PDF - Pinsent Masons

advertisement

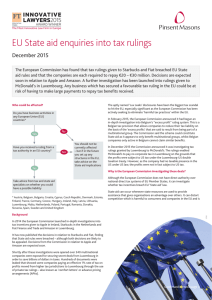

The Most Innovative Law Firm in Europe EU State aid enquiries: What Gulfbased businesses need to know November 2015 The European Commission has found that tax rulings given to Starbucks and Fiat breached EU State aid rules and that the companies are each required to repay €20 – €30 million. Decisions are expected soon in relation to Apple and Amazon. Any Gulf-owned business which has secured a favourable tax ruling in the EU could be at risk of having to make large payments to repay tax benefits received. Who could be affected? The aptly named ‘Lux Leaks’ disclosures have been the biggest tax scandal to hit the EU, especially significant as the European Commission has been actively seeking to eliminate ‘harmful tax practices’ within the EU. Do you have business activities in any European Union (EU) countries* Yes Have you received a ruling from a tax authority in an EU country? Yes No No You should not be currently affected – but if in the future you set up any structures in the EU, take advice on the State aid implications Take advice from tax and state aid specialists on whether you could have a possible liability * Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and United Kingdom Background In 2014 the European Commission launched in-depth investigations into tax incentives given to Apple in Ireland, Starbucks in the Netherlands and Fiat Finance and Trade and Amazon in Luxembourg. It has now published the decisions in relation to Starbucks and Fiat, finding that State aid rules were breached. Decisions from the Commission in relation to Apple and Amazon are expected soon. Shortly after these investigations were opened over 340 multinational companies were exposed for securing secret deals from Luxembourg in order to save billions of dollars in taxes. Hundreds of documents were leaked that showed some companies paying an effective 1% rate of tax on profits moved from higher tax jurisdictions to Luxembourg through the use of private tax rulings – also known as ‘comfort letters’ or advance pricing arrangements (APAs). In February 2015, the European Commission announced it had begun an in-depth investigation into Belgium’s “excess profit” ruling system. This is a Belgian tax provision that allows companies to reduce their tax liability on the basis of the ‘excess profits’ that are said to result from being part of a multinational group. The Commission said the scheme could constitute State aid as it appears to only benefit multinational groups, whilst Belgian companies only active in Belgium cannot claim similar benefits. Why is the European Commission investigating these deals? Although the European Commission does not have direct authority over national direct tax systems of EU Member States, it can investigate whether tax incentives breach EU ‘State aid’ law. State aid can occur whenever state resources are used to provide assistance that gives organisations an advantage over others. It can distort competition which is harmful to consumers and companies in the EU and is effectively a breach of EU law. A tax ruling can be seen to constitute an advantage as it effectively means a tax authority is waiving a right to collect taxes otherwise due. What are the implications of the investigation? It will not be a defence to a State aid enquiry that rulings have been a common arrangement, even though almost every major group will have used a Luxembourg finance ruling as part of its overall structure. The consequences are that companies may have to repay up to 10 years’ worth of tax benefits. A particularly worrying aspect of the Starbucks case is that the company appeared to have undertaken a full transfer pricing review and to have complied with the Netherlands’ long-established and internationally well-respected rulings process. The European Commission has undertaken to scrutinise the papers published as part of the ‘Lux Leaks’ disclosures meaning that hundreds of companies risk joining Apple, Starbucks, Fiat and Amazon under the microscope of a formal State aid investigation. 7925 Continued on next page > The Most Innovative Law Firm in Europe EU State aid enquiries: What Gulfbased businesses need to know November 2015 There could also be serious adverse publicity if a group becomes the subject of a formal investigation by the Commission. Such an investigation would result in the tax affairs and planning of the group being made public and could mean that company officials are named. It is likely to be particularly relevant to any group that has intellectual property, financing operations or group debt in the EU. Although all 28 Member States will be investigated, Luxembourg looks likely to remain a particular focus of the Commission’s investigations. The European Commission has extended its tax ruling probe to all 28 EU member states. The European Parliament has set up a special committee to look at tax ruling practices in EU member states, going back to 1 January 1991. Taking action now, before an approach by the Commission, could minimise a company’s liability and significantly reduce the risk of adverse publicity. What could have to be repaid? If a ruling is found to constitute unlawful State aid, the recipient could have to repay to the State in question the difference between the tax charged and the tax it would have paid without the ruling. Interest is also charged. The amounts to be repaid could be very substantial. For example Apple disclosed in a US Securities filing that the figure could be material and one analyst estimated the figure at $19bn. In repaying the aid no account is taken of the expenses a group has incurred in setting up in a particular state or region. A group can therefore be left seriously out of pocket as a result of a requirement to repay State aid. What does the future hold? Undoubtedly the days of being able to get very favourable rulings in EU States desperate to attract foreign investment are gone. All future investment in the EU needs to be checked to ensure it is State aid compliant and groups should carry out a ‘health-check’ on past investments. The EU is introducing automatic exchange of information on tax rulings between tax authorities every six months. It is aiming for a 1 January 2017 start date. There is no current proposal for making this information publicly available but this will be kept under review – and tax campaigners in Europe have been pushing for more and more publicly available information about the tax affairs of multinationals. What action should companies take? Companies whose effective tax rate in any EU country has been reduced by a ruling should consider the potential impact of the State aid challenge. With our local tax presence in the Gulf and the ability to call on our EU state aid experts, we are ideally placed to help clients understand the EU process as well as the potential tax issues. We can provide strategic risk mitigation advice as well as advising on alternative tax structures which are compliant with State aid law. For more information please contact: Ian Anderson Senior Consultant Tax Qatar and UAE T: +974 442 69210 M: +974 5586 2686 E: ian.anderson@pinsentmasons.com Jason Collins Partner Tax United Kingdom T: +44 (0)20 7054 2727 M: +44 (0)7790 909079 E: jason.collins@pinsentmasons.com Heather Self Partner (non-lawyer) Tax United Kingdom T: +44 (0)161 662 8066 M: +44 (0)7919 392006 E: heather.self@pinsentmasons.com Caroline Ramsay Senior Associate State Aid United Kingdom T: +44 (0)20 7054 2504 M: +44 (0)7860 607027 E: caroline.ramsay@pinsentmasons.com This note does not constitute legal advice. Specific legal advice should be taken before acting on any of the topics covered. Pinsent Masons LLP is a limited liability partnership registered in England & Wales (registered number: OC333653) authorised and regulated by the Solicitors Regulation Authority and the appropriate regulatory body in the other jurisdictions in which it operates. The word ‘partner’, used in relation to the LLP, refers to a member of the LLP or an employee or consultant of the LLP or any affiliated firm of equivalent standing. A list of the members of the LLP, and of those non-members who are designated as partners, is displayed at the LLP’s registered office: 30 Crown Place, London EC2A 4ES, United Kingdom. We use ‘Pinsent Masons’ to refer to Pinsent Masons LLP, its subsidiaries and any affiliates which it or its partners operate as separate businesses for regulatory or other reasons. Reference to ‘Pinsent Masons’ is to Pinsent Masons LLP and/or one or more of those subsidiaries or affiliates as the context requires. © Pinsent Masons LLP 2015. 7925 For a full list of our locations around the globe please visit our website: www.pinsentmasons.com