Carrefour, a global corporation

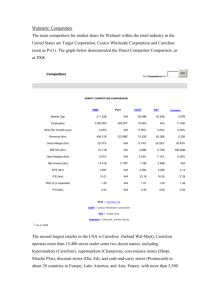

advertisement

Bre Clémence Proust Aurélie Chalvignac Benjamin 2ème année de MRIAE Année 2004-2005 Mieux consommer, c’est urgent. 1 Introduction Carrefour was created in 1959 by the Defforey and Fournier families as an out-oftown hypermarket. The leading French company concentrates solely on retail activities. In 2002, 59% of its sales revenue was generated by its hypermarket business, which is the company’s first, traditional activity. It pioneered and popularized the hypermarket concept in France and expanded largely through organic growth until the late 1990s, becoming France's leading hypermarket operator. Then, in the late 1990s, acquisitions became a more significant part of the Group’s growth strategy, and since 2001, the approach has become predominantly one of consolidation. Carrefour is still considered as a hypermarket operator, despite its diversification into other formats following its merger with Promodés in 1999. During the past financial year, supermarkets accounted for 18% of the Group’s sales revenue while hard discount store formats accounted for 8%. In the 1970’s the Group initiated its move into a foreign market by penetrating the Spanish market. However, it was the 1990s that marked the rapid development of the company, most notably in foreign markets in so far as new store openings were strictly regulated in France and the national French market was fairly saturated. In the meantime, Carrefour strengthened its international presence in the European, Latin American and Asian markets. By the end of June 2003, Carrefour operated 5,709 stores, across 30 countries spanning Europe, Asia and Latin America. The Group runs these under two dozen names, which include hypermarkets (Carrefour), supermarkets (Champion), convenience stores (Shopi, Marché Plus), discount stores (Dia, Ed), and cash-and-carry stores (Promocash). In 2002, France accounted for 51% of the retailer's sales and yet incorporated only 32% of the Group’s total outlets worldwide. Europe accounted for 34%, Latin America 8% and Asia 7% of the Group’s sales revenue. In Europe, Carrefour is the market leader while in Latin America it competes head-on with Wal-Mart for leadership, in a contest which started a decade ago. ********************************** 2 I. Retailing, in search of revival… A. The offensive of French retailing Confronted with a growth slowing down, French retailers confront each other through special offers on the national market and they spread out the world. Some limited room for maneuver in France: To be in the race, the French retailing doesn’t exclude any moving closer to its competitors in the way of reconciling profitability and its expansion politics. Some price falls under government pressure: The conflict on mark-up between suppliers and retailers leads them to an agreement introducing a price fall of consumable. It results from the government pressure which wanted to reform the Galland law on retailing price and relationships between suppliers and retailers. Retailing companies carry on diversifying more and more: Every shop sign rushes into services retailing such as travels, gas station and also financial products. Thus, Carrefour or Leclerc gas stations are flourishing on our highways whereas all retailing companies propose its fidelity cards, its travel agency or begin to offer insurance and finance services such Carrefour or Auchan are doing yet. The breakthrough of hard-discount: In front of hard-discount signs growing power such as Ed or Leader Price, hypermarkets are developing first price offer. France has entered in the “low-cost era”: every year, hard discounters gain one point of market share to the detriment of hypermarkets. Thus, hypermarkets counter-attack with “first price space” but the trend does not seem to be on the way to change. 3 B. The international retailing market On an international level, the retailing area is confronted with deep changes, between mergers and expansions. In Europe, the race to concentration: To remain competitive, the European retailing banks on the merging of businesses and a deep internationalization. With the arrival of Morrissons in the British retailing market, the retailing landscape turned upside down. Indeed, Morrissons bought Safeway in 2003 and became the fourth biggest market operator in Great-Britain. It’s one of the numerous examples of the deep changes which have taken place in Europe in the past 5 years. Moreover, high levels of price-cutting were exacerbated by the growing strength of low price formats such as discounters, hypermarkets and variety stores following the US model. This led to severe erosion of margins for all retailers. Thus, one solution would consist in the merging of businesses with the aim of taking advantage of large-scale retail and giving much strength to face up to a stronger competition. Nevertheless, this running to mergers remains strictly controlled by the European Commission and its competition department. But, this does not prevent Auchan from emerging, in 2004, as the third food retailer in Italy. Expansion into higher growth international markets was also significant, with many retailers investing in emerging regions such as Eastern Europe and Asia Pacific, especially towards the end of the period as economies began to stabilize. These markets, although not stable, offered better opportunities than Western Europe due to lower level of retail development, low start up costs, comparative lack of competition and less regulatory restrictions. Sluggish climate in United States: Some American retailers such as Kmart went through a deep crisis but seem to bring back to an even keel. Until the end of 2004, American retailing showed signed of tiredness. In 2001, the presence of tough competition was exacerbated by some degree of economic cooling and weakening of consumer confidence following the terrorist attacks on the US and the slowing US economy, which impacted at global level. However at the end of 2001, downturn was not as severe as feared, with spending habits relatively buoyant. Nevertheless, the Second Iraq War pushed down on retailer’s shops weekly sales which reduced by 2% during the first two weeks of the conflict. But, sales evolution wasn’t the only problem for American retailing. Indeed, some companies such as Kmart met accountant irregularities and were under a bankruptcy procedure until may of 2003. Today, Kmart has merged with Sears to resist better to WallMart competition. Thus, merging of businesses seems to be a deep trend of the international retailing market. To conclude, the American retailing shows new signs of profitability even though the retailing western countries markets maturity urge us on being careful about being too much optimistic. 4 What about retailing in emerging regions? Expansion into higher growth international markets was also significant, with many retailers investing in emerging regions such as Eastern Europe and Asia Pacific, especially towards the end of the period as economies began to stabilize. These markets, although not stable, offered better opportunities than Western Europe due to lower level of retail development, low start up costs, comparative lack of competition and less regulatory restrictions. Indeed, today, future company developments are expected to focus largely on the Asian markets, most notably China, which is one of the world’s fastest growing economies and is forecast to stay that way, while much of Europe is likely to reach a saturation point in the medium term. Carrefour is already the number one foreign retailer in China, in terms of the number of stores it operates, and ahead of its rival, Wal-Mart. In addition, the Group’s expansion program involves a total of 65-70 hypermarkets in operation in China by the end of 2004, with further growth to be supported by the Group’s Dia discount chain – newly introduced to the country in July 2003 and also labeled for expansion. Nevertheless, the retailing expansion doesn’t only concern Asian markets. For instance, French retailing giant Carrefour-Promodes continues to be the absolute leading retailer in the Argentinean market. The group has 437 outlets including Carrefour hypermarkets, Norte Supermarkets, and Dia hard discounters. The second largest player in the field has been Ahold’s Disco supermarkets, which is in the process of being sold, due to the recent financial scandals affecting the Dutch group. The current bidders for Disco are Argentinean private investor Francisco de Narvaez, Chilean retailing giant Cencosud, as well as the Casino Group. Generally speaking, all those emerging markets constitute a large opportunity for the biggest retailers such as Carrefour, Wall-Mart, Tesco…because they face up a deep competition in their respective influence area, and the only solution go through merger or expansion. It’s the last solution which justifies what it’s happening in South America, Asia or Eastern Europe. 5 II. Carrefour in the global food retailing sector Carrefour, N°2 of global retailing business: a successful and growing corporation Carrefour’s global turnover represented 88,7 billion euros in 2003. It increased of 4, 2% in 2004 (included +3,9% for the fourth term of the year). If we exclude the results in France, the corporation’s turnover won 8,3% with its foreign layouts. Established in only 6 countries in 1992, Carrefour is now represented in 31 countries. It employs more than 360 000 people throughout the world (120 000 in France and 680 expatriates). Carrefour runs 10 387 retailing stores around the world. Since 1999 and the merge with Promodès, Carrefour became the leader on hypermarkets in the world, and on supermarkets in Europe. It also got the third place for harddiscount retailing in the world. Disposals and acquisitions as well as organic growth have shaped the company, which claims to be the world’s second largest retailer after the American owned Wal-Mart. A. A growth based on constant innovations and on diversification The first and major innovation of Carrefour corporation is the invention of the hypermarket. The first one was opened in 1963 in Sainte-Geneviève-des-bois (Essonne, France). These huge retail stores, from 5000 to 20000 m² width, contain an average of 100 000 different items and products. Since its origin, Carrefour has been predominantly a hypermarket operator. While its business strategy has led the company to acquire a significant number of supermarkets, more than 56% of its sales revenue was generated by its 848 hypermarkets around the world in 2003. 6 The firm has nevertheless always favoured the keeping a vast range of store sizes/types. - Carrefour also runs 2352 supermarkets (whose shop signs are “Champion”, “GS”, “Norte”, “Gb”), between 1 000 and 2 000 m² width, displaying 10 000 references. They generate 25,5% of the total sales of Carrefour (2003 figures). - It runs 4712 hard-discount stores (shop signs “Dia”, “Ed”, “Minipreço”) too. These are shops from 200 to 800 m² width, displaying a limited range of food references (800). Influenced by the American lifestyle and sales techniques, Carrefour was one of the first one to launch the concept of hard-discount in Europe in 1979 with its shop sign “Ed”. Now, this type of store reaches 8,4% of the total turnover. - With signs like “Shopi”, “Marché Plus”, “8 à Huit”, “Di per Di”, Carrefour is head of 2649 convenience stores. Adding 200 Cash and Carry stores (wholesale places for professionals), the results of these two types of stores (which Carrefour has only established in Europe) represent 9,3% of the Group’s total sales. - Carrefour also deals with food distribution for collectivities (signs “Prodirest”) but only in France. - However, the firm has extended its cybermarketing branch “ooshop.com” (an innovation lauched in1997) to the Spanish market: a store opened in 2001 in Madrid. 7 B. Expansion policies While much of Carrefour's growth can be clearly attributed to external acquisitions, the company has continued to open new stores: hypermarkets in emerging countries in Eastern Europe and in Mediterranean countries, Latin America and Asia, with supermarkets and hard discount stores in Europe. An early internationalization, a late booming… Created in 1959, Carrefour compagny has been fast to establish in foreign countries. In 1973, it started in Spain and only two years later Carrefour had already crossed the European border-lines to settle in Brazil. During the eighties, Carrefour targeted the Argentinean market (1982) but also Taiwan in 1989, which is its first step in Asia. In the early nineties, Carrefour continued to develop in Latin America (Mexico and Colombia) and started to boom in Europe (Greece, Portugal, Italy, Turkey). From the mid-nineties, Carrefour has concentrated on both Asian (Malaysia, China, South Korea, Thailand, Singapore and Indonesia) and Eastern Europe (Poland, Czech Republic and Slovakia) countries. Its recent establishments focus on the remaining Carrefour-less countries (Belgium and Switzerland) and on the huge Japanese market. Breakdown of consolidated sales incl. VAT by geographic region (as of 12/31/2003) Total : 70 486 M euros As we see, Carrefour is pursuing an intensive store expansion plan. For instance, in 2002, the Group opened 657 stores which brought the total to 9,632 stores under the Carrefour banner (but which included the stores owned by franchisees or partners of the Group). The vast majority of these openings were in the hard discount format with 338 in total, followed by supermarkets with 77 and 43 hypermarket formats. The remainder consisted of convenience stores as well as four cash and carries. Source: Carrefour 8 The franchise. Lost of stores of all formats1 (but mostly convenience stores: 2354 out of 2519) are franchised2 and consequently are not directly operated by the company. Carrefour invested in these in order to further increase its market presence and dominance. As we can see on the document “Les implantations du Groupe en 2003”, Carrefour settled in Belgium, Emirates, Qatar, Egypt, Tunisia, Romania, Norway, overseas French territories and the Dominican Republic through franchised stores. Carrefour, a global corporation ? Carrefour uses its financial ressources following a global strategy. However, through a decentralized organisation (50 exploitation units), the Group aims at adapting its innovations and retailing concepts to the local market (format of the store as well as local and regional products that satisfy local consumers’ needs). For ruling this system and besides its (new) CEOs Luc Vandevelde and José Luis Duran, Carrefour has placed regional executives (Asia, Europe, Americas). C. Carrefour current positionning In each continent… Dominance in Europe The Group also dominates Spain and Belgium with 21% and 30% market share respectively and holds the third position in Italy with a 6.5% market share. In Europe, the Group registered an increase of 6.6% in the previous year (2002 figures). This was due to a strong performance in some markets, notably in Eastern Europe, and the completed consolidation of GB in Belgium, GS in Italy and Marinopoulos in Greece. Latin America Sales Decline Latin America saw sales fall in 2002 by 36%. This reflected the impact of the crisis in Argentina and the severe devaluation of the Brazilian currency, which also impacted negatively on the region’s operating profits, despite Colombia, Chile and Mexico all recording relative good sales during the period 1998-2002. However, Carrefour has just decided to withdraw from Mexico, insufficiently competitive. According to the 2003 figures, Asia turns out to be a more attractive continent than Latin America3. 1 Supermarkets (909 out of 2380), Hard-discount stores (946 out of 4459), hypermarkets (73 out of 823). Carrefour invested in these in France too, where the market remains fairly saturated with alternative formats. These franchised stores do not appear in the company's financial statements, but sales to franchises are taken into account in the Group's financial statements. 3 Turnover 2003 (million euros) : Asia 4637, Americas 4619. 2 9 Increased Competition in Asia Growth in Asia increased by 2.5% in 2002. Growth here was largely led by a significant number of store openings. Trading was difficult particularly in Taiwan and Korea as a result of increasing competition and credit restrictions from the banks. A slight drop in sales in China was a result of the banning of vouchers previously distributed by local authorities. Despite this, Carrefour is number one in China in terms of the number of stores and before its rival Wal-Mart. This steal on its rival is through flexible marketing strategies in the country and understanding of China’s economic policies. Continued expansion is planned for China with an additional 12 hypermarkets opened by the end of 2003. Carrefour also plans to develop the Dia discount chain in China, having just opened its first one during July 2003. Here, prices are up to 10% lower than those of Carrefour’s Chinese hypermarkets. Taiwan is Carrefour’s largest market in Asia and it holds a leading position in the country, although faces increasing competition from Auchan/Rmart, Casino and Tesco. Auchan are planning an aggressive expansion programme in Taiwan in order to steal a march on Carrefour. Expansion for Carrefour is likely to be slower than in China owing to a high level of existing market penetration in the hypermarket sector. Vis-à-vis Competitors… French multiples, which pose the greatest threat to Carrefour in its domestic market, are Intermarché, Leclerc, Casino and Auchan. Recently, German discounters have successfully penetrated the French emerging and growing discount market. Latin America Carrefour is not alone in targeting Latin America for expansion, with a number of multinational operators competing for sales growth in the region. US giant WalMart looms ever larger as a threat to Carrefour in Latin America. In 1996, the company bought out Cifra, Carrefour's main competitor in Mexico. Business in Argentina and Brazil is also under threat as Wal-Mart revises its strategy in view of losses. NewWal-Mart stores are being opened offering a wider choice of goods at even lower prices, without the assistance of a local partner. French retailers Auchan and Casino also pose a threat in Latin America, as does the Dutch chain Makro (which entered Brazil in 1972). Any threat from Royal Ahold however, which bought into leading chains in Argentina and Chile and entered into a joint venture in Brazil, has now been subdued. This follows the emergence of accounting scandals within the company which obliged Ahold to dispose of several of its operations, including the bulk of its South American activities as well as some of its Asian businesses, before the end of 2003. The Asian market also looks set to become increasingly competitive but other retailers poseless of a threat here. For example, as restrictions on retailing in South Korea are further lifted, Carrefour looks set to forge ahead having already established a foothold. Carrefour's major competitor in Eastern Europe remains Royal Ahold, which despite its current problems and consequential disposals, is set to hold onto its core European operations, albeit with financial cutbacks expected. Carrefour has grown from a leading French hypermarket operator to a global retailer with its core activities spanning across hypermarket, supermarket and hard discount operations. 10 During the past decade the Group diversified its operations to incorporate other retail formats, including convenience stores, mostly through acquisitions4. In addition, the rationale behind Carrefour’s merger with Promodés in 1999 was to become the leading European retailer and reach the critical size necessary to compete in global markets with other competitors, notably Wal-Mart. Consequently, during the last couple of years the Group has moved towards a strategy of consolidation and organic growth on a worldwide scale. III. Carrefour’s strategy What about globalization of distribution?... Globalization of distribution fascias has gone through three periods: - Through the 70’s, retailing firms wondered why they should turn themselves into international brands. The answers were more opportunistic than based on a strong analysis of the areas where they settled. For instance, Carrefour’s choice for Spain was linked to the executives’feeling and not to a systematic search. - Through the 80’s, firms began elaborating real occupational strategies. In France, Carrefour became the champion of growing markets. Still, it did not prevent the firm from failures in South Europe and South America. - Through the 90’s, the major issue for big retailing groups was: how to succeed in internationalizing? The stakes are very high: local markets tend to be saturated, and laws make it more difficult to open new surfaces. The beginning of the 2000’s is probably attending the emergence of a new problematic: which architecture can be given to multicontinental nets? How to combine stores conceptions, logistic and human organization in different environments, with common values? This will be the main question that leads our demonstration. According to Carrefour, the firms’ strategy is to “reinforce its market shares in each country, by developing the most adapted core activity, and playing on the three formats, namely hypermarkets, supermarkets, and hard discount stores”. Carrefour based its international corporate strategy on two basic principles. The first one was to become the number one retailer in each of its major store format, and the second was to generate synergies between those formats. 4 For instance, Comptoirs Modernes in 1998. 11 A. Which settlement strategy? Difficulties of cultural difference. A country can be only a little different from the one the firm was born in. Both consumption attitudes and commercial structure can be very similar. But, in other cases, the foreign countries can vary much. Then, it can be very difficult to settle. The firm can be confronted to many entry walls. These different situations determine the location strategy: organic growth, franchise, acquisition or joint-venture. Most of the time, main international firms partners are other international firms. Organic growth can be chosen in a highly competitive context. It defines the situation in which a retailer uses its own resources to buy others’ retailers sites, or create some ex-nihilo. This type of growth is limited by the capability of the firm to finance its initial losses. Domestic activities must subsidize new locations as long as the billing / sales have not been reached. In this case, everything lays on the adaptability of the original format to the targeted market. Acquisition consists in buying some multiple stores on the targeted market. An advantage of this choice is that it provides the firm with a net of local retailers, distributing systems, and customers. It is very efficient on mature markets, where it is easier to buy some markets shares than to conquest new ones. Still, acquisition means melting two different corporate cultures. In the past, Carrefour has grown predominantly through acquisition, most notably with the merger with Promodès in 1999. By buying 100% of the capital of GB, Carrefour mixed acquisition and organic growth. It shows how external growth has become a major strategy of firms. Actually, it is most of all through joint-ventures that Carrefour grows. At an international level, the strategy followed by the group to strengthen its grip on global retailing market was centered on partnerships with local retailers, with Carrefour retaining the majority stake in the joint-venture. The group’s most recent strategy, however, has been one of consolidation. Joint-venture is the most convenient structure to countries with a very different culture, and hard to access to. Most European groups use it to settle in Asia. It is necessary to associate with a local partner. Thus, choosing this partner and defining is attributions is quintessential. Thus, Carrefour constituted a joint-venture with an experienced retailer in Taiwan, President Enterprise (the concluded the same type of contracts with brands such as Budweiser, PepsiCo, Frito Lay et KFC). In Brazil as well, Carrefour was first on the market, and chose the best retailer. On the opposite, the firm was late on the Mexican market, compared to its competitors. Wal Mart had already created a joint-venture with Cifra, the most accurate Mexican retailer for this association. Carrefour had to choose another retailer. 12 B. Carrefour’s Strategy First of all, Carrefour’s move to an internationalization was prompted by an ask strategy. It means that it moved outside of the French borders in order to flee saturated European markets. It was looking for a market, as well as new regulatory conditions, and less competition. Then, it has to focus on transcultural expectations of customers. Everyone knows the universal customer does not exist. Needs, as well as cultural practices, vary; incomes differ even within one country. Then, the question is: how to invent universal store formats, according to such different realities? D. Bernard, Carrefour’s CEO, stated that: “We need a management able to deal with very different cultures, in economic environment ranging from a 2000 to a 20.000 dollars GNP”. The major difficulty for stores looking forward to settle abroad is to incite consumers of the targeted country to radically modify their daily consuming habits. This is why Carrefour decided it would have a 90% local assortment. It keeps local capabilities on products, and plays on the exchange of “savoir-faire” between countries. For instance, Carrefour in Greece decided in 2000 that the hypermarkets would be named “Carrefour”, while the supermarkets kept the name “Marinopoulos”. Hence, Carrefour’s strategy was one of geographic diversification. It is looking forward to settle in three new countries each year, most of all those with a high purchasing power. Still, once it has settled, it needs to gain markets shares. In this objective, we can identify four main lines of Carrefour’s strategy: - focusing on core activities while creating global declinations - adapting to the consumers’ tastes - creating a purchase power both at a European and international level All of this is possible only by maintaining at the same time an efficient human resources policy. Centering on core activities, conceiving strong concepts of exported stores, adapting the hypermarket concept to local uses. During recent years, Carrefour has focused more on its internal operations, in order to optimize its operations after acquisitions, than on external operations. There has been no real business diversification in Carrefour recent strategy. Carrefour goes on centering on its core activity: hypermarket, supermarket and hard discount. It has an acknowledged ‘savoir-faire” in different stores formats. Its strategy is then to create a real synergy between those formats. An exported store builds itself around a particular view of its core values, which is the basis of the corporate culture. 13 Most of the time, an exported store is built on a demonstrated competitive advantage on its country of origin. Hence, Carrefour managed internationalizing after getting a leader position through the formula of its founders: hypermarkets. But this condition is not satisfactory: it is necessary to differentiate from others on targeted markets. Success in Brazil and Argentina cannot hide failure in the USA in the 80’s. Thus, an exported store does not mean an identical assortment policy in every country or culture. For instance, French hypermarket is constituted by a 90% local assortment, whether Ikea is a 90% worldwide assortment. Insisting on the core formula of the selling concept is important. Even communication varies from one country to another. For instance, Carrefour is currently developing a communication campaign in France, based on the slogan “mieux consommer, c’est urgent”. But, of course, the firm will not use it in China. Carrefour’s strategy is to use its own formulas and formats, by adapting it. Its policy is supported by a decentralized organization, around more than 50 exploitation units, each being responsible for the development in its country. This is a way to favor the best adaptation between the consumer and the store products. For instance, in China, there are some big consumption differences between Beijing and Shanghai, where Carrefour needs to adapt. There, products can even be regionally declined. Of course, the challenge is to determinate to what extend format and original products have to be adapted to the targeted market. When 90% of products come from local market, as it the case of Wal-Mart and Carrefour, the retailer does not take advantage of the leverage effect of an international supply. Constituting a purchasing power and optimizing logistic channels Carrefour’s strategy is to optimize costs and purchases. Here, the questions are: to which level financial capabilities and decision making process need to be centralized? Which logistics tools must be shared? In every country Carrefour settled, logistic and supply channels benefit from a unified approach. This enables Carrefour to develop synergies between countries. The accounting system also is shared between all the stores. In March 2000, Global Net Exchange was launched. It is a platform that links major distributors including Carrefour and suppliers. Thus, Carrefour’s international purchases are completed by this platform. The objectives of GNX include the development of information with suppliers, to optimize the supply chain, the decline in overheads, and the development of new business partnerships with new suppliers. Its goal is to centralize purchases. As a matter of fact, exporting the brand is not enough. It is necessary to supply the stores in competitive conditions. One key factor to success lays in the capability to concentrate purchases for several countries. 14 It is highly probable that those distributors which will build a global architecture able to control logistic and products conception will be in a better rank to become global distributors. As the proposed products are already available on the market, they have to distinguish themselves by a perfect distribution system. Firms that internationalize have to open many stores, to transfer their “savoir-faire” as for distribution. In this strategy of globalization, men are an essential part of marketing, in being permanent ambassadors of the brand in front of customers. As a consequence, human resources have to be organized around international or multinational rules. Thus, many leaders now have an international formation. *************************************** 15 Conclusion: No new strategy but an acceleration of present politics… We can notice that internationalization is a way to grow. Still, results are far from being immediate. It means starting from scratch, and few scale benefits at the beginning. Asia, and most of all, China, will only represent 10% of Carrefour’s sales within 5 years. The other obstacle to internationalization is time: hence, the firm has to be faster than its competitors to be able to win the market. On this point, Carrefour undeniably keeps its advance on its competitors. Still, it does not fully benefit from this advantage: foreign locations absorbed 81% of investments in 2003, but only furnished one third of exploitation results. A general trend is that too confident distributors underestimate the cultural differences they are confronted to, and refuse any foreign capital and local competences, fearing to loose the control of the firm. Nevertheless, the recent change of Carrefour direction could announce deep changes but that’s not it at all! Indeed, Daniel Bernard resignation –the former President of the supervisory board – seemed to be the proof of a future change in Carrefour strategy. And yet, the new Chairman of the board, Jose Luis Duran, announced during a press conference that his strategy will be based on “the continuation but the acceleration of a certain number of actions” in the aim that the retailing group becomes again “a growth value“. Moreover, Luc Vandelve - the new President of supervisory board – declared that Carrefour would want to be “among the three happy few in every country and every store size”. So, nothing new except the fact that Carrefour will change its statue by the adoption of a double direction with the supervisory board in one hand and the board of directors in the other hand. Carrefour still wants to be international while remaining French, but what about a possible tender offer from the more American of the international retailing companies: Wall Mart? The danger is serious, let’s M. Duran and M. Vandelve arrange things so the company becomes again “a growth value”. Growth is good as long as you take a look in the mirror… 16