Case 09-37010-sgj11 Doc 15 Filed 10/20/09 Entered 10/20/09 00

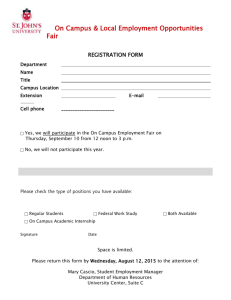

advertisement