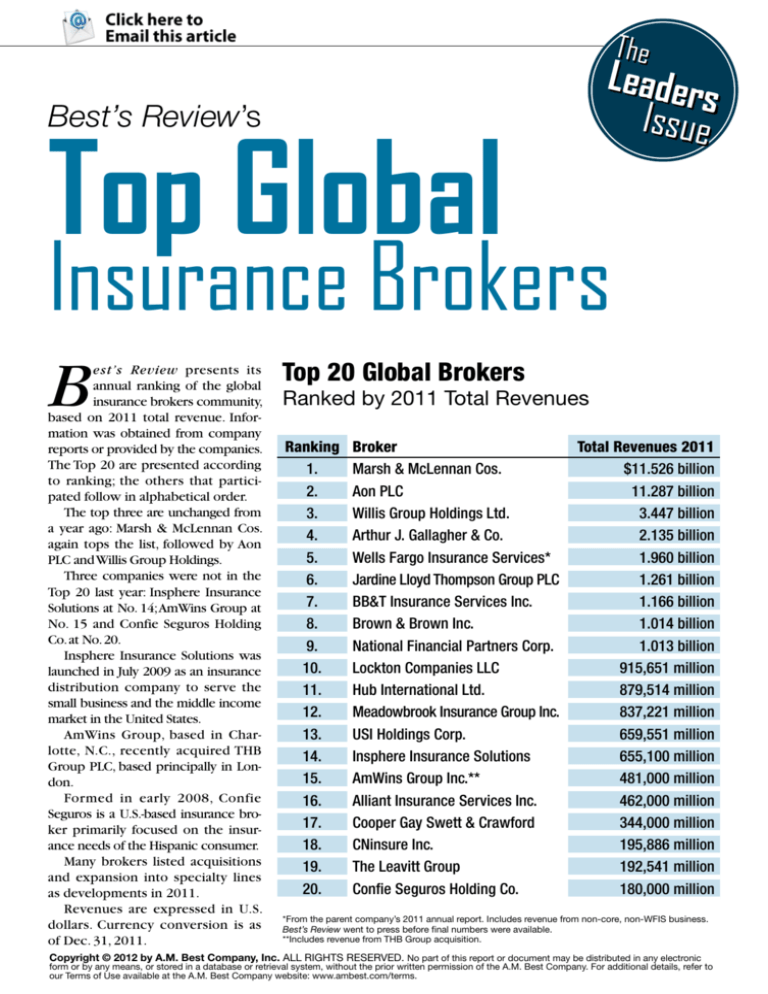

The

Leader

s

Issue

Best’s Review’s

Top Global

Insurance Brokers

B

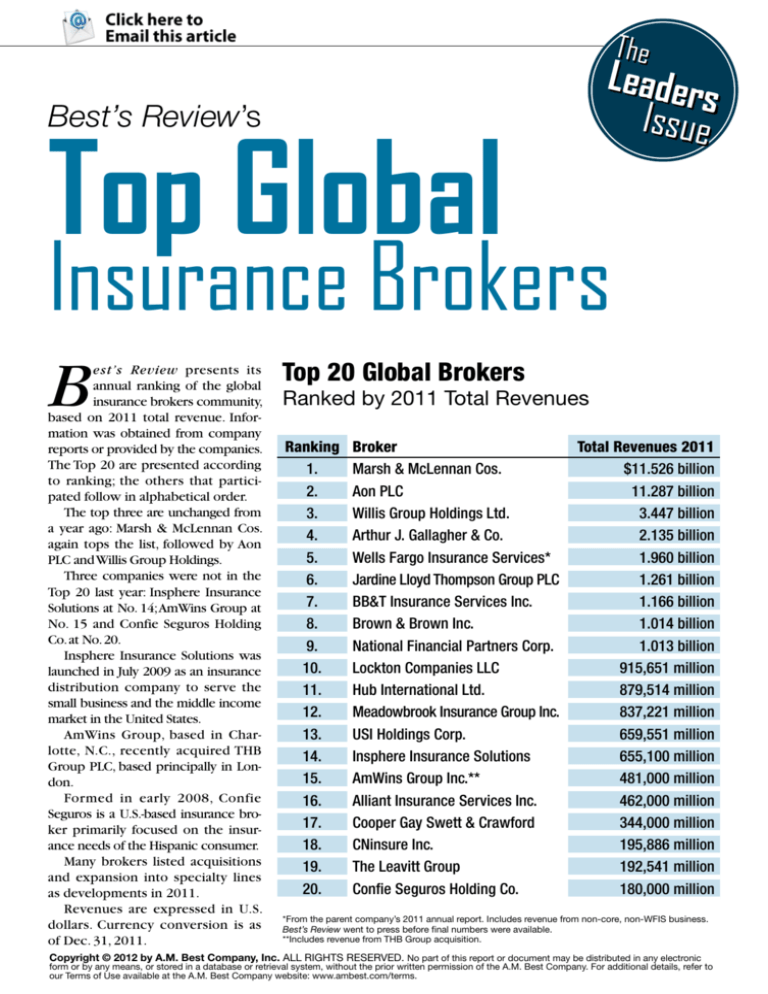

est’s Review presents its

annual ranking of the global

insurance brokers community,

based on 2011 total revenue. Information was obtained from company

reports or provided by the companies.

The Top 20 are presented according

to ranking; the others that participated follow in alphabetical order.

The top three are unchanged from

a year ago: Marsh & McLennan Cos.

again tops the list, followed by Aon

PLC and Willis Group Holdings.

Three companies were not in the

Top 20 last year: Insphere Insurance

Solutions at No. 14; AmWins Group at

No. 15 and Confie Seguros Holding

Co. at No. 20.

Insphere Insurance Solutions was

launched in July 2009 as an insurance

distribution company to serve the

small business and the middle income

market in the United States.

AmWins Group, based in Charlotte, N.C., recently acquired THB

Group PLC, based principally in London.

Formed in early 2008, Confie

Seguros is a U.S.-based insurance broker primarily focused on the insurance needs of the Hispanic consumer.

Many brokers listed acquisitions

and expansion into specialty lines

as developments in 2011.

Revenues are expressed in U.S.

dollars. Currency conversion is as

of Dec. 31, 2011.

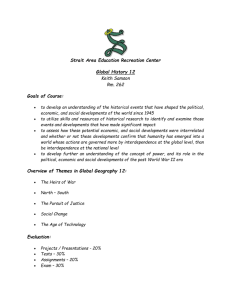

Top 20 Global Brokers

Ranked by 2011 Total Revenues

Ranking

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

Broker

Marsh & McLennan Cos.

Aon PLC

Willis Group Holdings Ltd.

Arthur J. Gallagher & Co.

Wells Fargo Insurance Services*

Jardine Lloyd Thompson Group PLC

BB&T Insurance Services Inc.

Brown & Brown Inc.

National Financial Partners Corp.

Lockton Companies LLC

Hub International Ltd.

Meadowbrook Insurance Group Inc.

USI Holdings Corp.

Insphere Insurance Solutions

AmWins Group Inc.**

Alliant Insurance Services Inc.

Cooper Gay Swett & Crawford

CNinsure Inc.

The Leavitt Group

Confie Seguros Holding Co.

Total Revenues 2011

$11.526 billion

11.287 billion

3.447 billion

2.135 billion

1.960 billion

1.261 billion

1.166 billion

1.014 billion

1.013 billion

915,651 million

879,514 million

837,221 million

659,551 million

655,100 million

481,000 million

462,000 million

344,000 million

195,886 million

192,541 million

180,000 million

*From the parent company’s 2011 annual report. Includes revenue from non-core, non-WFIS business.

Best’s Review went to press before final numbers were available.

**Includes revenue from THB Group acquisition.

Copyright © 2012 by A.M. Best Company, Inc. ALL RIGHTS RESERVED. No part of this report or document may be distributed in any electronic

form or by any means, or stored in a database or retrieval system, without the prior written permission of the A.M. Best Company. For additional details, refer to

our Terms of Use available at the A.M. Best Company website: www.ambest.com/terms.

1. Marsh & McLennan Cos.

Headquarters: New York

Revenues 2011: $11.5 billion

Top Executive: Brian Duperreault, president and CEO

Top Lines: Insurance; reinsurance; consulting.

Developments in 2011: Implemented restructuring

actions to eliminate about 400 positions at Mercer and 40 positions at

corporate for an annualized cost savings of about $45 million. Made

12 acquisitions in 2011 using $160 million in cash compared with $427

million used for acquisitions in 2010. Acquired several businesses,

including: RJF Agencies, an independent insurance agency in the

upper Midwest; Hampton Roads Bonding, a surety bonding agency

for commercial, road, utility, maritime and government contractors in

the state of Virginia and the Boston office of Kinloch Consulting Group

Inc.; Prescott Pailet Benefits, an employee benefits broker based

in Texas; the employee benefits division of Kaeding, Ernst & Co, a

Massachusetts-based employee benefits, life insurance and financial

planning consulting firm; and Seitlin Insurance, a property and casualty

insurance and employee benefits firm in South Florida.

2. Aon PLC

Headquarters: London

Revenues 2011: $11.3 billion

Top Executive: Greg Case, president and CEO

Top Lines: Risk management; insurance and reinsurance

brokerage; human resource solutions.

Developments in 2011: Corporate headquarters moved to London;

Aon Corp. became Aon PLC.; acquired brokers, including South

African broker Glenrand MIB Ltd.; launched Aon Risk Maturity Index,

a proprietary online tool created to empower risk and finance leaders

to assess their organization’s risk management; Aon eSolutions

introduced RIScloud, the next-generation cloud solution designed and

built for the risk, insurance and safety community.

3. Willis Group Holdings Ltd.

Headquarters: London

Revenues 2011: $3.45 billion

Top Executive: Joseph J. Plumeri, chairman and CEO

Top Lines: Commercial; reinsurance; property/casualty.

Developments in 2011: Acquired a 23% interest in a

South African brokerage at a total cost of $2 million; acquired a 100%

interest in a Polish brokerage, Brokerskie Centrum Ubezpieczeniowe,

at a total cost of $2 million; acquired 100% of Broking Italia, a Romebased employee benefits broker at a total cost of $12 million. Strong

contributions to 2011 organic commissions and fees growth from

most regions, including double-digit growth in Latin America and

Eastern Europe regions, together with single-digit growth in Asia

and Western Europe. In particular, strong growth in Brazil, Chile,

Argentina, Russia and China. Announced plans to accept contingent

commissions in employee benefits business as of April 2012 to remain

competitive.

4. Arthur J. Gallagher & Co.

Headquarters: Itasca, Ill.

Revenues 2011: $2.13 billion

Top Executive: J. Patrick Gallagher Jr., chairman,

president and CEO

Top Lines: Retail commercial property/casualty;

employee benefits; wholesale insurance brokerage.

Developments in 2011: Returned to organic growth; announced 23

mergers and acquisitions, including Heath Lambert Group, its largest

acquisition in its 84-year history, which more than doubled its U.K.

presence; successfully completed the integration of GAB Robins, which

expanded its risk management segment client base.

48

BEST’S REV)%7s*5,9

5. Wells Fargo Insurance Services

Headquarters: Chicago

Revenues 2011: $1.96 billion*

Top Executive: Laura Schupbach, executive vice president

and head of Wells Fargo Insurance

Top Lines: Commercial property/casualty; employee

benefits; personal lines; professional risk solutions; international

coverages; life insurance.

Developments in 2011: Named new head of insurance; expanded bank

cross-sell relationships; realigned brokerage and consulting leadership

around customers, key markets and bank partners; delivered employee

benefit growth; launched Health Care Reform Analyzer tool and Play

It Safe concussion care program; completed seven acquisitions; and

divested medical third-party administration and wholesale operations.

*From the parent company’s 2011 annual report. Includes revenue from non-core,

non-WFIS business. Best’s Review went to press before final numbers were available.

6. Jardine Lloyd Thompson Group PLC

Headquarters: London

Revenues 2011: $1.26 billion

Top Executive: Dominic Burke, group CEO

Top Lines: London market insurance/reinsurance

brokerage; employee benefits; insurance services.

Developments in 2011: Expanded further in Europe with the merging of

its Italian business with that of Marine & Aviation S.p.A. and the acquisition

of a 25% holding in a new joint venture in Spain formed with March-Unipsa

and increasing its shareholding in Siaci Saint Honoré from 20% to 26%;

the Irish business acquired FBD Insurance Brokers, an agri-food specialty

broker; and the South African office received regulatory clearances to

become fully operational; completed the acquisition of an initial 50.1% of

the share capital of Orbital Corredores de Seguros in Chile.

7. BB&T Insurance Services Inc.

Headquarters: Raleigh, N.C.

Revenues 2011: $1.16 billion

Top Executive: H. Wade Reece, chairman and CEO

Top Lines: Commercial property/casualty; employee

benefits; personal lines.

Developments in 2011: Acquired Liberty Benefit Insurance Services,

San Jose, Calif.; Atlantic Risk Management Corp., Columbia, Md.; and

Precept Group, with offices in Irvine and San Ramon, Calif.

8. Brown & Brown Inc.

Headquarters: Daytona Beach, Fla.

Revenues 2011: $1.01 billion

Top Executive: J. Powell Brown, president and CEO

Top Lines: Middle market property/casualty.

Developments in 2011: Total revenues for the year

exceeded $1 billion for the first time. The firm acquired Arrowhead

General Insurance Agency Inc., a deal expected to increase the

company’s annual revenues and staff size by about 10%.

9. National Financial Partners Corp.

Headquarters: New York

Revenues 2011: $1.013 billion

Top Executive: Jessica M. Bibliowicz, chairman, president

and chief executive officer

Top Lines: Benefits, insurance and wealth management.

Developments in 2011: NFP’s accomplishments in 2011 were

highlighted by the company’s revenue growing to more than $1 billion,

driven by organic growth and acquisitions. Adjusted EBITDA and margins

also improved. The company reports it continued to generate strong cash

flow and executed its balanced capital allocation strategy of acquisitions,

a share repurchase program and ongoing business investments.

Agent/Broker

Throughout 2011, NFP also took actions to further consolidate its

property/casualty and executive benefits businesses under the

coordinated brands of NPF P&C and NFP Executive Benefits.

10. Lockton Companies LLC

Headquarters: Kansas City, Mo.

Revenues 2011: $915.6 million

Top Executive: David M. Lockton, chairman

Top Lines: Risk management and commercial insurance

programs; employee benefits; affinity programs;

reinsurance; retirement services, surety.

Developments in 2011: Expanded geographically with the addition of

offices in Beijing, Oslo, Memphis, Charlotte, San Fernando Valley (Calif.),

Philadelphia and Omaha; prepared to launch Lockton Global partnership

to enhance service to multinational clients. Expanded advisory services

for clients in health care, cyber liability, executive liability, health risk

solutions, construction and design and private equity and hedge funds;

invested in data analytics talent and tools, including Lockton ARMR

for property/casualty market intelligence, L-SCALE for executive risk

coverage and health reform actuarial modeling.

11. Hub International Ltd.

Headquarters: Chicago

Revenues 2011: $879.5 million

Top Executive: Martin P. Hughes, chairman and CEO

Top Lines: Property/casualty; life/health; employee benefits.

Developments in 2011: Hub closed 37 acquisitions, a

record number, in 2011 and was ranked as the leading brokerage with

the highest number of M&A transactions during the year. In 2011, Hub

expanded its footprint in North America with key acquisitions in the

southeastern U.S. and Manitoba and entered Latin America with the

acquisition of Sao Paolo, Brazil-based brokerage, Harmonia Corretora

de Seguros Ltda.

12. Meadowbrook Insurance Group Inc.

Headquarters: Southfield, Mich.

Revenues 2011: $837.2 million

Top Executive: Robert S. Cubbin, president and CEO

Top Lines: Commercial business (property/casualty); life

and health; benefits; personal lines.

Developments in 2011: Revenue increased 11.6% to $837.2 million;

continued to expand product offerings, such as launching initiatives

to begin writing for personal watercraft, outdoor recreation and

technology markets. Meadowbrook expanded distribution of other

specialty products, including environmental and products liability,

and continued to build upon service and expertise in select workers’

compensation markets.

13. USI Holdings Corp.

Headquarters: Briarcliff Manor, N.Y.

Revenues 2011: $660 million

Top Executive: Michael J. Sicard, chairman, president and CEO

Top Lines: Commercial lines; personal lines; employee benefits.

Developments in 2011: Closed seven deals representing

$27 million in annualized revenue. Launched USI Solutions, a sales tool

which enables sales professionals to provide business issue driven

solutions to clients.

14. Insphere Insurance Solutions

Headquarters: North Richland Hills, Texas

Revenues 2011: $655.1 million

Top Executive: Kenneth J. Fasola, president and CEO

Top Lines: Individual health insurance; Medicare

Advantage life insurance; and supplemental commercial

15. AmWins Group Inc.

Headquarters: Charlotte, N.C.

Revenues 2011: $481 million

Top Executive: Steve DeCarlo, chief executive officer

Top Lines: Commercial property/casualty; employee

benefits; niche programs.

Developments in 2011: Completed several acquisitions including

London-based THB Group. Other developments include record revenues

and earnings and continued retailer RFP success.

16. Alliant Insurance Services Inc.

Headquarters: Newport Beach, Calif.

Revenues 2011: $462 million

Top Executive: Thomas W. Corbett, chief executive officer

Top Lines: Property/casualty; employee benefits.

Developments in 2011: Continued growth in specialty

market segments across multiple lines; strengthened construction and

surety specialization by adding a highly experienced construction team

of more than 50 professionals with the goal of making Alliant the national

leader in construction brokerage.

17. Cooper Gay Swett & Crawford

Headquarters: London

Revenues 2011: $344 million

Top Executive: Toby Esser, chairman

Top Lines: Property/casualty; specialty risks;

reinsurance.

Developments in 2011: Restructured to form three core trading

units in reinsurance, international and specialty lines; launched a new

international management team; regionalized Latin American operations

to drive market growth.

18. CNinsure Inc.

Headquarters: Guangzhou, Guangdong, People’s Republic

of China

Revenues 2011: $195.89 million

Top Executive: Chunlin Wang, chairman and CEO

Top Lines: Property/casualty; life insurance; and claims

adjusting.

Developments in 2011: At the end of 2011, announced the launch of

its China-wide insurance comparison website, known as Baowang;

announced a strategic partnership with Chartis Insurance Group China;

announced, then later withdrew, a non-binding proposal for going private,

citing unfavorable investment conditions.

19. The Leavitt Group

Headquarters: Cedar City, Utah

Revenues 2011: $193 million

Top Executive: Dane O. Leavitt, chief executive officer

Top Lines: Commercial property/casualty; health and

benefits; personal property/casualty.

Developments in 2011: Realized favorable results from efforts to

strengthen the company’s sales culture.

20. Confie Seguros Holding Co.

Headquarters: New York

Revenues 2011: $180 million

Top Executive: Joseph Waked, chief executive officer

Top Line: Personal lines and auto.

Developments in 2011: Fifteen companies acquired in

12 months. Entered five new markets: New York, New Jersey, Nevada,

Florida and Oregon. On pace to complete 30 acquisitions per year.

insurance.

BEST’S REV)%7s*5,9

49

Agent/Broker

The following brokers, although not ranked, shared their results and developments with Best’s Review.

They are listed alphabetically.

Beecher Carlson

Headquarters: Atlanta

Revenues 2011: $97 million

Top Executive: Dan Donovan

Top Lines: Property/casualty; executive liability.

Developments in 2011: Beecher Carlson filed for a patent on its ZOOM process.

Beneficial Insurance Services

Headquarters: Philadelphia

Revenues 2011: $7 million

Top Executive: Joseph F. Robinson, president

Top Lines: Professional liability; health insurance.

Developments in 2011: Successful cross-selling initiative. Implementation

of new agency management system.

CBIZ Benefits & Insurance Services Inc.

Headquarters: Leawood, Kan.

Revenues 2011: $171.2 million

Top Executive: Robert A. O’Byrne, president

Top Lines: Employee benefits; property/casualty; retirement plan services;

payroll; human resources consulting services.

Developments in 2011: Completed four acquisitions in 2011: Thompson

Dunavant, the largest locally owned accounting and tax provider in Memphis,

Tenn.; Multiple Benefit Services, an employee benefits consulting company

in Atlanta; Gresham Smith, an accounting service provider in St. Louis, Mo.

and Tulsa, Okla.; and Advantage Benefit Planning, an employee benefit and

retirement business in Pleasantville, N.J.

Frank Crystal & Co.

Headquarters: New York

Revenues 2011: $131.7 million

Top Executive: James W. Crystal, chief executive officer

Top Lines: Property/casualty; professional liability for corporations and

financial institutions; employee benefits; private client services.

Developments in 2011: Expanded property and casualty management

team; opened Los Angeles office; expanded global footprint through

BrokersLink alliance.

GrECo International Holding AG

Headquarters: Vienna, Austria

Revenues 2011: $92.5 million

Top Executive: Friedrich Neubrand Jr., chief executive officer

Top Lines: All lines of corporate insurance property and liability; financial

lines; employee benefits.

Developments in 2011: Mainly resulting from acquisitions, the group

finished with constant organic growth. The focus was on the further

development of its international partnership with JLT, one of the world’s

leading brokers; the marketing of GrECo Online Services; and the foundation

of regional offices in Central, Southeastern and Eastern Europe and

Commonwealth of Independent States.

Higginbotham & Associates

Headquarters: Fort Worth, Texas

Revenues 2011: $62 million

Top Executive: Rusty Reid

Top Lines: Property/casualty; risk management services; benefits; financial

products; life insurance.

Developments in 2011: Single Source mission of providing insurance, risk

management and financial services to commercial and personal property/

50

BEST’S REV)%7s*5,9

casualty coverage, employee benefits, retirement plans, life insurance and

executive compensation through broad market representation.

Hylant Group Inc.

Headquarters: Toledo, Ohio

Revenues 2011: $92.0 million

Top Executive: Mike Hylant, chief executive officer

Top Lines: Property/casualty; employee benefits; risk management.

Developments in 2011: Acquired AGIS (employee benefits) July 12, and

acquired ICAG (property/casualty) Nov. 23.

Integro Insurance Brokers

Headquarters: New York

Revenues 2011: $100 million

Top Executive: Peter F. Garvey, chief executive officer

Top Lines: Complex risk including property/casualty; management risk;

health care; international including wholesale and reinsurance.

Developments in 2011: Purchased Argo Insurance Brokers and marine

insurance broker Windward International to expand West Coast presence and

specialty product offerings. Revenues topped $100 million for the first time.

Keenan & Associates

Headquarters: Torrance, Calif.

Revenues 2011: $143.1 million

Top Executive: Sean K. Smith, president and CEO

Top Lines: Workers’ compensation; property and liability; employee benefits.

Developments in 2011: Public agency health care purchasing arrangement

to provide effective alternative in the health care reform environment;

expansion of training and loss prevention technology tools including special

education and employment practices liability resources; public agency

organizational transition programs providing early retirement incentives to

minimize layoffs and maintain staff revitalization.

Mathison Insurance Partners Inc.

Headquarters: Ridgeland, Miss.

Revenues 2011: $1.3 million

Top Executive: Chris Mathison, president

Top Lines: Agribusiness; excess; casualty; financial institutions; high-value

homeowners; management liability.

Developments in 2011: Expanded high-end homeowners capabilities by

adding E&S offerings. Also added three new excess casualty markets in

order to offer a more complete approach for agency partners.

Mesirow Insurance Services Inc.

Headquarters: Chicago

Revenues 2011: $87 million

Top Executive: Norman J. Malter, president

Top Lines: Property/casualty; management liability; employee benefits.

Developments in 2011: Expanded Mesirow Insurance Services Inc. to

include an international practice; launched Mesirow Financial FIRSTHR,

designed to provide integrated human resources solutions.

SullivanCurtisMonroe

Headquarters: Irvine, Ariz.

Revenues 2011: $30.5 million

Top Executive: John Monroe

Top Lines: Property; health; benefits; workers’ compensation.

Developments in 2011: Auto dealership program.