Regulatory Budget - Competitive Enterprise Institute

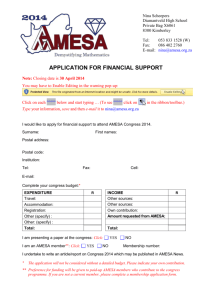

advertisement