Turnaround of Sears Holdings - Turnaround Management Association

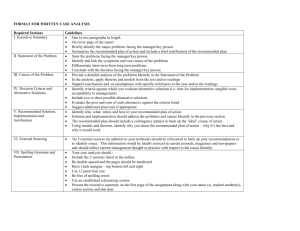

advertisement