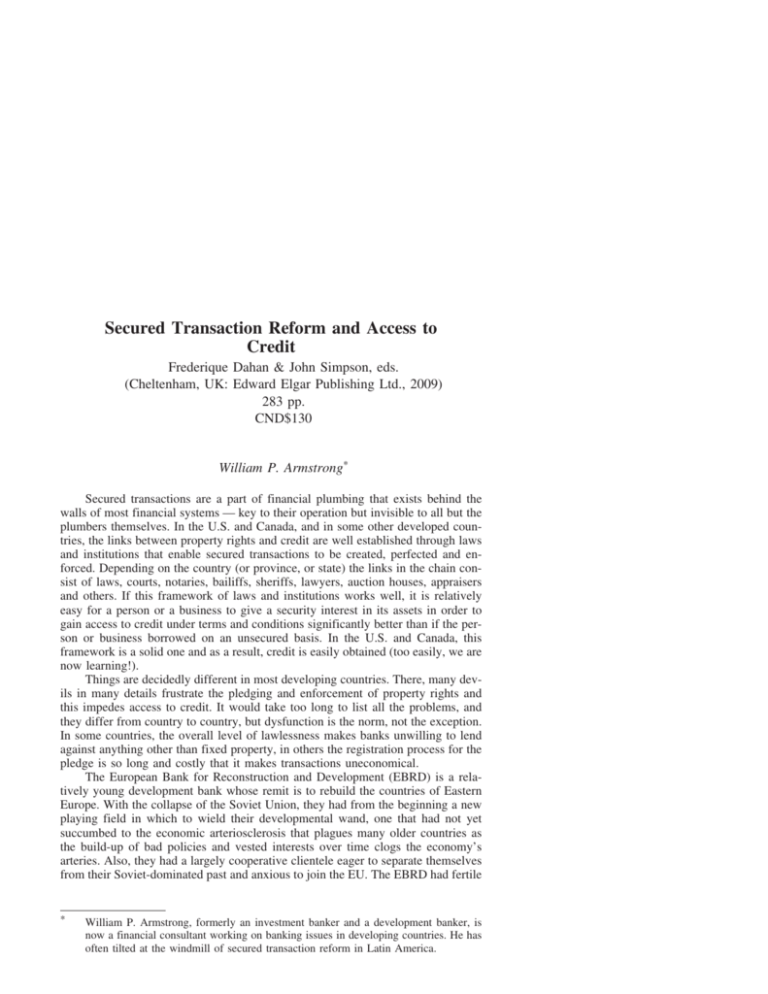

Secured Transaction Reform and Access to Credit

advertisement

Secured Transaction Reform and Access to Credit Frederique Dahan & John Simpson, eds. (Cheltenham, UK: Edward Elgar Publishing Ltd., 2009) 283 pp. CND$130 William P. Armstrong* Secured transactions are a part of financial plumbing that exists behind the walls of most financial systems — key to their operation but invisible to all but the plumbers themselves. In the U.S. and Canada, and in some other developed countries, the links between property rights and credit are well established through laws and institutions that enable secured transactions to be created, perfected and enforced. Depending on the country (or province, or state) the links in the chain consist of laws, courts, notaries, bailiffs, sheriffs, lawyers, auction houses, appraisers and others. If this framework of laws and institutions works well, it is relatively easy for a person or a business to give a security interest in its assets in order to gain access to credit under terms and conditions significantly better than if the person or business borrowed on an unsecured basis. In the U.S. and Canada, this framework is a solid one and as a result, credit is easily obtained (too easily, we are now learning!). Things are decidedly different in most developing countries. There, many devils in many details frustrate the pledging and enforcement of property rights and this impedes access to credit. It would take too long to list all the problems, and they differ from country to country, but dysfunction is the norm, not the exception. In some countries, the overall level of lawlessness makes banks unwilling to lend against anything other than fixed property, in others the registration process for the pledge is so long and costly that it makes transactions uneconomical. The European Bank for Reconstruction and Development (EBRD) is a relatively young development bank whose remit is to rebuild the countries of Eastern Europe. With the collapse of the Soviet Union, they had from the beginning a new playing field in which to wield their developmental wand, one that had not yet succumbed to the economic arteriosclerosis that plagues many older countries as the build-up of bad policies and vested interests over time clogs the economy’s arteries. Also, they had a largely cooperative clientele eager to separate themselves from their Soviet-dominated past and anxious to join the EU. The EBRD had fertile * William P. Armstrong, formerly an investment banker and a development banker, is now a financial consultant working on banking issues in developing countries. He has often tilted at the windmill of secured transaction reform in Latin America. 566 BANKING & FINANCE LAW REVIEW [25 B.F.L.R.] fields to plow and some of their best plowing was, and is, being done in the field of secured transactions reform. Leading the charge at the EBRD are Frederique Duhan, Senior Counsel, and John Simpson, Secured Transactions Project Leader. Working with other developmental organizations like the World Bank, they brought together experts in the field who broke new ground in the economics and law of property rights and developed a very useful body of knowledge about what does and does not work, and about how to pull off successful reforms in the area. Duhan and Simpson have co-edited Secured Transaction Reform and Access to Credit, a book that is a collection of articles presented at an international workshop on the theme held in London in 2006. These articles reflect the thinking of many of the leading experts in the field. In most cases, these experts were the same people who designed and helped to implement the innovative reforms that have been successful in some of the counties of Eastern Europe, so they bring a practical as well as theoretical knowledge. While the focus is on the Eastern European experience, their book includes useful information about the efforts of other countries, notably Latin American countries, that have shown an inexplicable and almost uniform hostility to the reforms that have proven to be so useful elsewhere. Some of the articles in the book are on the economic aspects of secured transactions, and others deal with legal aspects. The economic articles, by and large, develop the connection between the quality of the legal and institutional arrangements for property rights and economic growth. While it may sound somewhat obvious that a causal relationship should exist between how well property rights are defined and how easily secured transactions work, on the one hand, and economic development on the other, it had been difficult to prove until Florencio Lopez-deSilanes, a professor at the National Bureau of Economic Research and the author of the book’s first article, and others developed clever methods to deconstruct and test some of the elements of secured transactions law and institutions and observe their effects on economic growth. The results of their efforts proved the link between good frameworks for secured transactions and economic growth and provided a substantial boost to the efforts of reformists. Before, reforms like the ones that the EBRD has spearheaded could not get to first base. No minister would spend his or her political capital on launching esoteric changes to the heart of the country’s legal system without being able to convince themselves and their counterparts in other ministries that an economic payoff was likely to result. Heywood Fleisig, Director of Research at the Center for the Economic Analysis of Law (CEAL) another noted economist in the field, has contributed an article that illuminates a number of important points, starting with showing that a loan that is secured by a movable or immovable asset is far less expensive for the borrower, and that the borrower can raise a much larger loan for a longer term if he/she is able to pledge an asset. Fixed assets work better than movable assets in improving lending terms, since they cannot disappear or spoil. However, many kinds of movable assets can and are used to gain access to credit, such as accounts receivable, negotiable securities, inventory, cattle in the field and royalties. Mr. Fleisig goes on to describe important aspects of the process of building reforms in the area and notes with frustration that in spite of the fact that these reforms are largely a win/win situation for almost all the constituencies involved, they are seldom made. BOOK REVIEW 567 Martin Holtmann of the International Finance Corporation shares some useful information about the use of secured transactions to promote microcredit. In general, it is difficult and expensive to seize low value assets from poor people and, as a result, the microfinance industry is largely based on credit management technologies that do not involve collateral. However, exceptions to this general rule exist and some microlenders have improved the performance of their loans by taking collateral in innovative ways. Several articles in the book are very good at describing the elements of a good reform program and how to pull off a successful reform. In fact, the EBRD has developed a set of core principles that the legal and institutional framework should exhibit in order for secured lending to work well. These principles are set out in the article by Dahan and Simpson. Katerina Mathernova, Deputy Director of the European Commission, provides an article on the Slovakian reform program that serves as an excellent checklist for reform. Her article emphasizes the importance of having a willing patient and developing a consensus among the constituencies concerning what needs to be done. The article leaves one with the impression that such reforms are only possible when a unifying force (like the desire to modernize an economy in order to join the EU) exists. Slovakia was a very good patient indeed and it won the World Bank’s Doing Business award for the most reformed country in 2005. Diana Lupulescu, the Director of the Chamber of Commerce of Romania, contributed an article on the Romanian electronic archive for pledges on movable assets that contains a very good description of how these important institutions are intended to function. She is in a position to know. She was a champion of the secured transactions reform in her country. Romania has more secured transactions filings (measured in proportion to population or GDP) than any other country, and the access to credit that these measures have supported have, in turn, supported strong economic growth. Near the end of the book is a very good but decidedly disheartening article by Nuria de la Pena, Director of Legal Operations for CEAL. She writes on the many efforts that have been made and continue to be made to reform the regimes for secured transactions in Latin American countries. In spite of these efforts, it is almost impossible to think of a success story in Latin America. Ms. de la Pena’s frustration is evident as she tells us where the bodies are buried, how legal conservatives in Nicaragua refused to acknowledge that creating security interests on future flows could be made consistent with a Civil-Code-based legal system; or how notaries of Bolivia stifled reform, since it would relax the monopoly they enjoyed in the business of preparing simple mortgage documents. Her article is also an excellent checklist of the problems that can frustrate secured transaction reform. After the book was published Guatemala finally undertook a reform of secured transactions that CEAL and this reviewer had worked on over the years. Regrettably, the reform elements that were contained in draft legislation calling for an automated filing system and for expedited enforcement in the event of default were watered down significantly. Time will tell if Guatemala can overcome these deficiencies and make their system work, but it has gotten off to an inauspicious start. The book is unique and quite useful. It brings together articles on the economics and the law of property rights, and combines these with case studies, observations of what works and what does not, and a checklist of things to watch for. 568 BANKING & FINANCE LAW REVIEW [25 B.F.L.R.] Nonetheless, it falls a bit short — it could have been a contender with a little more attention to detail. Mr. Lopez-de-Silanes’ article is overly long, written in high econospeak, and several key charts have missing column headings, which render them inscrutable. Some articles seem to be filler — one article is not even about secured transactions. And the book is littered with distracting and unnecessary footnotes, often of the author conveniently citing other articles he has written. Also, the book could have usefully included some explanation about key problem areas of secured transactions reform that confound many practitioners, such as why registering property ownership is fundamentally different that registering a security interest and the problems that Civil-Code-based legal systems present for reform. With the addition of some explanation of the main problem areas, the book could nearly have become a textbook for reform. As it is, such a textbook is still to be written. Finally, this reviewer wishes to register his strong objection to invoking asymmetrical information as the reason lenders require collateral. This notion has been handed down over the years from footnote to footnote and is now a defect firmly coded in the DNA of the field. It is difficult to find an article about collateral that does not refer to this. When two parties enter into a contract, in our case a loan contract, the borrower knows more about whether he is actually going to pay or not than the lender does, or so the theory goes. To compensate for this asymmetry of knowledge, the bank requires the borrower to post collateral to guaranty that he/she is not hiding some material facts or lying about their intention to repay. Alas, it is just plain wrong as a general theory, (though it may be present in very specific and not very important circumstances). With the experience of thousands of borrowers to compare and analyze, banks are not exactly innocents in this game and actually have a better idea of whether the borrower will be able to repay than the borrower herself. Thus, there is no such asymmetry, at least none of the kind that the literature is imagining. Furthermore, even if both borrower and lender had exactly the same information, banks would still require collateral, since the purpose of collateral is to protect against the natural rhythms of business, where some businesses succeed and others fail, and not, as the theory of asymmetrical information would tell us, to protect against information that the borrower has not shared with the lender. Collateral is required in order to provide the lender with some insurance against the basic uncertainty of the future, not against being taken advantage of by an unscrupulous borrower. The academic record on this point should be corrected. Apart from these distractions, it is fair to say that this is a very useful book that should appeal to reformers working in the field, whether they are governmental officials trying to modernize their economies, or economists and lawyers working in developmental agencies. It covers the issues in secured transactions fairly well and there are few other books or publications that bring together the views of experts working in this important, albeit somewhat neglected, area of financial sector plumbing.