Present Value of College v

advertisement

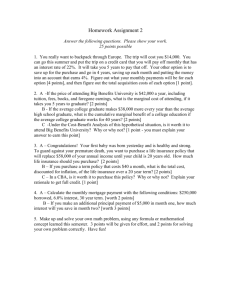

Present Value of College v. High School Module 7 Jeffrey Wilson, Douglas Brewer, Alexsandr Ioffe, Rudolf Johnson, Alexander Butler November 3, 2004 This analysis describes the present value of the income for an individual in the future. There are a few assumptions that can be made from this data. But first I suggest that a person makes decisions based on a marginal cost benefit structures. In this case a person would be deciding whether or not to attend college based on their value of money earned (benefit) in the future now and the price of going to college (cost). Going to college, in this case, is a good choice when marginal benefit is greater than or equal to marginal cost. But there is still the issue of defining who it is that can be compared. In this case persons with similar rates 1 should be compared. In doing so one can locate the present value of expected income a person earns if they were to attend college and for those who do not. What’s more, the value of attending college in terms of future earnings can be compared to going straight into the workforce after high school. Still a person has other considerations. Imagine they were to invest the money they would have otherwise used to attend college. That money would accrue interest until that person retired and therefore should be included in a person’s decision to attend college. But there are a fixed set of steps that must be made to end up with accurate results. Starting with an accurate model of the income streams of related individuals we can begin the calculations. We found our data on the starting incomes of a college graduate and a high school graduate to be $27,074.00 and $17,840 respectively. These figures were from the year 1998. We found the data in Jim Saxton’s report titled “Investment in Education: Private and Public Returns (I). Obviously the college student will start out at a high income then the high school graduate but the high school graduate has a four year head start. While the college student is incurring costs during school, the high school graduate is out in the real world making a steady income. The costs of college in 1998 were found to be $3,200 per year (II). This figure represents only the tuition costs of school. It does not cover the costs of dorms and meal plans because one has to eat and sleep somewhere whether or not he or she is attending a university. In order to obtain the increases in these two income levels of a normal life time of work we had to apply an interest rate to each. We used a flat rate of 4.0% to both the high school and college income streams. 1 Rate is the value a person puts on money in the future as described by the function PV=Ae^-rt (given that income is constant). r is significant in its description of a person’s present-oriontedness or their personal capacity or willingness to, in this case, attend college and forfeit present earnings. Income in dollars 200000 150000 100000 50000 0 -50000 18 Income Comparison 28 High School Income college 38 48 Year 58 The progression on each can be seen in the above graph. When looking at the comparison of the college student and the high school graduate, it may be wise to look at present value. Present value is the sum of money which if invested now at a given rate of compound interest will accumulate exactly to a specified amount at a specified future date. When comparing the present value of having a college education vs. entering the work force after high school graduation is not hard to see that present value figures are much higher for the person that went to college. In the beginning at age 18 the high school graduate may be having a higher income due to the fact that the college student is paying for education and not having any form of income. In that first year the high school graduate receives an income which at present value equals $17,840.58 while the college student present value is -21,040.58, the reason for such a low number for the college student is that the college student is missing his opportunity cost that comes from not working as well as the cost of college that he needs to pay. We do not see the benefit of college until the 5th year. In the fifth year the college student is working and earning an income that is higher than that of the high school graduate by a difference of $11,759.11 in present value terms. Through out the periods that the college graduate receives income, his income in present value terms will always be higher that that of the high school graduate, hence showing that going to college does pay off. The sum of the present values of high school v college can help us to find the year when the individual reaps the benefits of his or her college education. In the graph below you can see that by the time you are 36 or 37 the sum of the present value of college has exceeded that of high school. Sum of PV HS Sum of PV College Sum of PV's $600,000.00 $500,000.00 $400,000.00 PV $300,000.00 $200,000.00 $100,000.00 $0.00 -$100,000.00 18 28 38 48 58 -$200,000.00 Year In conclusion, our data indicates that it would be advantageous for an individual to attend college based on a comparison data for present value income. We were able to show that the sum of the present value for high school income falls below the sum of the present value for college income at 36 or 37 years of age. This conclusion would not hold true if we were to implement a 12 year horizon because the present value of high school income would exceed the present value of college income (age 34). The final consideration worth mentioning is total cost related to attending college. We used tuition as the only cost (fixed) associated with college. A more accurate representation might have been reached had we included other variable costs such as books, meal plans, room and board, etc. Finally, the decision to pursue a Masters Degree would affect this analysis by shifting the present value of college income further to the left. Therefore, the cost in relation to pursuing a Masters Degree is greatly increased which could possibly offset the potential future value of income. References (I): Saxton, Jim. "Investment In Education: Private and Public Returns." January 2000. Joint Economic Committee. 03 Nov 2004 <www.house.gov/jec/educ.htm>. (II): "College Cost Increases: Outpaces Inflation." 7 October 1998. CNN. 03 Nov 2004 <Cnn.com>.