How long is a minute

advertisement

How long is a minute ?

∗

Juan D. Carrillo

University of Southern California

and CEPR

Isabelle Brocas

University of Southern California

and CEPR

Jorge Tarrasó

University of Southern California

February 2015

[Preliminary]

Abstract

Psychophysics studies on time perception argue that the way we represent time intervals is not linear in true time intervals. Economics research on time discounting

reveals that future rewards are valued less the longer the delay involved. Here we combine both strands and present experimental data in which subjects perform two tasks.

First, they produce short intervals of time (seconds, minutes). Second, they choose

between different rewards separated by long delays (weeks, months). We estimate the

time perception functions and the time discounting functions at the individual level.

We find that subjects for whom one unit of time feels longer than true time discount

the future at a higher rate than subjects for whom one unit of time feels shorter than

true time. The result suggests that our capacity to delay consumption is related to

our mental representation of time delays between now and the future. They also indicate the existence of an underlying internal clock that governs time representations

irrespective of the unit of time.

Keywords: laboratory experiments, time perception, time discounting, time estimation.

JEL Classification: C91, D03, D91.

∗

We are grateful to members of the Los Angeles Behavioral Economics Laboratory (LABEL) for their

insights and comments in the various phases of the project. We also acknowledge the financial support

of the National Science Foundation grant SES-1425062. Address for correspondence: Isabelle Brocas,

Department of Economics, University of Southern California, 3620 S. Vermont Ave., Los Angeles, CA

90089, USA. E-mail: <brocas@usc.edu>.

Time is too slow for those who wait, too swift for those who fear, too long for those

who grieve, too short for those who rejoice, but for those who love, time is not.

Henry Van Dyke (Music and Other Poems, 1904)

1

Introduction

Time is subjective. It flies when you enjoy and virtually stops when you suffer. Tomorrow

is “in a very long time” for kids and “practically now” for seniors. The objective of this

paper is to explore the relationship between time perception and time discounting. Our

conjecture is simple: if one person perceives one week to be longer than another person,

it seems natural that he will be less willing to delay a reward by that (objective) amount

of time. If this hypothesis is correct, it can help understand the paradoxical tendency of

older adults to save more than younger adults (Banks et al., 1998) despite their shorter life

expectancy. It may also explain why an individual will choose whether to postpone gratification or not depending on the prospective experience during that time interval. More

generally, it suggests that eliciting discount rates is a valuable but incomplete measure

to understand intertemporal tradeoffs. Indeed, an individual who succumbs to immediate

gratification may in fact be someone with a highly distorted perception of time duration,

and that his preference for the present can be dramatically affected just by correcting such

perception.

To address this question we ask our subjects to perform two tasks in a controlled

laboratory environment. First, we elicit their time discount rates using the method proposed by Andreoni and Sprenger (2012a) (hereafter, [AS]), where subjects allocate a fixed

amount of tokens between two dates. We use their convex time budget (CTB) method

due to its robustness and stability, and structurally estimate a quasi-hyperbolic discount

function and curvature of utility.1 Second, we elicit their time perception estimates by

asking subjects to reproduce intervals of lengths ranging between 20 seconds and 4 minutes. Formally, we ask them to click the start box to begin a time interval and click again

when a predetermined amount of time (e.g., 2 minutes and 31 seconds) has passed. This

task is performed in conjunction with a distractor task that prevents them from counting

seconds. We estimate for each individual a time perception power function that maps

true time intervals into perceived time intervals. Finally, we correlate the impatience or

preference for the present derived from the time discounting task (T D) with the subjective

evaluation of time obtained from the time perception task (T P).

1

An advantage of CTB over the traditional methods is that it controls for diminishing marginal utility,

although it has also received some criticisms recently. Our paper does not attempt to innovate on the

method to elicit time preferences. We realize that different methods have different advantages and use one

which has proved simple and reliable.

1

Our results can be summarized as follows. We find substantial dispersion in the time

discounting of our subjects. The estimated parameters in the T D task are in line with

those found in [AS], with low levels of impatience, little evidence of present bias and some

small (but positive) concavity in the utility function. Perception estimates in the T P task

are also heterogeneous. Although a majority of individuals underestimate time, we still

observe the opposite tendency in some subjects. More generally, we find evidence of both

concave and convex time perception functions.

The main novelty of the study, however, is to analyze the relationship between time

perception and time discounting. To this purpose, we perform an upward extrapolation

of time perception estimates to intervals of time as high as 7 days and a downward extrapolation of time discounting estimates to intervals of time as low as 1 hour. We then

correlate the individual estimates in both tasks. For all intervals of time between 1 hour

and 7 days we find a strong negative correlation between the level of impatience estimated

in the T D task and the subjective perception of time estimated in the T P task (Pearson

coeff. between -0.24 and -0.26 and p-value between 0.024 and 0.035). In other words and

consistent with our hypothesis, subjects who perceive 1 day as a longer time interval than

it really is are less likely to delay consumption by that amount of time than subjects who

perceive 1 day as a shorter time interval than it really is.

We then perform a cluster analysis and endogenously identify four groups of people.

One large group of subjects is close to what we would expect of rational economic agents:

patient, time-consistent, and with a perception of time reasonably close to the true time.

A second group is composed of subjects with a concave time perception function. They

underestimate time and are more willing to delay consumption than subjects in the first

group. The remaining two (small) groups of subjects exhibit the opposite tendency: convex

time perception functions, significant overestimation of time and lower discount parameters

than the rest of the population.

Before proceeding with the analysis, we provide a brief review of the existing literature. Time discounting has received much attention in economics. Researchers have

proposed different parametric formulations of the time discounting function as well as

different experimental designs to elicit them, and the empirical and experimental estimates vary significantly across studies (see Frederick et al. (2002) for a review). There

are two main challenges for the elicitation of time discounting. First, subjects may not

be time-consistent and place a greater value on immediate gratification compared to any

future consumption. This has motivated hyperbolic specifications of time discounting as

opposed to the standard exponential formulation.2 Second, time is inherently uncertain

2

The quasi hyperbolic formulation was first developed by Phelps and Pollak (1968) and later reintroduced by Laibson (1997). The most general hyperbolic specification is due to Lowenstein and Prelec

2

and deciding to postpone consumption amounts to choosing a lottery. It is therefore important to be able to disentangle risk preferences from time preferences. Moreover, when

choosing between consumption now (for sure) and consumption in the future, a subject

may choose the former because of his intrinsic willingness to not delay immediate gratification, or because uncertainty about the future makes the safer option more desirable.

Said differently, the two challenges are inherently related. The recent literature proposes

methods to jointly estimate time and risk preferences (Harrison et al. (2005); Andersen et

al. (2008); Andreoni and Sprenger (2012a and 2012b)) and reports less or no evidence of

a present bias.3 Our analysis relies on this last line of research which allows us to better

isolate time discounting.

Time perception has also been extensively studied in the psychophysics literature. It

is centered on prospective time evaluations, where subjects are informed beforehand that

they have to make a time related judgment. These studies mostly focus on extremely

short intervals (milliseconds, seconds) and use methods in which subjects have either to

verbally assess a duration, reproduce or produce a time interval, or compare the duration

of intervals presented successively (Lorraine (1979); Grondin (2010)). There are two major

results in this literature. First, prospective time evaluation is often consistent with WeberFechner’s law of human perception, implying that subjective time is not linear in true time

but rather proportional to its logarithm (Grondin, 2001). Second, individual evaluations

are qualitatively similar for short and long intervals of time (Lewis and Miall, 2009),

suggesting the existence of a single ‘internal clock’ mechanism that governs prospective

timing. Our study draws on the concept and methods developed in this literature and

also focuses on prospective timing. However, it departs in several respects. First, we focus

on significantly longer time intervals than the majority of the literature (several minutes).

Second, we introduce a new and incentivized elicitation method together with a distractor

task that prevents subjects from counting. Third, we provide a structural estimation

of a two-parameter power time perception function instead of imposing a logarithmic

functional form. Finally, we estimate the perception function at the individual not the

aggregate level. This allows us to study heterogeneity in perception across subjects.4

(1992). Laibson (1998) discusses its relevance to life cycle consumption. Kirby et al. (1999) report that

time discounting is hyperbolic while Benhabib et al. (2010) find support for a present bias but their data

is best fitted with yet an alternative specification.

3

See also Augenblick et al. (2013) for a comparison between time-dated monetary rewards and real

effort. The authors find evidence of a present bias only in the case of effort.

4

Some studies investigate instead retrospective time evaluation, where subjects are not informed beforehand that they will have to make a time related judgment (Block and Zakay, 1997). By definition,

under this approach only one measure can be obtained per individual. The studies find that retrospective

time evaluations are usually shorter than prospective time evaluations (Fraisse, 1984) and they draw on

different (memory) processes. We performed a one-shot retrospective time evaluation task and also found

3

Finally, there is a small literature relating time perception to time discounting. Ray

and Bossaerts (2011) propose a novel theory where they show that if individuals discount

the future exponentially with respect to biological time but the internal representation

of time is stochastic and autocorrelated, then choices will be present-biased with respect

to calendar time. Cui (2011) demonstrates that the scalar property of time perception

(the idea that the incremental amount of change required for a stimulus to be noticeable

is proportional to the current stimulus magnitude) also implies hyperbolic discounting.

Zauberman et al. (2009) and Han and Takahashi (2012) study time discounting and time

perception in the laboratory. They elicit time discount rates through hypothetical questionnaires and time perception estimates by asking subjects to place a mark on a line that

represents their perception of different horizons. Their aggregate analysis reveals hyperbolic discounting with respect to objective time but exponential discounting with respect

to subjective time. Besides the methodological differences, our study departs from these

experimental papers in that our goal is not to “explain” hyperbolic discounting at the

aggregate level based on subjective time perception (in fact, there is little evidence in our

data in favor of hyperbolic discounting). Instead, we are interested in the fundamental

relationship between time discounting and time perception at the individual level, and the

idea that subjects who perceive objective time as subjectively longer should be less prone

to delay consumption.

2

2.1

The experiment

Design and procedures

The experiment was conducted in the Los Angeles Behavioral Economics Laboratory (LABEL) at the University of Southern California.5 A total of 124 subjects participated in

the study in 14 groups of 6 to 10 participants each. In order to participate in the experiment, subjects were required to be enrolled USC students with a USC Discretionary Card

Account. Students frequently use their USC Card to pay in businesses on campus and

the surrounding area. By special arrangement with the USC Card Department, we were

able to deposit money into their accounts at our convenience. Sessions lasted for about

1h30min and started either at 10am or 12pm. They consisted in two main tasks, always

administered in the same order (time discounting task followed by time perception task).

Instructions were read out loud at the beginning of each task.

Time perception task. Participants were asked to produce 9 time intervals τ of 24,

more underestimation than under prospective time evaluation (see Appendix A2).

5

For information about the lab, please visit http://dornsife.usc.edu/label.

4

31, 41, 53, 69, 89, 116, 151 and 196 seconds respectively, without knowing in advance the

number of intervals to produce.6 We designed a Matlab-based program to implement the

elicitation of the participants’ time perception. The program presented the instructions

on the screen and guided subjects to estimate time intervals. Subjects were prompted the

length of the interval τ to be estimated. Then, subjects marked the beginning and end of

the interval by clicking on a button on the top right corner of the screen. The order for

the 9 intervals was randomly selected but it was the same for all subjects.7

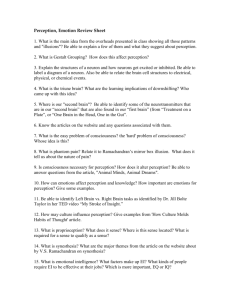

To make sure that subjects did not count time, we asked them to solve filler (distracting) tasks while estimating time intervals. In these tasks, subjects were presented a

4 × 6 table where each row and column had a name and they were instructed to click on a

specific cell. In the example of Figure 1, subjects were asked “Please click the cell where

the column to the right of the column labeled athena intersects the row above the biology

row”.

Figure 1: Example of a filler task

The names of the rows and columns as well as the phrasing of which cell to click on

changed from task to task to make sure subjects would pay attention. There was a random

and unspecified time limit to complete each task (between 10 and 15 seconds) and failure

to complete it counted as an incorrect answer.8

6

This is called a prospective time estimate in a production paradigm. Prospective (as opposed to

retrospective) refers to a case where subjects know in advance that they will be requested to estimate the

elapsed time. Production occurs when subject are informed about the length of the interval they must

produce (Nichelli, 1996). This is different from reproduction, where subjects experience a time interval

(without knowing its real length) and are then asked to reproduce a second interval of the same size.

7

Before coming to the laboratory, subjects were asked to put away any time-keeping devices such as

watches, music players and cell phones. An experimenter made sure that subjects placed these items in

their bag and monitored that they did not use any such device.

8

The task required sufficient effort to prevent subjects from counting but was easy enough to make sure

all subjects could complete it if they put attention. Participants were informed that if they reported the

5

The amount earned depended on the proportion of correct answers in the filler tasks

and the distance between time estimates and true time intervals. For each subject, one

time interval was randomly selected for payment. For this time interval, the subject earned

money only if at least 80% of the filler tasks were correctly answered. The subject would

then earn $25 if the estimate was within ±5% of the real length of the interval, $15 if it

was within ±10% and $5 if it was within ±20%. If less than 80% of the filler tasks were

correctly answered, the subject did not earn anything no matter how good the estimation

of the time interval was.9 The entire procedure was announced beforehand. We chose this

method because it is easier to explain and more intuitive than a quadratic scoring rule.

Time discounting task. Since the goal of the paper was not to provide an innovative way

to elicit time discounting, we followed closely the CTB design and allocation procedure

in [AS]. We provided subjects with a budget of experimental tokens to allocate either to

a sooner time t or a later time t + k, at different token exchange rates. The relative rate

at which tokens translated into money determined the gross interest rate, (1 + r). The

amounts allocated at dates t and t + k were denoted by ct and ct+k respectively. We

implemented a 3 × 3 design with three sooner payment dates starting from the experiment

date (t ∈ {0, 7, 21}) and three delay lengths (k ∈ {21, 42, 63}). For each of the 9 pairs of

(t, k), there were 5 different budgets and exchange rates for a total of 45 sooner-later token

allocation tasks. Dates were selected to avoid holidays, vacations and examination dates.

To avoid differential weekday effects, t and k were both multiples of 7 so that payments

were scheduled to arrive on the same day of the week.

Subjects were given 10 tokens for each of the 45 allocation tasks. Tokens assigned to

sooner and later payments had values vt and vt+k , respectively. Since vt+k /vt = (1 + r)

is the gross interest rate over k days, (1 + r)1/k is the daily interest rate. Values were

never multiples of $0.05 to avoid gravity point effects. To formally implement choices, we

provided paper booklets. Subjects had to circle their preferred token allocation among

the eleven possible combinations of tokens sooner vs. token later in each of the 45 tasks.

Appendix A1 shows the token rates, standardized daily interest rates and corresponding

annual interest rates for all 45 budget set. It also shows the presentation of the first 5

tasks of the paper booklet, corresponding to t = 0 and k = 21 (Figure 10).

To avoid in-lab vs out-lab payments at different dates, all sooner and later payments,

including those for t = 0, were deposited into the subjects’ USC Card Accounts by 4pm on

end of an interval during a task, that task would not count as correct or incorrect. Subjects also estimated

a 10th time interval of 219 seconds that was not used for analysis. The objective was to make sure that

the 9 relevant intervals were estimated while all subjects could hear all other subjects clicking cells and

therefore could not use the absence of clicking as a cue that the others had finished their time estimations.

9

In 84% of the trials, subjects answered correctly at least 80% of the filler tasks and therefore were

eligible for payment.

6

the specified date.10 Subjects were described the payment method and the arrangement

made with the USC Card Department. They were told that they would receive a $4.64

thank-you payment for participating in two payments, $2.32 at the sooner and $2.32 at

the later date regardless of their choices, and that all experimental earnings were added to

these two payments. Subjects knew in advance that one of the 45 choices was selected for

payment by drawing a numbered ball from a bingo cage. They were given Professor Juan

Carrillo’s business card and they were told to contact him if payments did not reflect in

their account, in which case a payment would be hand-delivered immediately. Subjects

were asked if they trusted the payment method at the end of the experiment and 95% of

respondents replied yes.11

Other tasks. We conducted three peripheral tasks: a one-shot retrospective time estimate

task, a cognitive ability test, and a survey to collect demographic information. Details of

the procedures and results obtained in these tasks can be found in Appendix A2.

2.2

Limitations

An experimental study of time perception vs. time discounting is subject to two limitations.

First, the temporal horizons are different. We can realistically elicit multiple prospective

time estimates that are on the range of minutes whereas meaningful monetary tradeoffs

must involve temporal delays that are on the range of weeks. We will therefore extrapolate

our estimates upwards for time perception and downwards for time discounting to make

them comparable.

Second and related, we are interested in comparing perception and discounting across

individuals. If time perception functions are not linear in true time and/or time discounting functions are not exponential, rankings may depend on the horizon (for example, a

hyperbolic discounting subject may be more impatient in the short run and less impatient

in the long run than another hyperbolic discounting subject). In the analysis, we will

put special emphasis in determining the time range for which the estimated rankings are

preserved.

10

This removes the salience of immediate payment. It is likely to result in the later option being chosen

more frequently but it also makes the uncertainty and potential anxiety over payment similar whether it

is today or in the future (for a discussion, see Andreoni and Sprenger (2012a, 2012b)).

11

The full list of differences relative to [AS] are (first item refers to our design, second item to theirs): (i)

payment to USC card vs. payment by check; (ii) thank you payments of $2.32 vs. $5; (iii) slight differences

in (r, t, k, m) but calibrated to equalize daily gross interest rates (see Figure 10); (iv) 11 vs. 101 choices

per budget; (v) pen and paper vs. computerized implementation; and (vi) 124 vs. 97 subjects.

7

Time perception (T P)

3

3.1

Modeling time perception

In this section we present the theoretical framework and experimental results of our time

perception task. Time perception refers to the fact that an objective length of time may

be inaccurately perceived, leading to under- or over-estimation of true delays. We consider

a simple model of time perception in which subject i formulates a subjective duration θi

of a true time interval of length τ according to the function:

θi (τ ) = ai τ bi

(1)

where ai is the reaction to time and bi the sensitivity to time (notice that ai = bi = 1

corresponds to a correct time perception). This representation is borrowed from Steven’s

law, which proposes a relationship between the magnitude of a physical stimulus (brightness of an image, level of a sound, sugar component of a meal, etc.) and its perceived

strength (Stevens, 1957). It has been applied to a variety of such problems, including time

perception (Stevens (1975); Luce (2002)).

We fitted this model to the data obtained from the time perception task, hereafter

referred to as T P. For each individual i, we estimated by non linear least squares (NLS)

the parameters ai and bi of the following regression:

yis = ai τsbi + is

(2)

where, for trial s ∈ {1, ..., 9}, the reported perception of individual i is yis , the true

length in seconds is τs ∈ {24, 31, 41, 53, 69, 89, 116, 151, 196}, and the noise in the process

is is ∼ N (0, σi2 ). The software did not record the choices of 4 subjects and 4 others were

outliers. Figure 2 graphically depicts the estimated parameters (âi , b̂i ) of the remaining 116

subjects.12 For illustrative purposes, Figure 3 presents the choices of three representative

subjects (with b̂i > 1, b̂i ' 1 and b̂i < 1, respectively).

We obtained three main findings. First, the power model explains remarkably well the

data: the average R2 is 0.97 and 105 out of 116 individuals have an R2 greater than 0.95.13

In other words, subjects typically reported estimates that were very close to the best time

perception power fit. Second, there is substantial heterogeneity across individuals in our

sample. Indeed, 77 and 39 subjects had an estimated parameter âi greater and smaller

12

Four subjects clearly double clicked in one trial, so we estimated their time perception parameters

based on one fewer observation.

13 2

R is expected to be high since we fit two parameters with 9 observations. Still, since we impose

θi (0) = 0, our regression has 7 degrees of freedom. The subjects in Figure 3 are representative of the fit.

We also tried a linear model but the fit dropped substantially.

8

6

a

4

2

0

0.50

0.75

1.00

1.25

b

Figure 2: Estimations of individual time perception parameters (âi , b̂i ).

than 1, respectively. Similarly, 81 and 35 subjects had an estimated parameter b̂i smaller

and greater than 1, respectively. Third and perhaps most significantly, time perception

parameters ai and bi are not independent across individuals. More precisely, we found a

strong hyperbolic relation between the two parameters. We ran the regression:

1

âi = q + ηi

b̂i

where ηi ∼ N (0, σ 2 ) is an error term, and obtained an estimate q̂ = 1.52 (p-value =

0.000). This means that both parameters cannot be studied in isolation: an individual

with a concave perception of time (b̂i < 1) is extremely likely to exhibit a steep reaction

to time (âi > 1) and vice versa.

3.2

Ordering of subjects’ time perceptions

Remember that our main interest in this section is to compare the degree of under- or overestimation of perceived time across individuals. The non-linearity of the time perception

function is potentially problematic for this comparative analysis (see section 2.2): a subject

with b̂i < 1 may over-estimate short intervals and under-estimate long intervals whereas

another subject with b̂j > 1 may exhibit the opposite bias. However, the link between

the variables âi and b̂i is extremely helpful. Indeed, consider the following one-parameter

time perception function that exploits the hyperbolic relationship âi = q/b̂i :

q

θ̃(τ ; b̂i ) = τ b̂i

b̂i

It is immediate that ∂ θ̃/∂ b̂i > 0 if τ > exp1/b̂i . Since min{b̂i } = 0.5 in our sample, it

means that if the hyperbolic relationship were exact, then rankings would be stable for

9

!

250

200

200

200

150

100

50

0

Perceived time

250

250

Perceived time

Perceived time

Id 105: a=3.91, b=0.65

Id 67: a=1.03, b=1.00

Id 52: a=0.38, b=1.23

150

100

50

0

50

100

150

Real time

200

0

150

100

50

0

50

100

Real time

150

200

0

0

50

100

150

200

Real time

Figure 3: Three examples of choices in time perception task

all τ > exp2 ' 7.4 seconds. Stated differently, if b̂i > b̂j then θ̃(τ ; b̂i ) > θ̃(τ ; b̂j ) for all

τ > 7.4s. This monotonicity property is extremely useful as it may allow us to rank the

subjects’ degree of under- or over-estimation at all the relevant time intervals on the basis

of just one parameter.

In our data, the relationship between âi and b̂i is not exact so a perception ranking

independent of the time interval is not possible. We can, however, determine whether

the hyperbolic relationship is accurate enough that the ranking of the time perception

functions estimated for intervals between 24s and 196s is preserved for longer time intervals,

such as 588s (three times the highest measured interval), 1 hour, 1 day, 7 days and 14

days.

To address this question, we performed the following exercise. For each subject i and

given their estimated parameters (âi , b̂i ), we evaluated his perception of an interval of

length τx (that is, θ̂i (τx ) = âi τxb̂i ) and then ordered the subjects from maxi {θ̂i (τx )} to

mini {θ̂i (τx )}. We repeated the same exercise for an interval of length τx0 . Finally, we

determined how much the time perception ranking of subjects changed between τx and

τx0 . We found that the ranking of 28% of our subjects changed by more than 5 positions

between 588s and 1 hour. This percentage dropped to 20% between 1 hour and 1 day, to

1% between 1 day and 7 days and to 0% thereafter. Overall, subjects in our sample can

be ranked very steadily regarding their perception of time for intervals above 1 hour.

10

!

4

4.1

Time discounting (T D)

Modeling time discounting

In this section we present the theoretical framework and experimental results of our time

discounting task. We refer to [AS] for more details of the theory and estimation. Subject i

chooses at time 0 to allocate a budget m between consumption at t, ci,t , and consumption

at t + k, ci,t+k , continuously along a convex budget set. Denoting (1 + r) the gross interest

rate, the budget constraint can be written as:

(1 + r)ci,t + ci,t+k = m

(3)

We assume a time separable time discounting function Φi (t) of time t from the perspective

of time 0, and a CRRA utility of money:

U0 (ci,t , ci,t+k ) = Φi (t)

1

1

(ci,t )αi + Φi (t + k) (ci,t+k )αi

αi

αi

(4)

where αi > 0 is the curvature parameter. To estimate the inter-temporal utility function of

each individual, we arbitrarily restrict attention to quasi-hyperbolic discounting functions,

that is, functions of the form:

βi δit t > 0

Φi (t) =

1

t=0

where δi ∈ (0, 1) is the one period discount and βi > 0 the time inconsistency parameter.

Note that βi = 1 corresponds to the standard exponential discounting model. A subject

is time inconsistent when βi 6= 1, exhibiting a present-bias when βi < 1 and a future-bias

when βi > 1. The subject chooses ci,t and ci,t+k by maximizing (4) subject to (3). The

optimal amounts are:

m

m

and

c∗i,t =

(5)

c∗i,0 =

1

1

1−αi

1−αi

k

k

(1 + r) + (1 + r)βi δi

(1 + r) + (1 + r)δi

We fitted the model to the data obtained from the time discounting task, hereafter

referred to as T D. For each individual, we estimated by NLS and MLE the parameters

αi , δi and βi of the following regressions:

m

m

ci,0 =

1 +εi,0 and ci,t =

1 +εi,t (6)

1−αi

1−αi

k

k

(1 + r) + (1 + r)βi δi

(1 + r) + (1 + r)δi

where εi,0 ∼ N (0, σi2 ) and εi,t ∼ N (0, σi2 ). Notice that variations in delay lengths k and

interest rates (1 + r) allow for the identification of αi and δi . Variations in starting times

t allow for the identification of βi .

11

From the 124 subjects who participated in the study, we removed 21 subjects who

had very little to no variance in behavior.14 The algorithm did not converge for 5 more

subjects and 16 other were outliers, with estimates that did not make sense (e.g., α̂i < 0

or δ̂i >> 1).15 Figure 4 presents the distributions of the (β̂i , δ̂i , α̂i ) estimated parameters

for the 82 remaining subjects using MLE.

12

24

10

10

20

8

6

6

4

4

2

2

0

0

0.8

1.0

1.2

beta

!

count

16

count

count

8

1.4

12

8

4

0

0.980

0.985

0.990

delta

0.995

1.000

0.25

0.50

0.75

alpha

Figure 4: Distribution of parameters in the time discounting task (β̂i , δ̂i , α̂i )

We obtained reasonable estimates. The estimates are also similar (and generally consistent) with those in [AS] (see their Figure 3 in p. 3351).16 In particular, the vast majority

of our β̂i estimates are close to 1, implying no evidence of present-biased behavior. If

anything, just like in [AS] we observe a future bias, although this is likely due to small

measurement errors. As expected, the overwhelming majority of the δ̂i estimates are

between 0.99 and 1.0 and most of the α̂i estimates are above 0.85 (but still below 1).

Notice also that the one-period discounting and time inconsistency parameters are

correlated in our T D data. Figure 5 reports the (β̂i , δ̂i ) estimated pairs for each individual

and the best linear fit between the two.

A simple linear regression suggests a statistically significant negative relationship between the two parameters (δ̂i = 1.017 − 0.02β̂i , p-value = 0.000). We conjecture that this

relationship must be present in most datasets on time discounting estimates. It may not

surprise some readers, although we have not seen reported in any paper. On the other

hand and as expected, there is no statistically significant relationship between δ̂i and α̂i or

14

More precisely, those who chose the later option more than 95% of the time. We could have estimated

the parameters of those individuals but we would have obtained only range estimates and they would have

not been very reliable, so we preferred to omit them.

15

Having non-reliable estimates for some subjects is not unusual in this type of exercise. For example,

among the 97 subjects in [AS], 2 did not converge, 2 made automatic choices, 22 chose the later option

more than 95% of the time and 7 were outliers according to our definition.

16

As expected, MLE and NLS gave extremely close estimates. The fit of the model was good. The

average R2 in our NLS estimation was 0.80.

12

1.00

1.000

delta

0.995

0.990

0.985

0.980

0.9

1.0

1.1

1.2

1.3

beta

Figure 5: Estimations of individual time discounting parameters (β̂i , δ̂i )

between β̂i and α̂i . As developed in the next section, this empirical relationship is useful

when we attempt to rank individuals by their degree of impatience.

4.2

Ordering of subjects’ time discounting

As it is well-known, as soon as we move away from exponential discounting, the impatience

ranking of individuals may depend on the time horizon considered. However, just like the

hyperbolic relationship between the variables in the time perception task helped rank

subjects by their time perception, the negative and (roughly) linear empirical relationship

between the discounting variables also helps rank subjects by their impatience. Indeed, if

the relationship between the variables was exactly δ̂i = 1.017 − 0.02 β̂i , one could rewrite

the discount function of subject i with only one parameter:

t

Φ̃(t; β̂i ) = β̂i 1.017 − 0.02 β̂i

This would imply that ∂ Φ̃/∂ β̂i > 0 if t <

1.017

0.02β̂i

− 1. Since max{β̂i } = 1.37, the ranking

would be unambiguously determined by β̂i for all t < 36 days.

Naturally, the relationship between β̂i and δ̂i is not exact in our data, so the ranking

of impatience across individuals may not be fully preserved within that horizon. We

therefore conducted an exercise similar to that in section 3.2, where we use the estimated

(β̂i , δ̂i ) parameters to determine what is the value at date 0 for subject i of one unit of

consumption at date tx , where tx is 1 hour, 2 hours, 6 hours, 12 hours, 18 hours, 1 day, 7

days and 14 days. Again, the objective is not to find meaningful discount rates for such

short intervals but rather to evaluate if the ranking of impatience across individuals is

13

preserved in that range of time. We found that 27% of the subjects changed ranks by

more than 5 positions between 1 day and 7 days and none between any of the shorter

intervals. Overall, we are confident that subjects are ranked steadily in terms of their

time discounting for all time horizons below 1 day.

5

From time perception to time discounting

The previous sections suggest that the time perception and time discounting of each individual i are well summarized by (ai , bi ) and (βi , δi , αi ), respectively. Furthermore and to

address the challenges described in section 2.2, we have shown that upward extrapolation

of time perception to intervals as high as 1 day and downward extrapolation of time discounting to intervals as low as 1 hour are reasonable in our setting, in the sense that they

preserve the rankings across individuals. In this section, we address the main question of

the paper, namely the relationship between time discounting and time perception.

We hypothesize that objective delays between consumption dates are evaluated in a

subjective manner, and the subjective estimates are used to choose between consumption

options over perceived delays. We first investigate this conjecture at the aggregate level.

More precisely, we hypothesize that objective time intervals are perceived subjectively and

differently across individuals resulting in different evaluations of future consumption. This

in turn generates heterogeneity in fitted discount functions.

5.1

Hypotheses

Consistent with our conjecture, we hypothesize that there exists a time-weighting function

f (·). The discounting of an objective time interval for individual i, Φi (·), corresponds to

the time-weighting f (·) of the perceived length of that interval, θi (·). Assuming for the

time being that f (·) is identical for all individuals, we formally have:

Φi (t) = f (θi (zt)) ∀i

(7)

where z is the conversion rate between units of time in the discounting and perception

tasks.17 According to (7), differences in discount functions across individuals are due to

differences in their subjective perception of time. We impose the natural assumption that

rewards at more distant perceived dates are valued less (f 0 < 0) but, for now, we do not

posit any specific functional form on f (·). This alone immediately implies:

θi (zt) ≷ θj (zt) ⇔ Φi (t) ≶ Φj (t)

17

(8)

In our case, given we formulated the time perception task in seconds (τ = 1 second) and the time

discounting task in days (t = 1 day), we have z = 60 × 60 × 24 = 86, 400.

14

The relationship in (8) captures the intuitive idea that if an objective length of time zt is

subjectively perceived as a longer interval by subject i than by subject j (θi (zt) > θj (zt)),

then subject i is less willing than subject j to postpone a reward by that amount of

time (Φi (t) < Φj (t)). Stated differently, our first testable hypothesis is that subjects who

underestimate time should be patient while subjects who overestimate time should be

impatient.

Hypothesis 1 The individual time discounting estimate Φ̂i (t) = β̂i δ̂it obtained from T D is

negatively correlated with the individual time perception estimate θ̂i (zt) = âi (zt)b̂i obtained

from T P.

We have also highlighted that the close relationship between âi and b̂i and between β̂i

and δ̂i in our data implies that both the time perception and time discounting rankings

across individuals are stable (at least in the range of 1 hour to 1 day). It also implies that

focusing on one parameter (âi or b̂i for time perception and β̂i or δ̂i for time discounting)

may sometimes be sufficient to capture the main properties of the functions. Therefore,

if Hypothesis 1 is satisfied, we should also observe that the estimated time discounting

obtained from T D is negatively correlated with b̂i (and, by the negative relationship

between the variables, positively correlated with âi ). Similarly, we should also observe

that the estimated time perception obtained from T P is negatively correlated with β̂i

(and, by the negative relationship between the variables, positively correlated with δ̂i ).

Hypothesis 2 For all time intervals between 1 hour and 1 day:

(i) The time discounting estimate Φ̂i (t) = β̂i δ̂it obtained from T D is decreasing in the

parameter b̂i and increasing in the parameter âi obtained from T P;

(ii) The time perception estimate θ̂i (zt) = âi (zt)b̂i obtained from T P is decreasing in

the parameter β̂i and increasing in the parameter δ̂i obtained from T D.

We will test Hypotheses 1 and 2 in the remainder of the section. As already discussed,

time perception estimates have been obtained for relatively small time intervals (minutes)

while time discounting estimates have been obtained for relatively large time intervals

(weeks). It implies that the point estimates are not expected to predict accurately data

in the extrapolated intermediate time intervals. For instance, a small error in estimating

bi produces a larger mistake when converted in the perception of hours, making this prediction quantitatively inaccurate. We will look for qualitative properties of our estimates

rather than quantitative ones.

15

5.2

Aggregate analysis

Given the exclusion criteria considered earlier for our estimations, we kept for this analysis

only the 77 subjects for whom we obtained reliable estimates of ai , bi , δi , βi and αi . We

removed one more subject whose time perception estimate seemed reasonable but became

an outlier when extrapolated: his perception of 1 day was 9.6 days (keeping this subject

did not alter our main results). This left us with a total of 76 subjects.

To test our hypotheses, we constructed a hypothetical experiment in which subjects

would be asked to produce intervals of time T (for the perception task) and to determine

the discount applied to one unit of consumption at that same T (for the discounting task).

Since we feel confident with upward extrapolation of time perception as high as 1 day and

downward extrapolation of time discounting as low as 1 hour, we considered the following

time intervals: 1 hour, 2 hours, 6 hours, 12 hours, 18 hours and 1 day (to which we added

7 days and 14 days for the purpose of comparison).

For each time interval T and for each subject i, we predicted both time perception

and time discounting based on the estimates obtained from the T D and T P datasets.

Therefore, we explicitly assumed that the same time evaluation process governs time perception in seconds, minutes and hours and that the same time valuation process governs

discounting in weeks, days and hours.18 We computed Pearson’s correlation coefficients

(PCC) between time perception and time discounting for each interval T . Table 1 summarizes the findings. Figure 6 represents the scatterplot of predicted time perception and

predicted time discounting when T = 1 day.

At

At

At

At

At

At

1 hour

2 hours

6 hours

12 hours

18 hours

1 day

At 7 days

At 14 days

PCC

p-value

-0.25

-0.25

-0.26

-0.26

-0.26

-0.26

0.032

0.027

0.024

0.024

0.024

0.024

-0.24

-0.21

0.035

0.073

Table 1: Correlation between time perception estimate (θ̂i (zt) = âi (zt)b̂i ) and time

discounting estimate (Φ̂i (t) = β̂i δ̂it )

18

Obviously, we were careful to control for the different units of times used to obtain our estimates in

the previous sections, and we applied the relevant conversion rate.

16

1.3

1.1

0.9

Discount (1 day)

The result provides support for Hypothesis 1. Impatience is associated with the perception that time passes slowly, as predicted by the model. More precisely, subjects who

are predicted to produce a high time interval in the time perception task are also predicted

to consume early in the time discounting task.

0

1

2

3

4

5

Time perception (1 day)

Figure 6: Time perception and time discounting estimates for T = 1 day

From Figure 6 it appears that the negative relationship is convex and that there is

substantial heterogeneity across individuals in the valuation of future rewards and the

subjective evaluation of delays. Notice also that the discounting is above 1 for the majority of subjects. Taken literally, it would mean that individuals strictly prefer 1 unit of

consumption tomorrow to 1 unit today. This is obviously not sensible. The reason is that

many β̂i -estimates are above 1, so the extrapolation of the parameters to one day results

in unreasonably high patience.19 In Appendix A3, we present the same scatterplot when

T = 14 days. For that interval, estimates of time discounting become more reasonable,

although there is still a fraction of subjects with discounting above 1.20 On the other hand,

the correlation between time discounting and time perception when T = 14 days is weaker

and statistically less significant due to the previously mentioned problem of extrapolating

time perception to intervals above 1 day.

Following Hypothesis 2, our next step in the investigation of the relationship between

discounting and perception consists in a correlation analysis of the relevant parameters

of the two datasets. The first two columns of Table 2 present the correlation coefficients

between the predicted time discounting function β̂i δ̂it from dataset T D and the parameters

19

Remember, however, that the main objective of our analysis is not to estimate levels of time discounting

and time perception but to be able to perform comparisons across individuals.

20

We need to set T = 35 days (5 weeks) in order to have a discounting below 1 for more than 90% of

our subjects.

17

âi and b̂i of the time perception function. The last two columns present the correlation

coefficients between the predicted time perception function âi (zt)b̂i from dataset T P and

the parameters β̂i and δ̂i of the time discounting function. These correlations are performed

for the same time intervals T as previously.

Φ̂i (t) ≡ β̂i δ̂it

âi

At

At

At

At

At

At

1 hour

2 hours

6 hours

12 hours

18 hours

1 day

0.21

0.21

0.21

0.21

0.21

0.21

(0.064)

(0.064)

(0.065)

(0.066)

(0.066)

(0.067)

θ̂i (zt) ≡ âi (zt)b̂i

β̂i

δ̂i

b̂i

-0.25

-0.25

-0.25

-0.24

-0.24

-0.24

(0.033)

(0.033)

(0.033)

(0.033)

(0.033)

(0.034)

-0.25

-0.25

-0.26

-0.26

-0.26

-0.26

(0.032)

(0.027)

(0.024)

(0.023)

(0.023)

(0.023)

0.21

0.21

0.21

0.21

0.21

0.21

(0.075)

(0.067)

(0.064)

(0.065)

(0.067)

(0.068)

(p-values in parenthesis)

Table 2: Correlation between parameters across datasets

The results are very much in line with those in Table 1. The correlations (Φ̂i (t), b̂i ) and

(θ̂i (zt), β̂i ) are remarkably similar to the correlation (Φ̂i (t), θ̂i (zt)) studied previously. This

is not surprising since we know that the estimates b̂i and β̂i capture the main elements of

perception and discounting, respectively. The correlations (Φ̂i (t), âi ) and (θ̂i (zt), δ̂i ) go in

the right direction but they are statistically significant only at the 10% level. It suggests

that if we have to focus on only one parameter for discounting and perception, we should

prioritize the degree of time-inconsistency and the sensitivity to time perception.

It is worth emphasizing that the estimates (âi , b̂i ) on one hand and (β̂i , δ̂i ) on the other

are obtained from independent and unrelated datasets, T P and T D. There is a priori no

exogenous reason why the measures constructed from these two dataset should correlate.

And yet, there is striking evidence that the mechanisms underlying time perception and

time discounting are closely linked. The sign of the correlation coefficients obtained in

Tables 1 and 2 remain the same for larger time intervals. However, and due at least in

part to the inherently noisy nature of our data, correlations are no longer significant after a

certain interval length. Overall, the data provides support for the link between subjective

perception of time and impatience, and the existence of a time-weighting function f (·)

that transforms perceived time into discount rates.

18

5.3

Cluster analysis

The aggregate analysis shows that differences in time perception are associated with differences in impatience but it also suggests substantial heterogeneity in behavior. The

objective of this section is to investigate in more detail the differences across subjects.

To study heterogeneity, we use the time perception and discount estimates to group

individuals with the objective of finding common patterns of behavior. We focus on the

time interval T = 1 day.21 We consider a model-based clustering method to identify

the clusters present in our population. A wide array of heuristic clustering methods

are commonly used but they typically require the number of clusters and the clustering

criterion to be set ex-ante rather than endogenously optimized. Mixture models, on the

other hand, treat each cluster as a component probability distribution. Thus, the choice

between numbers of clusters and models can be made using Bayesian statistical methods

(Fraley and Raftery, 2002). We implement our model-based clustering analysis with the

Mclust package in R (Fraley and Raftery, 2006). We consider ten different models with a

maximum of nine clusters each, and determine the combination that yields the minimum

Bayesian Information Criterion (BIC).22 For our data, the diagonal model with equal

volume and equal shape that endogenously yields four clusters minimizes the BIC. Table

3 presents the average statistics of the time perception and time discounting parameters

for subjects within each cluster. Figure 7 provides the same scatterplot as Figure 6 with

subjects coded by cluster (the ellipses superimposed on the classification plot correspond

to the within-cluster covariances and the mean of each cluster is marked with a ∗ sign).

Cluster 1 is close to what we would expect of rational economic agents. Their subjective perception of time is linear and reasonably close to the true time, with a slight

underestimation. They are also very patient and time-consistent. Cluster 2 is a group

of subjects exhibiting a concave time perception function. They tend to underestimate

time and, as a consequence, they are more willing to delay consumption than subjects in

cluster 1. This is reflected by an extremely high patience and a future bias (as discussed

previously, the fact that the estimated discount is above 1 is likely due to a measurement

error of extrapolation). Clusters 3 is a small group of subjects exhibiting moderately

convex time perception functions and a significant overestimation of time. Their discount

parameter is lower than the previous subjects. Finally, cluster 4 is an extreme version of

21

We conducted the same analysis with the other time intervals reported in Tables 1 and 2 and obtained

consistent results. Only a few subjects shifted from one group to another as we shifted the time interval,

and none of the differences were significant.

22

Hierarchical agglomeration first maximizes the classification likelihood and finds the classification for up

to nine clusters for each model. This classification then initializes the Expectation-Maximization algorithm

which does maximum likelihood estimation for all combinations of models and number of clusters. Finally,

the BIC is calculated for all combinations with the Expectation-Maximization generated parameters.

19

Perception (1 day)

a

b

Discounting (1 day)

β

δ

α

Cluster 1

Cluster 2

Cluster 3

Cluster 4

0.68

1.49

0.92

1.03

1.03

0.996

0.93

0.47

2.04

0.85

1.26

1.28

0.992

0.90

2.06

0.70

1.10

1.00

1.00

0.997

0.95

4.84

0.42

1.22

0.94

0.95

0.998

0.94

# subjects

(0.05)

(0.12)

(0.01)

(0.01)

(0.01)

(0.00)

(0.01)

56

(0.10)

(0.46)

(0.05)

(0.02)

(0.02)

(0.00)

(0.02)

10

(0.15)

(0.11)

(0.02)

(0.02)

(0.02)

(0.00)

(0.01)

7

(0.33)

(0.07)

(0.01)

(0.03)

(0.03)

(0.00)

(0.00)

3

Standard errors in parenthesis

Table 3: Summary statistics by cluster for T = 1 day

cluster 3, with strongly convex time perception, extreme overestimation of time and the

lowest discount. They are the only subjects to exhibit a present bias.

1.1

1.3

Cluster

Cluster

Cluster

111

Cluster

Cluster

Cluster

222

Cluster

Cluster

Cluster

333

Cluster

Cluster

Cluster

444

0.9

Discount (1 day)

Classification

0

1

2

3

4

5

Time perception (1 day)

Figure 7: Time perception and time discounting by cluster

To investigate the significance of differences across clusters, we ran a series of t-tests.

We found that the 1-day time discounting is significantly different between the most patient

cluster 2 and any of the other clusters but not between clusters 1, 3 and 4. By contrast, the

1-day time perception is significantly different between all pairs of clusters except between

1 and 2.

20

5.4

Discounting of perceived time

In section 5.2 we have emphasized a relationship between time perception and time discounting. In section 5.3, we have highlighted the substantial heterogeneity in choices

across individuals. In this section, we study how much of this heterogeneity is driven by

the differences in the subjective perception of time.

To study this question, we propose the following exercise. Let xi = θi (t) denote

individual i’s subjective time perception of t objective units of time, where θi is increasing

for all i. Inverting the function, we can determine ti = θi−1 (x). This function represents

individual i’s real time interval that corresponds to x perceived units of time. So, for

example, if i overestimates time (θi (t) > t) and j underestimates time (θj (t) < t), then it

requires a shorter objective time interval to subject i than to subject j in order to fill the

same perceived amount of time x (θi−1 (x) < θj−1 (x)). Next, we can compute how much

individual i discounts x units of perceived time:

θ−1 (x)

Φi (x) ≡ βi δi i

.

0.8

0.4

0.0

Discount

1.2

Finally, we can use the discount estimates (β̂i , δ̂i ) determined in section 4.1 for the 76

individuals in our sample to compute the discounting of each individual i for x units of

perceived time. Figure 8 presents a boxplot of these estimates for different perceived

intervals of time x (1 hour, 1 day, 7 days, 14 days and 21 days).

1 hour

1 day

7 days

14 days 21 days

Perceived times

Figure 8: Discounting of perceived time intervals

The line in the middle of the box is the median. The top and bottom lines are the

1st and 3rd quartile (Q1 and Q3) of the distribution, the notches are the 95% confidence

21

interval for the median and the whiskers’ edges indicate the smallest and highest nonoutlier observations. Outliers are defined as observations below Q1 − 1.5 [Q3 − Q1] or

above Q3 + 1.5 [Q3 − Q1] and are plotted separately with a hollow circle.

According to Figure 8, the median of discounting per unit of perceived time is in a

reasonable range (between 1.0 and 0.8). Discount estimates are, with some exceptions,

concentrated for intervals up to 7 perceived days, as shown by the relatively small height

of the boxes. This means that heterogeneity in discounting is attenuated when we use

perceived rather than true time as the temporal unit of measure, at least for short intervals.

Table 4 presents summary statistics of the average discounting (including standard

error, standard deviation and coefficient of variation) for different units of perceived time

x using the full sample of 76 individuals. It also contains the same information after

excluding the 16 outliers identified in Figure 8.

Full sample [76]

Perceived

interval (x)

1 hour

1 day

7 days

14 days

21 days

Avg. discount

1.055

1.018

0.905

0.833

0.778

(0.01)

(0.02)

(0.03)

(0.03)

(0.04)

Excluding outliers [60]

st. dev.

C.V.

0.10

0.16

0.26

0.29

0.31

9.9

15.6

29.0

35.1

39.4

Avg. discount

1.021

1.015

0.973

0.924

0.879

(0.01)

(0.01)

(0.01)

(0.01)

(0.02)

st. dev.

C.V.

0.06

0.06

0.07

0.10

0.14

6.1

6.0

7.1

11.1

16.0

Standard errors in parenthesis, number of individuals in brackets

Table 4: Average discount as a function of perceived time intervals.

The results in Table 4 confirm those in Figure 8. As before, average discounting is

above 1 for very short perceived intervals (1 hour, 1 day) due to the β̂i -estimates but it

becomes less than 1 for intervals above 7 days and, as one would expect, it monotonically decreases as the interval increases. Discounting is concentrated for short perceived

intervals. It is more dispersed for long perceived intervals but this is due to a few number of outliers. Once these individuals are removed, standard deviations (and therefore

coefficients of variation) decrease substantially. Overall, this section reaffirms the conclusion that considering perceived units of time rather than objective units of time helps

understanding the decision of individuals to postpone rewards.

22

6

Individual time-weighting function

From the T P dataset, we showed that individual i’s time perception is well summarized

by θi (zt) = ai (zt)bi . From the T D dataset, we found that individual i’s discount function

can be approximated by Φi (t) = βi δit . Our aggregate analysis revealed that the discount

function can be interpreted as the time weighting of perceived time. Even though a given

perceived time interval is reached for different true time intervals for different individuals,

its weighting is similar across individuals. Overall, we have shown that the data can

be summarized reasonably well by a common weighting function f (·), that transforms

perceived times into discount rates Φi (t) = f (θi (zt)). Still, we noted some individual

differences. The purpose of this section is to investigate this heterogeneity in more detail.

To do so, we posit that the weighting function that transforms perceived time into

discount has the same structure for every participant but it is parametrized individually.

More precisely, we assume:

a (zt)bi

Φi (θi (zt)) = β̃i d˜i i

This quasi-hyperbolic formulation is the same as the one we used to estimate discounts,

except that now participants are assumed to discount payoffs with respect to their perception of time rather than the true time. It also uses one second as the unit interval of

b

time, so d˜i can be interpreted as the discount per second. Notice that if we set δ̃i ≡ d˜iz i ,

then we can rewrite the previous function using one day as the (standard) unit of time:

ai (t)bi

Φi (θi (t)) = β̃i δ̃i

Our objective is to revisit the T D data and to propose a new discounting model driven

by perceived time rather than true time. Following the very same optimization procedure

as in section 4.1, the optimal consumption of individual i at date t is:

c∗∗

i,0 =

m

ai (k)bi

(1 + r) + (1 + r)β̃i δ̃i

1

1−α̃i

and c∗∗

i,t =

m

ai (t+k)bi −ai (t)bi

(1 + r) + (1 + r)δ̃i

1

1−α̃i

We imported the time perception parameters âi and b̂i estimated from the dataset T P and

we estimated by MLE the remaining three parameters (β̃i , δ̃i , α̃i ) in dataset T D exactly as

we did in section 4.1. We excluded one outlier with an estimated δ̃i = 1.809 (the results

are virtually unchanged if we keep that subject). Figure 9 presents the distributions of

the (β̃i , δ̃i , α̃i ) estimated parameters for the 75 remaining subjects.

A comparison between Figure 4 and Figure 9 suggests that the distribution of estimated

parameters are remarkably similar when we consider perceived time rather than true time.

We find that β̂i and β̃i are positively correlated (PCC = 0.54, p-value = 0.000) and so are

23

16

14

14

12

18

16

10

8

6

4

14

count

10

count

count

12

8

12

10

6

8

4

6

4

2

2

0

0

0.75

20

1.00

1.25

1.50

1.75

2.00

2

0

0.980

0.985

beta

0.990

0.995

1.000

0.25

delta

0.50

0.75

alpha

Figure 9: Distribution of parameters (β̃i , δ̃i , α̃i )

!

α̂i and α̃i (PCC = 0.82, p-value = 0.000). Said differently, participants have very similar

time inconsistency and curvature estimates in both models.

Interestingly, even though the distributions of δ̂i and δ̃i are very similar, the parameters

are not significantly correlated (PCC = 0.22, p-value = 0.0919). This is not surprising

because δ̃i is now applied to perceived time and individuals are highly heterogeneous

in their time perception. The new parameter is therefore adjusting for the individual

b

perception biases. Formally, the counterpart of δ̂it is now δ̃iat so, unlike for parameters β

and α, correlations of δ across models cannot be studied independently of t (for that very

same reason, δ̃i cannot be interpreted as the daily discount factor). Overall, the model

introduced here is a reinterpretation of the standard quasi-hyperbolic discounting model

in terms of perceived times and, according to AIC, both models perform equally well.

Last, we present in Table 5 the average statistics of the time discounting parameters

using the clusters obtained in section 5.3.

Perceived

Discounting (1 true day)

β̃

δ̃

α̃

# subjects

Cluster 1

Cluster 2

Cluster 3

Cluster 4

1.05

1.06

0.995

0.93

1.33

1.36

0.990

0.89

0.99

0.99

0.997

0.95

0.93

0.93

0.998

0.93

(0.02)

(0.02)

(0.01)

(0.02)

56

(0.04)

(0.05)

(0.00)

(0.02)

10

(0.02)

(0.02)

(0.00)

(0.02)

7

(0.03)

(0.03)

(0.00)

(0.01)

3

Standard errors in parenthesis

Table 5: Summary statistics by cluster for T = 1 day under perceived time

Again, a comparison between Table 3 and Table 5 reveals that the results obtained

earlier are qualitatively unchanged. Consistent with our previous discussion, the discount

24

1.00

parameter δ̃ is adjusting for the individual perception biases. When t = 1, the average

discount adjusted by the average perceived time in each cluster is very close to the average

discount from Table 3 (formally, δ̂ ' δ̃ a ), meaning that the differences across clusters are

preserved when we consider perceived rather than true time.

7

Concluding remarks

This paper provides experimental evidence on the relationship between time perception

and time discounting. Our data reveals a negative correlation between the two: subjects

for whom one unit of time feels longer than true time also discount rewards at a higher

rate than subjects for whom it feels shorter than true time. This result suggests that our

ability to delay consumption is related to our mental representation of time delays between

now and the future. Our result also indicates the existence of an underlying internal clock

that governs time representations irrespective of the unit of time.23

Prospective timing has been associated with working memory, a function performed

by the dorsolateral prefrontal cortex (dlPFC) (Grondin (2010); Lewis and Miall (2006)).

Interestingly, recent evidence in neuroscience supports the idea that this region is also

implicated in time discounting (Hare et al., 2014). This provides a rationale for why time

perception and time discounting should be related, as indicated by our data.

Our results are also in line with findings obtained in the time discounting and time

perception literature over the life cycle. It has been shown that the subjective perception

of the passing time tends to speed up with age. People increasingly underestimate time as

they age. Ordinary days appear longer for children and shorter for older adults (Block et

al. (1999); Coelho et al. (2004)). In parallel, children succumb to immediate gratification

while older adults are typically willing to wait for rewards (Green et al. (1999); Lockenhoff

et al. (2011)). In other words and consistent with the results presented here, children are

impatient and overestimate time whereas older adults are patient and underestimate time.

Interestingly, the dlPFC, which we conjecture is at the core of time related judgments,

is late to develop in children (Casey et al., 2005) and early to age (Raz et al., 2005).

These points taken together suggest that the relationship between time perception and

time discounting and the changes over the life cycle are no coincidence.

23

This conclusion is strengthened by the fact that, according to our retrospective task, there is also

a relationship between retrospective and prospective time evaluation (see Appendix A2). Overall, we

conjecture that a single mechanism is involved in all time related evaluations.

25

References

1. Andersen, S., G. Harrison, M. Lau and E. Rutstrom (2008) “Eliciting risk and time

preferences”, Econometrica, 76(3), 583-618.

2. Andreoni, J. and C. Sprenger (2012a) “Estimating Time Preferences from Convex

Budgets”, American Economic Review, 102(7): 3333-3356.

3. Andreoni, J. and C. Sprenger (2012b) “Risk preferences are not time preferences”,

American Economic Review, 102(7): 3357-3376.

4. Augenblick, N., M. Niederle and C. Sprenger (2013) “Working Over Time: Dynamic

Inconsistency in Real Effort Tasks”, NBER Working Paper 18734.

5. Banks, J., R. Blundell, and S. Tanner (1998) “Is There a Retirement-Savings Puzzle?”, American Economic Review, 88(4), 769-788.

6. Benhabib, J., A. Bisin and A. Schotter (2010) “Present-bias, quasi-hyperbolic discounting, and fixed costs”, Games and Economic Behavior 69, 205-223.

7. Block R.A. (1990) “Models of psychological time”, in Cognitive Models of Psychological Time R.A. Block ed. Erlbaum, Hillsdale, 1-35.

8. Block R.A. (2003) “Psychological timing without a timer: The roles of attention and

memory”, H. Helfrich (Ed.), Time and mind II: Information processing perspectives,

Hogrefe & Huber, Gttingen, Germany, 41-59.

9. Block R.A., Zakay D. (1997) “Prospective and retrospective duration judgments: a

meta-analytic review”, Psychonomic Bulletin and Review, 4, 184-197.

10. Block R.A, D. Zakay, P.A. Hancock (1999) “Developmental changes in human duration judgments: a meta-analytic review”, Developmental Review, 19, 183-211.

11. Brown, S. W. (2008) “Time and attention: Review of the literature”, in S. Grondin

(Ed.), Psychology of time, Bingley, U.K., 111-138.

12. Casey B.J., N. Tottenham, C. Liston, S. Durston (2005) “Imaging the developing

brain: what have we learned about cognitive development?”, Trends in Cognitive

Sciences, 9, 104-110.

13. Chen, K. (2013) “The Effect of Language on Economic Behavior: Evidence from Savings Rates, Health Behaviors, and Retirement Assets”, American Economic Review,

103(2), 690-731.

26

14. Coelho, M., Ferreira J.J., Dias B., Sampaio C., Pavao Martins I., Castro-Caldas A.

(2004) “Assessment of time perception: the effect of aging”, Journal of the International Neuropsychological Society, 10(3), 332-341.

15. Cui, X. (2011) “Hyperbolic discounting emerges from the scalar property of interval

timing”, Frontiers in Integrative Neuroscience, 5(24), 1-2.

16. El Haj M., Moroni C., Samson S., Fasotti L., Allain P. (2013) “Prospective and retrospective time perception are related to mental time travel: evidence from Alzheimer’s

disease”, Brain and Cognition, 83(1), 45-51.

17. Fraisse, P. (1984) “Perception and Estimation of Time”, Annual Review of Psychology, 35, 1-36.

18. Fraley, C., and Raftery, A. (2002) “Model-based clustering, discriminant analysis,

and density estimation”, Journal of the American Statistical Association, 97 (458),

611-631.

19. Fraley, C., and Raftery, A. (2006) “MCLUST version 3: an R package for normal

mixture modeling and model-based clustering”, Mimeo, University of Washington.

20. Frederick, S., G. Loewenstein and T. O’Donoghue (2002) “Time discounting and

time preference: A critical review”, Journal of Economic Literature, 351-401.

21. Green L., J. Myers and P. Ostaszewski (1999) “Discounting of delayed rewards across

the life span: age differences in individual discounting functions”, Behavioural Processes, 46, 89-96.

22. Grondin S. (2001) “From physical time to the first and second moments of psychological time”, Psychological Bulletin, 127(1), 22-44.

23. Grondin S. (2010) “Timing and time perception: a review of recent behavioral and

neuroscience findings and theoretical directions”, Attention, Perception and Psychophysics, 72(3), 561-582.

24. Han, R. and T. Takahashi (2012) “Psychophysics of time perception and valuation

in temporal discounting of gain and loss”, Physica A, 391(24), 6568-6576.

25. Hare T., S. Hakimi, A. Rangel (2014) “Activity in dlPFC and its effective connectivity to vmPFC are associated with temporal discounting”, Frontiers in Neuroscience,

8-15, 50.

27

26. Harrison, G., M.Lau, E. Rutstrom, M. Sullivan (2005) “Eliciting risk and time preferences using field experiments: Some methodological issues”, in G. Harrison, J.

Carpenter, J.A. List (ed.) Field Experiments in Economics, Emerald Group Ltd,

125-218.

27. Kirby, K.N., N.M. Petry, and W.K. Bickel (1999) “Heroin Addicts Have Higher

Discount Rates for Delayed Rewards Than Non-Drug-Using Controls”, Journal of

Experimental Psychology: General, 128(1), 78-87.

28. Laibson, D (1997) “Golden Eggs and Hyperbolic Discounting”, The Quarterly Journal of Economics, 112(2), 443-477.

29. Laibson D. (1998) “Life-cycle consumption and hyperbolic discount functions”, European Economic Review, 42, 861-871.

30. Lewis P. and C. Miall (2006) “Remembering the time: a continuous clock”, TRENDS

in Cognitive Sciences, (10)9, 401-406.

31. Lewis, P. and C. Miall (2009) “The precision of temporal judgement: milliseconds,

many minutes, and beyond”, Philosophical Transactions of the Royal Society, 364,

1897-1905.

32. Löckenhoff C.E., O’Donoghue T., Dunning D. (2011) “Age differences in temporal

discounting: the role of dispositional affect and anticipated emotions”, Psychology

and Aging, 26(2), 274-284.

33. Loewenstein, G. and D. Prelec (1992) “Anomalies in Intertemporal Choice: Evidence

and an Interpretation”, The Quarterly Journal of Economics, 107(2), 573-597.

34. Lorraine, A. (1979) “The perception of time”, Perception and Psychophisics, 26 (5),

340-354.

35. Luce, R.D. (2002) “A psychophysical theory of intensity proportions, joint presentations, and matches”, Psychological Review, 109 (3): 520-532.

36. Macar F. (1996) “Temporal judgments on intervals containing stimuli of varying

quantity, complexity and periodicity”, Acta Psychologica, 92, 297-308.

37. Nichelli P. (1996) “Time perception measurements in neuropsychology”, in M. Pastor, J. Artieda Advances in Psychology: Time, Internal Clocks and Movement, Elsevier Amsterdam, 187?204.

28

38. Phelps, E and A. Pollak (1968) “On Second-Best National Saving and Game-Equilibrium

Growth”, The Review of Economic Studies, 35(2), 185-199.

39. Raven, J., Raven, J.C., and Court, J.H. (1998) Manual for Raven’s progressive matrices and vocabulary scales.

40. Ray, D. and P. Bossaerts (2011) “Positive temporal dependence of the biological

clock implies hyperbolic discounting”, Frontiers in Neuroscience 5(2), 1-5.

41. Raz, N., Lindenberger, U., Rodrigue, K. M., Kennedy, K. M., Head, D., Williamson,

A., Dahle, C., Gerstorf, D., and Acker, J. D. (2005) “Regional Brain Changes in Aging Healthy Adults: General Trends, Individual Differences and Modifiers”, Cerebral

Cortex, 15(11), 1676-1689.

42. Stevens, S.S. (1957) “On the psychophysical law”, Psychological Review, 64(3): 153181.

43. Stevens, S.S. (1975) Psychophysics: introduction to its perceptual, neural, and social

prospects, Transaction Publishers.

44. Zakay D. and R.A. Block (2004) “Prospective and retrospective duration judgments:

An executive-control perspective”, Acta Neurobiologiae Experimentalis, 64, 319-328.

45. Zakay D, and E. Fallach (1984) “Immediate and remote time estimation - a comparison”, Acta Psychologica 57, 69-81.

46. Zauberman, G., K. Kim, S. Maldoc and J. Bettman (2009) “Discounting time and

time discounting: Subjective time perception and intertemporal preferences”, Journal of Marketing Research 46 (4), 543-556.

29

Appendix

Appendix A1. Time discounting tasks

Sheet2

Set

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

!

t

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

k

21

21

21

21

21

42

42

42

42

42

63

63

63

63

63

v(t)

$1.484

$1.438

$1.339

$1.236

$1.532

$1.484

$1.438

$1.339

$1.236

$1.532

$1.482

$1.326

$1.159

$0.981

$1.517

v(t+k)

$1.532

$1.532

$1.532

$1.532

$1.752

$1.532

$1.532

$1.532

$1.532

$1.752

$1.532