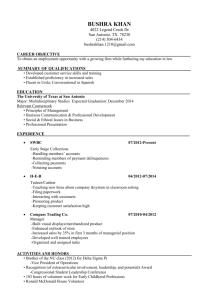

Proposal - Saint Mary`s College of California

advertisement

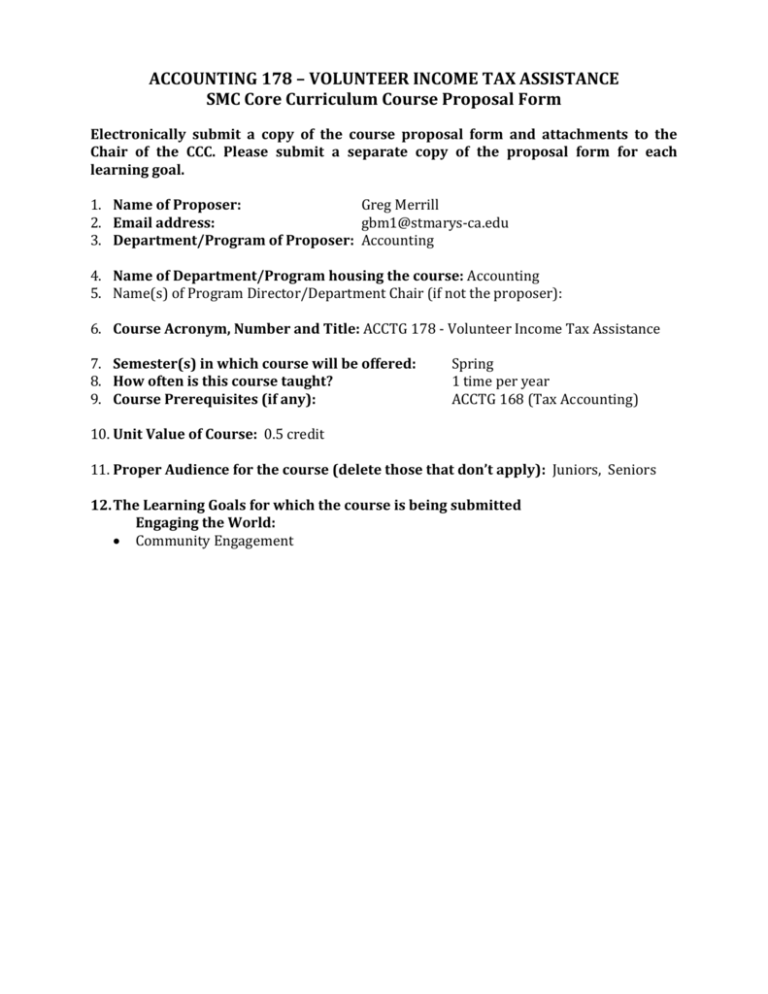

ACCOUNTING 178 – VOLUNTEER INCOME TAX ASSISTANCE SMC Core Curriculum Course Proposal Form Electronically submit a copy of the course proposal form and attachments to the Chair of the CCC. Please submit a separate copy of the proposal form for each learning goal. 1. Name of Proposer: Greg Merrill 2. Email address: gbm1@stmarys-ca.edu 3. Department/Program of Proposer: Accounting 4. Name of Department/Program housing the course: Accounting 5. Name(s) of Program Director/Department Chair (if not the proposer): 6. Course Acronym, Number and Title: ACCTG 178 - Volunteer Income Tax Assistance 7. Semester(s) in which course will be offered: 8. How often is this course taught? 9. Course Prerequisites (if any): Spring 1 time per year ACCTG 168 (Tax Accounting) 10. Unit Value of Course: 0.5 credit 11. Proper Audience for the course (delete those that don’t apply): Juniors, Seniors 12. The Learning Goals for which the course is being submitted Engaging the World: Community Engagement Expected Attachments (1) Syllabus: Course syllabus containing a course description and a list of learning outcomes. The course’s learning outcomes should include coverage of the Learning Outcomes associated with the Core Curriculum Learning Goal for which the course is being proposed. (2) Teaching: A brief narrative (300 words) that explains how the course will guide students toward achieving the Learning Goal. The CCC believes it would be simplest both for the proposer and for the Working Groups if the narrative addressed the Learning Outcomes one by one. (3) Learning: A brief explanation of how coursework (e.g., papers, exams, videotaped presentations) will be used to measure student achievement of each of the Learning Outcomes. Please address the outcomes directly and one by one. Any course approved for the core must provide data for the assessment of Core curriculum learning goals at an institutional level. Via this proposal a chair/program director agrees to oversee the submission of the student work necessary for the assessment of the learning goals. If the proposal is from an instructor, that individual agrees to oversee submission of work from appropriate sections of their course. Similarly, while courses, and individual sections within courses, may vary, the Core should provide somewhat consistent experiences within each Learning Goal. To this end, by submitting this proposal a chair/program director/instructor agrees that instructors of Core courses will participate in assessment exercises. Attachment 1, Syllabus ACCTG 178 –Volunteer Income Tax Assistance (Spring 2014) School of Economics and Business Administration Saint Mary’s College of California ************************************************************************************** Instructor: Virginia Smith Phone: 925-631-4598 Office: Galileo 321 Office Hours: TBD Email: vsmith@stmarys-ca.edu ************************************************************************************** Course Description: This service learning course allows students to gain practical experience by applying what they have learned from previous coursework in the preparation of income tax returns for low income individuals, in an economically disadvantaged neighborhood, on pro bono basis. Also, this course gives students an opportunity to increase their tax knowledge and interpersonal skills. Course Overview: In this course, students will gain practical experience, applying the concepts and tools learned in the classroom, by preparing tax returns for low income families in an economically disadvantaged neighborhood (Oakland area) while at the same time fulfilling the College’s mission. Students will learn the value of “people”, business and interpersonal skills. In addition, they will become acquainted with the complexity of working with laypersons, as well as learn about the value of “pro bono” work. Students will use an on-line IRS site called Link N Learn to learn about income tax preparation and current law, then they take a test at each level (Basic, Intermediate, Advanced) to get certified to prepare income tax returns through the VITA sites at Unity Center in the Fruitvale section of Oakland and the San Antonio site also in the Fruitvale section of Oakland, CA. Then, students will have one day training at the site with the AmeriCorps Program Manager. Prerequisites: • ACCTG 1 (Financial Accounting) • ACCTG 168 (Tax Accounting) Course Learning Outcomes: By the completion of this course, students will: • Register to become volunteer income tax preparers • Study for and pass an ethics test • Complete an on-line course called Link and Learn on the Internal Revenue Service site. • Pass, at a minimum, the Basic test, which certifies them to prepare tax returns at an authorized VITA site. (Students are encouraged to also pass the intermediate and advanced test and their course grade is determined in part by the level they achieve) • Apply academic methods and theories to promote collaboration and mutual benefit in a community setting by volunteering, through AmeriCorps, a minimum of 35 hours preparing tax returns for the economically disadvantaged at an IRS VITA site, usually the Unity Center in Oakland. • Prepare a critical reflection paper summarizing their experience and understanding of the interconnections between their experience and their responsibilities as members of social or professional communities Course Requirements: The minimum requirements for the course are: • Complete the Link and Learn Course on-line • Pass the IRS Ethics Test and the Basic VITA test • Print Certificate and hand in at the end of the course to the instructor • Volunteer at least 30 hours at the Unity Center • Receive a Certificate from AmeriCorps and make a copy for the instructor • Prepare a critical reflection paper summarizing their experience and understanding of the interconnections between their experience and their responsibilities as members of social or professional communities and hand in before the end of the semester Reading Assignments: IRS Publication 17 IRS Publication 1278,1290,4480,4491,1491X Grading: • Class attendance and participation • Complete the Link and Learn Course on-line • Pass the IRS Ethics Test and the Basic VITA test • Volunteer at least 35 hours at the Unity Center • Write a reflection paper Grading Scale: 100% - A+ 88-89% - B+ 78-79% - C+ 68-69% - D+ 95-99% - A 84-87% - B 74-77% - C 64-67% - D 90-94% - A80-83% - B70-73% - C- 60-63% - D- 5% 30% 10% 35% 20% 100% Below 60% - F Academic Honor Code: Saint Mary’s College expects every member of its community to abide by the Academic Honor Code. According to the Code, “Academic dishonesty is a serious violation of College policy because, among other things, it undermines the bonds of trust and honesty between members of the community.” Violations of the Code include but are not limited to acts of plagiarism. For more information, please consult the Student Handbook at http://www.stmarys-ca.edu/your-safety-resources/student-handbook. Student Disability Services: Student Disability Services extends reasonable and appropriate accommodations that take into account the context of the course and its essential elements for individuals with qualifying disabilities. Students with disabilities are encouraged to contact the Student Disability Services Office at (925) 631-4358 to set up a confidential appointment to discuss accommodation, policies, guidelines and available services. Additional information regarding the services available may be found at the following address on the Saint Mary’s website: http://www.stmarys-ca.edu/academics/academic-advising-andachievement/student-disability-services.html Attachment 2: Teaching Engaging the World Community Engagement In this course, students experientially explore the meaning of the common good and live the College’s Catholic and Lasallian tradition, by working hard to gain a particular expertise and then volunteering their time to help economically disadvantaged people in a nearby community meet the requirements of working in the United States. Their individual learning experiences are captured in a reflection paper. Perhaps it is best to hear this truth from the students themselves, in the words of their reflections (an ~ 10 page essay requirement of the course): Through my volunteer hours at the San Antonio CDC, I was awakened to a whole different world of people and issues. I realized how much I do love giving back to the community, and how I would like to do this more regularly, since they are open year-round. These are people who truly appreciate the help that they receive from Pat, and from the volunteers who impact this community in making individuals and families aware of the importance of tax and the ever-changing laws. In a matter of weeks, I have learned so much from Pat and the other volunteers on how intricate taxes can be and how to handle irregular situations that regularly occur at the tax centers. More importantly, I discovered a group of people that I have become rather fond of. I hope that in the future, I have the time to expose myself to more activities that make our community a better place. Amanda Lu Class of 2012 Volunteer work was a requirement in high school for me. I chose to go above the minimum, and I ended up receiving an honor at my graduation for it. I chose to volunteer for Pat Constantine, director of financial services at San Antonio Community Development Corporation in Oakland, California. My decision was purely for a personal gain, as I do try to volunteer every year. Once I began working there, however, my feelings were different. I was not just feeding the hungry, or preparing Thanksgiving meals like I have in the past. I was helping people who are actually working hard and doing what they can to change their own lives - to better themselves. Not only that, I’m actually taking knowledge I received from college and applying it into the real world. Anthony Tarrantino Class of 2010 The course requires that students reflect and write substantively on ways in which human beings, specifically themselves, find fulfillment in community and demonstrate a capacity for coherent, principled analysis of concrete social problems, those witnessed first-hand in the Fruitvale area of Oakland, CA. Attachment : Learning Engaging the World Community Engagement The final grade in the course is determined, in part, by the student’s reflection and essay on how this experience has: 1. Led to their own fulfillment from engaging in the Oakland- Fruitvale community 2. Increased their awareness of (and compassion for) what other members of our world are going through to survive, that is different from their own experience, and how social order creates a different experience for those at a lower strata than ourselves. Assessment of Learning Outcomes: 1. Apply academic methods and/or theories in a way that promotes collaboration and mutual benefit in a community setting. For this learning outcome, please be specific about the type of service project students will be doing, the approximate number of hours they will be spending, and in what community site. Explain how this project integrates into the academic methods and/or theories you will be teaching in the class. Students will be preparing individual tax returns for the economically disadvantaged. This is normally done in the Fruitvale area of Oakland. After studying the IRS material on current tax regulations (about 500 pages) students are required to pass an IRS exam prior to being allowed to prepare returns. Each student will volunteer a minimum of 35 hours at the location preparing individual tax returns applying the knowledge they gained from reading and testing. 2. Demonstrate critical reflection throughout their experience. Please explain further what "critical reflection" means for your particular course. Does it mean that your students will engage in ongoing dialogue about what impact their work might have in the community? Does it mean that they are writing regularly in journals? Will they have a reflective paper? In general, for this learning outcome, please talk about how your students might reflect on issues of impact, collaboration, and/or the application of your chosen academic theories and/or methods in the community setting. Your course may incorporate “critical reflection” in any number of ways that are appropriate for your course and discipline! In this course, students experientially explore the meaning of the common good and live the College’s Catholic and Lasallian tradition, by working hard to gain a particular expertise and then volunteering their time to help economically disadvantaged people in a nearby community meet the requirements of working in the United States. The students are required to write a reflection paper of approximately 10 pages about their experience at the end of the course. Based upon papers received from prior students taking this course they have seen what a positive impact they can have on society by volunteering their time using their specialized education to help the less fortunate. Perhaps it is best to hear this truth from the students themselves, in the words of their reflections: Through my volunteer hours at the San Antonio CDC, I was awakened to a whole different world of people and issues. I realized how much I do love giving back to the community, and how I would like to do this more regularly, since they are open yearround. These are people who truly appreciate the help that they receive from Pat, and from the volunteers who impact this community in making individuals and families aware of the importance of tax and the ever-changing laws. In a matter of weeks, I have learned so much from Pat and the other volunteers on how intricate taxes can be and how to handle irregular situations that regularly occur at the tax centers. More importantly, I discovered a group of people that I have become rather fond of. I hope that in the future, I have the time to expose myself to more activities that make our community a better place. Amanda Lu Class of 2012 Volunteer work was a requirement in high school for me. I chose to go above the minimum, and I ended up receiving an honor at my graduation for it. I chose to volunteer for Pat Constantine, director of financial services at San Antonio Community Development Corporation in Oakland, California. My decision was purely for a personal gain, as I do try to volunteer every year. Once I began working there, however, my feelings were different. I was not just feeding the hungry, or preparing Thanksgiving meals like I have in the past. I was helping people who are actually working hard and doing what they can to change their own lives - to better themselves. Not only that, I’m actually taking knowledge I received from college and applying it into the real world. Anthony Tarrantino Class of 2010 The course requires that students reflect and write substantively on ways in which human beings, specifically themselves, find fulfillment in community and demonstrate a capacity for coherent, principled analysis of concrete social problems, those witnessed first-hand in the Fruitvale area of Oakland, CA. 3. Express their understanding of the interconnections between their experience and their responsibilities as members of social or professional communities. These items are addressed in their reflection paper as outlined in 2 above.