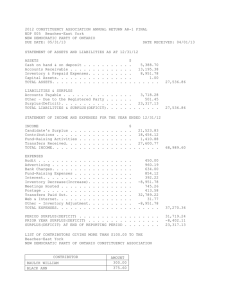

20 Questions About Government Financial Reporting

advertisement