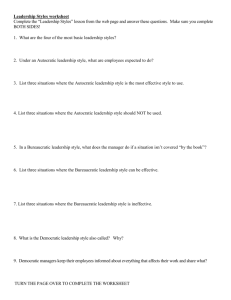

The Democratic Firm

advertisement