Neil Katkov, PhD

Trends in Anti-Money Laundering 2011

July 2011

This authorized reprint contains the full content of the Celent report

Trends in Anti-Money Laundering 2011. This report was not sponsored by

Fiserv in any way. This reprint was prepared specifically for Fiserv, but

the analysis has not been changed from the analysis presented in the

original report. For more information on Celent’s services, please contact

Celent at info@celent.com or +1.617.262.3120.

Content

3

4

5

5

6

7

9

11

12

15

15

17

19

20

23

26

27

28

30

31

32

32

33

34

34

36

37

39

39

39

40

Executive Summary

Introduction

AML Trends: The View from the Cockpit

AML Drivers

AML Operations: A Scale Game

AML Compliance Costs

AML Spending Trends

AML Compliance Cost by Function

Technology Sourcing Trends

Global Spending on AML Compliance

AML Technology Spending

AML Software Spending

AML Software Vendors

Market Consolidation

Evolution in AML Technology

Enterprisewide Compliance

Integrating Anti-Fraud and AML: The Holy Grail

The Case for Enterprisewide Compliance

Centralized Case Management as a First Step to Enterprisewide

Compliance

Internal Fraud

Expansion of AML Markets

Small Banking

Insurance AML

Nonbank Financial Services

Regional Markets

AML by ASP

Conclusions

Leveraging Celent’s Expertise

Support for Financial Institutions

Support for Vendors

Related Celent Research

Executive Summary

This report incorporates the results of an exclusive Celent survey of

anti-money laundering compliance departments at more than 75

financial institutions globally. The report benchmarks AML operations

and costs, and analyzes trends in AML technology, including Celent’s

estimates of global spending on AML software, vendor consolidation,

and advances / product enhancements in AML technology. The report

also examines the emerging trend towards enterprisewide compliance,

in terms of consolidation of siloed AML operations and technology, as

well as integration of AML and anti-fraud.

This is the first in a series of four reports covering the current state of

the AML technology market. The other reports in the series are:

Evaluating the Enterprisewide Compliance Vendors 2011: Solutions

for Anti-Money Laundering and Anti-Fraud, which profiles more

than 20 providers of end-to-end AML/fraud solutions, and

assesses them using Celent’s ABCD evaluation model.

Evaluating the Vendors of Watchlist and Sanctions Solutions,

which profiles providers of both batch-based and real time

OFAC/sanctions watchlist solutions and assesses them using

Celent’s ABCD evaluation model.

Specialist Providers of Anti-Money Laundering Technology pres-

ents an overview of advanced technology issues in AML and

provides profiles of a variety of specialist vendors. Because

these firms are working in different areas, an ABCD evaluation is not provided.

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

3

Introduction

Ten years after 9/11, the compliance regime surrounding anti-money

laundering (AML) continues to evolve and expand, inexorably and

across multiple dimensions. With each passing year, AML compliance

covers ever more geographies, industry segments, and processes. In

order to fulfill the increasing requirements, financial firms continue to

grow and refine their compliance operations, often on a global scale. In

turn, to fulfill the requirements of financial firms and compete in a

crowded marketplace, the providers of AML software continue to

enhance their technology. And then somewhere a new regulation is

imposed, triggering another round of development.

Celent estimates that 2011 spending on AML compliance, including

operations and technology, will reach US$5.0 billion globally. Operations accounts for US$3.8 billion. Technology, including internal and

external IT spending, makes up the other US$1.2 billion. Of the technology spending, packaged AML software will reach US$458 million in

2011. Celent projects that the overall AML compliance burden will

expand at a rate of 7.8% annually, reaching a global total of US$5.8 billion in 2013. Global spending on AML software will expand at a rate of

10.4% annually, to US$557 million in 2013.

Such staggering sums imply that AML compliance is a complex domain

with numerous subsections, each of which generates its own substantial costs. This report is intended as a guide to the AML compliance

industry today, including emerging trends Celent has identified that

we believe will be central to AML compliance in future.

The first section presents the results of a Celent survey of more than 75

financial firms globally. The survey presents the views of compliance

officers on spending trends and captures benchmarking data for small,

medium, and large firms.

The remainder of the report examines global spending on AML operations and technology, the maturation of the AML vendor marketplace,

evolution and improvements in AML software, and AML compliance

across industries and geographies. Finally, we look at emerging trends

that will shape the future of AML compliance, including integrating

AML and anti-fraud to achieve enterprisewide compliance, and AML

outsourcing, including BPO, ASP, and SaaS approaches.

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

4

AML Trends: The View from the

Cockpit

Nearly ten years after 9/11, AML compliance continues to evolve, due to

increasing regulatory demands on the one hand and developing organization and technology best practices by financial institutions on the

other. As a result, the cost of running an AML compliance program

continues to rise. Faced with increasing pressures in terms of both

compliance and costs, financial institutions are seeking efficiencies in

operations and technology. This need to achieve greater efficiencies is

driving a trend towards centralization and standardization of AML

operations, as well as integration of AML and anti-fraud programs.

In a nutshell, this is the picture provided by a recent Celent survey of

AML compliance in the financial services industry. In this section we

present highlights of this survey, which polled more than 75 financial

institutions of all sizes globally.

AML compliance is having profound effects on the culture, organization, and technology of banking. The importance being placed on AML

compliance is ever increasing. As a result, AML operations are more

complex, and technology plays a bigger role than five years ago.

Moreover, the influence of AML compliance on financial institutions

often goes beyond operations and technology to the core of a firm. This

was expressed well by the compliance officer of a US community bank

which, when asked to characterize how AML compliance has changed

over the past five years, said, “There has been a cultural change in the

banking industry. Before we were focusing more on the customer, now

we have to focus more on compliance.”

AML Drivers

AML compliance is usually thought of as a cost center, an ineluctable

obligation imposed by the regulator. But there are other reasons for

implementing a solid AML program, which touch on the business side

as well as the regulatory. Foremost among these is reputational risk.

Revelations of a financial firm abetting money laundering or terrorist

funding, or simply a black mark on compliance from regulators, may

drive current and potential customers away and result in loss of business. Strong AML compliance can also improve business results. For

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

5

example, an AML officer at a prominent bank in Asia cited a link

between rigorous compliance and investor confidence in the bank, as

reflected in its share price.

Most respondents to our survey (42%) cited regulatory requirements as

the main driver for AML compliance. However, a substantial segment

(25%) named reputational risk and protecting the brand as the primary

purpose of their AML efforts. In practice, these drivers are inter-dependent. In qualitative interviews accompanying the statistical survey, a

number of firms saw the key drivers of AML compliance as interlinked.

Regulatory compliance creates a need to guard against reputational

risk, which improves business results by, for example, potentially

increasing shareholder value.

Figure 1: AML Compliance Drivers

What is the m ain driver for AML c om plianc e at

your firm ?

Regulatory

c omplianc e

42%

Other

25%

Improv e

bus ines s

res ults

8%

Reputational

ris k/protec t

the brand

25%

Source: Source: Celent AML compliance survey

AML Operations: A Scale Game

AML is a scale business. While there is some variation among firms,

the size and cost of AML compliance departments follow fairly predictable patterns according to the size of the financial institution. The size

of AML compliance departments is fairly constant among bank tiers,

but especially represent a burden at the larger firms. Celent’s survey

results indicate that small banks of less than US$1 billion in assets typically have ten or fewer full time equivalent (FTE) staff engaged in AML

compliance related tasks. Medium-sized institutions have to deal with

AML across several lines of business lines, which increases the size of

the total AML operation. Banks with US$1 billion to US$100 billion in

6

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

assets will typically range from 15 to 50 FTEs working on AML compliance. Banks over US$100 billion in assets may have 50 to 200 AML staff,

in rough scale to the bank’s size (see Figure 2 on page 7).

Figure 2: Typical AML Compliance FTEs by Size of Firm

AML c om plianc e organization by s ize of firm

~500

100

No. of Staff

80

60

40

20

0

<US $1bn

as s ets

US $1 - 10 bn US $10 - 100 >US $100 bn

as s ets

bn as s ets

as s ets

L arge

multinational

Source: Celent AML compliance survey

Compliance departments at insurance companies follow a similar pattern. Brokerages and asset managers tend to have smaller compliance

staff relative to the size of the business.

The outlier to the scale rule is large multinational banks operating in

dozens of countries. These firms tend to be universal banks with

numerous lines of business including retail and wholesale banking,

brokerage and asset management and possibly insurance. In addition

they maintain on-the-ground AML staff in each country, as well as

large AML operational and IT platforms. AML compliance personnel at

such firms can exceed 500 or even 700 staff, distributed amongst a variety of LoBs and regions.

AML Compliance Costs

Turning our attention to the cost of AML compliance, it is fair to say

that AML is a burden at any institution. However, Celent’s survey

results indicate that the cost burden is disproportionately heavy at the

smallest banks. Like the size of AML compliance operations, costs are

also generally predictable according to the size of the institution. AML

compliance costs, including personnel and technology, range from several US$100,000s at small banks, to tens of millions of dollars at large

institutions (see Figure 3 on page 8).

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

7

Figure 3: Typical AML Compliance Costs by Size of Firm

AML c om plianc e c os t, by s ize of firm

20

US$ mn

15

10

5

0

<US $1bn

as s ets

US $1 - 10 bn US $10 - 100

as s ets

bn as s ets

>US $100 bn

as s ets

Source: Celent AML compliance survey

If we look at the relative burden of AML compliance costs to a financial

institution, as measured by proportion of AML costs to total assets, we

find that the cost burden is a fairly consistent 0.005% to 0.01% at

medium to large size banks (assets over US$1 billion). Small banks

carry a disproportionate compliance burden compared to the other

tiers, with AML costs averaging 0.4% of assets, or 40 to 80 times greater

as a proportion of assets than at medium and large firms (see Figure 4

on page 8).

Figure 4: Relative cost of AML Compliance by Bank Tier

AML c om plianc e c os ts as % of as s ets

1.0%

0.8%

0.6%

0.4%

0.2%

0.0%

<US $1bn

as s ets

US $1 - 10 bn

as s ets

US $10 - 100

bn as s ets

>US $100 bn

as s ets

Source: Celent AML compliance survey

8

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

AML Spending Trends

The results of our survey show, not surprisingly, that financial institutions expect AML compliance costs to continue to increase (see Figure

5 on page 9).

Figure 5: AML Spending Trends

Will AML c os ts inc reas e or dec reas e over the

next 12 m onths ?

11 - 20%

inc reas e

26%

5 - 10%

inc reas e

32%

>50%

dec reas e

11%

5 - 10%

dec reas e

5%

No c hange

26%

Source: Celent AML compliance survey

A majority of respondents, 58%, expected that AML compliance costs,

including both personnel and technology costs, will increase by at least

5% over the next 12 month period. About half of these (26% of the total

pool) see spending increasing by at least 10%. Respondents indicated

that the greatest driver for the increase is new regulatory demands for

additional processes and technology, such as implementation of riskbased scoring or identification of an account’s ultimate beneficial

owner (UBO) during the customer due diligence process.

On the other hand, medium or large banks that have recently completed substantial technology initiatives expect overall AML costs to

fall dramatically, for the simple reason that costs were high during the

implementation phase. Running costs for installed software can be

only a fraction of the purchase and implementation costs. For these

and other reasons, 11% of respondents expected AML costs to drop by

50% or more.

At the same time, a substantial portion, about one-fourth of respondents, saw spending as remaining flat. The reason for this differed by

tier:

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

9

Small banks in the US have recently fallen under the scrutiny

of regulators, and so have had to ramp up their AML efforts,

putting in place new technology and hiring additional staff.

With this new compliance set-up in place, such banks project

their current AML operations will be sufficient to handle any

increased regulatory demands in the short term. For small

institutions that have recently installed new AML software,

because implementation costs at small banks tend to be low,

overall costs are expected to hold steady, rather than dip at

the larger firms that have recently implemented new

technology.

Large banks, particularly multinational banks, see increased

regulatory needs driving up costs on the one hand, and standardization and realization of efficiencies reducing costs on

the other, with these forces balancing one another.

Standardization of Processes to Keep AML Costs in

Check

Some explanation will help put this balancing act at large multinationals in context. Large firms are continually seeking to refine processes,

realize efficiencies, and reduce compliance risk. At large multinational

banks, the processes and technology of AML compliance are being

affected by the globalization of AML regulation. For large multi-nationals operating in many countries, technology is becoming an

increasingly global setup. This is driving a need to standardize processes across regions, subsuming country-specific regulations and

regulators where possible. At the same time, such banks are applying

more technology to processes, including processes that were largely

manual, such as customer due diligence As a compliance officer at one

large multinational bank put it, “The focus is now more on standardization and automation, while before it was on mere regulatory

compliance.” While these banks can not, at least not yet, hope for compliance costs to fall, they are attempting to hold them in check through

standardization and automation of processes.

10

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

AML Compliance Cost by Function

Celent also asked firms regarding the breakdown of their AML costs in

terms of operations and technology (see Figure 6 on page 11). Operational costs (essentially personnel costs) involved in training, customer

due diligence, and ongoing monitoring, analysis and reporting make

up 77% of AML compliance costs on average.

Figure 6: AML Compliance Costs: Operations and Technology

Breakdown of AML c om plianc e c os ts

CDD

ac c ount

onboarding

16%

Tec hnology

23%

Ongoing

trans ac tion

monitoring

47%

Training

14%

Source: Celent AML compliance survey

Ongoing AML monitoring / analysis and associated reporting account

for close to half of AML compliance costs, with customer due diligence

at account onboarding and training together accounting for 30% of

costs. Technology, including both internal and external spending, is an

average 23% of AML costs at the institutions surveyed.

AML Functional Cost Breakdown by Tier

Some important differences emerge from the functional breakdown

when analyzed by the size of the financial institution (Figure 7 on page

12). Ongoing monitoring and analysis make up the greatest proportion

across all tiers, but are particularly high (60% of AML costs) at medium

sized banks. Celent believes this is due primarily to the high retail

transaction volumes typical of firms of this size, which operate in one

major home market.

At the same time, customer due diligence at small to medium sized

banks is 15% or less of AML costs, but a much larger proportion (24%) at

large institutions. The greater weight of spending on CDD at larger

institutions can be attributed to the considerable business they do in

high-value accounts, both wealth management on the retail side, and

corporate accounts.

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

11

The proportion of AML spending directed to technology also varies

widely among tiers. IT makes up a fairly small proportion of total AML

costs at banks with over US$10 billion in assets (10% to 16%). This is

due both to the economy of scale created by automating the monitoring process, and to the fact that analysis of generated alerts is still a

very manual (although technology assisted) process. IT is a larger proportion of AML costs (28% to 37%) at institutions under US$10 billion in

assets, again relative to the fairly small analyst teams needed at firms

of this size.

Figure 7: AML Compliance Cost Breakdown by Tier

AML c om plianc e c os t breakdown by s ize of firm

100%

80%

60%

10%

28%

37%

15%

16%

14%

15%

17%

24%

12%

15%

12%

41%

39%

<US $1bn

as s ets

US $1 - 10 bn

as s ets

40%

60%

20%

46%

0%

Ongoing trans ac tion monitoring

Training

US $10 - 100

bn as s ets

>US $100 bn

as s ets

CDD ac c ount onboarding

Tec hnology

Source: Celent AML compliance survey

Interestingly, the proportion of AML costs attributed to training is fairly

consistent among all tiers, ranging from 12% to 17%.

Technology Sourcing Trends

Celent’s survey results indicate that financial institutions are continuing to actively acquire new AML software (Figure 8 on page 13). Over

half of survey respondents installed new AML software within the last

two years. This suggests that the combination of regulatory pressure,

evolving AML technology, and accumulating bank expertise in AML

compliance operations have been driving purchases of new technology

in recent years.

Moreover, this purchase cycle has not run its course, as institutions

with aging technology will seek to replace it in response to regulatory

and operational pressures. Nearly one-quarter of respondents stated

their AML systems were over five years old; such firms will have a need

to replace them in the near future. Interviews with institutions also

12

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

revealed that some firms will replace an AML system if it is not

enabling them to meet their compliance obligations. As a result, some

of the 23% of firms whose software is three to five years old can also be

expected to make new purchases.

Figure 8: AML Technology Replacement Trends

z

Age of AML s oftware

<1 y ear

23%

>5 y ears

23%

1 - 2 y ears

31%

3 - 5 y ears

23%

Source: Celent AML compliance survey

In terms of deployment, a full 90% of survey respondents indicated

they are running their AML software inhouse (see Figure 9 on page 13).

Clearly it will take some time for firms and regulators in some jurisdictions to overcome their concerns over relying on external providers for

AML compliance. At the same time, the 10% of firms that do use ASPbased AML systems reflects the emerging trend to outsourcing of AML

technology and operations.

Figure 9: AML Technology Deployment Trends

AML tec hnology deploym ent

In-hous e

90%

AS P

10%

Source: Celent AML compliance survey

Nearly any institution, regardless of size, uses several providers to

cover all their AML compliance needs. Recent years, though, have seen

a trend to rationalizing technology suppliers for increased efficiency,

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

13

standardization and, potentially, lower cost. Even large institutions,

which may have dozens of AML solutions scattered among the different silos and regions of the enterprise, are using AML suites where it

makes sense.

This means more firms are using one vendor for the entire suite of

AML functionality: CDD, ongoing transaction monitoring, watchlist filtering, case management and reporting. Indeed, 40% of survey

respondents indicated they have or are intending to go the AML suite

route in terms of technology sourcing (Figure 10 on page 14). At larger

firms, this is due to the efforts to standardize and centralize operations

and technology. For smaller firms, the choice of an AML suite is made

simpler due to the availability of affordable yet highly functional software packages targeted at this tier.

Figure 10: AML Vendor Sourcing Trends

Tec hnology s ourc ing: vendor s trategy

Bes t-ofbreed/multiv endor

60%

AML s uite

40%

Source: Celent AML compliance survey

14

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

Global Spending on AML

Compliance

Depending on where one sits in the compliance value chain, the cycle

of ever more stringent regulatory demands generating a need for ever

more efficient AML operations may appear virtuous or vicious. Whichever view you take, the scale of the AML compliance “industry” is

impressive. Celent estimates that spending on AML compliance,

including operations and technology, will reach US$5.0 billion globally

in 2011 (see Figure 11 on page 15). Operations—training, analysis and

reporting—accounts for about three-quarters of the total, or US$3.8 billion. Technology, including internal and external IT spending, makes

up the other US$1.2 billion. Celent projects that global AML compliance

spending will increase at a compounded annual growth rate (CAGR) of

7.8% annually, to reach US$5.8 billion in 2013, with operations accounting for US$4.4 billion of the total and technology US$1.4 billion.

Figure 11: Global AML Compliance Spending

Global AML c om plianc e s pending

5,830

6,000

USD mn

5,000

4,000

5,406

4,648

5,013

4,310

991

1,069

1,203

1,297

1,399

3,000

2,000

3,319

3,579

3,810

4,109

4,431

2009

2010

2011

2012

2013

1,000

0

Operations

Tec hnology

Source: Celent

AML Technology Spending

AML technology spending is dominated by vendor-provided software,

as well as by internal spending by financial institutions (see Figure 12

on page 16). Celent estimates that of the US$1.2 billion spent on AML

technology in 2011, internal spending will account for US$371 million,

or 31%, while vendor solutions will make up USS458 million, or 38% of

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

15

the total. In addition to the software itself, Celent includes vendor- provided professional services—which may reach 40% of an AML software

vendor’s revenues—in our external software spend estimates.

The high proportion of spending on these two areas is due to the

increasing complexity and specialization of the software, as well as the

onerous data management, customization / configuration and fine

tuning often needed to meet an institution’s specific needs and produce optimal results.

As a result, a relatively smaller proportion of AML IT spending goes to

other external services (16%) and hardware (15%).

Figure 12: Global AML technology spending breakdown

Global AML tec hnology s pending

1400

1200

USD mn

1000

800

183

150

157

600

400

200

165

191

202

211

223

233

173

458

504

557

318

371

381

386

2010

2011

2012

2013

375

413

309

2009

0

Internal S pending

Ex ternal S erv ic es

Ex ternal S oftw are

Hardw are

Source: Celent

16

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

AML Software Spending

Focusing on the external software segment, global spending on packaged software and associated services provided by AML software

vendors is projected to expand from US$458 million in 2011 to US$557

million in 2013, for a CAGR of 10.4% (see Figure 13 on page 17).

Figure 13: AML software spending by region

Global AML s oftware s pending

600

CAGR = 10.4%

500

USD mn

400

300

200

100

92

117

148

166

195

171

184

150

166

178

2011

2012

2013

145

152

160

138

144

2009

2010

0

Americ as

EMEA

As ia

Source: Celent

The AML software market in the Americas, which was characterized by

flat growth from 2009 to 2011 due to the maturity of the market as well

as spending contraction following the financial crisis, is undergoing a

striking rebound. Celent projects that AML software spending in the

Americas will grow from US$150 million in 2011 to US$178 million in

2013, for a healthy CAGR of 8.9% over this period.

Specific requirements from regulators, such as customer due diligence

/ risk scoring at customer onboarding and Fincen’s proposed cross-border electronic funds transfer reporting rule, are one important driver.

Another factor driving the spending growth is the broadening of regulatory scrutiny to new segments such as small banks / credit unions,

insurers and brokerages. Previously, many institutions including small

banks handled AML requirements through manual processes, or

evaded them altogether. On the other hand, large insurers built

focused, lean solutions inhouse. This constrained growth in spending

on AML software. However regulators are increasingly putting pressure

on these industry segments to implement industry standard technology. Finally, the trend to integration of anti-money laundering and antifraud operations onto a common platform, the enterprisewide compliance approach, is gathering steam, with a significant number of

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

17

financial institutions adding new anti-fraud modules to existing AML

platforms, or replacing legacy systems with software capable of supporting both AML and anti-fraud.

Looking at other regions, we see that the fastest growth in AML software spending will be found in Asia. Celent projects that AML software

spending by financial institutions in Asia will expand from US$148 million in 2011 to US$195 million in 2013, a growth rate of 14.8% annually.

Continuing the pattern of the past five years, this growth will be driven

by the gradual adoption of more stringent AML regulation in scattered

countries around the region, rather than a coordinated regionwide

wave of regulation. The gradual trend to AML compliance in the region

will ensure the healthy, long-term growth of the AML software market

in this region.

Spending on AML software in Europe has also maintained steady,

though more modest, growth. The original adoption of the Third EU

Money Laundering Directive has been followed by subsequent regulation like the UBO requirement, country specific initiatives such as in

the UK, and the gradual adoption of AML regulation in Eastern and

Central Europe. As a result, Celent sees AML software spending in

Europe expanding from US$160 million in 2011 to US$184 million in

2013, a CAGR of 7.2% (and following upon a 5.1% growth rate from 2009

to 2011).

18

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

AML Software Vendors

Anti-money laundering software comprises several distinct functional

areas: transaction monitoring, watchlist screening (including real time

screening of wires), customer due diligence (CDD), case management,

and reporting.

Increasingly, AML vendors are expanding their product lines

to include most or all of this functionality in an end-to-end

solution, or AML suites.

A smaller segment of vendors concentrates on watchlist

screening, either in batch mode for screening of transactions

and customer lists, or in real time for screening and sanctioning of outgoing wires or other payments.

The need for ever more effective technology has given rise to

an interesting ecosystem of specialist vendors focusing on

various intractable problems in AML compliance, such as foreign names transliteration, watchlist filtering optimization,

case management, and media screening.

The AML software market is crowded, with numerous vendors entering

and leaving the market each year. Among this crowded pool, Celent

has identified a number of vendors which might reasonably be

included in a financial institution’s software selection process (see

Table 1 on page 20). Celent’s list includes both market dominant vendors, as well as smaller niche providers, regional vendors, and vendors

catering to the needs of smaller financial institutions. Many of these

vendors will be featured in our three upcoming AML vendor reports,

Evaluating the Enterprisewide Compliance Vendors 2011: Solutions for AntiMoney Laundering and Anti-Fraud, Evaluating the Vendors of Watchlist and

Sanctions Solutions, and Specialist Providers of Anti-Money Laundering

Technology.

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

19

Table 1: Selected AML software vendors: A virtual long list

AML Suites

Watchlist Specialists

Specialist

Technologies

3i Infotech

Ocean Systems

Accuity

AML RighSource

ACI Worldwide

Oracle / Mantas

Attus Technology

Basis Technology

Aquilan

SAS

Fircosoft

Intersoft KK

BAE / Detica Norkom

SunGard

Innovative Systems

KYC360

Cellent Finance Solutions

TCS

Lexis Nexis / Bridger

KYCNet

EastNets

Temenos / Viveo

Logica

NetBreeze

Experian

Thomson Reuters /

Northland Solutions

Oracle / Datanomic

Pegasystems

FIS

Tonbeller

Thomson Reuters /

Complinet

Safe Banking Systems

Fiserv

Top Systems

Infrasoft

Verafin

Jack Henry

Wolters Kluwer

Truth Technologies

Nice / Actimize

Source: Celent

Market Consolidation

AML is a necessary business, but not necessarily a hugely profitable

one. As described above, high-profile institutions are spending substantial sums on AML, both due to receiving greater attention from

regulators, but also their sensitivity to reputational risk. Regional

demand in Asia, EMEA and South America is on the rise. More industry

sectors and tiers are being required to automate their AML processes.

However, due to the high cost of developing this specialized software,

as well as a crowded vendor market, the steady demand for ever more

sophisticated software does not necessarily translate into high yearon-year growth or profitability for any particular vendor.

This fact of life has given rise to a deep wave of consolidation (see

Table 2 on page 21). In some cases, such as the acquisition of one AML

firm by another in order to acquire its client base, this may result in the

acquired vendor’s software being sunsetted. The motivation is very different when a large technology firm acquires an AML vendor; typically

the large firm wishes to offer the AML bit as part of a larger suite of services which they can market to their extensive client bases.

20

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

Table 2: Consolidation in the AML Market, by Acquiring Firm Type

General Technology

Firms

FSI Software / Services

Buyer

Target

Year

Oracle (i-flex solutions)

Mantas

2006

Nice

Actimize

2007

Oracle

Datanomic

2011

BAE Systems

Norkom

2011

Wolters Kluwer Financial Services

Atchley Systems

2003

LexisNexis (ChoicePoint)

Bridger Systems

2003

Experian

Americas Software

2004

Lombard Risk Management

STB Systems

2005

FIS (Metavante)

Prime Associates

2005

Fiserv

NetEconomy

2007

Thomson Reuters

Complinet

2010

Thomson Reuters

Northland Solutions

2011

Nice Actimize

Fortent

2009

Warburg Pincus

Searchspace (Fortent)

2005

Esprit Capital Partners

NetEconomy

2005

AML Specialists

Private Equity

Source: Celent

In such cases, rather than obsolescence the acquisition will more likely

mean the long-term viability of the software. In addition to providing

an attractive exit strategy for the vendor’s shareholders, acquisition by

a large technology firm may substantially enlarge the potential client

base / pipeline for the product. It may provide a new lease on life for

more basic AML packages, making them more attractive as part of the

more extensive service package of the large vendor.

From an industry perspective, consolidation of AML vendors may spur

innovation and change in the industry, not from the start-up grass

roots (which is already occurring, as will be shown in the upcoming

Celent report on specialist AML technology providers), but from the top

down. A large technology firm may invest in adding new functionality,

for example by adding anti-fraud capability to create an enterprisewide

compliance package. The trend is also driving an increase in outsourced AML services for small to medium sized banks. For example,

large core banking processors such as FIS and Fiserv are providing their

acquired AML software offerings on an ASP basis to their core processing clients.

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

21

This trend to consolidation is important to financial institutions

because it means that today's AML vendors will be around tomorrow,

and they can count on continued support for their products. Rather

than being a sign of weakness in the industry, the ongoing consolidation indicates the AML software market is entering a stage of maturity.

Firms that may have been shaky on their own will be all the more stable with these deep-pocketed owners behind them. Overall, Celent

sees this as a positive, not negative, trend for the AML software

industry.

22

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

Evolution in AML Technology

The ongoing evolution of AML compliance requirements and the development of best practices within bank’s compliance organizations,

along with a crowded AML software market, is driving AML vendors to

continue to upgrade their offerings with new functionality and

improved look-and-feel and usability. Celent has always held that the

most crucial element in AML technology is effective case management,

and many of these enhancements involve case management or user

interface functionality.

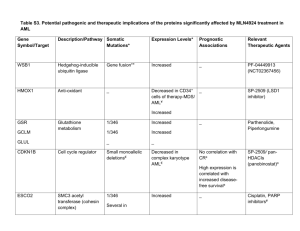

Table 3: AML technology product enhancements

Compliance suites

Technology

Usability

Analytics / scenarios

KYC / CDD

Real-time processing

Browser-based delivery

Anti-fraud scenarios

Transaction monitoring

Multi-channel capability

Navigability

Channel-specific scenarios

Anti-fraud

Scalability: users

Data slice-and-dice

LoB-specific scenarios

Watchlist screening

Performance: throughput

Configurability

Advanced analytics

Visualization tools

Neural networks,

Bayesian learning

Case management

Source: Celent

Recent product enhancements by vendors have focused on the following areas (see Table 3 on page 23).

End-to-end compliance suites. Vendors that previously

offered single-purpose systems such as transaction monitoring or watchlist filtering have been adding modules including

KYC, various types of fraud including insider fraud, and case

management and reporting, in order to provide end-to-end

AML compliance functionality.

Real-time processing. AML transaction monitoring has tradi-

tionally been a process of investigating past activity for

suspicious behavior; as such monitoring transactions in

batch mode was sufficient. As AML vendors expand into

anti-fraud, real-time monitoring capabilities become necessary in order to prevent or minimize remote channel fraud

such as online / ACH fraud and ATM fraud.

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

23

Multi-channel capability. For AML as well as anti-fraud,

there is a growing need to monitor transactions through

remote channels, and ideally to analyze transactions across

these multiple channels in an integrated fashion. In

response, vendors are enhancing multi-channel capabilities,

including the development of specific scenarios designed to

uncover suspicious activity specific to a channel (for example, common point of compromise for ATMs).

Scalability. Vendors with products perceived as less scalable

have been seeking to increase the through-put, performance

and scalability of their software in order to better compete

for business from the larger financial institutions.

Look and feel. Up to a few years ago many AML systems

were thick-client applications, although in some cases Javabased. To simplify version upgrades, facilitate enterprisewide

distribution and support ASP or SaaS delivery, vendors have

been migrating AML software to browser-based versions.

Visual clarity and presentation has also been a focus.

Navigability. In response to FI demands for more effective

and efficient case management tools, vendors have been

enhancing their systems with improved workflow and navigability. This includes alert drill-down, data sorting, and

other data “slice-and-dice” capability. To overcome the

latency introduced by moving to browser-based systems,

some vendors are introducing Ajax and other web technologies to minimize delays caused by screen-refresh time.

Improved configurability. Five years ago, AML interfaces

tended to be coded and modifications required development

by the vendor or at best an institution’s internal IT team.

Since that time, the configurability of many products has

improved significantly. Administrator-configurable features

include access and permissions, as well as some aspects of

workflow such as email notifications and analyst queues.

Features configurable by the business analyst (or other

authorized user) include thresholds and parameters for

rules, ad hoc rules, and scheduled queries. The more

advanced products provide the ability to configure screens to

present data tables in the desired format.

Visualization tools. A common gap in AML products is

robust visualization to facilitate the rapid comprehension of

complex data and patterns by analysts as well as compliance

officers. Vendors have been enhancing their visualization

tools by providing richer sets of data graphs, including graph-

24

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

ing for compliance dashboards, and interactive graphics with

drill-down functionality to display the results of a network

analysis.

Advanced analytics and scenarios. While business rules are

still the most commonly used type of analytics in AML, more

vendors are developing sophisticated capabilities such as

historical profiling and network analysis, as well as advanced

analytics such as neural networks and Bayesian learning.

Most vendors continue to develop new scenarios, including

AML scenarios for specific lines of business and scenarios to

detect various types of fraud.

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

25

Enterprisewide Compliance

Over the years, financial institutions have tended to implement separate AML solutions for each of their major business lines. These AML

systems typically have been installed at different times, in accordance

with regulators’ timelines for the various financial services segments.

As a result, disparate systems may be used in each of the business

lines, such as retail, corporate and private banking, and retail and institutional brokerage. In addition, AML operations are often similarly

siloed. For FIs operating in multiple geographies, operations and software may also differ for each jurisdiction.

These multiple systems and operational units create a substantial

challenge in terms of management and of course costs. More importantly in terms of compliance, because AML efforts are siloed by

business unit and geography, it is difficult for the institution to obtain

an integrated view of AML risk across the entire enterprise. Moreover,

this in turn makes it hard to manage and improve AML compliance

efforts across the firm.

Financial institutions have also typically run their AML programs separately from their anti-fraud efforts—even though the technology and

operational approaches required for AML and anti-fraud are similar in

many respects—further complicating the management and costs of

operations focused on financial crime.

In order to reduce the complexity and cost of operations, as well as

improve the efficacy of compliance efforts, in recent years a number of

financial institutions have been consolidating their disparate AML

platforms, and in some cases their anti-fraud platforms. Elements of

this enterprisewide compliance approach include:

Reorganizing siloed AML units into a centralized AML com-

pliance department.

Consolidating multiple AML systems onto fewer, or even one,

technology platforms.

Integrating AML and anti-fraud operations and technology.

Most of the effort to date has focused on consolidating AML operations

and technology, both across business units and across geographies.

Some larger banks have chosen a preferred AML vendor and are progressively moving AML at multiple business units onto their preferred

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

26

platform. In terms of regional standardization, multinational banks

such as Citi, HSBC and Standard Chartered have been working to standardize AML technology across the dozens of countries in which they

operate. Due to the specific requirements of different lines of business

on the one hand, and local compliance requirements in each jurisdiction, total consolidation will remain an elusive goal. Nevertheless,

some financial institutions have made significant headway in this

direction.

More interesting in terms of the potential benefits for a firm’s overall

financial crime operations is combining anti-fraud with AML, which

will be explored in the next section.

Integrating Anti-Fraud and AML: The Holy Grail

Financial institutions are overloaded with a panoply of onerous and

expensive compliance regulations, from Basel II and III to IFRS to BCP.

The AML programs required by regulators in the US and many other

countries are a particular headache. As described above, banks have

invested hundreds of millions of dollars in AML technology alone, not

to mention the personnel costs for the compliance teams, front-office

staff training, reporting and other functions. The outsized compliance

burden for AML has got banks to thinking about ways they can leverage

their investment in AML systems and operations. As Celent has argued

since our first report on AML trends in 2002, one way forward could be

to integrate their AML and anti-fraud efforts. Over the past few years,

banks have at last started to move in this direction to build an enterprisewide compliance framework for financial crime.

While banks fret over the burden of AML compliance, at the same time

they invest in and build anti-fraud systems—which are not much different in kind than AML systems—quite willingly. This is of course

because banks have a natural interest in preventing people from stealing money from them or their customers. In other words, anti-fraud is

a business activity, with direct benefits to a bank's bottom line. By

combining anti-fraud and AML systems, therefore, banks can potentially get a business benefit from the “AML burden.”

Software vendors have for some years promoted the idea of using one

technology platform for both AML and anti-fraud. In particular, a number of the larger AML vendors have developed anti-fraud products

using their core behavior detection technologies (see Table 4 on page

28). This potentially holds out the promise of a sort of compliance holy

grail: leveraging the compliance investment in AML for their anti-fraud

efforts, thus producing some tangible business return from the invest-

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

27

ment. Some of the more forward-looking banks have started to take

advantage of this to simplify their compliance and fraud systems and,

potentially, lower costs.

Table 4: Typical Anti-Fraud Product Offerings of AML Vendors

Channel Fraud

Sector Fraud

Internal Fraud

ATM fraud

Card fraud

Internal fraud

Check fraud

Insurance fraud

Broker compliance / market

abuse

Online fraud

Red flags

Payments / ACH fraud

Source: Celent

Using AML technology for anti-fraud can be daunting though. It is not

simply a case of writing new business rules in the software to cover

anti-fraud. Anti-fraud often involves additional functionality, such as

real-time transaction monitoring (AML typically makes do with monitoring on a batch basis), additional data feeds, and of course getting

multiple business lines to agree to use a common system.

Because until recently there has been little uptake by financial institutions of the anti-fraud modules to date, and vendors may use their first

implementations of a product as a means of fully developing its functionality (transforming it from vaporware to a real product), the antifraud capabilities of some vendors might not be all they claim to be

when you look under the hood. As more financial institutions move

towards an enterprisewide compliance approach combining AML and

fraud, this will drive further development in AML vendors’ anti-fraud

capabilities, much as the many AML implementations of the past

decade contributed to the evolution of AML technology.

The Case for Enterprisewide Compliance

The benefits of consolidating multiple AML programs onto one platform is straightforward: reducing duplication of technology and

operations can reduce costs, create efficiencies, and provide an enterprisewide view of AML risk.

Although intuitively attractive, many institutions may find it more difficult to build a business case for integrating AML with anti-fraud.

While AML compliance is a cost center, anti-fraud is a business activity

that generates a direct benefit to a firm’s bottom line by reducing

financial losses due to fraud. Anti-fraud departments may then quite

reasonably resist being tied in with the AML albatross. Therefore, getting buy-in from a firm’s executive management is crucial.

28

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

The most direct business case for integrating anti-fraud and AML is

demonstrating that putting anti-fraud onto a new technology platform

will enable an increase in the dollar amount of fraud that is prevented

due to this new technology. Fortunately, the compliance-driven development of modern AML software, analytics and case management has

created a new generation technology that can often deliver better

results than legacy anti-fraud systems. This is the reason why enterprisewide compliance initiatives often replace legacy anti-fraud

systems with the anti-fraud products of the AML vendors, rather than

vice versa. An incremental improvement in fraud reduction of even

five to ten per cent may be enough to build the case for moving antifraud onto the AML platform.

Table 5: Drivers and Barriers for Enterprisewide Compliance

Drivers

Barriers

Consolidation increases efficiency and efficacy

Siloed business lines and channels

Anti-fraud generates ROI to offset AML

compliance costs

Cost of replacing legacy systems

Enterprisewide data management can also

support business needs

Difficulty of data management needed to support

enterprisewide compliance

Real-time monitoring for fraud also

enhances AML

Anti-fraud requires additional functionality

Regulators taking holistic view of fraud and

ML

Buy-in from fraud division may be elusive

Source: Celent

In addition to this ROI argument, integrating anti-fraud and AML can

provide a number of other benefits:

The data management work needed to implement enter-

prisewide compliance can also support business needs,

including analytical CRM, customer profitability analysis and

risk management.

The real-time monitoring capability necessary for anti-fraud

can strengthen AML efforts as well (AML monitoring has typically been carried out on a batch basis).

Regulators have started to include anti-fraud within their

purview, due not only to the simple fact that fraud generates

illicit gains, but also to the discovery of links between fraud

and money laundering activities. As anti-fraud itself

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

29

becomes an AML compliance issue, regulators will expect

financial institutions to develop integrated approaches covering AML and anti-fraud.

Due to this link between fraud and money laundering activi-

ties, investigating both types of activity on a common case

management platform may reveal suspicious patterns of

activity that would otherwise remain hidden.

Although enterprisewide compliance makes sense, there are a number

of barriers that can lead financial institutions to reasonably reject this

approach.

Siloed business lines and channels can prevent adoption of a

common operational or technology platform for organizational, cost or political reasons.

Cost of ripping out existing solutions can be prohibitive.

Data management and sourcing data from multiple back-end

systems can be a major undertaking.

Using AML technology for anti-fraud is not simply a case of

writing new business rules, but often involves additional

functionality, such as real-time transaction monitoring and

additional data feeds

As a result, some firms will continue to take a siloed approach to AML

and anti-fraud, both by business line (retail, corporate and private

banking; cards; retail and institutional securities, insurance) as well as

by system module (transaction monitoring, analytics, watchlist filtering, case management, reporting). While this best-of-breed approach is

a viable technology choice, it will reduce the opportunity to realize efficiencies through implementation of one (or at least fewer),

standardized platform.

Centralized Case Management as a First Step to

Enterprisewide Compliance

Despite the logical elegance of the enterprisewide compliance

approach, especially at larger institutions it is a complex, expensive

initiative with far-reaching systems and organizational implications.

At the same time, as C-level management becomes increasingly

involved in AML efforts, executives are asking for an easy-to-access,

enterprisewide view of risk. This is driving a need for compliance dashboards, presenting a one-screen view of a firm's activities and

exposure across the enterprise.

30

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

For these reasons, an effective, concrete first step to consolidating AML

compliance across business lines and channels, as well as integrating

technology for AML and anti-fraud, is implementing an “enterprise

risk” dashboard, which can provide a business intelligence-driven view

of AML and fraud indicators across the enterprise. The dashboard can

be used by upper management, such as a Chief Risk Officer, to monitor

risk levels and performance of compliance and anti-fraud departments. Enterprise risk dashboards can also support centralized

internal and external reporting.

A number of institutions have had some form of risk dashboard in

place for some years. In its most developed form, however, an enterprise risk module will be a full-fledged case management system that

consolidates the output of siloed AML and / or anti-fraud systems into

a central, enterprisewide case management system to allow investigation of cases by a similarly centralized analyst operation. This enables

the investigation of schemes involving the products of multiple business lines and channels, and that cross the boundaries of money

laundering and fraud.

Enterprisewide case management requires access to clean, reliable

data from a firm's siloed business lines, which involves considerable

effort, time and expense. To date, relatively few financial institutions

have managed to implement enterprisewide case management, making this a ripe area for future development.

Internal Fraud

Financial institutions are also seeking ways to grapple with internal

fraud, which requires a somewhat different technology approach than

external fraud or AML. For example, internal fraud software needs to

analyze access logs on employee computers to see what systems they

are looking at and when. Sniffing technology can be employed to

record employees’ activity on internal systems, keystroke by keystroke.

On the case management side, audit trails will be designed not just to

check analyst’s productivity, but also possible collusion with money

laundering through, for example, putting a customer on the bank’s

“good guy” list. Because insider fraud may involve paper-based material such as contracts, it is less amenable to purely analytic

technologies, and the software is at an earlier stage of evolution than

for AML. Vendors have only been providing solutions aimed at insider

fraud for the past several years.

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

31

Expansion of AML Markets

Far from going away as a concern for financial institutions, AML compliance continues to expand, across financial segments, industry tiers,

and geographies.

Small Banking

In terms of industry tiers, while the initial focus after passage of the

USA PATRIOT Act was on larger financial institutions, over the past

several years regulators in the US have been getting tougher on smaller

institutions. In particular, community banks and credit unions are

under scrutiny to implement more effective AML technology. AML software vendors have responded by offering versions of their product

tailored to the needs of smaller institutions. Typically these packages

are essentially not customizable and include a smaller set of scenarios

and functionality. Core processors such as Fiserv and FIS are offering

AML on an ASP basis to their existing client base. New entrants such as

Verafin are also offering products aimed primarily at the small bank

market.

In just the past few years, some of these firms have already achieved

significant uptake in the small banking market, with clients numbering in the hundreds. Given the large number of banking institutions in

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

32

the US, continued growth can be expected in this sector for some time

to come. Celent projects that spending by small banks in the US will

reach US$28 million in 2013 (see Figure 14 on page 33).

Figure 14: AML Spending Trends: Small Banks

AML s oftware s pending

(US banks under US$1 bn in assets)

30

USD mn

25

20

15

24

10

5

14

16

28

18

0

2009

2010

2011

2012

2013

Source: Celent

Insurance AML

The AML needs of insurance firms have not been as great as in the

banking and brokerage sectors. This is partly because “transactions” at

insurance firms—policy applications, claims and payouts—are generally on multi-day batch cycles, so there is more time to analyze and

investigate them for suspicious activity. Regulators have also seen less

risk for money laundering in the insurance sector, and so have not

come down as hard on it. As a result, insurance firms have felt more

comfortable implementing simpler solutions, and often building them

inhouse.

In recent years, however, more insurers have felt the need to implement world-class AML technology. In the US, this has been driven by an

increased focus by regulators on insurance as a vehicle for money

laundering. The growth of online insurance sales has been another

driver, due to the easy access the online channel provides for money

laundering, as well as fraud. In addition, the faster cycle times of

online insurance sales, often delivering instant decisioning, is creating

a need for automated due diligence and AML checks.

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

33

Nonbank Financial Services

Non-banks have also been busy implementing AML technology. The

large money services companies have some of the largest AML software implementations, spanning multiple operations around the globe

in order to control risk for cross-border remittances as well as domestic

business.

The growth of online alternative financial services such as P2P payments and social lending is also creating a new market for AML

software. Some of these firms facilitate very large numbers of transactions, for virtually any counterparty. The lack of a traditional KYC

process in the online channel makes screening of client and counterparty names against watchlists crucial for achieving AML compliance.

In addition, firms are implementing transaction monitoring with analytics tailored to their business to look for potential abuse of the

system.

Regional Markets

The USA PATRIOT Act ushered in a new era of AML compliance, not

just in the US but globally. US compliance approaches have had a ripple

effect in jurisdictions ranging from the Euro zone and UK, to the Middle

East, Africa and Asia-Pacific. In these new jurisdictions, regulators will

often first focus on the implementation of watchlist screening capability, particularly for cross-border wires due to sensitivity to the US’

attention to overseas correspondent banks’ AML and counter-terrorist

funding programs. Transaction monitoring will typically be implemented at a later stage.

This process is currently underway in, for example, Asia Pacific, as can

be seen by the differing degrees of regulatory focus on compliance and

implementation of AML technology in each jurisdiction in that region

(see Figure 15 on page 35). The fact that many of the countries in AsiaPacific are still in the early stages of AML compliance regulation sug-

34

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

gests that this region will see the highest growth in AML software

spending in the medium term, as described in the AML Technology

Spending section.

Figure 15: AML Adoption in Asia-Pacific

Source: Celent

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

35

AML by ASP

Outsourcing of AML operations and technology is still in early days.

Large banks in the US have been generally unwilling to outsource their

AML operations due to security concerns. In addition, larger institutions are more likely to keep their technology inhouse, and so with

their AML software. In the US, the past few years have seen core processors such as FIS and Fiserv and identity verification service

providers such as LexisNexis and Experian acquire transaction monitoring or watchlist screening software vendors. These firms are

targeting these outsourced AML services mainly at small banks, particularly but not exclusively banks who already use their services. Such

firms have hundreds or thousands of such customers, providing a large

potential client base for the AML products. The capabilities of these

products tends to be fairly basic when compared to the industry stateof-the-art technology, but for small to medium sized banks this is often

sufficient. Fiserv has been providing AML services as part of its outsourcing arrangements for some time and probably has the most

experience in this area.

Compliance processes such as customer due diligence may be more

difficult to justify to regulators and hence more difficult to outsource to

a business process outsourcing (BPO) provider. And certainly AML can

be a more sensitive area than commoditized back-system operations.

Nevertheless, major BPO providers such as Infosys are providing support for AML operations. In addition, a number of new specialist firms

are offering outsourced AML services. In the US, for example, AML

RightSource offers managed services for transaction monitoring / analysis, customer due diligence and watchlist screening. In Europe,

KYCnet provides customer due diligence for corporate clients as well

as for compliance review purposes. In the area of watchlist screening,

Thomson Reuters’ Complinet provides an ASP service as well as an

Internet-based delivery channel. Innovative Internet-based models

have also emerged to assist with negative media as well as KYC issues;

examples include KYC360 and NetBreeze.

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

36

Conclusions

AML compliance presents financial institutions with a unique set of

challenges in terms of operations, technology and enterprisewide

management. The substantial and ongoing costs associated with

achieving compliance also make it important for firms to seek efficiencies in operational and technology costs, without sacrificing the

efficacy of their AML programs.

Increasingly, financial institutions are responding to these challenges

by adopting elements of an enterprisewide compliance approach, with

the ultimate—and quite long-term—goal of integrating their AML and

anti-fraud operations and technologies across business silos and, for

multinational firms, geographical regions.

No matter what their size, financial institutions embarking on this

journey will need to carefully assess the vendor solutions that can

assist them. Aside from the vendor’s ability to deliver on implementation and after service, the three main areas institutions will want to

evaluate are scalability, sophistication of analytics, and case management capabilities. Needs in these areas will differ according to the size

of the institution, business line, and existing solutions and compliance

procedures already in place. Smaller institutions may not need, or even

be able to effectively use, a very advanced solution, whereas top tier

institutions may require sophisticated data mining and analytics just

to keep track of their large volumes of transactions and accounts. Institutions will know their own scalability needs, but should be careful to

perform due diligence on the claims made by vendors.

Once a solution meets the institution's analytics and scalability

requirements, strong case management functionality is crucial. The

biggest headache compliance departments face is how to sift through

the voluminous alerts generated by AML systems, divvy them up

among their analysts, and investigate them effectively. These difficulties will be amplified when anti-fraud and AML are placed on the same

platform, making strong case management capabilities even more

urgent.

Building the business case for an enterprisewide approach to compliance is not easy. To justify the investment, compliance officers will

need to gather evidence from case studies of other financial institutions that the new anti-fraud products of AML vendors are effective

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

37

and can produce incremental improvements in loss prevention enough

to create an ROI. Top management and board buy-in to the initiative is

important in overcoming political divisions and resistance from siloed

P&Ls. Finally, a phased roadmap, perhaps starting with a centralized

case management system to unite disparate legacy AML and anti-fraud

systems, will help provide a workable and achievable blueprint for the

journey towards enterprisewide compliance.

38

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

Leveraging Celent’s Expertise

If you found this report valuable, you might consider engaging with

Celent for custom analysis and research. Our collective experience and

the knowledge we gained while working on this report can help you

streamline the creation, refinement, or execution of your strategies.

Support for Financial Institutions

Typical projects we support related to anti-money laundering technology include:

Vendor short listing and selection. We perform discovery specific to

you and your business to better understand your unique needs. We

then create and administer a custom RFI to selected vendors to assist

you in making rapid and accurate vendor choices.

Business practice evaluations. We spend time evaluating your business processes. Based on our knowledge of the market, we identify

potential process or technology constraints and provide clear insights

that will help you implement industry best practices.

IT and business strategy creation. We collect perspectives from your

executive team, your front line business and IT staff, and your customers. We then analyze your current position, institutional capabilities,

and technology against your goals. If necessary, we help you reformulate your technology and business plans to address short-term and

long-term needs.

Support for Vendors

We provide services that help you refine your product and service

offerings. Examples include:

Product and service strategy evaluation. We help you assess your market position in terms of functionality, technology, and services. Our

strategy workshops will help you target the right customers and map

your offerings to their needs.

Market messaging and collateral review. Based on our extensive experience with your potential clients, we assess your marketing and sales

materials—including your website and any collateral.

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

39

Related Celent Research

IT Spending in Financial Services: A Global Perspective

Jacob Jegher

Enterprise Operational Risk, Compliance, and Governance Solutions:

Towards a Convergence End Game

Cubillas Ding

Internal Fraud: Big Brother Needs New Glasses

Jacob Jegher

Insurance Fraud Mitigation Technology: Beyond Red Flags

Donald Light

Copyright 2011 © Celent, a division of Oliver Wyman, Inc.

40

Copyright Notice

Prepared by

Celent, a division of Oliver Wyman

Copyright © 2011 Celent, a division of Oliver Wyman. All rights reserved. This report

may not be reproduced, copied or redistributed, in whole or in part, in any form or by

any means, without the written permission of Celent, a division of Oliver Wyman

(“Celent”) and Celent accepts no liability whatsoever for the actions of third parties

in this respect. Celent is the sole copyright owner of this report, and any use of this

report by any third party is strictly prohibited without a license expressly granted by

Celent. This report is not intended for general circulation, nor is it to be used, reproduced, copied, quoted or distributed by third parties for any purpose other than

those that may be set forth herein without the prior written permission of Celent.

Neither all nor any part of the contents of this report, or any opinions expressed

herein, shall be disseminated to the public through advertising media, public relations, news media, sales media, mail, direct transmittal, or any other public means

of communications, without the prior written consent of Celent. Any violation of

Celent’s rights in this report will be enforced to the fullest extent of the law, including the pursuit of monetary damages and injunctive relief in the event of any breach

of the foregoing restrictions.

This report is not a substitute for tailored professional advice on how a specific

financial institution should execute its strategy. This report is not investment advice

and should not be relied on for such advice or as a substitute for consultation with

professional accountants, tax, legal or financial advisers. Celent has made every

effort to use reliable, up-to-date and comprehensive information and analysis, but

all information is provided without warranty of any kind, express or implied. Information furnished by others, upon which all or portions of this report are based, is

believed to be reliable but has not been verified, and no warranty is given as to the

accuracy of such information. Public information and industry and statistical data,

are from sources we deem to be reliable; however, we make no representation as to

the accuracy or completeness of such information and have accepted the information without further verification.

Celent disclaims any responsibility to update the information or conclusions in this

report. Celent accepts no liability for any loss arising from any action taken or

refrained from as a result of information contained in this report or any reports or

sources of information referred to herein, or for any consequential, special or similar

damages even if advised of the possibility of such damages.

There are no third party beneficiaries with respect to this report, and we accept no

liability to any third party. The opinions expressed herein are valid only for the purpose stated herein and as of the date of this report.

No responsibility is taken for changes in market conditions or laws or regulations

and no obligation is assumed to revise this report to reflect changes, events or conditions, which occur subsequent to the date hereof.

For more information please contact info@celent.com or:

Neil Katkov

The Imperial Hotel Tower

13th Floor

1-1-1 Uchisaiwai-cho

Chiyoda-ku, Tokyo 100-0011 Japan

+81 3 3500 3034

nkatkov@celent.com

North America

Europe

Asia

USA

France

Japan

200 Clarendon Street

28, avenue Victor Hugo

The Imperial Hotel Tower, 13th Floor

Boston, Massachusetts 02116

75783 Paris Cedex 16

Tel.: +1.617.262.3120

Tel.: +33.1.73.04.46.20

1-1-1 Uchisaiwai-cho

Chiyoda-ku, Tokyo 100-0011

Fax: +1.617.262.3121

Fax: +33.1.45.02.30.01

Tel: +81.3.3500.3023

Fax: +81.3.3500.3059

USA

United Kingdom

China

1166 Avenue of the Americas

55 Baker Street

New York, NY 100136

London W1U 8EW

Beijing Kerry Centre

South Tower, 15th Floor

1 Guanghua Road

Tel.: +1.212.541.8100

Tel.: +44.20.7333.8333

Fax: +1.212.541.8957

Fax: +44.20.7333.8334

Chaoyang, Beijing 100022

Tel: +86.10.8520.0350

Fax: +86.10.8520.0349

USA

India

Four Embarcadero Center, Suite 1100

Level 14, Concorde Block

UB City, Vittal Mallya Road

Banglalore 560 001

San Francisco, California 94111

Tel.: +1.415.743.7900

Fax: +1.415.743.7950

Tel: +91.80.40300538

Fax: +91.80.40300400