Interactive Messaging Participant Specifications for Comparison

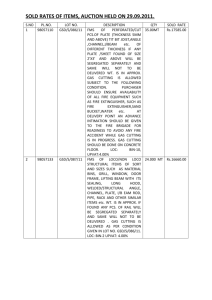

advertisement