Panama Colombia Market Study Tour Take

advertisement

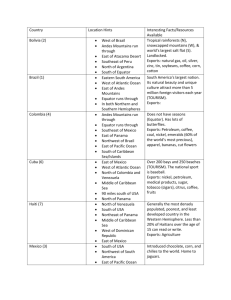

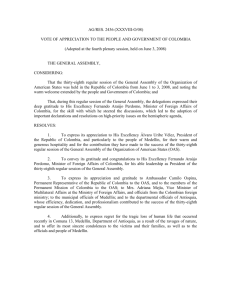

Panama Colombia Market Study Tour Take-Aways (March 25, 2011) Free Trade Agreements Panama and Colombia are strategic regional allies who desire a closer economic relationship with the U.S. and want to buy our products. Both nations view an FTA with the U.S. as a way to enhance their image and status as global strategic and economic partners. Colombia and Panama cooperatively negotiated and quickly passed the FTAs in their own countries nearly 5 years ago. Political posturing and a lack of understanding of the negotiations to date and the agreements themselves have held up the two FTAs in the U.S. Additional delays in passing the FTAs will only cause further damage to these important relationships. Panama and Colombia are complimentary, not competing ag markets to the U.S., exporting flowers, tropical fruits, coffee, and other products while importing feed grains, meat, and processed foods. Not having the FTAs signed with Panama and Colombia is already damaging agricultural and other exports from the U.S. and costing thousands of jobs. In 2008 alone, U.S. exports to Colombia fell 50% and agricultural exports are estimated to have declined by $800 since that year. In 2008, the U.S. sold $600 million worth of corn to Colombia, by 2010 U.S. exports fell to $200 million as Argentine and Brazilian corn received more favorable tariff treatment than U.S. corn. Agricultural exports in particular are being supplanted by Argentine and Brazilian corn and soybeans due to their Colombia-MERCOSUR FTA. The U.S. now stands to lose its opportunities in Colombia's important wheat and beef import markets. The Colombia-Canada FTA is ratified in both countries and will be implemented in June 2011. When that occurs, Canadian beef, wheat, and other ag (and manufactured products) will be enter Colombia at much lower tariffs than their U.S. counterparts. The U.S.-Colombia FTA will directly benefit Illinois by eliminating tariffs on: - ag products including soybean meal and flour, corn, feed grains, and pork - bulldozers and other construction equipment - road tractors and off-highway trucks - chemicals The U.S.-Colombia FTA is an "WTO-plus" - it requires Colombia to meet higher labor, environment, and sanitary and phytosanitary standards than are currently in place. Not having a signed agreement is, therefore, more unfair to U.S. workers than passing the agreement. (continued) Transportation and Infrastructure The long term health of U.S. agriculture and the entire economy depends on this nation making the necessary upgrades in our transportation system. Growing global demand is already taxing the U.S. transportation system, and an "aging" and underinvested logistical infrastructure is damaging US export prospects. Ag export groups have described the situation of trying to handle the rising demand for U.S. ag exports with our current infrastructure as "trying to attach a garden hose to a fire hydrant". Exporters like CGB/Zen-Noh and shipping companies like Evergreen are making the needed investments in technology and infrastructure to better meet growing demand and changing needs (e.g., more container shipments). Container shipping "changed the game" in the last few years, providing opportunities: - for outboard freight from Asia - to get into smaller ports - for identity preserved grains. Panama and Colombia see the value of investing in infrastructure and are committed. End users (China) and others (Europe, the U.S.) are also investing in both countries. It was amazing to see infrastructural developments and future plans in Panama and Colombia. Not only will these developments make U.S. products more accessible, but they will also reduce the cost of transport to those countries. Infrastructure improvements in Panama and Colombia will directly benefit Illinois heavy equipment manufacturers (Caterpillar and Navistar) as well as ag shippers. It is troubling that the U.S., which has so much to lose, cannot find the leadership to invest in its infrastructure., while 78% of Panamanians voted to expand the Canal. The Market Study Tour participants found it depressing that the U.S. can't seem to manage to find and spend the $30 million requested for immediate upgrades to 75 year old locks and dams in the U.S., when Panama is spending $5.25 billion just to widen the canal to accommodate larger container vessels.