長榮大學九十二學年度第二學期資管系經濟學期中考試卷

advertisement

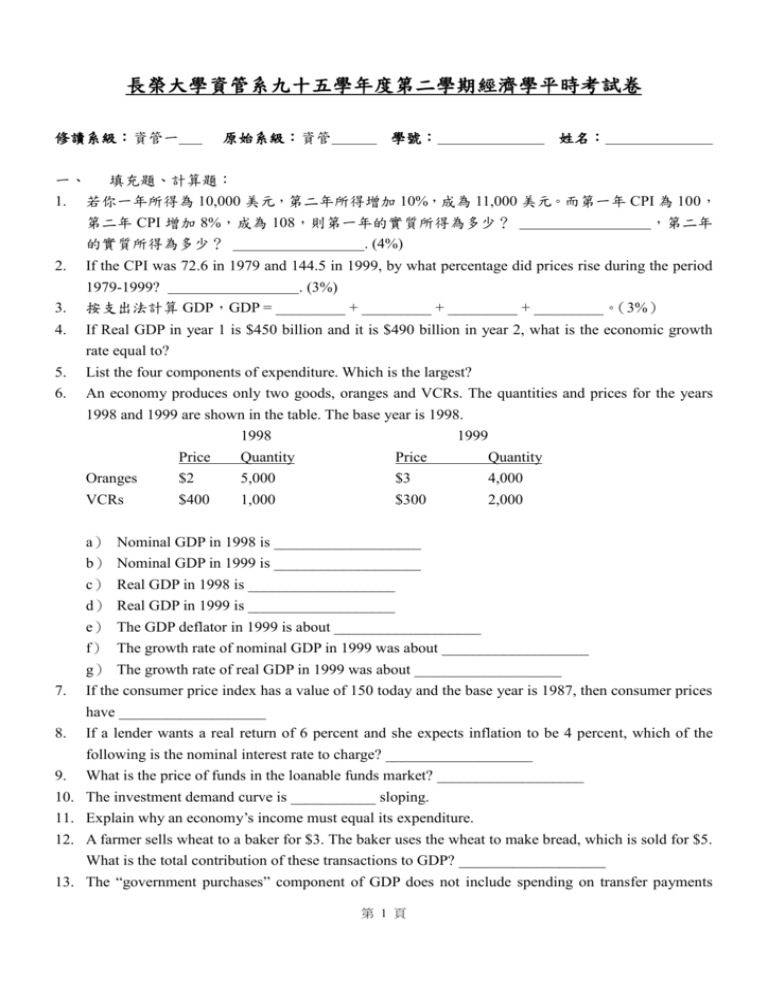

長榮大學資管系九十五學年度第二學期經濟學平時考試卷 修讀系級:資管一 原始系級:資管 學號: 姓名: 一、 填充題、計算題: 1. 若你一年所得為 10,000 美元,第二年所得增加 10%,成為 11,000 美元。而第一年 CPI 為 100, 第二年 CPI 增加 8%,成為 108,則第一年的實質所得為多少? ,第二年 的實質所得為多少? . (4%) 2. 3. 4. 5. 6. If the CPI was 72.6 in 1979 and 144.5 in 1999, by what percentage did prices rise during the period 1979-1999? . (3%) 按支出法計算 GDP,GDP = _________ + _________ + _________ + _________。(3%) If Real GDP in year 1 is $450 billion and it is $490 billion in year 2, what is the economic growth rate equal to? List the four components of expenditure. Which is the largest? An economy produces only two goods, oranges and VCRs. The quantities and prices for the years 1998 and 1999 are shown in the table. The base year is 1998. 1998 1999 Price Quantity Price Quantity Oranges $2 5,000 $3 4,000 VCRs 7. 8. 9. 10. 11. 12. 13. $400 1,000 $300 2,000 a) Nominal GDP in 1998 is ___________________ b) Nominal GDP in 1999 is ___________________ c) Real GDP in 1998 is ___________________ d) Real GDP in 1999 is ___________________ e) The GDP deflator in 1999 is about ___________________ f) The growth rate of nominal GDP in 1999 was about ___________________ g) The growth rate of real GDP in 1999 was about ___________________ If the consumer price index has a value of 150 today and the base year is 1987, then consumer prices have ___________________ If a lender wants a real return of 6 percent and she expects inflation to be 4 percent, which of the following is the nominal interest rate to charge? ___________________ What is the price of funds in the loanable funds market? ___________________ The investment demand curve is ___________ sloping. Explain why an economy’s income must equal its expenditure. A farmer sells wheat to a baker for $3. The baker uses the wheat to make bread, which is sold for $5. What is the total contribution of these transactions to GDP? ___________________ The “government purchases” component of GDP does not include spending on transfer payments 第 1 頁 such as Social Security. Thinking about the definition of GDP, explain why transfer payments are excluded. 14. Consider the following data on U.S. GDP: Year Nominal GDP(in billions) 1999 9269 2000 9873 GDP Deflator 113 118 a) What was the growth rate of nominal GDP between 1999 and 2000? b) What was the growth rate of the GDP deflator between 1999 and 2000? c) What was real GDP in 1999 measured in 1996 prices? d) What was real GDP in 2000 measured in 1996 prices? e) What was the growth rate of real GDP between 1999 and 2000? 15. Suppose that people consume only three goods, as shown in this table: Tennis Balls Tennis Racquets 2003 price $2 $40 2003 quantity 100 10 2004 price 2004 quantity $2 100 $60 10 (base year 1996) Gatorade $1 200 $2 200 a) What is the percentage change in the price of each of the three goods? ___________________ b) What is the percentage change in the overall price level? ___________________ 16. The New York Times cost $0.15 in 1970 and $0.75 in 2000. The average wage in manufacturing was $3.36 per hour in 1970 and $14.26 in 1999. a) By what percentage did the price of a newspaper rise? ___________________ b) By what percentage did the wage rise? ___________________ c) In each year, how many minutes does a worker have to work to earn enough to buy a newspaper? ___________________ d) Did workers’ purchasing power in terms of newspapers rise or fall? ___________________ 17. When deciding how much of their income to save for retirement, should workers consider the real or the nominal interest rate that their savings will earn? ______________________________________ 18. List and describe four determinants of a country’s productivity. ___________________ ___________________ ___________________ ___________________ 19. List the capital inputs necessary to produce each of the following. a) cars ___________________ ___________________ ___________________ ___________________ b) high school educations ___________________ ___________________ ___________________ ___________________ c) plane travel ___________________ ___________________ ___________________ ___________________ d) fruits and vegetables ___________________ ___________________ ___________________ 第 2 頁 ___________________ 20. Suppose that society decided to reduce consumption and increase investment. a) How would this change affect economic growth? b) What groups in society would benefit from this change? What groups might be hurt? 21. Suppose that an auto company owned entirely by German citizens opens a new factory in South Carolina. a) What sort of foreign investment would this represent? b) What would be the effect of this investment on U.S. GDP? Would the effect on U.S. GNP be larger or smaller? 22. What is the role of the financial system? Name and describe two markets that are part of the financial system in our economy. Name and describe two financial intermediaries. 23. Why is national saving? What is private saving? What is public saving? How are these three variables related? 24. What is a government budget deficit? How does it affect interest rates, investment, and economic growth? 25. When the Russian government defaulted on its debt to foreigners in 1998, interest rates rose on bonds issued by many other developing countries. Why do you suppose this happened? 26. Suppose GDP is $8 trillion, taxes are $1.5 trillion, private saving is $0.5 trillion, and public saving is $0.2 trillion. Assuming this economy is closed, calculate consumption, government purchases, national saving, and investment. 27. Describe three ways that a risk-averse person might reduce the risk. 28. The interest rate is 7 percent. Use the concept of present value to compare $200 to be received in 5 years and $300 to be received in 10 years. 29. About 20 years ago, native Americans sold the island of Manhattan for $100. If they had invested this money at an interest rate of 5 percent per year, how mush would they have today? 30. A company has an investment project that would cost $3.5million today and yield a payoff of $5 million in four years. a) Should the firm undertake the project if the interest rate is 11 percent? 10 percent? 9 percent? 8 percent? 31. Imagine that you intend to buy a portfolio of ten stocks with some of your saving. Should the stocks be of companies in the same industry? ___________________. Should the stocks be of companies located in the same country? Explain. 32. What is the loanable market? 33. The interest rate is 7 percent. What is the present value of $15,000 to be received in10 years? 34. What is the fundamental analysis? What is the informationally efficient? 第 3 頁