130744 - Queen Mary University of London

advertisement

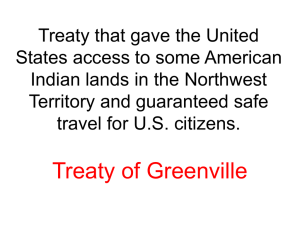

Queen Mary University of London International Tax Guest Lecture Some Treaty Issues for Developing Countries Heather Self, Pinsent Masons LLP 30 January 2014 Outline • • • • • History of Double Tax Agreements OECD and UN models How Developing Countries attract FDI How companies decide to invest Other specific issues Royal Commission on Taxation, 1920 Reasons to reject a principled approach to UK DTR: • tax systems and principles differ between countries • in relation to each country, winners would join but losers would stand aloof • practical difficulties would be enormous • the cost would be too great Evidence of Sir Josiah Stamp, as discussed by John F Avery Jones CBE Development of Treaties • • • • • • League of Nations Report 1923 UK/US Treaty 1945 First OECD model 1963 UN model (based on OECD model 1977) Current OECD model 1992, regularly updated BEPS process 2013 Source v Residence If State A is the state of Residence and State B the state of Source, then: • business income derived by a resident of State A will be taxed in State B if there is a PE there • State B may levy withholding taxes on dividends, interest and royalties paid to a resident of State A • State B may retain taxing rights on capital gains from land situated in State B State A will give relief for tax paid in State B by credit (global system) or exemption (territorial system) Current UK approach "We are taking action in three areas: first, to make the UK tax system more competitive to ensure it supports investment and growth; second, to clamp down on tax avoidance and aggressive tax planning; and third, to drive forward reform of the international tax framework.“ UK Government response to House of Lords Economic Affairs Committee Capital exporting countries v capital importing countries "It is useful to recall that in the digital tax debate, the EU is generally rather a source than a residence country. One therefore should realise that strengthening the taxing rights of the EU in the digital economy, may imply or trigger stronger taxing rights for source countries generally, with potential adverse consequence for the EU's entitlement to tax the revenues of the traditional economy.“ EU Commission Expert Group on Taxation of the Digital Economy, December 2013 OECD v UN Model Treaty The UN Model Treaty generally allocates greater taxing rights to the source country: • • • • • higher wht on dividends lower threshold for a PE sometimes wht on services source country taxation of royalties retain CGT taxing rights Treaty patterns in Less Developed Countries • • • • often based on original colonial influences unequal bargaining power lack of strategic planning OECD model often prevails Treaty network in sub-Saharan Africa Slide provided by Martin Hearson, LSE Case study – building a power station in Rwanda EUPower's bid proposal • • • • • why the project fits the group strategy risks benefits summary financial model recommendation The financial model • • • • key assumptions estimated profit and loss account for whole project calculate NPV stress testing Where does tax fit in? • • • • • • part of the model but NOT a critical factor prudent assumptions debt:equity mix? withholding taxes? exit routes? stability of tax system Why is stability important? BG Group warned future oil and gas exploration projects in the North Sea would be put on hold following a controversial windfall tax on offshore producers. "Because the UK fiscal burden has increased, you wouldn't be surprised to hear that (North Sea) projects have moved further down our order of priorities. As far as the UK is concerned, this is the third change to the fiscal regime in a relatively short period. "Ours is an industry where very substantial investments are made in order to produce returns over a long period. But we are concerned about the volatility of the British fiscal environment." The Guardian, Tuesday 10 May 2011 Tax and investment decisions • • • • Tax is part of the picture but does not drive the project Stability is crucial: otherwise risk will be priced in Capital may be a scarce resource What other projects are available? Rwandan Government's perspective Key objective is to get a vital piece of infrastructure built at lowest cost • • • • • should tax incentives be offered? will this investment be a catalyst for other FDI? would a DTA signal stability? how should risks and rewards be shared? is Rwanda competing with neighbouring states? The Prisoner's Dilemma Positive or neutral aspects of a DTA • • • • a signal of stability retain full taxing rights over local profits some withholding tax income from passive sources dispute resolution processes NB local system needs to be robust, with clear antiavoidance rules Key features for DTA strategic approach • what best serves the local interest? • should neighbouring countries co-operate? • should OECD members accept higher source taxation? Other specific issues • • • • the use of holding companies capital gains (Vodafone India) withholding taxes on services cancellation of treaties Why use an intermediate holding company? • • • • • administrative convenience robust local law local Treaty network how much substance? commercial choice or Treaty-shopping? Deloitte advised big business on how to avoid tax in some of the poorest countries in Africa, ActionAid report reveals 03 November 2013 One of the world’s Big Four accountancy firms, Deloitte, offered advice to large companies on how to avoid potentially hundreds of millions of dollars of tax in some of the poorest countries in the world, according to an ActionAid investigation released today. ActionAid has uncovered a Deloitte document called ‘Investing in Africa through Mauritius' which details how tax can be avoided in African countries by structuring business through Mauritius. The strategy, which is entirely legal, could potentially be used to deprive African countries of vitally needed tax revenue. Vodafone India dispute H Gp V Gp Sale of shares Cayman India VNL Vodafone India dispute • Indian law: nonresidents subject to wht on gains from Indian capital assets • Vodafone: gain on sale of a Cayman asset • India: gain on indirect sale of Indian asset Vodafone won in Supreme Court in 2012, but retrospective law (back to 1962) then proposed by Indian Government. Tullow Tanzania dispute – withholding tax on services • Tullow operated in Tanzania and paid tax on profits • Seismic data analysis by Irish and South African suppliers • assessed to wht: did payments have a source in Tanzania? • assessment on Tullow: no discussion of PE issues for supplier "Tullow Tanzania BV was the provider of employment to the professionals involved in the work for which payment was made and to the extent that fee was generated by employment service in Tanzania it was therefore subject to withholding tax." Tax avoidance – Developing countries take on multinationals Zambia and Mongolia have told the BBC they want to stop mining companies shifting profits out of their countries before they can be taxed. The speaker of the Mongolian Parliament, Mr Z. Enkhbold, told the BBC that Mongolia is cancelling international tax treaties which mining companies had intended to use to take profits from their Mongolian operations tax free. "Tax must be paid where the real business is located," Mr Enkhbold told the BBC, "not in offshore countries". BBC News, 24 May 2013 Conclusions • Tax is part of investment decisions, but usually not the key factor • Stability is very important (and underestimated) • LDCs should think strategically about their DTA priorities • Co-operation with neighbouring states may be better than competition • Holding companies should be respected, within agreed Treaty framework • Could BEPS provide an opportunity to improve DTAs for developing countries? Pinsent Masons LLP is a limited liability partnership registered in England & Wales (registered number: OC333653) authorised and regulated by the Solicitors Regulation Authority, and by the appropriate regulatory body in the other jurisdictions in which it operates. The word ‘partner’, used in relation to the LLP, refers to a member of the LLP or an employee or consultant of the LLP or any affiliated firm of equivalent standing. A list of the members of the LLP, and of those non-members who are designated as partners, is displayed at the LLP’s registered office: 30 Crown Place, London EC2A 4ES, United Kingdom. We use ‘Pinsent Masons’ to refer to Pinsent Masons LLP and affiliated entities that practise under the name ‘Pinsent Masons’ or a name that incorporates those words. Reference to ‘Pinsent Masons’ is to Pinsent Masons LLP and/or one or more of those affiliated entities as the context requires. © Pinsent Masons LLP 2013 For a full list of our locations around the globe please visit our websites: www.pinsentmasons.com www.Out-Law.com