8’s Gary Brocklesby and Busch are expected to become “senior consultants to the board of directors”. The transaction is expected to close in the first half of 2015. Genmar is backed by private equity’s Oaktree Capital Management, and it is thought to be just a matter of time before the enlarged owner seeks a New York listing. Jefferies advised Navig8 on the transaction, while Evercore worked with General Maritime. Photo courtesy: Star Bulk Carriers SA 8 MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2015 AJGINTERNATIONAL.COM ARTHUR J. GALLAGHER Costa Concordia Verdict The captain of the Italian cruise ship Costa Concordia has been found guilty of manslaughter and sentenced to 16 years in prison. Captain Francesco Schettino was at the helm when the ship hit rocks and sank in 2012, killing 32 people. He was accused of taking the liner too close to the shore and then abandoning ship with passengers and crew still on board. Schettino denied the charges and said he was being made a scapegoat. His lawyers had argued that it was a collective failure of the ship’s crew and others should share the blame for the disaster. Schettino was not present when Judge Giovanni Puliatti read out the verdict at the court in the city of Grosseto. The 54-year-old is expected to appeal against the verdict Baltic Dry Index Hits New Record Low The Baltic Dry Index (BDI) dropped by another eight points reaching its new record low at 522 points on Monday 16th February. The Baltic Dry Index has fallen close to 50% over the past 12 months. The Baltic Capesize Index fell to 614 points, 16 points lower than last reported, whereas Baltic Supramax Index stood at 480 points, 6 points lower. Only Panamaxes seem to be holding out with the index at 505 points, recording a 6-point rise. The BDI’s downturn has seen dry bulk vessel owners left in dire conditions, especially since there are no signs of recovery any time soon. ARTHUR J. GALLAGHER AJGINTERNATIONAL.COM Print 2000 2000 1500 1500 1000 1000 MAR APR MAY JUN JUL AUG SEP OCT NOV DEC 2015 FEB Graph: THE BALTIC DRY INDEX (Mar2014- Feb 2015) Source: Bloomberg MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2015 9 OIL PRICE FLUCTUATIONS: A MARINE HULL INSURER’S PERSPECTIVE As ship-owners and charterers well know, fluctuations in the price of crude oil can present many commercial opportunities and challenges. Part of the role of the ship-owner is, of course, to manage these fluctuations based on their experience in the market and entrepreneurial judgment. Indeed, the success of many shipping companies has hinged upon their owner’s ability to make the right calls in a changing environment. For a Marine-Hull insurer, the recent drop in crude prices also presents challenges in the form of a changing risk environment. These challenges are both commercial and physical and relate to how the shipping market adapts and changes the way vessels are operated in response to the changing commercial situation. “WE VALUE OUR REPUTATION AS KNOWLEDGEABLE AND CONSISTENT UNDERWRITERS ” As one of the largest Marine Hull underwriters in the Lloyd’s market, we value our reputation as knowledgeable and consistent underwriters, in addition to our recognised claims leadership and commitment to settling claims promptly. In order to maintain this hard-won reputation we believe in being pro-active and discussing emerging issues with our clients and the shipping industry as a whole. We hope to develop a deeper understanding of risk that can help ensure both ourselves and our clients are able to prosper in the short and longer term by reducing and effectively managing our shared exposure to risk. 10 MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2014 AJGINTERNATIONAL.COM ARTHUR J. GALLAGHER In the remainder of this article we wish to discuss some of these issues and offer an insight as to how, as underwriters, we view the recent fall in the price of crude. For the foreseeable future, it would appear that lower demand and oil prices are here to stay and will be a major factor for us all to deal with throughout 2015. Unfortunately, the usual benefits of lower oil prices, such as increased household disposable income and reduced industry costs that would normally trigger higher demand and growth have largely been offset by weak underlying global economic conditions. Other factors including weak currencies in consumer economies, lower spending in producer countries, global political events and mounting deflationary concerns have all helped to dampen the demand for oil. It could also be argued that the oil and global energy market is undergoing major historic changes that could have a longer-term effect on the industry. OPEC’s embrace of market forces and the US shale oil revolution, with its lower barriers to entry, are likely to mean that oil’s place in the global energy mix may be transforming. While an increase in global economic activity and demand levels might take time to be observed in containerised and other cargos, one of the first and most notable changes in vessel utilisation is in the tanker market, particularly the use of VLCCs as floating storage units. Chartering out a vessel as a storage unit may well be a sensible commercial move that makes the most of the available charter opportunities however, such a change of use does alter a vessel’s risk profile. It might be that an owner could expose themselves to an aggregation of risk if numerous vessels were moored at the same location. While vessels might be fully crewed and ready to get underway at any time, the ability of a static vessel to avoid approaching heavy weather is diminished, especially if there is limited prior warning of a localised weather front. The likelihood of collision also increases significantly when even a few vessels begin to anchor close to offshore terminals or ports. Sadly, Marine War underwriters must also consider the fact that such vessels are potentially an attractive target for terrorist attack, as has been recently observed in Libya. Although we have not seen this yet, one of the positive impacts of cheaper crude oil on the world economy may be an increase in growth and trade as cheaper energy eventually translates into cheaper production for manufacturers, and increased consumer spending. Should such a development occur, it will have a significant impact on the world container vessel fleet. Given that most industrial output is now transported in containers, it is likely that container vessels will be used to greater capacity on both east-west and west-east voyages. This is likely true of even the recent behemoths like the ‘Triple-E’ specification vessels and other 18,000+ TEU vessels of which large container lines are currently taking delivery. The recent case of the MV RENA, a constructive total loss and one of the largest P&I claims in history, shows just how costly a container salvage operation can be, not just financially but also environmentally and in terms of reputational damage to individual companies and the industry as a whole. With an increased size of such vessels, marine insurers must consider the potential for increased salvage awards. These changes in potential exposure should be factored into premium pricing in order to protect the industry at large. There will also need to be increased investment from salvage companies in equipment that can cope with the increased size of vessel and container volumes. Furthermore, while currently a hot-topic of debate amongst naval architects, underwriters must consider the compound effects faster steaming and more heavily laden vessels might have on the market experience of actual total loss. Debate still rages concerning the cause of the break-up of ‘MOL Comfort’ but the school of thought that contemporary modular construction methods and the use of high tensile steels may negatively affect loss experience must be considered. Potential negative impacts resulting from new construction methods and machinery must be included in pricing because it certainly isn’t the role of the underwriter to ARTHUR J. GALLAGHER AJGINTERNATIONAL.COM MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2014 11 provide funding for real-world research and development. Unfortunately, history shows us that unforeseen perils can always emerge. Of course, it’s not just the Tanker and Container sectors that will be affected by the reduction in oil prices. Another sector that we anticipate being significantly affected, particularly in the medium term when current charters are completed, is the Offshore and Seismic sector. Should, as many market commentators believe, a reduction in demand for exploration, supply and survey work result in increased numbers of vessels entering lay-up, the risks face by both owners and insurers change. Traditional Marine Hull policies, while often including provisions for lay-up, are primarily designed to protect vessels trading at sea. Here at Catlin, we’ve been discussing various different coverage solutions with our clients and brokers. We feel there might be genuine benefit for clients who are intending to lay-up vessels to have access to a policy which is flexible enough to offer different coverages when a vessel is laid-up, and which then can switch back to standard navigating perils once the vessel is active again. Such policies can also aid owners in protecting their laid-up vessels by including specific lay-up provisions tailored to the individual lay-up location of each vessel. It is hoped that this, and similar solutions will help ensure clients have the exact coverage they need and help ensure that they do not overspend on coverage that might not be required during difficult financial situations. Another key consideration for underwriters is what will happen to the offshore market. If weaker oil prices are to be a medium or long-term trend, offshore operators might struggle to maintain profitability. The solvency and liquidity of our clients is of paramount concern to us as underwriters and can be as important as the physical profile of a fleet. An operator’s ability to manage and protect themselves against risk depends entirely on having the available funds to undertake prudent risk management and employ quality labour and expertise. In tough economic times engines and other machinery are often worked longer and harder, with increased intervals before overhaul and maintenance. While such measures are often only undertaken with prior approval of, and in consultation with, classification societies and manufacturers, historical loss figures do show a connection between increased running hours and rates of machinery failure. In terms of physical risk, there are numerous issues that present themselves to ship-owners and underwriters when the price of oil drops dramatically as it has in recent months. For many of these risks, our working knowledge of them will only deepen over time once prediction has given way to real-world experience. However, both clients and insurers need to be proactive in preparing for potential negative impacts. The aim of this article is not to provide definite answers to the developing issues in marine risk as, no matter what we might think, no actuary or underwriter can predict the future! Rather, we hope to encourage an exchange of views between insurers and ship owners that takes into account the shared and unique considerations of each party. We believe in working with owners whose businesses are being affected by oil price fluctuations before they are exposed to greater risk. Failing to do so invariably results in financial, operational and reputational losses for both owners and insurers. It’s our job to be here when bad things happen and in some very unfortunate cases, losses are unforeseen, often tragic and unavoidable. On a day-to-day basis however, smaller scale, attritional losses can be anticipated and actively managed. It is these types of losses we hope to reduce by discussing them frankly and openly with clients. As an insurer, we have a direct stake in the profitability and success of our clients’ businesses, and we hope to benefit by working together with them in preparing for the future. 12 MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2014 2015 AJGINTERNATIONAL.COM ARTHUR J. GALLAGHER THANKS AND ACKNOWLEDGEMENTS We would like to thank Paul Hill and Steve McCarthy of BraemarSA for giving their time to discuss the issues discussed in this article. Furthermore, we’d like to give thanks to our numerous clients that have visited us at Catlin London or, have generously hosted ourselves and our colleagues and helped inform and develop our understanding THE AUTHORS David Hughes ACII, Senior Class Underwriter, Marine Hull & War. David began his insurance career in 1996 working for Sedgwick Insurance Brokers after graduating from Southampton University with a Master’s Degree in International Banking and Financial Studies. After a short period in Insurance consultancy at Accenture, David joined Catlin in 2003. Three years later he took a lead role in establishing the Catlin Hong Kong Office and developing Catlin’s footprint in the Asia-Pacific region. Eventually moving to the Singapore office, David became Head of Marine Insurance for the region in 2009. In this role David was responsible for growing profitable Hull, Cargo and Specie portfolios in Asia Pacific and developing the Catlin Singapore Office to become a leading insurance provider in Lloyd’s Asia and the region in general. In 2013 David decided to return to the UK in order to be closer to his family and is currently, alongside Simon Shrimpton, responsible for Catlin London’s Marine Hull portfolio and can be found underwriting at Lloyd’s on a daily basis. Jonathan Holmes ACII, Assistant Underwriter, Marine Hull & War. Jonathan began working for Catlin in 2011 after graduating from King’s College London with a Master’s Degree in Environmental Science. In the period since, he has worked alongside the class underwriters at the box in Lloyd’s, servicing the Marine-Hull account and continuing his technical training. ARTHUR J. GALLAGHER AJGINTERNATIONAL.COM MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2014 2015 13 CATLIN GROUP LIMITED Founded in 1984 by the current CEO, Stephen Catlin, the Catlin Group began trading as a Lloyd’s syndicate in 1985. During its early years of trading the syndicate produced profitable results each year, even when the Lloyd’s market as a whole was suffering from large losses. Today, Catlin Group Limited is a global specialty, property/casualty insurer and reinsurer, writing nearly all lines of commercial insurance and reinsurance business worldwide. The company’s insurance carriers have been assigned an A (Excellent) financial strength rating from A.M. Best. Catlin is dedicated to disciplined underwriting and providing the highest levels of service to clients and brokers when underwriting risk as well as settling and paying claims. With regards to Marine insurance, Catlin writes Marine Hull and Cargo risks through four of its underwriting hubs: Asia-Pacific, Europe, London and the US. There are dedicated Marine underwriting and claims staff within each of these hubs. The Group is involved in assisting hundreds of clients worldwide manage both the Liability and Property risks associated with maritime trading. “THE GROUP IS INVOLVED IN ASSISTING HUNDREDS OF CLIENTS WORLDWIDE ” In London, where the majority of the group’s Marine Hull risks are written, the Catlin team boasts a wealth of experience. The Marine Hull class underwriters have more than 70 years of combined experience in the market and a wide range of expertise in various sub-sectors of the shipping industry, writing coverage for Blue-Water Hull, Coastal and Offshore Craft, Construction Risks, Loss of Hire, Yachts and Marine-War Perils. Furthermore, Catlin’s claims service has been ranked as best overall in the London market, by brokers participating in a survey conducted by Gracechurch Consulting. In London alone, the marine claims team has eight dedicated claims adjusters. To find out more about Catlin Group please visit www.Catlin.com or consult your broker. 14 MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2014 2015 AJGINTERNATIONAL.COM ARTHUR J. GALLAGHER WAR & PIRACY Libyan Air Force Plane Bombs Tanker, Killing Two Two crewmen on board a Greek-managed tanker were killed after a Libyan Air Force plane bombed the vessel in a Libyan port in an apparent case of mistaken identity, Greek and Libyan officials said Monday. The vessel, the Liberian-flagged Araevo, was “bombed immediately as it approached” Derna in the east of the country, an aide to the chief of staff of the Libyan Air Force said. The airstrike on Sunday 4th January 2015, killed a 29-yearold Greek cadet engineer and a 23-year-old Romanian seaman. Two other seamen, both Philippine nationals, were also injured. One was taken to hospital for emergency surgery. The vessel was under long-term charter by the National Oil Co. of Libya to carry fuel from various points along the Libyan coast to feed local power plants. It had been operating exclusively in Libyan waters for the past eight years. Second tanker bombed in war-torn Libya Libya has reportedly bombed a tanker near the port of Benghazi as it tried to deliver gasoline to a radical Islamist group, the second such bombing in a matter of days. The attack was carried out by the Libyan National Army, according to publication the Libya Herald. No further details have yet emerged on the identity of the tanker, the extent of the damage or whether there are casualties. According to the Libya Herald, smoke was seen by local residents coming from the coast near the port of Benghazi. Around a week earlier, a plane controlled by the Libyan National Army bombed the Greek tanker “Araevo”, which was moored in the port of Derna, and operated by Aegean Shipping Enterprises. As reported by Lloyd’s List, Aegean Shipping Enterprises was still awaiting a proper account of why that vessel was attacked by a Libyan jet, killing two young crew members and leaving another two hospitalised. Libya seems to be in a period of turmoil worse than at any time since the ousting of Colonel Gaddafi in 2011, according to Lloyd’s List Intelligence. The situation is seriously harming its crude export operation and therefore cargo-carrying opportunities for tankers. In December, shipments from Es Sider and Ras Lanuf were halted, according to Lloyd’s List Intelligence. Following the attack on December 25 at Es Sider that resulted in six crude oil storage tanks being set ablaze, it was estimated that crude oil production in Libya had fallen to only 350,000 barrels per day, of which 128,000 bpd came from fields connected to Marsa el Brega, with the balance from offshore fields. ARTHUR J. GALLAGHER AJGINTERNATIONAL.COM MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2015 15 Ghanian Naval Forces Free Pirated Tanker After Tracking Device Activated ACCRA, Jan 18 (Reuters) – Ghana’s navy has freed a tanker ship hijacked off the coast of Nigeria and arrested eight pirates believed to be responsible for seizing it, a military spokesman said on Sunday. Pirate attacks have increased in West Africa in recent years, jacking up insurance costs for shipping companies. Experts say gangs based in the waters off Africa’s top oil producer Nigeria are extending their reach across the region’s Gulf of Guinea. Colonel Aggrey Quarshie would not say when the “MT Mariam” was seized by pirates. The small tanker’s owners, using an onboard tracking device, informed Ghanaian authorities of its position in Ghanaian waters on Saturday. “The Ghana Navy responded swiftly with a patrol team to the area and they were able to overpower the pirates and free the ship. But when they got there, the cargo had already been transferred to another vessel,” Quarshie told Reuters. It was not immediately clear what cargo the ship was transporting. Its crew members were unharmed, Quarshie added. The pirates, armed with weapons including AK-47 rifles, were arrested and handed over to Ghana’s Bureau of National Investigations. Cash was also recovered during the operation. “They are all suspected to be Nigerians,” Quarshie added. He said Ghana’s navy and other forces from Togo, Benin and Nigeria had launched a search for the ship carrying the stolen cargo. (Reporting by Kwasi Kpodo; Editing by Joe Bavier and Clelia Oziel) 16 MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2015 AJGINTERNATIONAL.COM ARTHUR J. GALLAGHER Deadly pirate raid on Greek ship in Nigeria Gunmen have boarded a Greek-owned tanker anchored near a Nigerian port, killing one crew member and taking three others hostage, officials say. The “Kalamos” was attacked while it was waiting to load at Qua Iboe, an oil terminal in south-eastern Nigeria.The pirates killed a Greek deputy captain of the ship, and took two Greeks and a Pakistani citizen hostage, according to the Greek government. The Gulf of Guinea in West Africa is regarded as a new centre of piracy. The International Maritime Bureau recorded 33 incidents of piracy and armed robbery in the area between January and September last year, according to the AFP news agency. The remaining 19 crew members are believed to be safe. The Maltese-flagged “Kalamos” had travelled from China without any cargo. Twenty days later, the two Greeks and one Pakistani seafarers were released and were taken to hospital after their ordeal ended. Aeolos Management said it was greatly relieved that the men were free, but it added there was still great sadness over the chief officer who lost his life. The company is not releasing any details of the operations that led to the release of the hostages, as it might encourage further attacks. Source: BBC, Tradewinds Pirates Hijack Tanker off Indonesia On 28th January 2015, a tanker carrying around 1,100 tonnes of fuel was hijacked while its crew forced to board a lifeboat off North Sulawesi, Indonesia. Initial reports suggested that, eight masked men armed with knives approached and boarded the MT Rehobot on a wooden boat, forcing 14 of the ship’s crew members to climb into the lifeboat which was then left behind. The crew was found and rescued with no reported injuries on January 31 by Indonesian authorities. The Philippine Coast Guard found the hijacked tanker three days later abandoned and grounded in Davao Oriental province. ARTHUR J. GALLAGHER AJGINTERNATIONAL.COM MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2015 17 CASUALTY SOURCES VESSEL Norman Atlantic SOURCE PHOTO http://www.shipwrecklog.com/log/2014/12/ norman-atlantic/ http://www.e-typos.com/gr/kosmos/article/111134/sto-bridizi-eftase-to-norman-atlantic-/ http://www.nydailynews.com/news/world/italianprosecutors-order-fire-ravaged-greek-ferry-backarticle-1.2061689 Gokbel http://www.hurriyetdailynews.com/captain-namedamong-dead-seamen-in-turkish-ship-crash-off-italy. aspx?pageID=238&nID=76308&NewsCatID=359 Vicente http://www.seatrade-global.com/news/middle-eastafrica/passengers-still-missing-in-cape-verde-ferrysinking.html Cemfjord http://www.independent.co.uk/news/uk/home-news/ rescue-teams-search-for-crew-of-overturned-cargoship-cemfjord-off-north-coast-of-scotland-9955779. html# Bulk Jupiter http://gcaptain.com/gearbulk-owned-ore-carriersinks-vietnam/ Better Trans http://www.shipwrecklog.com/log/2015/01/ better-trans/ Cidade do Mateus http://gcaptain.com/five-killed-four-missingpetrobras-fpso-accident-update/ Bulk Jupiter Sinking Prompts Bauxite Liquefaction Warnings http://gcaptain.com/bulk-jupiter-sinking-promptsbauxite-liquefaction-warnings/ 18 MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2015 AJGINTERNATIONAL.COM ARTHUR J. GALLAGHER MARKET NEWS SOURCE PHOTO Largest Containership delivered http://www.shipspotting.com/gallery/photo. php?lid=2169474 China lifts ban on Valemaxes https://worldmaritimenews.com/archives/151712/ china-lifts-ban-on-valemaxes/ Capesize Chartering Joint Venture http://www.starbulk.com/UserFiles/sblk021015.pdf Tanker Merger http://www.tradewindsnews.com/tankers/354929/ gener8-ready-to-roll Costa Concordia Verdict http://www.bbc.co.uk/news/world-europe-31430998 Baltic Dry Index hits new record low http://worldmaritimenews.com/archives/152342/ baltic-dry-index-hits-new-record-low/ PIRACY REPORTS SOURCE PHOTO Two Tanker crewmen killed in Libya after attack by unidentified military jet http://www.wsj.com/articles/two-tanker-crewmenkilled-in-libya-after-attack-by-unidentified-militaryjet-1420453961 Second Tanker Bomber in war-torn Libya http://www.lloydslist.com/ll/sector/tankers/ article455549.ece Ghanian Naval Forces Free Pirated Tanker after Tracking device activated http://gcaptain.com/ghanian-naval-forces-freepirated-tanker-tracking-device-activated/ Pirates Hijack Tanker off Indonesia http://worldmaritimenews.com/archives/150948/ pirates-hijack-tanker-off-indonesia/ Deadly Pirate Raid on ship in Nigeria http://www.bbc.co.uk/news/world-africa-31141078 ARTHUR J. GALLAGHER https://worldmaritimenews.com/archives/149775/ ghanas-navy-frees-oil-tanker-from-pirates/ http://worldmaritimenews.com/archives/153116/ update-philippine-coast-guard-finds-hijackedtanker/ http://www.tradewindsnews.com/piracy/354923/ kalamos-crew-freed AJGINTERNATIONAL.COM MARINE HULL & MACHINERY AND WAR RISKS MARKET UPDATE 2014 19 Arthur J. Gallagher Walbrook Office The Walbrook Building 25 Walbrook London EC4N 8AW Tel: Fax: +44 (0) 20 7204 6000 +44 (0) 20 7204 6001 www.ajginternational.com Arthur J. Gallagher (UK) Limited is authorised and regulated by the Financial Conduct Authority. Registered Office: The Walbrook Building, 25 Walbrook, London EC4N 8AW. Registered in England and Wales. Company Number: 1193013. www.ajginternational.com The information contained in this market review has been compiled by Arthur J. Gallagher from various news sources. This review does not purport to be comprehensive or to give legal advice. While every effort has been made to ensure accuracy, Arthur J. Gallagher cannot be held liable for any errors, omissions or inaccuracies contained within the document. Readers should refrain from acting upon information in this document without first taking further specialist or professional advice.