INTRODUCTION

advertisement

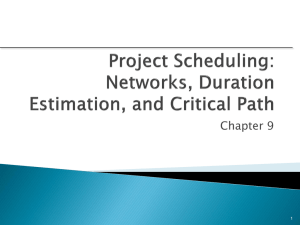

THE INVERTED U-SHAPED RELATIONSHIP BETWEEN BUSINESS UNITS’ SLACK AND PERFORMANCE: THE CASE OF INDONESIA1 Fuad, Diponegoro University, Indonesia fuad@undip.ac.id ABSTRACT This study reconciles the positive and negative views of behavioral theory of the firm and economists regarding slack. This study tested the non-linear effect of business units’ slack to its performance outcome on 135 manufacturing business units in Indonesia. Using nonmonotonic structural equations modeling, the study showed that corporate diversification positively affects the budgetary slack while it provides little evidence for the significant effect on financial slack. The study also indicated that both the financial and budgetary slack increased the financial and non-financial performance at some “peak” levels, and beyond them, they would hurt the business units performance. Keywords: financial slack, budgetary slack, financial and non financial performance INTRODUCTION Slack that is defined as the excess of resources above the necessary minimum to produce a given level of organizational output has been an important and intriguing domain in management accounting literature. Particularly it is because of the opposing theoretical streams among economists and behavioral accountants on the true role of slack that have led confusions among the researchers to justify the conclusive, robust findings. Accounting “behaviorists” for instance, have evoked the use of idle resources that may act as a buffer from environmental pressures (Lin et al. 2008, Patzelt et al. 2008, Geiger & Makri 2006, George 2008, Stede, 2000; 2001a; Cyert & March, 1963), or as a shock absorber (Merchant 1985), and as a buffer to engage in risk taking/innovative behavior (Yang et al. 2009, Herold et al., 2006; Love & Nohria, 2005). These “idle resources” are, therefore, important in providing organizations capabilities to act in ways that are not possible for other organizations poorer in resources (Nohria & Gulati, 1996). George (2005) maintained that the presence of slack can be used as an enactment of strategies. Lawson (2001) urged that attempts to reduce slack may be ill-advised; and in a more provoking position, Martinez and Artz (2006) even argued that “it is not possible for a firm to survive long without the presence of resources above and beyond its immediate needs” (p.12) On the other hand, economists such as Jensen (1986; 1993) and Jensen and Meckling (1986) argued that slack reduces incentives to innovate and promotes undisciplined investment in R&D activities. They further argued that this slack creation rarely yield economic benefits and reflects the self-serving interest of managers. Bourgeois (1981) and Yasai-Ardekani (1986) documented that slack promotes the creation of suboptimal systems, processes, and structures that reduce a firm’s aggressive explorations of new responses (e.g. innovation, 1 The paper is funded by Indonesian Higher Degree General Directorate, Ministry of Education, Indonesia , under scheme No 238/E5/LL/2011 1 creativity). In fact, as been noted by Cheng and Kesner (1997), the term slack itself conjures up a host of negative perceptions. This study is not going to pick either side of this debate, but rather this study aims to provide a way out of this intractable debate by reconciling the views of economists and accountants. Particularly, this study proposes that there is a “curse” and at the same, “bless” for both approaches. In simpler words, current study maintains that there is an inverted U-shaped between slack and performance, in which the relationship is positive and may turn to negative when the extent of slack reaches its optimum peak. Although the positive and negative impact of slack have been recognized in the literature, few research in management accounting has attempted to test whether slack is good or bad for business units performance. Bourgeois (1981), trying to reconcile economists and behaviorists, postulated a curvilinear relationship between slack and organizational performance in general. Recent studies by Nohria and Gulati (1996), Geiger and Cashen (2002) and Herold et al. (2006) have extended the non-linear argument between slack and R&D intensity. They argued that R&D activities cannot be carried out without any slack available; and on the other hand, too much slack may deteriorate the R&D due to wasted spending and careless innovation projects. Furthermore, this study believes that lack of interpretable results between slack and its outcome may not be looked on the relationships, per se. but the focus of the study must also be directed to the slack conceptualization that we believe, is the source of those intractable, unsolved debate. Slack creation, that can be traced back to the behavioral theory of the firm (see seminal works of Cyert and March, 1963 and Bourgeois, 1980) is a multi-dimensional construct, and not as observed variable that can be traced directly to the budgeting process of a firm. The use of subjective measures per se raises some question about the accuracy in measuring budgetary slack. Organizational theorists (e.g. Bourgeouis, 1981; Cyert & March, 1963) proposed objective measures of slack in organization that rarely put into considerations in management accounting research, despite its flourishing use of its conceptualizations. Such objective measures were usually operationalized using financial indicators of slack such as absorbed and unabsorbed slack (Singh, 1986) and available (Ahuja, 2000, Combs & Ketchen, 1999), recoverable (Steensma & Corley, 2000) and potential slack (Simerly & Li, 2000, see also Daniel et al., 2004 for a meta analysis). Therefore, in order to provide a more meaningful result, this study looks at slack from the objective and subjective measures. Therefore, this study aims to examine the non-linear pattern of multidimensional construct of organizational slack to its performance outcome. As a consequence, this study also contributes to the wide-array of accounting literature in several ways. First, this study is among the first to test the non-linear attributes regarding the relationship between slack and performance, in their higher order terms (multi-dimensional constructs). Second, this study provides a way out of the intractable debate between behaviorists and economists by reconciling those views. In particular, this study insists that there is “curse” in both “too few slack” and “too much slack”. For instance, too few slack may inhibit the business units to flexibly engage in their activities because there is no room to make maneuvers (as there is no idle resource). On the other hand, too much slack reveals inefficiency and pursues the business units to make insufficient, pet projects that may not yield economic benefits to the organizations. 2 This study is decomposed into several sections. The next part of this study explains in detail the literature review and hypotheses developments, while the methodology of the study is explained in the third part. The fourth and fifth parts of the study elaborate the findings and discussion, while the conclusion, limitations and avenues for further research are discussed in the last section. LITERATURE REVIEW AND HYPOTHESES DEVELOPMENT Nature of Organizational Slack The leading view of financial (organizational) slack used in the literature is one based on Cyert and March (1963), in their seminal work entitled A Behavioral Theory of the Firm. They are credited and cited most often for their preconceived ideas on organizational slack. Their impressive essence conceptualization of slack was excess of payments over the minimum necessary required to maintain the organization that took an additional idea which is so-called “reserved resources”. Thus, it is likely that members of the organization may have a different resource needs and different slack requirement depending upon environmental favorableness. Cyert and March (1963) suggest the need for slack as a buffer by proposing that …it seems to be useful in dealing with the adjustment of firms to gross shifts in the external environment…When the environment becomes less favorable, organizational slack represents a cushion. Resource scarcity brings on renewed bargaining and tends to cut heavily into the excess payments introduced during plush times…the cushion provided by organizational slack permits firms to survive in the face of adversity. (pp. 37-38) A great deal of authors have then defined slack into diverse conceptualizations (kindly compare the works of Nohria & Gulati, 1996; George, 2005; Chattopadyay, 2001; Love & Nohria, 2005; Martinez & Artz, 2006, among others). These various conceptualizations also lead to the conflicting stands regarding the benefits and disadvantages of having slack in an organization (refer to table 1) 3 Table 1: Positive and negative impacts of organizational slack. Positive impacts of organizational slack 1. enhance the fit between strategy and structure (George 2005) 2. influences ability of a firm to adapt to its environment (Bourgeois, 1981; Miller et. 1996) facilitates innovation (Cyert & March, 1963; Herold et al. 2006, Martinez & Artz 2006; Nohria & Gulati 1995) Encourages increased risk-taking (Martinez & Artz, 2006; Singh 1986) Facilitates creative strategic behavior (Bourgeois 1981; McGratch & macMillan, 2000; George 2005) Encourages experimentation (Bourgeois 1981) 3. 4. 5. 6. 7. 8. Negative impacts of organizational slack 1. reflects organizational inefficiency (Bourgeois, 1981; Jensen and Meckling 1978) 2. encourages a lack of discipline 3. Diminishes incentives to innovate (Jensen 1986) 4. enhancing the non-optimizing behavior (Bourgeois 1981, Jensen & Meckling 1978) 5. Loosen the management control systems (Davis & Stout 1992) 6. leads to wasted resources and careless spending (McGrath & MacMillan 2000) Encourages increased risk-taking (Singh 1986) Supports exploitation of opportunities (Bourgeois 1981) Financial Slack Slack resources can be measured using several financial indicators. Most prior researches differentiate slack into three main typologies; which are available, recoverable, and potential slack resources (Bourgeois, 1981; Bourgeois & Singh, 1983; Sharfman et al, 1988; Singh, 1986). Available slack (that can also be referred as unobserved slack) describes the resources that are available but not yet committed for any particular allocation such as the funding for innovation activities or dividend payments to shareholders (Martinez & Artz, 2006). Recoverable slack (as it is sometimes referred as absorbed slack) represents resources that have been allocated and absorbed by the organization but can be easily recovered through cost-cutting and efficiency. One example of recoverable slack is the overhead costs for executive salary. Nevertheless, as pointed out by Herold et al. (2006) and Hendrick (2006), although recoverable slack is theoretically easy to recover, but in practice the recovery could be difficult and may bring out some strong negative consequences. Potential slack on the other hand is simply conceptualized as the organization’s future capability to earn resources. Usually potential slack is basically operationalized as the extent of equity capital owned by the company. 4 The presence of slack has been linked to the idle capacity of the firms. As company resources increase, the presence of slack in organization also increases, but in a faster rate (e.g. Cyert & March 1963). In contrary, when the company resources decrease, organizational slack decreases, also at a faster rate. The financial mechanism of slack over time is a function of sales growth, profitability, situational and behavioral factors. Leavins (1995) postulated that the slack in the highly performing firms inherently tend to increase, but firms can find many alternative ways to reduce the costs if they are forced to do so. This relationship was modeled by Wolf (1971) as: E SGE 0, 0, R E and E SGE R R E SGE 0, 0, R R and E SGE R R Use of resources in a slack building state Use of resources in a slack reduction state E indicates the change on profit on time t and t-1 while ΔR denotes the change on revenue, while ΔSGE denotes the change on selling and general expenses. The models obviously evoke the question why firms have lower change of profit while on the profitable situation, and they still can operate normally and earn above-average profit even in a very fierce situation, as is the case of some organizations in the crisis period. Budgetary Slack Earlier work defined budgetary slack as the result of management’s consciousness and intentional behavior during the budgetary process as an outcome of rigid budgetary evaluation (Schiff and Lewin 1968). Recently, Douglas et al. (2007) defined budgetary slack as the variances of actual spending and budgeted spending and the difference between the expected and actual performance. Garrison et al. (2006) proposed budgetary slack as the consequence of self-imposed budget which might result in inefficiency and waste. On the other hand, Yuen (2004) conceptualized budgetary slack as the building of excess resources in a budget or understating productive capability and thus will make the budget easier to attain. Douglas and Wier (2000) claimed that budgetary biasing behavior is the difference between planned performance target and real performance capabilities. Leavin et al. (1995) insisted that budgetary slack exist due to the results of management conscious and intentional behavior during the budgetary process. The non-linear relationship between slack and performance Organizational slack which is the available resources above immediate, required needs is one possible source of funding for many activities. Therefore, several researchers have linked the needs of slack for innovation-lead performance activities. Nohria and Gulati (1996) insisted 5 that slack may increase the undisciplined investment and thereby deteriorating the innovation activities. A behavioral theory of the firm would maintain that slack to have some positive impacts on performance in several ways (Cyert & March, 1963; Bourgeois, 1981). First, the presence of slack may loosen the managerial controls rigidity of a particular organization (Cyert & March, 1963), allowing manages to embark on discretionary steps in pursuing new projects (Geiger & Makri, 2006). Second, the slack resources can be consumed during bad times and thus becoming less vulnerable to the uncertainty of experimental projects and thereby increasing the innovative cultures (Nohria & Gulati, 1996). Members of the organization are also less likely to worry about the risk of failure in embarking a particular project because they have resources as a buffer against the failure (Geiger & Makri, 2006). On the other hand, slack has been argued to have some negative impacts on performance as the managers may utilize the slack resources for less risky activities thereby may decrease the experimentation and innovation activities (Denis et al., 1999; Jensen, 1986). Agency perspective also warned the use of slack not as to foster experimentation and innovation, rather as a resource to maximize their own personal wealth or interests. On the other hand, XEfficiency theory of Leibenstein (1978) view slack as wasteful and incompetence of business units. These two views of theories would maintain that slack should be reduced and if possible eliminated. Reconciling the behavioral theory of the firm and economics, it is interesting to note that slack can be a blessing and a curse, implying the presence of curvilinear relationship between slack and performance. The advocates of slack (a behavioral theory of the firm) maintained that slack as a resource facilitating proactive strategic actions and thereby increasing performance (Daniel et al., 2004). In contrary, those who assume slack as idle resources denotes for inefficiency (X-Efficiency (Leibenstein, 1966; theory of the firm of Jensen & Meckling, 1978) and diminish long term organizational performance. This inefficiency paradigm also posits that slack can encourage satisfying or self-serving behavior that hurt performance. For instance, Jensen and Meckling (1978) and Jensen (1986) maintained that the presence of excess resources may enhance the managers tendency to pursue self-serving projects. It is therefore, interesting to figure out whether there is a “curse” in both the economics and behavioral perspectives. In this vein, organization must have excess resources to absorb for the unforeseen contingencies but not too much so that preventing the self-serving behavior of the managers.. Therefore, this study predicts that the relationship between slack and performance is inverted U-Shaped. METHODOLOGY The population frames of current study, where the source of data were gathered, were from several sources. Corporate parents’ annual reports and Indonesian Capital Market Directory (ICMD) 2006 & 2007 were used to identify the number of business units being controlled and firms-specific financial attributes. ICMD periodically published a concise public firm’s financial statements. Firm’s annual reports were then utilized to identify the business units. Another set of directory that was used in this study is Indonesian Manufacturing Industry Directory (IMID) that is issued periodically. This directory was useful in identifying 6 addresses, primary products and employment of business units. The total manufacturing companies per December 2006 is 20,890 companies. In order to ensure the validity of the findings, the study restricts the sampling procedure into a subsidiary of a corporate with a 50% ownership minimum and must at least own two subsidiaries. Therefore, this study was conducted at the business units’ level in order to understand the ways, effectiveness and appropriateness of control and monitoring activities placed by the corporate parents. The cover letter involving questionnaires were sent via mail (in stamped addressed envelope) directly to the top and middle level manager in a respective business unit since they are the ones that have considerable contact with the corporate. The cover letters also assured that there would be no responses attributed to any individual or business unit, and only statistical, summary data from the total responses from several business units would be published. The questionnaires were developed using 6 item Liker scale. The use of six items Likert scale has been commonly employed in social sciences and in fact, may result in greater efficiency and reliability (Chang 1994). A study conducted by Infosurv (2006) and CICIES (2007) indicates that some respondents prefer the 6-items Likert Scale because the respondents have to commit to either positive or negative values, without any neutral point. Operationalization of Variables Organizational Slack Business units’ slack, in this study, is conceptualized as the excess of actual or potential resources that could assist the organization to absorb the environmental pressures and shocks (Bourgeouis, 1980). This variable is a multidimensional constructs consist of two dimensions: financial (business units’ slack and budgetary slack). Financial slack represents the extent to which the organizations have the access to the resources to be further utilized during unexpected shocks or take immediate actions for the emergent opportunities (Martinez & Artz, 2006). With regard to this financial slack, agreement has been reached pertaining to its operationalizations. Usually, it consists of available slack, potential slack and recoverable slack. For these variables, two steps were employed. The study use archival, objective measures of business units slack generated from annually financial statements and/or annual report. If these data were not available, survey method will be conducted. Business units managers will be asked to indicate the amount of slack (proxied by several financial ratios) in their business units. If both data are available, objective measures will be used since there is no social obligation from managers to report good results thereby increasing the validity of the data. Financial slack is measured using three indicators: 1) available slack that is determined according to current ratio (i.e. current assets/current liabilities) which a reflection of organizations’ resources availability on terms of liquid assets that can be used as a buffer from the negative implications of environmental shocks (Herold et al., 2006). Current assets in this study are simply defined as the assets that can be easily converted into cash within a short time. It consists of cash, marketable securities, receivables, inventories and other short term assets. Current reliabilities on the other hand is the financial obligations that have to be settled within a short period of time. 2) potential slack, that is defined as the firm’s ability to 7 have new capital resources through debt borrowings (Martinez & Artz, 2006). Following Palich et al. (2000) and Simerly and Li (2000) suggestions, this study measures potential slack as debt-equity ratio. 3) recoverable slack, that is also known as absorbed slack, is the extent to which resources are embedded in firms as excess costs but could be recovered through when firms experience financial difficulty (Singh, 1986). Following Geiger and Makri (2006), recoverable slack is measured by selling, general and administrative expenses divided by sales. Budgetary slack, on the other hand, is defined as manager’s likelihood to set the budgets lower by underestimating the budgeted revenues and overestimating the budgeted costs so that the budget targets becomes easier to achieve. (Lukka, 1988). This variable was measured by Dunk (1993) and Stede’s (2000; 2001) measurement consists of 5 items (items 1-4, using 6 items Likert’s scale from strongly disagree to strongly agree, and item 5 is fully anchored question asking whether the budget is very easy to attain until impossible to attain). Following Stede (2001, p. 41), the questionnaires include: 1. Succeed to submit budgets that are easily attainable; 2. Budget target induce high productivity in my business unit (reverse coded); 3. Budget target requires cost to be managed carefully in my business unit; 4. Budget target have not caused me to be particularly concerned with improving efficiency in my business unit; and 5. a fully anchored question: “My Business unit budget is…” from very easy to attain to impossible to attain Performance Current study adopted two widely used of financial performance, which are Return on Assets, Return on Equity, operating profit and sales growth. Moreover, subjective measures of business unit performance were also employed. Using financial, objective measures of performance will increase the likelihood the presence of 1 or more year lag relationship between slack and performance. For instance, slack resources may not affect the performance on its current year, but it probably affects performance on its 1 or more year a head. While subjective, non-quantitative measures of performance are created using the measurements of Birkinshaw et al. (2005). In this vein, the performance of business units managers are evaluated, relative to other business units, on the basis of their productivity, quality, supplier relationships, labor costs, productivity improvements, technology and customer development on a six point scale, ranging from 1=significantly worse than competitors, and 6 = significantly better than competitors. Data Analyses Structural Equation Modeling (SEM) was employed in this study for several reasons. First, SEM allows the analysis of multiple relationships simultaneously that cannot be conducted by other conventional multiple regressions analyses. Thus, SEM accounts for the presence of structural errors. Ignoring these errors may lead to the specification errors affecting validity of the results. Second, SEM provides measures of overall model fit. These measures were important to figure whether the model is acceptable given a particular data. Third, and most importantly, SEM explains the significance of each relationship between the variables hypothesized. SEM also allows for testing the indirect effects between variables. Fourth, unlike regression models and path analysis, SEM may account for the effects of measurement errors in multi-item variables (constructs). Since constructs were measured using multiple indicators, it is unreasonable to assume that these constructs are error-free, and instead, there are potential errors in those indicators. 8 In testing the non-monotonic relationship of the hypothesis, this study adopts an approach suggested by Ping (2004, 1995) and Cohen et al. (2003) involving two steps. In the first step, the measurement model is evaluated by Confirmatory Factor Analysis. The measurement model assessed whether all items in a given scale represented the same latent factor. Second, the structural model then examined to ensure whether the variables hypothesized were fit. On the next step, an estimation technique is proposed for quadratic latent variables in structural equation modeling specifying these quadratic latent variables with a single indicator (Ghozali & Fuad, 2004). With regard to this single indicator approach, the quadratic product (x:x) of slack is specified as [x1 + x2 + … + xn]2. The loadings (λx:x) are given by [λx1 + λx2 + …+ λn]2 and measurement errors (θx:x) are fixed by [4(λx1 + λx2 + …+ λn)2. VAR(X). (θε.x1 + θε.x2 + … + θε.xn). As been suggested by Anderson and Gerbing (1988), use of a measurement model must be separated from model structure issues. Therefore, besides using the measurement model to ensure unidimensionality of the constructs, parameter estimates from a linear-term measurement model can be used to compute the values of λx:x and θx:x (fixed loadings and fixed errors, respectively). This approach may eliminate the substantial differences in the estimated parameters of measurement models and structural models (Ping, 1995). 9 ε1 x1 ε2 x2 ε3 x3 ζ1 x4 ε5 x5 ε6 ε7 η1 Bus.Unit Slack Prfrmance x8 y2 y2 y3 y3 y4 y4 y5 Y5 y6 y6 y7 y7 y8 y8 y9 y9 N.F.P FIN.SLK ξ2 ε8 F.P. ζ3 x6 x7 y1 BUDSLK ξ1 ε4 y1 ζ4 ζ2 ζ5 η2 1 1 y10 y10 y11 y11 Figure 1: the structural model of second order performance outcome of business units’ slack. 10 This model is estimated using this polynomial technique by (1) estimating the measurement model parameters, (2) calculating the equations above to generate the loading (λx:x) and error variances (θx:x) for the quadratic latent variable, and (3) estimating the structural model with the fixed values of λx:x and θx:x. This method employed Linear Structural Relationship using Maximum Likelihood approach. This procedure requires mean-centered indicators for both exogenous and endogenous latent variables, which is created by subtracting the indicator’s mean with its each value in the data set per case (i.e. [xi - µx]; where xi denotes for observation i-th of x manifest variables and µx denotes for mean of a particular manifest variable x). the model fit was tested by several indices. Table 2 portrays important indices and their respective cut-offs. RESULTS The profile of business units are clearly portrayed in table 5.6. Business units with public-listed corporate parent comprise 55% of the sample while the remaining 45% are business units with non-public listed corporate parent. Regarding the size of the firm (in terms of average sales), sixty seven business units are considered large as they earn more than Rp 10 billion on sales, fifty one are considered medium as they make Rp.5-10 billion sales while seventeen are regard as small since their average sales are less than Rp 5 billion. Regarding the types of the business units, seventy five business units are local based-company seeing that their products are aimed for local markets, while sixty business units are multi-national company. Regarding the business units tenure, eighty one business units have been in operation for more than ten years, while fifty three business units have been in operation for 6-10 years. Pertaining to the production type, fifty one business units engage in food and beverages industry, thirty one in textile mill products, twenty nine in lumber and wood products, and twenty three business units enroll in chemical and allied products. Regarding the focus of their market, forty five business units focus on local market and twenty one business units focus on export market. Sixty nine business units focus on both local and export market. All of the respondents reveal that they are involved in the budgeting process, but only sixty nine of one hundred thirty five receive full autonomy from the corporate parent, while the remaining sixty six business units hold no/partial autonomy. 11 Table 2: Business units’ characteristics. Frequency Percent Corporate Status - Public Listed - Non-public listed 74 61 54.8 45.2 Type of Business Units - Local based Company - Multi-national Company 75 60 55.6 44.4 Business Units Tenure - 1-5 years - 6-10 years - More than 10 years 1 53 81 0.07 39.3 60 51 31 29 37.8 23 21.5 23 17 1 0.07 Type of Products - Consumer products - Industrial products - Both or others 77 52 6 57 38.5 4.4 Autonomy - Full Autonomy - Partial/No autonomy 69 66 48.9 51.1 Production Type - Food and Beverage - Textile Mill Products - Lumber and Wood Products - Chemical and Allied Products - Others The result of Confirmatory Factor Analysis (CFA) in the first step is conducted in order to calculate the fixed loadings and error variances for the second step are portrayed in table 3. The results below did not used for measurement models testing. Rather, this step is conducted in order to uncover the fixed and constrained values for the single indicator of quadratic latent variables of financial and budgetary slack. 12 Table 3: First step of Ping (2004) approach in non-linear Structural Equations Modeling. Items BUDSLK1 BUDSLK2 BUDSLK3 BUDSLK4 BUDSLK5 CRT DERT SLEXT Loading 0.39 0.55 0.38 0.39 0.40 0.21 -0.31 0.38 Errors 0.84 0.69 0.85 0.85 0.84 0.96 0.90 0.86 R2 0.16 0.31 0.15 0.15 0.16 0.04 0.1 0.14 Applying the generated loadings to [λx1 + λx2 + …+ λn]2 yield the constrained loadings for budgetary slack of 2.01 and financial slack of 0.1296. Furthermore, applying the generated error variances to [4(λx1 + λx2 + …+ λn)2. VAR(X). (θε.x1 + θε.x2 + … + θε.xn) yield constrained error variance about 73.528 for budgetary slack and 1.399 for financial slack. Thus, the measurement model for non-linear outcome performance equation is: x1 x1.1 x 2 x 2.1 x3 x 3.1 x 4 x 4.1 x5 x 5.1 x6 0 x7 0 x8 0 x 0 9 x10 0 0 0 0 0 0 y1.2 y 2.2 y 3.2 0 0 1 2 3 0 0 0 0 1 4 0 0 2 0 0 3 6 0 0 4 7 0 0 8 73.528 4.4944 0 0 0.1296 1.399 0 0 0 0 The constrained error variances and loadings generated then used to calculate the nonmonotonic relationships hypothesized in this study. The results are depicted in table 4. The results indicate that there is an inverted U-shaped () relationship between financial slack and financial performance ( = -0.027, t = -6.90). However, the proposed inverted relationship between financial slack and non-financial performance cannot be accepted ( = -0.0035, t = 1.18). 13 Table 4: Results of Non-linear Structural Equations Modelings. The Effect of… Financial Slack Budgetary Slack Financial Slack2 Budgetary Slack2 Financial Slack Budgetary Slack Financial Slack2 Budgetary Slack2 To… Financial Performance Financial Performance Financial Performance Financial Performance Non-Financial Performance Non-Financial Performance Non-Financial Performance Non-Financial Performance Estimates 0.73 -0.25 -0.034 0.0082 0.28 0.52 -0.0043 -0.0061 t-values 7.37* -2.45* -6.96* 1.02 3.84* 6.39* -1.15 -7.90* Interestingly, this study found that there is no quadratic effect of budgetary slack to financial performance ( = 0.002, t = 1.10), but hinted the presence of non-linear relationship () between budgetary slack and non-financial performance ( = -0.013, t = -7.90). The results can also be elaborated to figure-out the optimum level of slack. For instance, the results above indicate that there is a non-linear relationship between financial slack and financial performance. For a simple non linear function of Y = b1 X + b2X2 +e, the maximum value of vertex (peak value of the parabolic graph) would be –b1/2b2. Kindly recall that the non-linear structural equation function is FP = 0.73*FS + -0.034*FP+0.28 therefore, the maximum value of the vertex would be = 0.73/(2*-0.034). The graph below visualizes the non linear relationship between financial slack and financial performance. Financial Performance 21 17 15 19 Financial Slack 13 11 9 7 5 3 Series1 1 4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 S1 Figure 1: The non-linear relationship between financial slack and financial performance. DISCUSSION This study cannot test the effect of higher order business units’ slack to higher order overall performance as the model did not fit well with the data. Rather, this study examines the nonmonotonic impacts of lower order exogenous variables of business units’ slack (e.g. financial and budgetary slack) to lower order endogenous variables of performance (e.g. financial and 14 non-financial performance). The acceptance or rejection of the hypothesis therefore, is based on this assumption. This study found that there is a non-monotonic relationship between financial slack and financial performance. In particular, this study found that the relationship between financial slack and financial-performance is inverted U-Shaped. It means that the relationship between financial slack and financial performance is positive, until it reaches the peak point and then turn to negative. Hence, it signifies that there is a “curse” in both very few financial slack and too much financial slack pertaining to its effect with financial performance. This non monotonic () relationship implicitly concurs with several arguments on the slackperformance relationships (Latham & Braun 2008; George, 2005; Tan and Peng, 2003; Nohria and Gulati, 1996). This finding substantiates the joint roles of behavioral theory of the firm as well as economist perspectives. The behavioral theory of the firm argues that slack as good and may increase the innovative ideas and to absorb the shock of environmental turbulent and thus may increase the firm’s financial performance. After some level, based upon the perspective of economist, too much slack may inhibit the innovative ideas as there is a great chance that the business units will be investing in pet-, non productive projects, and therefore may inhibit financial performance. However, it is interesting to figure out that the alternative hypothesis of the non-linear effect of financial slack to non-financial performance cannot be accepted. One main possible explanation for this failure is probably due to the presence of lag effect financial slack to non-financial performance. In particular, the presence of financial slack may not directly affect the nonfinancial performance in a timely manner, rather, it is plausible that the effect can only be seen within the next few years a head. Or simply stated, current financial slack may impinge on future non-financial performance (e.g. productivity, product quality, supplier relationship, productivity improvement, technology, customer development and labor cost). However, this speculation cannot be further tested as this study is cross-sectional in nature and such longitudinal data are very hard to attain. The use of objective, pure quantitative data may also be blamed for such a finding. Furthermore, the result of this study indicates the rejection of the alternative hypothesis regarding non-monotonic relationship between budgetary slack and financial performance. Rather, this study found the negative, linear effect of budgetary slack to financial performance. Several arguments are offered regarding the non-acceptance of non-linear effects of budgetary slack ton financial performance and acceptance of negative linear effect of budgetary slack to financial performance. First, the sample of this study is the business units that are held accountable on terms of the cost spent and revenues generated, or simply stated the samples were profit centers of the corporate parents. With this regards, the slack creation during the budgeting process implicitly means the flexibility, innovativeness and creativeness that are transformed into operating actions that shall yield in short-term profit or performance. Indeed, there is a possibility that the positive effects of budgetary slack to financial performance may not be exist in the long-run, as they may in fact impair the long-term profitability. Nevertheless, this argument cannot be further tested in this particular finding as longitudinal or pooled, cross-series study should play a major approach for this type of study. 15 Furthermore, as expected, this study found the presence of non-monotonic relationship between budgetary slack and non-financial performance. This finding indicate that slack creation during the budgeting process yields the intangible performance, but again, too much budgetary slack may in fact impair the stability of the firms’ particularly on terms of its intangible performance relative to business unit’s performance. This finding apparently solve the intractable debate between “behavioral accountants” (Stede 2000; 2001, Davis et al., 2006; among others) and the economists (so called “theorists of the firm” such as Jensen, 1986; Jensen & Meckling, 1976 among others) regarding the non (discretionary) use of budgetary slack to the performance. CONCLUSION The findings of these studies need to be considered in light of several limitations. First, the research was confined to a manufacturing industry in Indonesia, and thus generalizations to other industries should be used with extra cautions. It is very plausible that the pattern of relationships between the slack and performance may be different than those found in this study. In order to provide fruitful findings, as well as robust generalizations of the estimated parameters, further study should consider other industries, particularly in Indonesia. Martinez and Artz (2006), Hendrick (2006), Combs and Ketchen (1999), Hitt et al. (1991), and many others argued that slack requirement may be different among different industries, and thus the reasons and its outcome may be different from one industry to another. Second, it is necessary to acknowledge the limitation of cross sectional based survey research, as such this study design prevent any test on causal statement on the time series basis. Besides, slack creation can be an accumulation of several periods phenomenon. In particular, the slack creation may not affect the performance in the timely manner, but they may be transformed and require time period to show its real effect. For instance, slack may affect future performance, instead of current performance. With this regard, future research should also consider the time series properties of the data, particularly on the contextual variables affecting business units’ slack and slack outcome to performance. REFERENCES 1. Ahuja, G. (2000). Collaboration networks, structural holes, and innovation: a longitudinal study. Admnistrative Science Quarterly, 45, 425 2. Anderson, J. C., & Gerbing, D. W. (1988). Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin, 103 (3), 411-423 3. Birkinshaw, J., Hood, N., & Young, S. (2005). Subsidiary entrepreneurship, internal and external competitive forces, and subsidiary performance. International Business Review, 14, 227 4. Bourgeois, L.J. (1981). On the measurement of organizational slack. Academy of Management Review, 6, 29 5. Chang, L. (1994). A Psychometric Evaluation of 4-Point and 6-Point Likert-Type Scales in Relation to Reliability and Validity. Applied Psychological Measurement 18, (3), 205-215 6. Chattopadyay, P., Glick, W.H., and Huber, G.P. (2001). Organizational Actions in 16 Response to Threats and Opportunities. Academy of Management Journal 44(5), 20. 7. Cheng, J. L. and Kessner, I. (1997). Organizational slack and response to environmental shifts: The impact of resource allocation pattern. Journal of Management, 23, 1, 1-18 8. Cohen, J., Cohen, P., West, S.G. and Aiken, L.S. (2003). Applied multiple regression/correlation analysis for the behavioral sciences. New Jersey: Lawrence Erlbaum Associates 9. Combs, J. and Ketchen, D. (1999). Explaining interfirm cooperation and performance: toward a reconciliation of predictions from the resource based view and organizational economics. Strategic Management Journal, 20, 867-888 10. Cyert, R.M. & March, J.G. (1963). A behavioral theory of the firm. New Jersey: Prentice Hall 11. Daniel, F., Lohrke, F.T., Fornaciari, C.J., and Turner, A. T. (2004). Slack resources and firm performance: a meta analysis. Journal of Business Research, 57, 565-574 12. Davis, G.F. and Stout, S.K. (1992). Organization theory and the market for corporate control: a dynamic analysis of the characteristics of large takeover targets, 1980-1990. Admnistrative Science Quarterly, 37, 605-633 13. Denis, D.J., Denis, D.K., and Sarin, A.. (1999). Agency theory and the influence of equity ownership structure on corporate diversification strategies. Strategic Management Journal, 20, 1071-1076 14. Douglas, P.C., HassabElnaby, H., Norman, C.S., and Wier, B. (2007). An investigation of ethical position and budgeting systems: Egyptian managers in US and Egyptian firms. Journal of International Accounting, Auditing and Taxation. 16, 90-109 15. Dunk, A. S. (1993). The Effect of Budget Emphasis and Information Asymmetry on the Relation Between Budgetary Participation and Slack. The Accounting Review, 68, 2, 400-410. 16. Geiger, S. W., and Makri, M. (2006). Exploration and exploitation innovation processes: the role of organizational slack in R&D intensive firms. Journal of High Technology Management Research, 17, 97-108. 17. Geiger, S. W., and Cashen, L.H. (2002). A multidimensional examination of slack and its impact on innovation. Journal of Managerial Issues, 14, 1, 68-84. 18. George, G. (2005). Slack Resources and the Performance of Privately Held Firms. Academy of Management Journal, 48(4), 17. 19. Ghozali, I. and Fuad. (2005). Structural equations modeling dengan LISREL: teori, konsep dan aplikasi. Semarang: Badan Penerbit Universitas Diponegoro 20. Herold, D. M., Jayaraman, N., and Narayanaswamy, C.R. (2006). What is the Relationship between Organizational Slack and Innovation? Journal of Managerial Issues, 18(3), 22. 21. Jensen, M.C. (1986). Agency costs of free cash flow, corporate finance and takeover. American Economic Review, 76, 323-329 22. Jensen, M.C. (1993). The modern industrial revolution, exit and the failure of internal control systems. Journal of Finance, 48, 831-880 23. Jensen, M.C. and Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency cost and ownership structure. Journal of Financial Economcis 3: 305-60 24. Kahneman, D. and Tversky, A.(1979). Prospect theory: an analysis of decision under risk. Econometrica, 47, 263-292 25. Latham, S and Braun, M. (2008) The Performance Implications of Financial Slack 17 during Economic Recession and Recovery: Observations from the Software Industry, Journal of Managerial Issues, 20, 1. 26. Lawson, M.B. (2001). In praise of slack: time is of the essence. Academy of Management Executive 15(3): 125-35 27. Leavins, J. R., Omer, K., and Vilutis, A. (1995). A comparative study of alternative indicators of budgetary slack. Managerial Finance, 21(3), 52-67. 28. Lin, W.T., Cheng, K.Y., and Liu, Y. (2008). Organizational slack and firm’s internationalization: a longitudinal study of high technology firms. Journal of World Business. In press 29. Love, E. G., and Nohria, N. (2005). Reducing Slack: The Performance Consequences of Downsizing by Large Industrial Firms, 1977-93. Strategic Management Journal, 26, 21. 30. Martinez, R. J., and Artz, K. (2006). An Examination of Firm Slack and Risk Taking in Regulated and Deregulated Airlines. Journal of Managerial Issues, 18(1), 23. 31. McGratch, R.G. and MacMillan, I. (2000). The entrepreneurial mindset: strategies for continuously creating opportunity in an age of uncertainty. Boston: Harvard Business School Press 32. Merchant, K. A. (1985). Budgeting and the Propensity to Create Budgetary Slack. Accounting, Organizations and Society, 10(2), 201-210. 33. Miller, D., Lant, T.K., Milliken, F.J., and Korn, H.J. (1996). The evolution of strategic simplicity: exploring two models organizational adaption. Journal of Management, 22(6), 863-887 34. Nohria, N., and Gulati, R. (1996). Is Slack Good or Bad for Innovation? Academy of Management Journal, 39(5), 20. 35. Patzelt, H., Shepherd, D.A., Deeds, D., Bradley, S.W. (2008). Financial slack and venture manager’s decision to seek a new alliance. Journal of Business Venturing. 23: 465-481 36. Ping, R.A. (1995). A parsimonious estimating technique for interactin and quadratic latent variables. Journal of Marketing Research 32: 336-47 37. Schiff, M. and Lewin, A.Y. (1968). The impact of people on budgets. The Accounting Review, 259-268 38. Sharfman, M.P., Wolf, G., Chase, R.B., and Tansik, D.A. (1988). Antecedents of Organizational Slack. Academy of Management Review 13, 601-614 39. Simerly, R. & Li, M. (2000). Environmental dynamism, capital structure and performance: a theoretical integration and an empirical test. Strategic Management Journal 21, 31-50 40. Singh, J.V. (1986). Performance, slack, and risk taking in organizational decision making. Academy of Management Journal 29 (3), 562-585 41. Stede, W. A. V. (2000). The Relationships between Two Consequences of Budgetary Controls: Budgetary Slack Creation and Managerial Short term orientation. Accounting, Organizations and Society, 25(6), 609-622. 42. Stede, W. A. V. (2001a). The Effect of Corporate Diversification and Business Unit Strategy on the Presence of Slack in Business Units Budget. Accounting, Auditing and Accountability Journal, 14(1), 30-52. 43. Steensma, H. and Corley, K. (2000). On the performance of technology-sourcing partnerships: the interaction between partner interdependence and technology attributes. 18 Academy of Management Journal 43: 1045-1067 44. Tan, J. (2003). Curvilinear relationship between organizational slack and firm performance: evidence from chinese state enterprises. European Management Journal, 21(6), 740-749. 45. Yang, M.L., Wang, A.M.L., and Cheng, K.C. (2009). The impact of quality of IS information and budget slack on innovation performance. Technovation. In press 46. Yasai-Ardekani, M. (1986). Structural adaptations to environments. Academy of Management Review, 11, 9-21 47. Yuen, D. (2004). Goal characteristics, communication and reward systems, and managerial propensity to create budgetary slack. Managerial Auditing Journal, 19(4), 517-532. 19