midterm #1

advertisement

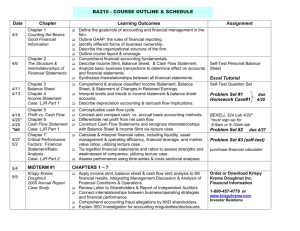

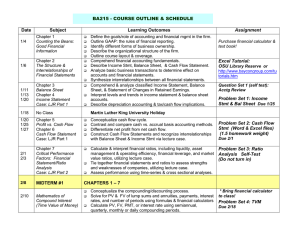

BA215 - COURSE OUTLINE & SCHEDULE Date 9/25 Chapter Chapter 1 Counting the Beans: Good Financial Information Learning Outcomes 9/27 Chapter 2 The Structure & Interrelationships of Financial Statements 10/2 10/4 10/9 10/11* 10/16 10/18 10/23 10/25 10/30 11/1 Define the goals/role of accounting and financial mgmt in the firm. Outline GAAP: the rules of financial reporting. Identify different forms of business ownership. Describe the organizational structure of the firm. Outline course layout & coverage. Comprehend financial accounting fundamentals. Describe Income Stmt, Balance Sheet, & Cash Flow Statement. Analyze basic business transactions to determine effect on accounts and financial statements. Synthesize interrelationships between all financial statements. Comprehend & analyze classified Income Statement, Balance Sheet, & Statement of Changes in Retained Earnings. Interpret levels and trends in income statement & balance sheet accounts. Describe depreciation accounting & tax/cash flow implications. Conceptualize cash flow cycle. Contrast and compare cash vs. accrual basis accounting methods. Differentiate net profit from net cash flow. Construct Cash Flow Statements and recognize interrelationships with Balance Sheet & Income Stmt via lecture case. Integrate accounting concepts with computer spreadsheet models Calculate & interpret financial ratios, including liquidity, asset management & operating efficiency, financial leverage, and market value ratios, utilizing lecture case. Tie together financial statements and ratios to assess strengths and weaknesses of companies, utilizing lecture case. Assess performance using time-series & cross sectional analyses. Chapter 3 Balance Sheet Chapter 4 Income Statement Case: LJR Part 1 Chapter 5 Profit vs. Cash Flow Chapter 6 Cash Flow Statement Case: LJR Part 1 Excel Computer Lab Chapter 7 Critical Performance Factors: Financial Statement/Ratio Analysis Case: LJR Part 2 MIDTERM #1 CHAPTERS 1 – 7 Krispy Kreme Doughnut 2006 Annual Report Case Study Apply income stmt, balance sheet & cash flow stmt analysis to KK financial results, integrating Management Discussion & Analysis of Financial Conditions & Operations. Review Letter to Shareholders & Report of Independent Auditors Connect interrelationships between business/operating strategies and financial performance. Comprehend accounting fraud allegations by KKD shareholders. Explain SEC investigation for accounting irregularities/disclosures. Assignment Excel Tutorial: OSU Library Reserve or www.extension.iastate.edu/P ages/Excel/homepage.html Self-Test Question Set Problem Set #1 due 10/9 *No lecture: Group Homework Case#1 (2-3 per group) due 10/16 Problem Set #2 due 10/23 BEX120: 11-12 or 11:55-12:50 Problem Set #3 (self-test) purchase financial calculator Order or Download Krispy Kreme Doughnut Inc. Financial Information 1-800-457-4779 or www.krispykreme.com Investor Relations Download KK PowerPoint slides from Romero web site Date Chapter 11/6 11/8 Romero Lecture Notes & Excel Spreadsheets Personal Financial Planning MIDTERM #2 Krispy Kreme Case; Personal Financial Planning; Time Value of Money 11/13 11/15 11/20 11/22 Learning Outcomes Create a personal cash flow statement and evaluate spending patterns for budget preparation. Homework #4 Differentiate between fixed and variable expenses in budgeting. Due 11/13 Prepare a personal budget and evaluate appropriateness to life situation and financial goals. Learn budget to actual variance evaluation techniques. Create a personal balance sheet, properly classifying assets into liquid, household, and investments, and liabilities into current and long term; identify and calculate net worth. Prepare Excel spreadsheets and charts for all personal financial statements to enable life-long updating, monitoring, and planning. Investigate various Internet resources for personal financial planning. Romero Lecture Notes Conceptualize the compounding/discounting process. * Bring financial calculator to Mathematics of Solve for PV & FV of lump sums and annuities, payments, interest class Compound Interest rates, and number of periods using formulas & financial calculators. (Time Value of Calculate PV, FV, PMT, or interest rate using semiannual, quarterly, Money) monthly or daily compounding periods. Romero Lecture Notes Apply time value concepts to determine monthly payments on car loans Time Value of Money or mortgages, saving for retirement, value of future payment streams, Problem Set #5 Applications and effective interest rates on loans. Due 11/20 Illustrate use of financial calculators in solving financial problems. Romero Lecture Notes Investments & Equity Markets 11/27 11/29 Romero Lecture Notes Investments & Equity Markets Guest Lecturer 12/4 Assignment FINAL EXAM Compare and contrast the interrelationships between personal and corporate financial management. Describe long term debt instruments (term loans, bonds, debentures) and equity securities (common stock). View from both a company’s and investor’s perspective. Comprehend the workings of stock markets & composition of major indices. Describe investment securities (such as mutual funds). Determine relevant investment objectives and impact on asset allocation Distinguish between stock, bond, and blended mutual funds. Identify and use resources (such as Morningstar) to assess risk and research performance of various investment alternatives. Show knowledge of how to buy investments via broker or on-line. 9:30-11:20am PEAVY 130 Optional Reading: Chapters 11 & 12 Financing the Business: Debt vs. Equity Options Explore www.morningstar.com ALL COURSE MATERIAL