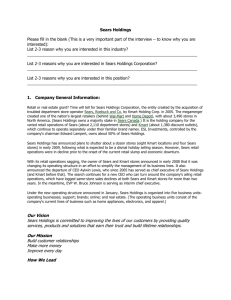

A. The Valuation of Sears

advertisement

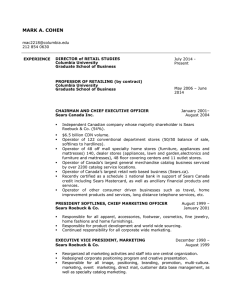

The Valuation of Sears Holdings Calvin Wing 2nd Annual Wall Street Conference and Case competition A college student competition that offers a real world application of the knowledge attained with an undergraduate degree. Criteria: Choose an industry Choose a company from that industry Compile comprehensive report within 9 days. Report must include a description of the industry, an overview of the chosen company, drivers of growth for the company, competitor overview, and the final valuation methods used to make a conclusion. Retail industry Department and discount retail industry is built up of roughly 50 companies. (i.g.) Wal-Mart, JC Penny, Kohl’s, Macy’s, K-Mart, and many more. Effects on industry from recession? Industry valued at $1.25 trillion in 2007. Within year has grown to approximately $1.6 trillion. Consumer increase in consumption spending in market rise of 28.14% Net income valued at $43.36 billion in 2007. Has grown to approximately 60.9 billion. Resulting growth of 40.48% Possible reasons? SEARS HOLDINGS Originally started by Richard Sears, Alvah Roebuck Sears catalog debut 1888, main target audience was farmers. Catalog popularity.1895 closing sales of $750,000 ($19,952,780 current) First retail store opens 1925 For next 50 years company expands to urban and suburban markets as the largest retailer in the US. Starts incurring some losses in the 1980’s. Is purchases by K-mart in 2005. Is ranked 65th on the Fortune 500 list. Sears Holdings Current Headquarters is located in Hoffman Estates Illinois. Operates through three subsidiaries, Canada Inc., K-Mart Holdings Corporation, and Sears Roebuck Co. Owns 4,010 Full line and specialty retail stores in the US and Canada. For competition performed a SWOT analysis from I-Metrix. SWOT: Strengths Weaknesses Opportunity Threat Drivers of growth Technology adaptation. Creating loyalty programs. Digital marketplace. Shop Your Way Rewards Cutting cost By eliminating marginally performing stores, and converting stores. Competitor Overview comparison analysis. We chose to compare Sears Holdings to Macy’s, Kohl’s, and Wal-Mart. Compared current financial standings as well as past finances, as well as technological advances and new business strategies. Valuation Methodology Variables chosen: Total current liabilities, debt, long term lease obligations, assets, profit margins, and after tax returns on equity. Running a company comparison using I-Metrix, we were able to calculate a company’s risk as well as how they balance their assets with their liabilities. Conclusion Overall financial standings. After-tax return on equity of -47% Difference with entire retail industry of 96% Spread too thin with too many liabilities Sears is a high risk company that we have valued as a low company that will continue to suffer as long as they continue to try and fill so many market wants. Thank you