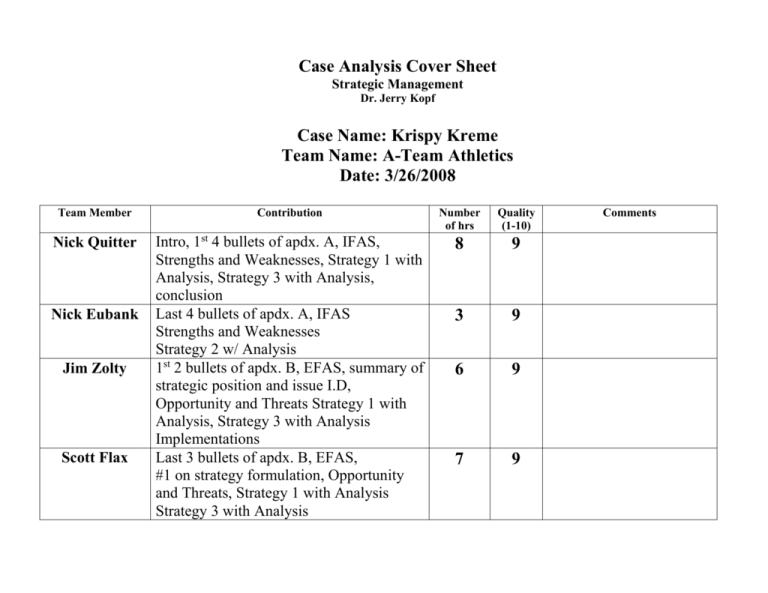

Case Analysis Cover Sheet Strategic Management Dr. Jerry Kopf

advertisement

Case Analysis Cover Sheet Strategic Management Dr. Jerry Kopf Case Name: Krispy Kreme Team Name: A-Team Athletics Date: 3/26/2008 Team Member Contribution Number of hrs Quality (1-10) Nick Quitter Intro, 1st 4 bullets of apdx. A, IFAS, Strengths and Weaknesses, Strategy 1 with Analysis, Strategy 3 with Analysis, conclusion Last 4 bullets of apdx. A, IFAS Strengths and Weaknesses Strategy 2 w/ Analysis 1st 2 bullets of apdx. B, EFAS, summary of strategic position and issue I.D, Opportunity and Threats Strategy 1 with Analysis, Strategy 3 with Analysis Implementations Last 3 bullets of apdx. B, EFAS, #1 on strategy formulation, Opportunity and Threats, Strategy 1 with Analysis Strategy 3 with Analysis 8 9 3 9 6 9 7 9 Nick Eubank Jim Zolty Scott Flax Comments Introduction Krispy Kreme Company is an international manufacturer and distributor of glazed donuts. Their main products are hot donuts fresh off the production line. A sizeable portion of their sales come from off-site sales to grocery stores and other retail establishments. Currently, they have seen a sharp decline in revenue due to many factors. They have also recently undertaken a big growth campaign, but have had many difficulties continuing this strategy due to the drop in sales and a change in consumer tastes. Going along with this trend, revenues from the sale of specialized equipment to franchisees has dropped. Additionally, accounting malpractices have hurt previous years’ profits and their employees have filed lawsuits against top management due to the loss of their retirement accounts. Situational Analysis Firm Analysis Key Strengths KKD has a strong brand loyalty, due to the fact that 80% of their customers are repeat customers. KKD customers also share their experiences at these retail stores with word of mouth. KKD allows the community to get involved by not only selling to the community and keeping a friendly atmosphere. KKD also engages in fundraisers to benefit high schools and youth organizations. KKD hired a team of upper level management with a good record of turning troubled companies around as noted in appendix A. KKD has a particular strength and distinctive competency of having their donut manufacturing process visible to all customers who walk through the doors. Key Weaknesses Financial position (See Appendix A for further financial analysis) KKD employs a high number of employees at each location which increases overhead The positioning of KKD’s product line is not focused in the areas that could benefit them in products beside donuts. Environmental Analysis Opportunity o Increase wholesale coffee sales by implementing our first strategy and positioning it more as a high quality gourmet coffee. o Increase private label awareness by making private label product known to customers that doughnuts were produced by Krispy Kreme, and also better build partners for selling to local markets. o Offering more than a breakfast menu would increase variety in products and be able to have diversity in their menu. Threats o With the increase diversification of competitors menu’s Krispy Kreme needs to become more than just a doughnut shop and move to a bigger market and offer items for the lunch menu. o Make sure that they do not have any more accounting mishaps. Try not to make public awareness seem that you are losing the battle in financial needs. Summary of Strategic Position Product or service o Coffee, assorted pastries (hot doughnuts), Competitive strategy o Differentiation—based on quality of doughnuts Fresh, hot, glazed, specialty coffee, slow rising doughnuts, specialized equipment, Market (Attractiveness) Fundraising—Community involvement, Wide market range—old, young, men, women Growth Strategies o Vertical v Horizontal More of a vertical integration company because the sell their equipment and mixes to their franchisee o Related v Unrelated Growing related way by market penetration by using existing models and going into new markets. New product development which has more depth in the products for sale. o Internal v External Externally – Bought out Montana Mills to diversify, but sold off. Internally – Building new company owned stores and new franchisee and producing the new plants o Domestic v International More effort into domestic with little bit of trying to get international Issue Identification Krispy Kreme expanded too quickly at the wrong time, because part of their product differentiation strategy which is based on taste, changed at the time of their growth. One of their faults was that they oversaturated the market when people could have easily driven to get a doughnut. Their business model was not conducive to what their customers expected and the new management did not realize the fact that it hurt sales when customers wanted to come into and see and smell the doughnuts being made. Strategy Formulation 1. Become more involved in wholesale sales within grocery stores and other convenience store locations. They can do this by creating a hot display case which features there famous hot doughnuts from 6-10am daily. These hot cases will also offer unglazed doughnuts with hot packets of sugar glaze for the consumer to put on the doughnut. In addition to these doughnut innovations they can push their wholesale coffee sales next to the hot cases. 2. KKD needs to reposition their image as not only a gourmet donut retailer but also as a company who serves gourmet coffee, and other options besides donuts for food and beverage. As far as their coffee marketing efforts, they need to make it more appealing and appetizing to compete with a market saturated with gourmet coffees shops being prevalent in our society. If KKD can bring customers in for just a cup of coffee they are more than likely going to smell the donuts or see the other products and impulse buy them increasing sales. 3. Health Donut -Whole-wheat, splenda-sugar covered donut that tastes at least as good as the current donut. Evaluation of Alternatives Strategy 1 Advantages Increasing brand awareness Increasing offsite sales, which could lead to an increase in in-store sales Increase sales of premium coffee blend Disadvantages Costly to implement and maintain New products may be unpopular and/or disappointing Strategy 2 Advantages Bring in a different clientele that would ultimately result in higher store traffic. Emphasizes the different products sold by KKD More room for profit by selling a larger variety of products. Marketing products will cause more cause and effects purchase of complementary products. Disadvantages Pushes them away from their original grassroots marketing which has worked since the 30’s. New positioning could overshadow their original product of success. Potential for new higher expenses Strategy 3 Advantages Coincides with current consumer tastes and preferences A healthier product compared with the current one Disadvantages Some people may not like the new taste, even if it’s similar to the old Would most likely lead to a higher price May not be technically feasible Conclusion Based on the SWOT analysis of each strategy, as seen in the appendix chart for alternative strategies, we would not choose strategy 3 mainly due to a big disadvantage that it would not be possible to make. We would like to see a 50-50 split in resources between strategy 1 and 2. Strategy 1 would enhance off-site sales which would most likely build in-store sales due to an increase in brand image. Strategy 2 would help the market image of KKD by informing customers of the greater product line breadth that is available in all stores, and you can still get a great tasting , hot, fresh donut. Implementation Short term goals and objectives: Set and objective to have a summer promotion take place. Launch date would be June 1st for kids getting out of school and promote other items like chillers, and have it end with a warm doughnut. Develop a “hot box” and the sugar packets so that customers will be able to have a hot doughnut and have hot glaze sauce and be able to store it into the hot box and take it home. Have in place to top 30 percent revenue generating markets within 6 months. Long term goals and objectives: Increase of overall revenues of 12.5 percent in all markets where change was implemented, all within one year. Assumptions: People will like the “hot and fresh” convenient doughnuts and that people will like the other products that we offer and would like buy them. Easily reach short term goals and objectives by summer, and retailers will like to pay for the “hot box.” CSF: Developing and implementing “hot box” into local retailers. Good campaign that highlights all the different products. Risks: Low ROI. Appendix A Firm Analysis Based on the attached simplified income, balance sheet, and cash flow statements, the following conclusions can be reached: Margins o Operating profit grew by an average of 9.8% a year and net profit margin grew by an average of 5.6% a year from 2000 until 2005 when they dropped significantly. KKD has made progress in achieving better results coming into 2007, but these margins are still negative o ROA and ROE were fairly constant and preferable from 2000-2004. 2005 marked huge negative numbers. ROE still has not gotten much better while ROA seems like it will at least be positive in 2008 Costs o From 2005 to 2006 KKD’s operating expense rose higher than their revenues, growing by $287M compared to $58M raise in revenues. o Their quick and current ratios have lowered to below 1, coinciding with a lower inventory turnover, almost down a half from 2003 to 2007 o Their working capital per $ of sales was above $0.10 after going public until 2005 when it was zero and negative $.01 for 2006 and 2007 Debt o Their interest coverage ratios were great from 2001 to 2004, then dropped below 0 in 2005 as income before taxes fell. It has gotten better, but is still negative o As of 2006 and 2007, KKD has more debt than equity. This trend has been increasing from 2001 by an average of 22.6% a year. When KKD went public in 2000 it had zero debt. A lower share price has reduced its overall equity, which is currently around the lower $3. Assessment of Management Scott Livengood, 48 and KKD’s CEO until January 2005, joined KKD’s HR department with a degree in industrial relations and a minor in psychology. He rose through the management ranks without a degree in business. In 2005, Steven Cooper was named CEO and Steven Panagos named president and COO. These two men were outsiders with noted expertise in turning around troubled companies. They were brought in at a good time for Krispy Kreme. Donald Henshall, 38, was hired in December of 2000 as the president of international development. Assessment of Marketing KKD’s sales have been decreasing, mainly in their off-site/private-label sales to grocery stores. Inside sales have also fallen, but not nearly as much. These results are not mainly due to poor marketing, rather changing consumer tastes and trends. Their market share is fine. Their grassroots marketing effort has peaked and saturated their target market, and other forms of marketing have been overlooked. Assessment of Finance KKD’s stock price has been low since 2004 when it was announced that their offsite sales were falling due to a number of factors including a current low-carb diet trend. Their stock equity has been falling since this time which is accounted for in the very low, and negative, ROE. They have a negative interest coverage ratio, but are continuing to borrow more money. This ratio has been getting better since 2005, but is nowhere near to what it was in 2001. Assessment of Physical Resources -Krispy Kreme updated many of its larger buildings that were antiquated by their overwhelming size. Many of the buildings cost too much to operate being that they where 7000 sq feet so they relocated to busier areas with more traffic and possibility of business als making them smaller to allow for cheaper production. Krispy Kreme also standardized its equipment to make production more homogeneous across Krispy Kreme’s distribution channels. -Krispy Kreme will need to invest in some type of gourmet coffee machines in the near future to compete and hopefully bring themselves out of the hole that they are in. They are going to need to invest in something to give them a competitive edge against Dunkin Donuts, Starbucks, and companies that have evolved over the past couple of years unlike Krispy Kreme. Distinctive Competencies -Krispy Kreme Donuts has unique features that have aided in their success. One of the features being the Hot Donuts signs to attract customers to get a hot fresh donut right off of their production line which is in the store. Customers also are able to view the donut making process while they are in the store. -Krispy Kreme’s distribution channels are unique as well. They allow the central Krispy Kreme to provide the materials to make the donuts at a central location which enables them to profit off of their mix’s to franchised stores and keep a constant quality. They also have their retail stores selling wholesale to grocers, convenience stores, and other stores who want to buy them in bulk. -The recipe of their donut is a secret recipe that has been in house since the early 30’s and hasn’t changed keeping them traditional in a sense. -They also have traditional style buildings with a retro feel with mint green walls and smooth metal chairs to give a feel nostalgic to that of diners. Krispy Kreme’s Work Force & Human Resources -Scott Livengood, worked his way up from management all the way to President, CEO, and Chairman of the board. Livengood is well educated with degrees in two different areas from UNC Chapel Hill. He brought the new idea of a retail store and distributing to grocers, gaining royalties from franchises. -Their stores typically employed 125 people, which of 65 where full time positions. I wold say that their labor costs would be pretty high compared to a store like starbucks which is in a similar field. They can manage with 5 or 6 employees at once. Employee’s seemed to me that they were personable and friendly because they had so much repeat business. Major Stake Holders -Krispy Kreme issued 3.45 million shares of stock at 21.00 per share. Then each franchise has some interest in the company and all of the board of directors is involved. I imagine they are not very happy with the results at this present day since they have not met the financial obligations that where promised to shareholders. Also stakeholders cannot be but so happy since the company continues to lose money. Appendix B External Environment Analysis • Profitability: Describe each of Porter's five forces: • Power of Suppliers: • Not necessary need since most of the donuts are made in store rather than supplied by suppliers. • More of a homemade atmosphere. • KKMD has had unit average about 30 percent of total Krispy Kreme revenues. • Power of Buyers: • When doughnuts started they were sells for 60 or 75 cents each. • Customers typically got an dollar per dozen discount on purchases for 2 or more a dozen. • Stores revenue was built on 3 ways: • On premise sales of doughnuts • Sales of coffee and other beverages • Off premises sales of branded and private-label doughnuts to local supermarkets, convenience stores, and fundraising groups. • Cost of new store opening was around 2 million. • Franchising fee per unit was 40,000 • Threat of New Entrants: • HUGE!!!! KK has been in the breakfast industry and including themselves in grocery stores too. With that in mind entrants from other competitors leaves the door wide open, especially in their private label sector. Also along with off premise sales of private label, they do a lot of fund-raising groups. This may reduce sales if they allocate their efforts to promote sales in this area. • Threat of substitute Products or Services, • Dunkin Donuts: • Coffee, cinnamon buns, cookies, munchkins, breakfast sandwiches, nine flavors of coffee, iced coffees and lemonade coolatta • Tim Horton’s: • Coffee, teas, hot chocolate, sandwiches, fresh baked goods ( cookies, muffins, pies, croissants, bagels, etc..), • Winchell’s Donut House: • Croissants, bagels, éclairs, tarts, apple fritters, and bear claws • LaMar’s Donuts • Donuts, more focused into coffee, cappuccinos, espressos, lattes, iced coffee • Rivalry among competitors: • Rivalry not an issue since more of the companies has earned the market share in their own region. KK not based on sales. • • Since most of the companies are divided into sections of the US, most of the companies stay away from branching into rivalry territory. Growth: Is the market growing faster or slower than GNP? • Tremendously, at first with the store operations from 1998 to 2004 an increase sales volume. IN 1998 sales were at 203,439 and ended in 2004 at 984,895. 1. Risk: What political, technological, economical, social, or legal risks exist? a. Political-None b. Technological- Keep up to date more modern equipment that produces more doughnuts and reduces wasted product production. Even though their stores may have a “Retro” 50’s feel they need to keep up with modern technological advances within the food service industry. Also keeping their centralized mix manufacturing center in Winston Salem and Effingham technologically up to date to ensure freshness and quality of distribution. c. Economical-Again, reducing waste by keeping up to date technology and reducing fixed costs as much as possible. Also, don’t acquire business’s that are not making money such as Montana Mills Bakery’s. Lastly to be more economical continue to franchise more stores, rather than open company owned stores. This will cut down on startup costs and the other fixed costs that come along with company owned stores. d. Social- A major risk is the new low carbohydrate fad diets. This greatly hurt Krispy Kremes wholesale sales in grocery stores in 2004 and 2005. They need to come up with a solution to this problem like a whole wheat doughnut. Socially speaking they are a very good company when it comes to helping organizations do fundraising and other such activities. They need to continue to get involved with local communities when it comes to fundraising and service events. e. Legal Risks- Krispy Kreme needs to get their accounting practices together. As a publicly traded company they cannot afford to be investigated by the SEC on any issues. Also, they need to work out the dispute with workers about retirement benefits. They risk being perceived negatively in the public eye when it comes to taking care of their employees. 2. Competitor analysis: who are they, where are they, what are they doing, how well are they doing? a. Dunkin Doughnuts i. Who are they?-Dunkin Doughnuts was the largest coffee and baked goods retailer in the world. They are owned by Allied Domecq PLC. which is based out of the United Kingdom. They sell 4.4 million doughnuts and 1.8 million cups of coffee daily. ii. Where are they? - They are located in 40 countries around the world and with a total of 6200 franchised outlets. There are 4,418 stores in the U.S. and in New England Alone there are 1,200 stores with 600 residing within the greater Boston area where the chain was founded. In 2000 they ranked #9 on Entrepreneur Magazines top 500 franchises. iii. What are they doing? – They are almost better known for their coffee than their doughnuts. They also sell muffins, bagels, cinnamon buns, cookies, brownies, doughnut holes, cream cheese sandwiches, 9 flavors of fresh coffee and iced coffee, and other frozen drinks. From what I have observed in the Richmond, Virginia market where both Krispy Kreme and Dunkin Doughnuts compete, it seems like Dunkin Doughnuts does more advertising and wholesale coffee sales. iv. How well are they doing? – From the looks of it they are doing well. They have a lot of small store locations and manufacture their doughnuts in centralized locations. They are also backed by a large company with many different interests. They are also expanding very heavily into Canada, and this will be an interesting venture for them because there is heavy competition there. b. Tim Hortons i. Who are they? – Tim Hortons is a subsidiary of Wendy’s International. They are named after a famous hockey player and are based mainly in Canada. ii. Where are they? – They are located mainly within Canada and the U.S. They have over 2400 locations in Canada and 200 in the U.S. In 2004 they acquired 42 Bess Eaton coffee and doughnut shops located in Rhode Island, Conn. and Mass. That they are going to convert to Tim Hortons. iii. What are they doing? – They are mainly franchised and have store sizes between 1150 and 3030 square feet. These included baking most products in house. Most store offer a 24 hr drive through and are capable of supplying several smaller satellite stores close to the main restauraunt. The menu consists of hot and cold drinks, including coffee, cappuccino. Also, they have many different varieties of sandwiches, soups and fresh baked goods. They also sell wholesale cans of coffee for use at home. iv. How well are they doing? - They seem like they are doing pretty well. They had systemwide sales of 3 billion + dollars. Also they are ranked #1 in market share in Canada for breakfast. Canada is also said to have more doughnut shops per capita than anywhere in the world. c. Winchell’s Doughnut House i. Who are they? –They were founded in 1948 by Vernon Winchell. They mainly sell coffee and doughnuts and are mainly located in the western U.S. ii. Where are they? – They currently have 200 locations in 12 states and 4 locations internationally. This is down from 600 units in 2000. Winchell’s is the largest doughnut chain on the West Coast, and they have 97 percent brand recognition in California. iii. What are they doing? - To combat Krisy Kremes entry in to California Winchell’s implemented a Warm and Fresh program in 2000. They basically had a case of warm fresh doughnuts replaced every 15 min. They were basically offering fresh warm doughnuts from 6 to 11 am daily. Winchells “dozen” of 14 doughnuts were selling for $5.99. The also sell all sorts of breakfast pastries and cream cheese sandwiches as well as coffee and other drinks. iv. How well are they doing? - Winchells seems to be doing fair. They are currently seeking franchises in 14 western states and are charging $7,500 franchise fee as well as the franchisor to put of $75,000 in un-borrowed funds to invest. There corporate goal for the next 5 years was to triple sales. d. LaMar’s Doughnuts i. Who are they? – They were a small privately owned doughnut chain headquartered in Englewood, California. On a typical day lines would begin to form before 6am. They had 32 corporate owned or franchised stores open or under development in 10 states. 8 stores were located in the Denver area. They were bought out by Franchise Consortium International in 1997 and moved the company’s headquarters to Denver, Colorado. They are typically located along neighborhood routes. ii. Where are they? – They are mainly located west of the Mississippi with many shops in the Denver area. They were founded in Kansas City. iii. What are they doing? – They were pursuing an aggressive growth strategy. They make an artisan quality doughnut with no preservatives. They also serve coffee and other hot and cold drinks. They also use the tagline “Simply a Better Doughnut”. iv. How well are they doing? – They seem to be doing fair. It seems that they have pursued an extremely aggressive growth strategy and might have set their goals to high. They had set goals of 1200 stores in operation by 2013. 3. Trends in consumer tastes, technology, laws, social norms, or other variables which may present the company with either an opportunity or a threat a. Taste- The tastes of doughnuts is pretty established. New variations such as doughnut holes and new flavors of fillings and are always being tried. Also, newer trends in higher quality coffee and frozen coffee drinks are emerging. b. Technology- More efficient doughnut making machines. Also more on site baking technology. There is even the technology to make a caffeinated doughnut. c. Laws- None d. Social Norms-The new diet trends in low carbohydrate and low sugar products have hurt the doughnut industry. The doughnut industry needs to combat these trends with a lower carbohydrate doughnut and a healthier more filling doughnut.

![저기요[jeo-gi-yo] - WordPress.com](http://s2.studylib.net/store/data/005572742_1-676dcc06fe6d6aaa8f3ba5da35df9fe7-300x300.png)