2011-12 economics and business department

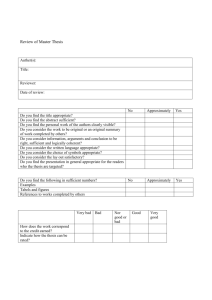

advertisement

COLORADO COLLEGE 1874 2011-12 ECONOMICS AND BUSINESS DEPARTMENT SENIOR THESIS GUIDELINES AND ILLUSTRATIVE MATERIALS Reprinted Sept 2011 FINAL DUE DATES FOR SENIOR THESES IN THE ECONOMICS AND BUSINESS DEPARTMENT, ACADEMIC YEAR 2011-12 Student Copy If your second thesis block is: Block II Block III Block IV Block V Block VI Due date for submission of your completed thesis is 2:00 pm on : December 9, 2011 February 3, 2012 March 2, 2012 April 6, 2012 May 4, 2012 Each due date falls on a Friday. The completed thesis MUST be UPLOADED TO THE THESIS SUBMISSION MODULE BY NO LATER THAN 2:00PM OF THE DAY THAT IT IS DUE. The uploading process will time-stamp your submission, so be aware that changes to your uploaded document will delay the official submission time of your thesis. A “completed thesis” is the final typed SINGLE DOCUMENT computer copy which complies with ALL the thesis requirements of the Department and your advisor. Failure to comply with this 2:00 p.m. deadline will result in the following sanctions: Date/time thesis turned in Grade Consequence Potential Grade Turned in on Due Date Friday On or before 2:00 pm No reduction in grade If grade was an “A” Turned in on Due Date Friday Between 2:00-4:00 pm Reduce grade by 1/3 Grade reduced to “A-“ Turned in after 4:00 pm on the Friday it was due Through the following Monday, before 2:00 pm Reduce grade by 1 Grade reduced to “B” Turned in after 2:00 pm on the Monday after it was due Through the following Tuesday, before 2:00 pm Reduce grade by 1 Grade reduced to “C” Turned in after 2:00 pm on the Tuesday after it was due Through the following Wednesday, before 2:00 pm Reduce grade by 1 Grade reduced to “D” Not a passing grade Turned in after 2:00 pm on the Wednesday after it was due “NC” grade given I have reviewed the thesis deadline policy and agree to abide by it. /s/______________________________________ Date ______________________ NAME (printed) ______________________________________________________ Advisor’s Signature ________________________________________________ SENIOR THESIS COURSE MEETING RULES AND ASSOCIATED HELP-SESSION INFORMATION Senior Thesis is a two-block course. Under the academic rules of Colorado College each student must meet with the course instructor at 9:00 a.m. of the first day of each thesis block. Students must check with the course instructor by 9:00 a.m. either for the formal meeting or, if the thesis instructor is teaching another course scheduled at 9:00, the alternative time for the thesis meeting which has been assigned by the thesis advisor. Students who fail to meet with their thesis advisor on the first day of their first thesis block may be dropped from senior thesis. Students who fail to meet with their thesis advisor on the first day of their second thesis block may earn 2 blocks of NC. Students must comply with the deadlines established for each thesis block by their thesis advisor, whether written or verbal. Students who fail senior thesis, either one or both blocks, may be allowed to re-enroll if there are both thesis slots remaining and faculty members available to supervise. Each Senior Thesis student is required to attend a meeting with a Reference Librarian in Tutt Library the first week of the student's first thesis block. Please contact the Social Science Librarian at Tutt Library Reference Desk to make an appointment. Senior thesis students who are unfamiliar with word processing are required to sign up for and complete word processing sessions through Information Services (Computing Services). Information about dates and times of the programs can be secured by contacting Information Services. The Department of Economics and Business will provide additional computer assistance in solving word processing problems only to those students who have completed their sessions. An explanatory guide to using Microsoft Word on the Macintosh/WINDOWS is available from the Economics Lab Technical Statistical Coordinator. In addition, templates are available on all Colorado College student computers for the following preliminary materials: title page, honor code page, table of contents, and list of figures/tables. If not serving the department in another capacity which takes priority, the Economics and Business Department paraprofessional will be available for computer-related assistance. Each thesis must be submitted online and will require the entire document to be in a SINGLE DOCUMENT. Instructions for submission and formatting will follow in this document and can also be found on the Economics and Business Department website. SPECIAL NOTE: Many types of field research (surveys, interviews, simulations, and some types of case study research) will require approval by the Institutional Review Board (IRB). Guidelines describing the kinds of research activities that require the review and approval of the IRB as well as the process of obtaining IRB approval can be found at the IRB’s website: http://www.coloradocollege.edu/dean/oir/irb/. SENIOR THESIS PURPOSE AND STANDARDS PURPOSE: The primary purpose of senior thesis is to demonstrate that senior majors in economics can draw from their undergraduate education comprehensively in analyzing a significant problem or issue. Thus, the thesis is intended to develop through individual initiative and independent research, a final product that demonstrates conclusively that the student can formulate a testable hypothesis, present necessary background material, apply appropriate theories, organize relevant data, and draw unbiased conclusions. The product must display good formal writing, appropriate citation, logical progression, and a balance among description, theory, and analysis. STANDARDS: The hypothesis must state a problem or question whose answer is not known or readily observable; it can be shown to be valid or invalid using logic and facts; it must require research of differing opinions, theories, or facts to arrive at a logical, defensible conclusion. The student must review both intermediate theory and elective courses in the discipline to select, describe, and apply appropriate theories to the issue. Use of appropriate data (both primary and secondary), demonstrated familiarity with documents, periodical literature, and journals in the discipline, and a demonstrated ability to organize, evaluate, and present conflicting information are necessary for success. CONSIDERATIONS IN GRADING No two instructors grade in exactly the same way. The following considerations are some of the more important questions an instructor will probably ask when considering what grade to give your thesis. If the author has a thesis to defend, has the case been presented effectively and persuasively? Has the author squarely faced the hard problems the position being analyzed presents? Is the examination of the thesis based on theory? Is the theory clearly explained and has the student researched all applicable theory? Is the theory at an intermediate level? Has the research been properly done? How thorough has the writer been in examining the authorities and other related materials? Has the writer been accurate in making statements and citing authority? Has the writer said something new? Is the writer original in thought and are the ideas valid or at least worthy of consideration? Has the writer used the accumulated data to support a conclusion of some consequence? Has the paper been written in a literate manner? Does it read well? Does it conform rigorously to the prescribed form? Is the paper one the instructor could recommend to an interested layman seeking material bearing on the subject of the thesis? Was the paper completed in a timely manner? RULES TO PASS OR FAIL BY 1. CITATIONS must conform to Turabian's A Manual for Writers of Term Papers, Theses, and Dissertations, 7th ed. On the Economics & Business website under Thesis Resources is a link to a PDF with examples of correct citations. A resource for citing sources in both footnotes and a Sources Consulted list can be found at the University of Wisconsin Madison website at http://writing.wisc.edu/Handbook/DocChicago.html, a link to this site can also be found on our Tutt Library’s webpage for citing sources. Another example for reference using Turabian can be located at the Duke University website at http://www.lib.duke.edu/libguide/cite/works_cited.htm (link available from Tutt Library’s Style and Writing Guide pages). RefWorks, a bibliography management program available to all Colorado College students, can be a helpful tool for saving and organizing citations. It is an effective method to assist in the formatting of your bibliography, but some hand editing is necessary. You are encouraged to attend a RefWorks workshop or consult with the Social Sciences Liaison Librarian before you begin using RefWorks. 2. STYLE: Several respected guides to style are Fowler, Modern English Usage (in paperback form edited by Margaret Nicolson); Sir Ernest Gower's The Complete Plain Words; Strunk and White's The Elements of Style; Ross-Larson's Edit Yourself ; and Deirdre McCloskey’s Economical Writing. 3. FORM: a. The thesis must be double spaced. b. Margins: Most computers will automatically be set with a left margin of 1”. This should be changed at the beginning of the thesis writing to 1½”. This left margin is necessary to allow for thesis binding. The left margin should be checked each time new material is written (The margin is correctly set in the thesis template in the Economics Lab. For more examples see Turabian, pages 374-375). Measure the margin with a ruler to be sure you are exact; occasionally the computer will shorten the margin. The right, top, and bottom margins must be 1” EXCEPT for the first page of each chapter, which should have a 2” upper margin rather than the automatic 1”. This can most easily be accomplished by hitting the “enter/return” key several times. Use a ruler and measure! The chapter title begins one double-spaced line below the chapter number and is centered and capitalized. If the chapter title is longer than one line, the remainder of the title should be single spaced in inverted pyramidal form. c. The first line of the chapter text begins one triple-spaced line below the chapter title. Pages must be numbered. It is easiest if you create section breaks in your paper for each chapter, each appendix, and your sources consulted. This way you will be able to format the page numbers for each section. Number the first page of each section (i.e. chapter, appendix, glossary and sources consulted) at the bottom; all other pages should be numbered in the upper right corner. Again, having section breaks makes this possible and easier to format. d. Footnotes are required and must be placed at the bottom of the typed page on which the footnoted materials appear. This makes the manuscript easier to read and verify. They must be single spaced, with double spacing between each one. Numbering begins again with each new chapter. Thus, the first footnote in Chapter 1 will be numbered 1; the first footnote in Chapter 2 will be numbered 1, etc. This instruction supersedes the option in thesis numbering contained in Turabian. This decision reflects the fact that if editing requires insertion or deletion of a footnote, a word processor can operate more rapidly, the fewer footnotes it is forced to renumber. If your paper is in sections you can easily format the footnotes to “restart at each section.” e. A Sources Consulted (bibliography) is absolutely necessary and must be alphabetized. The Sources Consulted listing includes not only those sources cited in the thesis but also any other sources the thesis writer has consulted in more than a superficial way. This broad listing enables both the reader and the thesis advisor to determine the depth and breadth of the research conducted by the thesis student. The sources consulted section should not be “padded,” but it should accurately reflect the research that undergirds the thesis. f. A Title page is required. g. It is required to abide by the Honor Code when writing a thesis. There will be a check-box that must be filled out when submitting a thesis. h. Sections and Subsections (Headings and Subheadings) follow Turabian, pp. 397-398. Headings and subheadings are placed one triple-spaced line below the last line of text; if more than one line, these should be single-spaced in inverted pyramidal form. Headings should be centered. Subheadings should be aligned on the right. The chapter titles, headings, and subheadings define the entries in the Table of Contents. You should remember that your subheadings indicate the organization of your thesis and serve as a guide for a reader of not only what is included but its relation to your hypothesis. i. Orphans and widows: Make sure that one-liners are not left hanging on a new page or stranded on the page before. Create or delete spaces and indents to prevent this from happening. Similarly, do not leave titles and subsection headings stranded on the page before. j. Requirements for tables and figures Every table should be a self-contained unit so that if the table were torn from the thesis and presented to a reader, the reader would not need to consult the thesis to understand the data incorporated in the table. A table should present the data in the clearest and most attractive way possible within the constraints of the thesis format and style and accuracy in presenting the data. See Chapter 26 (pages 369371) of Turabian 7th ed. Each table must be given a table number. Tables are to be given Arabic numbers and are to be centered two spaces above the first line of the table title. Each table must be given a full and complete title. The full table title is always to be capitalized and single spaced. DO NOT BOLD THE TABLE TITLE. If the table title is too long for a line, the title should be typed in inverted pyramidal form. The title must indicate what the table contains, where the data applies, the units in which the data are expressed, and the period covered by the table. If explanatory notes are considered necessary or desirable, they should be entered at the appropriate point in the table using symbols [*, **, #, ##] In typing a table, the left margin must always be 1-1/2 inches. However, the right margin may extend past the usual 1 inch right-hand margin (mandatory for pages of text) if necessary. In the headings of the columns of the table, if the units in which a column or columns are cited apply to several columns, center the units under a caption describing the material contained in the columns. The heading may incorporate the units of measurement above the sub captions of the separate columns. Units entered in a table are aligned on the decimal point (if the material contains decimal points). If a table is too long for a single page, a second continuation page(s) should be made. Continuation pages are to be centered. The proper form on the following centered page is TABLE 1 - Continued. The full table title should not be repeated. Explanatory notes of a table are to be entered before the source citation. Every table must have a full source citation in the form used in any first citation of a source in a footnote. Ibid and other shortened citations forms of material discussed on a previous page of the thesis are not acceptable in the source note for a table. Figures (the term to be applied to all illustrative material other than tables and including graphs, maps, diagrams, and other similar non-tabular material) are all to be labeled as FIGURE, followed by sequential Arabic numbers. For example, the second figure in Chapter 1 would be FIGURE 1.2, the fourth figure in Chapter 1 would be FIGURE 1.4, and so on. If figures are too large for placement within the margins of a single page, the figure may be created and then reduced on a copier. REMEMBER: the reduced figure must remain legible and the 1-1/2 inch left margin is still mandatory! Both tables and figures may, if absolutely necessary, be placed vertically rather than horizontally. However, the rules regarding numbering, titling, explanatory notes, and sources still apply, as does the 1½-inch left margin (which now becomes the figure's top margin). Clear as mud? Ask the Technical Statistical Coordinator. Graphs should center captions for both horizontal and vertical axes horizontally above or below the axis to which the caption applies. Since graphs are a visual method of conveying information, do not distort arithmetic graphs by beginning the vertical axis's origin at some value other than zero. If values are so large an arithmetic graph does not reveal important changes adequately, use a semi-logarithmic graph. If graphic problems develop in your thesis, consult your thesis advisor. Each table or figure must be placed immediately following the text in which first reference to the material occurs. Exception to this placement of your thesis tables and figures may be made if you and your thesis advisor decide that tables and figures should be placed in an appendix. If tables and figures are placed in an appendix, adherence to the other general requirements for tables and figures apply. Writers should remember that tables and figures are devices for summarizing important material with accuracy, completeness and pleasant appearance. If these goals cannot be attained, the table or figure should not be used. 4. ASSEMBLE the thesis in the following order: a. title page b. abstract c. dedication (if considered appropriate and of great importance) d. blank page e. table of contents f. list of tables g. list of figures h. preface (usually not included in a senior thesis) i. acknowledgements (if desired) j. text k. appendix(es) (if appropriate) l. glossary (if appropriate) m. sources consulted 5. SUBMISSION: The thesis is due by 2:00 p.m. on the dates indicated at the front of this document. Your responsibility is to meet this deadline without exception. You must upload the entire document to the thesis submission module (online) by this due date, it will be time stamped so there is no hiding it! It is your responsibility to anticipate and avoid delays. Please keep in mind that formatting a thesis into a single document takes a significant amount of time. Don’t leave this task until 1:30pm the day that it is due!! The Murphy's Law of Thesis states that the computer network will experience downtime the week your thesis is due. The URL for the submission module can be obtained from the CC Economics and Business Department Website. The module DOES NOT WORK OFF CAMPUS, so you HAVE TO COME TO CAMPUS TO SUBMIT YOUR THESIS. See your Technical Statistical Coordinator for more instructions on how to upload your thesis to the submission module. FAILURE TO MEET THE DEADLINE WILL RESULT IN SANCTIONS THAT MAY INCLUDE UP TO A GRADE OF 2 BLOCKS OF NO CREDIT FOR THE COURSE. See Page 2 for further details. 6. BINDING: You may have personal copies bound and mailed to you for a charge. Since your thesis will be archived digitally, you should consider retaining a copy for your own use. Ask the department secretary for the cost of the personal copy. 7. LENGTH: The minimum length of the paper is 50 typed pages of essentially original writing. Shorter theses will be severely reduced in grade or even rejected at the discretion of your thesis advisor. Awards and thesis funds available Ray O. Werner Thesis Prize: There is a cash prize awarded for the best Economics and Business Department senior thesis. The winner is selected by a panel of judges from the department. Robin Satterwhite: There is a cash prize awarded to the thesis exhibiting the most original methodology or research approach. The winner is selected by a panel of judges from the department. Thesis Funds: In certain extraordinary circumstances, thesis funds of $500 or less are available to support thesis work. These funds may only be used for purchase of data or software. These data and software will then belong to the department. Applications to the department must include a description of the data or software to be purchased, the use to be made of it, an explanation of why free data or data available through the library or existing software is inadequate to the needs of the project and a letter of support from the thesis advisor. Center this page horizontally & vertically. (Template available on the Economics & Business website.) YOUR THESIS TITLE Title is in ALL CAPS. Watch out for typos. A THESIS Presented to The Faculty of the Department of Economics and Business The Colorado College 1-1/2” margin on left. 1” margin on right. In Partial Fulfillment of the Requirements for the Degree Bachelor of Arts By [Your Name] Graduation Month Year This will be either December or May. NO PAGE NUMBER. Copy your title from your title page. Template available on the Economics & Business website. TITLE OF THESIS GOES HERE Your Name This is either December or May. Month Year Major Abstract Insert text of abstract here. An abstract must be no longer than one page, but may be as short as 1 paragraph. An abstract is a brief summary of your thesis. It should include the context of the problem, a statement of your problem or hypothesis, the approach or method, and the data or evidence used in your analysis. An abstract usually ends with a statement of the main point or with a statement that anticipates the main point of the thesis. KEYWORDS: (Word, Word, Word) Center this page horizontally & vertically. THIS PAGE IS ONLY IF YOU WANT TO GET YOUR THESIS BOUND (Template available on the Economics & Business website.) ON MY HONOR, I HAVE NEITHER GIVEN NOR RECEIVED UNAUTHORIZED AID ON THIS THESIS Signature NO PAGE NUMBER. Center Table of Contents top to bottom. Hit “enter” a few times, or “del.” Use “tab” to create additional Rows and Cells. (Template available on the Economics & Business website.) TABLE OF CONTENTS ABSTRACT iii ACKNOWLEDGEMENTS iv 1 INTRODUCTION 1 2 THEORY 5 2.1 The Net Present Value (NPV) Argument....................................................... 8 2.2 Stochastic Processes....................................................................................... 9 2.2.1 Wiener Process..................................................................................... 9 2.2.2 Ito’s Lemma......................................................................................... 23 2.2.3 Application........................................................................................... 27 2.3 Other Elementary Stochastic Processes......................................................... 30 NO PAGE NUMBER. Center Table of Contents top to bottom. Hit “enter” a few times, or “del.” Use “tab” to create additional Rows and Cells. (Template available on the Economics & Business website.) LIST OF TABLES 2.1 Turkish Population in Europe (2005) ………..………………….…………... 10 2.2 Descriptive Statistics …………………………….………………………….. 45 5.3 Type of Employment Status ………………………………………………… 70 NO PAGE NUMBER. Center top to bottom. Hit “enter” a few times, or “del.” Use “tab” to create additional Rows and Cells. (Template available on the Economics & Business website.) LIST OF FIGURES 3.1 Venture Capital Decision Process.……………………………………………. 26 3.2 Financing Decision……...…………………………………………………….. 31 3.3 Potential Investors…...………………………………………………………... 32 3.4 SBA Loan Process……..……………………………………………………… 34 3.5 Banks…..……………………………………………………………………… 35 3.6 Angel Investors……...………………………………………………………... 36 3.7 Venture Capital………..……………………………………………………… 37 NO PAGE NUMBER. CHAPTER I INTRODUCTION Recent literature in behavioral finance has contradicted the notion of efficiency of markets. More emphasis on how psychological biases influence the behavior of an investor and its implications on the asset prices has led to a strong debate among ' proponents of behavioral finance and neoclassical finance. Some financial economists claim that the premise that rational individuals in a complete, competitive market to maximize their utility level does not truly determine the structure and dynamics of asset prices. In other words, some poorly informed and unsophisticated investors might lead the financial markets to be inefficient. Though the principles of traditional corporate finance have great value, some psychological obstacles may exist that prevent the organizations from putting them into practice.2 The wide-ranging debate between neoclassical and behavioral finance has a concrete effect on the financial markets worldwide including emerging market^.^ This has resulted in the need to study how the psychology of investors affects financial decisions in households, markets and organizations. ' Werner De Bondt, Gulnur Muradoglu, Hersh Shefrin and Sotiris K. Staikouras,"Behavioral Finance: Quo Vadis?" Journal of Applied Finance (FalVWinter 2008): 7-2 1. Ibid. Ibid. Previous research studies have done substantial work on defining a human sentiment function in a stochastic discount factor (SDF) model. Furthermore, the recent financial turmoil that took place in 2008 reflected highly volatile swings of sentiment in both equity and debt markets. This has motivated the author to investigate the direct linkage between the investor sentiment function and the pricing of an asset. Investor sentiment, broadly understood as erroneous beliefs about future cash flows and risks, potentially affects the prices of all the asset^.^ Both behavioral finance and neoclassical finance have different implications for asset pricing and the relationship between risk and return. This paper will provide the necessary fi-amework for understanding the behavioral asset pricing model (which includes human sentiment) and the traditional neoclassical pricing model (which excludes human sentiment) to find out which model better explains the pricing of an asset. The study looks into 35 large sample firms belonging to three different industries (healthcare, financial services and aviation and defense) and conducts an empirical analysis on the effect of the investors' sentiment measure on stock prices over a time period of 56 years, from 1950 to 2005. The paper is divided into the following chapters. Chapter I1 gives an overview of different of underlying opinions in behavioral finance and neoclassical finance. This includes different measurements of risk and return, models that incorporate market efficiency, psychological biases and information processing errors to which investors are prone, different sentiment indicators and a quantitative definition of the investor sentiment function. Chapter I11 presents a detailed description of how different financial theories on market efficiency and asset pricing have evolved over a period of time. The Evan Andersn, Eric Ghysels and Jennifer Juergens, "Do Heterogeneous Beliefs Matter for Asset Pricing?" The Review of Financial Studies, Vol. 1 8 , no. 3 (Autumn 2005): 902. CHAPTER I1 THEORY Both behavioral finance and neoclassical finance have different implications for asset pricing and the relationship between risk and return. Recent literature in financial economics has contradicted the notion of market efficiency and explained the influence of psychological biases on the behavior of an investor and the asset prices. It is necessary to delve into the fundamental theories of asset pricing - both neoclassical and behavioral - to better understand the linkage between investor sentiment and the asset prices. This chapter provides a comprehensive study of fundamental principles in the field of finance: models that represent market efficiency and behavioral theories related to information processing errors that lead to market inefficiency. It also explains in detail how modern asset pricing theory, built around the concept of a stochastic discount factor (SDF), can be extended to incorporate behavioral elements. Market Efficiency This section will discuss some significant theories in neoclassical finance that support the idea of rational investors, competitive markets and passive strategy. It explains in detail the theoretical arguments presented in support of market efficiency sequentially, particularly the models that depict the relationship between risk and return, It also sheds insight on some of the key elements of the efficient market hypothesis (EMH). The Capital Asset Pricing Model (CAPM) To better understand how assets are priced and valued, one must understand and consider the concept of the capital asset pricing model (CAPM). This model provides a precise prediction of the relationship between the risk of an asset and its expected return. It is built upon two basic assumptions: preference of investors and the nature of financial markets. First, investors consider trade-off between risk and return while allocating various investments between different assets for a specific period of time. They do not incur any transaction costs, such as commissions, service charges and taxes and have access to unlimited borrowing or lending opportunities. Second, the market consists of several investors who cannot affect prices by their individual trades and who analyze securities in the same way.' These assumptions facilitate the study of market equilibrium that can be mathematically expressed as: E( r,) - rf = A*D; (2.1) where E( rM) is the expected return of market portfolio, rf is the risk-free rate, A* is a scale factor representing the degree of risk aversion of the average investor and aM is the standard deviation of the return on the market portfolio.2 This equation shows that the risk premium on the market portfolio is directly proportional to the variance of the market portfolio and the investor's degree of risk aversion. One of the implications of CAPM is that all investors choose to hold the market portfolio (M), the tangency point of the capital market line (CML) and the efficient frontier (see Figure 2.1). Because each investor uses the market portfolio for the optimal risky portfolio, the capital allocation I Zvi Bodie, Alex Kane and Alan J. Marcus, Essentials of Investment: Capital Assel Pricing and Arbitrage Pricing Theory (New York: McGraw-HilliIrwin, 2008), 193. Bodie, Kane and Marcus, 194. FIGURE 2.1 THE EFFICIENT FRONTIER AND THE CAPITAL MARKET LINE E(r) = Expected return on market portfolio a,= Standard deviation of market portfolio SOURCE: Zvi Bodie, Alex Kane and Alan J. Marcus, Essentials of Investment: Capital Asset Pricing and Arbitrage Pricing Theoly (New York: McGraw-HillIIrwin, 2008), 195. TABLE 4.1 VARIABLE DEFINTIONS AND FORMULA Variable Definition PRI Price of a stock SI Investor Sentiment Index f(CEFD,S,TURN) GPGR Gross Profit Growth Rate Change in Gross Profit X 100 Initial Gross Profit LIA Current Ratio Total Current Assets Total Current Liabilities LEV Debt Ratio Total Debt Total Assets ROE Return on Equity Net Income Stockholders' Equity DIV Dividends per Share Total Dividends Average number of shares FCF Free Cash Flow to Equity FCF = Net Income - Net Capital Formula f(SI,GPGR,LIA,LEV,ROE,DIV,FCF) Expenditure - Change in Net Working Capital + New Debt - Debt Repayment Independent Variables The empirical model uses seven different independent variables: investor sentiment index (SI), gross profit growth rate (GPGR), current ratio (LIA), debt ratio (LEV), return on equity (ROE), dividends per share (DIV) and free cash flow to equity (FCF). These variables are discussed briefly in the following section. -22.62 1.11 195.17 1.23 FCF DIV 0.55 0.53 LEV 5.85 2324.42 0.70 0.85 -362.91 0.28 56 56 562.45 0.66 56 0.11 FCF DIV LEV 1.17 -1367.29 1.38 1.2 1 -210.35 1.35 1.78 8347.56 1.92 0.87 0.76 -14497.79 STATISTICAL SUMMARY FOR EACH INDUSTRY AND THE ENTIRE SAMPLE TABLE 4.2 0.23 3692.29 0.23 42 44 43 WORKS CONSULTED Abel, Andrew B. "An Exploration of the Effects of Pessimism and Doubt on Asset Returns." Journal ofEconomic Dynamics & Control 26, no. 7 (2002): 1075. Andersen, Torben M. "Some Implications of the Efficient Capital Market Hypothesis." Journal of Post Keynesian Economics 6, no. 2 (1 983): 28 1. Anderson, Evan W., Eric Ghysels and Jennifer L. Juergens. "Do Heterogeneous Beliefs Matter for Asset Pricing?" Review of Financial Studies 18, no. 3 (2005): 875-924. Arnott, Robert. "An Overwrought Orthodoxy." Institutional Investor 40, no. 12 (2006): 36-41. Baker, Malcolm and Jeffrey Wurgler. "Investor Sentiment and the Cross-Section of Stock Returns." CFA Digest 37, no. 1 (2007): 49-50. . "Investor Sentiment in the Stock Market." Journal of Economic Perspectives 21, no. 2 (2007): 129-151. . "The Equity Share in New Issues and Aggregate Stock Returns." Journal of Finance 55, no. 5 (2000): 2219-2257. Bakshi, Gurdip and Liuren Wu. "Investor Irrationality and the Nasdaq Bubble." Working Paper, University of Maryland (2006): 37. Barber, Brad M. and Terrance Odean. "Boys Will be Boys: Gender, Overconfidence, and Common Stock Investment." Quarterly Journal of Economics 116, no. 1 (2001): 26 1-292. Barberis, Nicholas, Andrei Shleifer and Robert Vishny. "A Model of Investor Sentiment." Journal of Financial Economics 49, no. 3 (1998): 307-343. Benartzi, Shlomo and Richard H. Thaler. "Myopic Loss Aversion and the Equity Premium Puzzle." Quarterly Journal of Economics 110, no. 1 (1995): 73. Block, Stanley B. and Geoffrey A. Hirt. Foundations ofFinancial Management. New York: McGraw-Hill/Irwin, 2008. Bodie, Zvi, Alex Kane and Alan J. Marcus. Essentials of Investment: Capital Asset Pricing and Arbitrage Pricing Theory. New York: McGraw-HillIIrwin, 2008. Brock, Wiliam, Josef Lakonishok and Blake LeBaron. "Simple Technical Trading Rules and the Stochastic Properties of Stock Returns." Journal of Finance 47, no. 5 (1992): 1731- 1764. Brock, William A. and Cars H. Hommes. "Heterogeneous Beliefs and Routes to Chaos in a Simple Asset Pricing Model." Journal of Economic Dynamics & Control 22, no. 8 (1998): 1235. Cochraine, John H. Asset Pricing. New Jersey: Princeton University Press, 2001. Coval, Joshua D. and Tyler Shumway. "Do Behavioral Biases Affect Prices?" Journal of Finance 60, no. 1 (2005): 1-34. Damodaran, Aswath. The Data Page. Stern School of Business, New York. Available online at: http://pages.stern,nyu.edu/-adamodar/New~Home~Page/data.html Daniel, Kent D., David Hirshleifer and Avanidhar Subrahmanyam. "Overconfidence, Arbitrage, and Equilibrium Asset Pricing." Journal of Finance 56, no. 3 (2001): 921965. De Bondt, Werner F. M, and Richard Thaler. "Does the Stock Market Overreact?" Journal o f Finance 40, no. 3 (1 985): 793-805. . "Betting on Trends: Intuitive Forecasts of Financial Risk and Return." International Journal of Forecasting 9, no. 3 (1993): 355-371. De Bondt, Werner, Gulnur Muradoglu, Hersh Shefrin and Sotiris K. Staikouras. "Behavioral Finance: Quo Vadis?" Journal of Applied Finance 18, no. 2 (2008): 721. De Long, J. Bradford, Andrei Shleifer, Lawrence H. Summers and Robert J. Waldmann. "Noise Trader Risk in Financial Markets." Journal of Political Economy 98, no. 4 (1990): 703. Dittmar, Robert F. "Nonlinear Pricing Kernels, Kurtosis Preference, and Evidence from the Cross Section of Equity Returns." Journal of Finance 57, no. 1 (2002): 369-403. Eastman, Byron D. Interpreting Mathematical Economics and Econometrics. New York: New York St. Martin's Press, 1984. Fair, Ray C. "The Estimation of Simultaneous Equation Models with Lagged Endogenous Variables and First Order ..." Econometrica 38, no. 3 (1 970): 507. Fama, Eugene F. "Efficient Capital Markets: a Review of Theory and Empirical Work." Journal ofFinance 25, no. 2 (1970): 383-417. Fama, Eugene F. and Kenneth R. French. "Common Risk Factors in the Returns on Stocks and Bonds." Journal ofFinancia1 Economics 33, no. 1 (1993): 3-56. . "The Cross-Section of Expected Stock Returns." Journal of Finance 47, no. 2 (1 992): 427-465. Jegadeesh, Narasimhan and Sheridan Titman. "Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency." Journal of Finance 48, no. 1 (1 993): 65-91. Jensen, Michael C. "Some Anomalous Evidence Regarding Market Efficiency." Journal o f Financial Economics 6, no. 2 (1 978): 95-1 01. Kahneman, Daniel and Amos Tversky. "Prospect Theory: An Analysis of Decision Under Risk." Econornetrica 47, no. 2 (1979): 263-291. Kaplanski, Guy and Haim Levy. "Sentiment and Stock Prices: The Case of Aviation Disasters." Journal of Financial Economics 95, no. 2 (2010): 174-201. Keynes, John M. The General Theory of Employment, Interest and Money. New York: Harcourt Brace, 1939. Koening, J. "Behavioral Finance: Examining Thought Processes for Better Investing." Trust and Investments 69 (1 999): 17-23. Krugrnan, Paul. "How did Economists Get it so Wrong?" The New York Times. Available online at: http://www.nytimes.com/2009/09/06/magazine/06Economic-t.html La Porta, Rafael. "Expectations and the Cross-Section of Stock Returns." Journal of Finance 51, no. 5 (1996): 1715-1742. Litzenberger, Robert H. and Krishna Ramaswamy. "The Effects of Dividends on Common Stock Prices Tax Effects or Information Effects?" Journal of Finance 37, no. 2 (1 982): 429-443. Long, J.S. and L.H. Ervin. "Correcting for Heteroscedasticity with Heteroscedasticity Consistent Standard Errors in the Linear Regression Model: Small Sample Considerations." Working Paper (1 998): 2. Markowitz, Henry. Portfolio Selection, Eficient Diversz~cationof Investments. New York: John Wiley and Sons, 1959. Miller, Merton H. and Franco Modigliani. "Dividend Policy, Growth and the Valuation of Shares." Journal of Business XXXIV (October 1961): 41 1-433. Navellier, Louis. The Little Book That Makes You Rich. Hoboken, NJ: John Wiley and Sons, 2007. Odean, Terrance. "Do Investors Trade Too Much?" American Economic Review 89, no. 5 (1 999): 1279-1298. Pindyck, Robert and Daniel Rubinfield. Econometric Models and Econometric Forecasts. Boston: Irwin McGraw-Hill, 1998. Poterba, James M. and Lawrence H. Summers. "Mean Reversion in Stock Prices: Evidence and Implications." Journal of Financial Economics 22, no. 1 (1988): 2759. Pradhan, Radhe Shyam. "Effects of Dividends on Common Stock Prices: The Nepalese Evidence." Research in Nepalese Finance (2003): 1- 13. Rosenberg, Joshua V. and Robert F. Engle. "Empirical Pricing Kernels." Journal of Financial Economics 64, no. 3 (2002): 341 -372. Shefi-in, Hersh. A Behavioral Approach to Asset Pricing. Boston: Elsevier Academic Press, 2005. . "Risk and Return in Behavioral Sdf-Based Asset Pricing Models." Journal of Investment Management 6, no. 4 (2008): 4-22. S h e h n , Hersh M. and Richard H. Thaler. "The Behavioral Life-Cycle Hypothesis." Economic inquiry 26, no. 4 (1988): 609. Shleifer, Andrei and Robert W. Vishny. "Contrarian investment." NBER Reporter (1995): 12. Somoye, Russell Olukayode Christopher, Ishola R. Akintoye and Jimoh E. Oseni. "Determinants of Equity Prices in the Stock Markets." International Research Journal of Finance and Economics 30 (2009): 178- 1 89. Statman, Meri. "Behavioral Finance." Contemporary Finance Digest 1 (Winter 1997): 522. Tobin, James. "Liquidity Preference as Behavior Towards Risk." Review of Economics Studies (February 1958): 65-86. Tsuji, Chikashi. "Does Investors1Sentiment Predict Stock Price Changes? With Analyses of Naive Extrapolation and the Salience Hypothesis in Japan." Applied Financial Economics Letters 2, no. 6 (2006): 353-359. Wooldridge, Jeffrey. Introductory Econometrics: A Modern Approach. Cincinnati, OH: South Western College Publishing, 2009.