Red Bull

advertisement

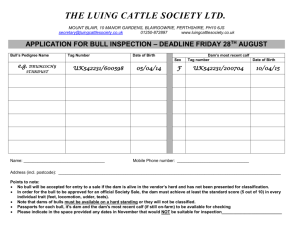

Red Bull Goes to China The energy drink Red Bull is produced by the Austrian Company Red Bull GMBH. Founded in 1987, the privately held energy drink producer achieved sales of more than € 5 billion in more than 160 countries in 2013. For 2014 projected sales are € 5.4 billion. According to the owner and CEO of the company, Dietrich Mateschitz, about 10% of sales were profits. The major part of Red Bull´s expenditures are marketing related. The energy drink producer has traditionally pursued a global communication strategy with high marketing activity for advertisement, sponsorship and product placement. Their slogan is "Red Bull gives you wings” and has been used consistently around the world. Red Bull sponsors two Formula-1 drivers, four football teams and hundreds of sport events. The management pursues the strategy to invest the major part of profits into the trade mark Red Bull. As a result, the company’s trade mark is the most precious one of Austria. Red Bull's rapid international expansion has earned it the undisputed number one position in the world's energy drinks market, according to Euromonitor International. In the face of growing competition from rival brands such as Hansen Natural Corp's Monster in the US, Red Bull is planning a more aggressive assault on Asia. Red Bull entered China in 2011. Red Bull's prime consumers are in their 20s and the large youth population in the region can potentially become energy drinks consumers in the long term. Last year Chinese energy drink sales reached 25 billion yuan, registering an annual growth of 45%, according to the market research group China Investment Research Consultant. Compared with the world's developed countries where the average per capita consumption of functional drinks is about 7 liter per year, the average Chinese consumer only drinks 1.5 liter of functional drinks. 1) Going global a) Red Bull has been truly committed to becoming a global company. The company has been entering new markets at breathtaking speeds. What are potential advantages and disadvantages of going global? b) What are important criteria to assess the attractiveness of the Chinese market for Red Bull? 2) Competitive analysis Red Bull has been very successful and made its owner one of the richest people in Austria. a) What is Red Bull’s main competitive advantage? b) How does Red Bull achieve this competitive advantage? What core competencies are required to pursue Red Bull’s global competitive strategy? 3) Red Bull’s global communication strategy a) Briefly describe the nature of a global versus a regional communication strategy. b) What are potential advantages and disadvantages of Red Bull’s global communication strategy? 4) Pricing a) A can of Red Bull is sold to wholesalers in the United States for $0.8. Assume the company wants to charge Chinese distributors the same price adjusted for additional shipping cost. Since the currency exchange rate is 1$ = 6 yuan, the price of a can would be 5 yuan (4.8 yuan +0.2 yuan for additional shipping cost). b) What are potential problems with this pricing strategy? c) How would you go about setting the price? 5) Culture China belongs to a high context culture. Using Hofstede’s dimensions, China rates high on Collectivism, low on Uncertainty Avoidance, high on power distance, and high on Masculine. What would you do differently in managing Red Bull’s sales force in China versus Red Bull’s sales force in the U.S.? 6) Financial Analysis a) Assume Red Bull is produced in Austria and shipped to Chinese wholesalers. The Chinese wholesalers pay in yuan. Consider the following cost structure for Red Bull in Austria’s Chinese business: Fixed cost Variable cost Cost for advertising in China Sales price to wholesalers Suggested sales price to consumers Sales forecast Currency exchange rate € 10,000,000 € 0.125 per can 240,000,000 yuan 5 yuan 14 yuan 100 Million cans 1€ = 8 yuan b) How many cans have to be sold to break even? c) What is the break even in Euro? d) What is the profit for Red Bull Austria if the sales forecast (100 Million cans) is correct? e) What happens to Red Bull Austria’s profit from its Chinese business if the value of the Euro is going up versus the U.S. Dollar? f) Management is concerned about the currency exchange rate risk concerning its Chinese business. What could management do to greatly reduce this exchange rate risk? Could they use futures?