Chapter 3—Building Customer Satisfaction, Value, and Retention

advertisement

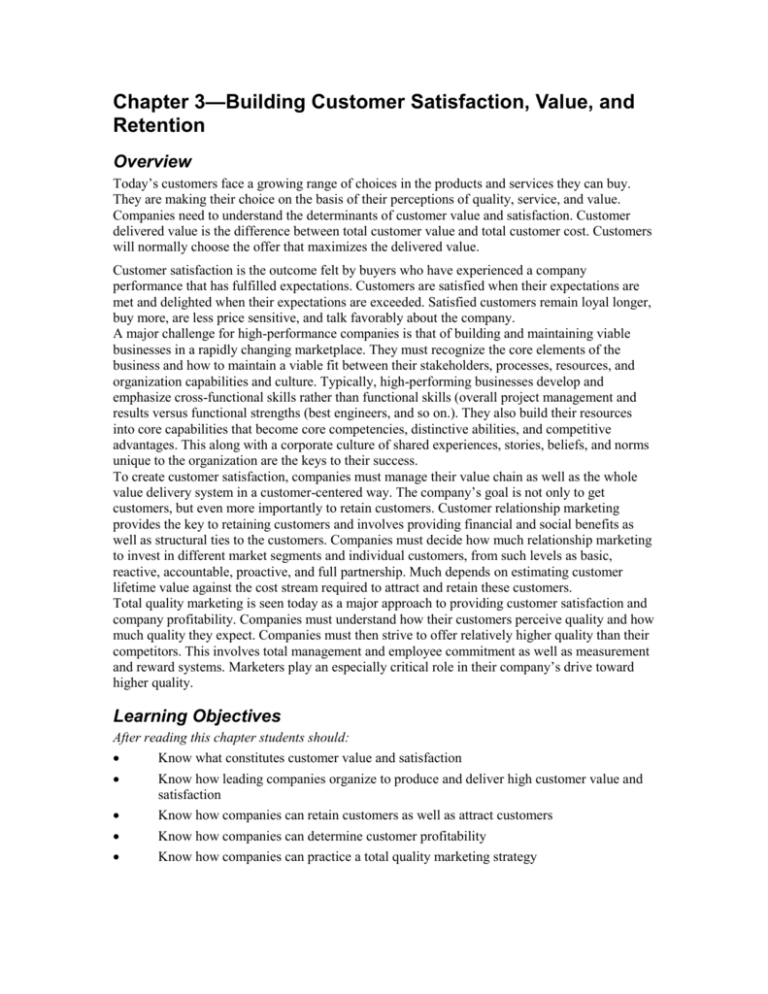

Chapter 3—Building Customer Satisfaction, Value, and Retention Overview Today’s customers face a growing range of choices in the products and services they can buy. They are making their choice on the basis of their perceptions of quality, service, and value. Companies need to understand the determinants of customer value and satisfaction. Customer delivered value is the difference between total customer value and total customer cost. Customers will normally choose the offer that maximizes the delivered value. Customer satisfaction is the outcome felt by buyers who have experienced a company performance that has fulfilled expectations. Customers are satisfied when their expectations are met and delighted when their expectations are exceeded. Satisfied customers remain loyal longer, buy more, are less price sensitive, and talk favorably about the company. A major challenge for high-performance companies is that of building and maintaining viable businesses in a rapidly changing marketplace. They must recognize the core elements of the business and how to maintain a viable fit between their stakeholders, processes, resources, and organization capabilities and culture. Typically, high-performing businesses develop and emphasize cross-functional skills rather than functional skills (overall project management and results versus functional strengths (best engineers, and so on.). They also build their resources into core capabilities that become core competencies, distinctive abilities, and competitive advantages. This along with a corporate culture of shared experiences, stories, beliefs, and norms unique to the organization are the keys to their success. To create customer satisfaction, companies must manage their value chain as well as the whole value delivery system in a customer-centered way. The company’s goal is not only to get customers, but even more importantly to retain customers. Customer relationship marketing provides the key to retaining customers and involves providing financial and social benefits as well as structural ties to the customers. Companies must decide how much relationship marketing to invest in different market segments and individual customers, from such levels as basic, reactive, accountable, proactive, and full partnership. Much depends on estimating customer lifetime value against the cost stream required to attract and retain these customers. Total quality marketing is seen today as a major approach to providing customer satisfaction and company profitability. Companies must understand how their customers perceive quality and how much quality they expect. Companies must then strive to offer relatively higher quality than their competitors. This involves total management and employee commitment as well as measurement and reward systems. Marketers play an especially critical role in their company’s drive toward higher quality. Learning Objectives After reading this chapter students should: Know what constitutes customer value and satisfaction Know how leading companies organize to produce and deliver high customer value and satisfaction Know how companies can retain customers as well as attract customers Know how companies can determine customer profitability Know how companies can practice a total quality marketing strategy Chapter Outline I. II. III. IV. Introduction A. Chapter focus 1. How companies can win customers 2. How companies can outperform competitors B. Marketing starts with good products that meet a need 1. Marketing can happen only when the firm has a competitively superior customer value-delivery system 2. A customer-focused firm with a value marketing orientation is essential Defining customer value and satisfaction A. Customer perceived value 1. Customer delivered value a) Difference between total customer value and total customer cost or “profit” to the customer b) Total customer value is the expected bundle of benefits 2. Total customer cost a) Bundle of costs consumers expect to incur in evaluating, obtaining, and using the product or service 3. Customer value assessment—weighing the value against all of the costs B. Total customer satisfaction 1. Perceived performance and expectations, and how they contribute to overall satisfaction 2. Methods of tracking and measuring customer satisfaction (includes customer satisfaction surveys, ghost shopping, and lost customer analysis) Nature of high-performance businesses A. Stakeholders 1. Customers, employees, suppliers, distributors B. Processes 1. Work flows through an organization to achieve cross functional skills C. Resources 1. Labor, power, materials, machines, information, energy, and so on, to achieve core competence, distinctive ability(ies), and competitive advantage D. Organization and organizational culture 1. Structures and policies. Corporate Culture is the shared experiences, stories, beliefs, and norms that characterize an organization Delivering customer value and satisfaction A. Value chain 1. Used as a tool for identifying ways to create more value, includes the nine value-creating activities B. Value-delivery network 1. V. VI. VII. To be successful a firm has to look for competitive advantages beyond its own operations 2. Building a better network can be a highly successful differentiation tactic that leads to greater customer satisfaction Attracting and retaining customers A. Attracting customers 1. Becoming harder to please, smarter, more demanding, and less forgiving B. Computing the cost of lost customers 1. Compute customer defection rate (4-step process) and steps to reduce the defection rate C. Need for customer retention 1. Cost of attracting a new customer is five times that of retaining a satisfied current customer D. Measuring customer lifetime value 1. Details developed in the text E. Customer relationship management (crm): the key—lifetime customer equity 1. The main drivers of customer equity a) Value equity b) Brand equity c) Relationship equity 2. The result is an integration of value management, brand management, and relationship management 3. The levels of investment in CRM building move from basic marketing (sell) to partnership marketing F. Forming strong customer bonds: the basics 1. Adding financial benefits—frequency marketing programs and club marketing programs 2. Adding social benefits—individualize and personalize customer relationships 3. Adding structural ties—help customers manage themselves Customer profitability, company profitability, and total quality management A. Measuring profitability 1. The ultimate test of a profitable customer is a) A person, household, or company that over time yields a revenue stream that exceeds by an acceptable amount the company’s cost stream of attracting, selling, and servicing the customer b) A company should not attempt to pursue and satisfy all customers B. Increasing company profitability 1. Based on sustainable competitive advantage (Porter) 2. However, at best it may be leverageable advantage Implementing total quality management A. Total Quality Marketing (TQM)—quality is the key to everything else 1. VIII. Most customers will no longer accept or tolerate average quality performance 2. There is an intimate connection among product and service quality, customer satisfaction, and company profitability B. Role of marketing now is 1. Extended beyond external marketing activities 2. Includes internal marketing roles to act as the customer’s watchdog within the organization Summary Lecture—Creating Customer Relationships that Last This lecture is intended for use with Chapter 3, “Building Customer Satisfaction, Value, and Retention.” The focus is on the increasingly powerful role of customers in the marketing process and the need for marketers to provide value that exceeds customer expectations. The concept of relationship marketing is also presented for further discussion, providing a link with other areas of the text. Objectives Help students to better understand the changing role of the customer in today’s marketplace To explain the concepts of product and service quality as they contribute to perceived value for the customer To present specific methods whereby marketers can engage in value-creating activities Discussion Introduction In the contemporary marketplace, it is hard to believe there was ever a time when customers were not treated as an integral part of the exchange process. Prior chapters consider some of the many shifts taking place in today’s marketing environment. Competition in the marketplace, along with advancing technology, affords customers the ability to learn significantly more about the products they will consider purchasing. The same factors also have created both the need and the opportunity for marketers to know their customers on a more personal level. Ever-increasing competition has forced marketers to seek out the information necessary to provide customers with the products and services they truly desire. Technology, when used to create a customer database, is one way marketers are answering to this new trend. Product development will be discussed in a later chapter; for now, we will focus on building satisfaction through customer relationship development activities. The concept of perceived value is based on Kotler’s explanation of customer delivered value. Customers, like marketers, seek to profit from an exchange. Perceived value is aptly named because it supports the notion that the customer and not the marketer determine value. The marketer’s responsibility is to create value, in both product and service quality, that lead to increased satisfaction and encourage a high perceived value. For example, service excellence is determined by customer perceptions and motivated by customer needs. Ken Blanchard, author of The One Minute Manager, says that the secret to competing successfully in today’s environment is to provide customers with service that is so far above their expectations that it is perceived to be legendary. Marketers, with both large and small organizations, can engage in activities that exceed expectations and lead to customer delivered value. Marketers with large organizations have the ability to tap into a sophisticated database, utilizing past purchase data to customize marketing programs. These marketers also can become experts at “guerrilla marketing,” or the implementation of local promotions for the purpose of getting closer to customers. Furthermore, large organization marketers also have the ability to create Web site and store-specific marketing programs that create retailer loyalty, build differentiation, and increase sales in desired market areas. Small business marketers, however, also have many opportunities to create strong customer relationships. By placing extra focus on what might generally be considered a commodity product, these marketers can stimulate demand and compete with large rivals in the same industry. If a company is small enough, its top executives can serve as the communication link for the company and various external publics, such as customers and retailers. Even internal publics, such as the sales staff, should be encouraged to make suggestions to top management. Finally, database programs are becoming more and more affordable, making direct-mail programs a viable option even for smaller firms. This leads to a discussion of an evolving direction for relationship marketing. Relationship Marketing Expanded Even though it is becoming increasingly possible, why would any rational customer actually want a “relationship” with the company that makes his or her razor blades, or dishwasher soap, or toilet paper? The answer is that the consumer probably would not necessarily desire a “relationship” with these companies, but the customer will want more spare time. Accordingly, he or she might like to have routine or repeat purchases for soap, paper towels, grocery staples, and so forth automated. What if you could turn on your personal computer or your interactive television set, call up a list of last week’s grocery purchases, make a few changes, and then simply order them delivered to your door? And what if, when you did this, the computer reminded you to order certain items such as toothpaste and paper towels because you might be running low on those items? What if, to help choose the groceries you wanted for your family, you asked the computer for a week’s worth of dinner menus, specifying recipes and ingredients? In many product categories, you don’t really care what brand the computer selects, but in some product categories you have a list of “approved” brands, as well as brands you never want to see again. The computer automatically seeks out the least expensive basket of products that meet these criteria. Once you confirm it, your order is paid for via credit card or direct debit. The elapsed time for all this shopping was just seven minutes. Now, from the marketer’s side of the equation, consider the immense business opportunity in serving your customers more thoroughly. Delivering grocery staples is one thing. But what about pharmaceuticals? Dry cleaning and laundry? Ready-made meals? FedEx and other pickups and deliveries? The companies become, in essence, share-of-customer marketers. A marketer’s primary task in the one-to-one future is not to find customers for the marketer’s products but rather to find more products and services for its customers. Consider that most retail chains have not really tried to figure out how to offer such conveniences as home delivery, because they don’t want to consider this for various internal reasons. They want customers to need to come in to the store (or into the virtual store) because they like to have customers walking up and down the aisles (or virtual aisles), making last-minute impulse purchases. For a large part of their business, today’s retailers depend on inconveniencing customers by requiring them to drive to their store (or virtual store) location to do their shopping. However, consider that marketers today jam twice as many products in the average supermarket as there were just over a decade ago (30,000 products now, compared with 15,000 in 1985). Furthermore, commercial messages abound for these products, the overwhelming majority of which do not now appeal to any particular consumer. Instead, we must all fight our way through the increasing number of advertising messages to pick out the information we need, just as we must struggle through the proliferating barrage of products in or out of stores just to select the ones we want to buy. Every shopping trip becomes an increasingly difficult attempt to accomplish the same basic task, thus adding to the increasing use of the Internet. Having an ability to buy these products more conveniently doesn’t mean people will completely stop going into stores, nor does it mean advertising will cease to exist. But if getting your regularly consumed products could be made nearly as convenient as “pushing a button,” wouldn’t you go into the store less frequently? Wouldn’t you, for the most part, prefer not having to shop for routine things? You could always choose to go out if you wanted to—after all, shopping is often a social experience, as well as a necessity. As with stores and other enterprises that cater to the interests of the interactive consumer (including information and entertainment providers), the manufacturer will be able to succeed competitively only by relying on individual feedback. For the manufacturer, success in the oneto-one marketing environment will mean soliciting information from consumers, individually, and then using that feedback to customize an offering to each individual customer, one at a time. This is the essence of one-to-one marketing. Marketing Spotlight—Charles Schwab Charles Schwab founded the discount brokerage named for him in 1974. The company’s no-frills investment offerings were predicated on Charles Schwab’s distaste for traditional brokers, who he labeled “hucksters of inside information, always trying to get me to buy this product or investment.” Until 1993, Schwab’s brokers were instructed not to offer investment advice, but rather to refer curious customers to publicly available research from Standard & Poor’s or Morningstar. Schwab benefited from the online trading boom. Long before any of the traditional brokerage houses considered an e-commerce move, in 1997 Schwab was one of the first discount brokerages to offer online trading. It offered online trades at $29.95 for the first 1,000 shares, compared with the per-trade fees that exceeded $100. Starting at zero in 1995, online trades accounted for 85 percent of all trades executed by Schwab by 2001. The company’s retail assets grew threefold to almost $1 trillion during the same time period, putting it in league with the biggest brokerages in America. Between 1997 and 2000, daily trades rose 183 percent, while profits increased 112 percent during that time frame. Schwab’s marketing activities helped the company become a household name synonymous with online trading. Early ads used real Schwab customers and employees in testimonial advertisements. In 1999, the company enlisted celebrity spokespersons to advertise its full-service online investing offerings. The humorous ads featured sports stars such as football player Shannon Sharpe and tennis star Anna Kournikova in cameo roles as Schwab customers who surprised competitors with their knowledge of investing principles. The tagline served to reinforce Schwab’s difference from online-only brokerages: “We’ve created a smarter kind of investing. We’ve created a smarter kind of investor.” These ads were part of Schwab’s $200 million marketing budget for 1999. In 2001, as online trading slowed in the wake of the dot-com crash, Schwab sought to expand its business by providing its customers with a greater number of services. Rather than rely on a high volume of low-cost trades to drive revenues, Schwab began focusing on providing investment advice to its clients. In new brokerage offices, Schwab placed financial advisers from whom clients could seek investment tips and other services for a fee. Schwab also considered offering proprietary stock research for its customers. Industry experts expected these new services would recast Schwab in a role more similar to traditional brokerage houses. A former Schwab executive predicted, “Schwab will be a lot closer to Merrill Lynch than it is to the Schwab of yesterday.” (Sources: John Gorman, “Charles Schwab, Version 4.0,” Forbes, January 8, 2001, pp. 89–95. Charles Gasparino and Ken Brown, “Schwab’s Own Stock Suffers from Move into Online Trading,” Wall Street Journal, June 19, 2001, p. A1. Rebecca Buckman and Kathryn Kranhold, “Schwab Serves Up Sports-Themed Ads,” Wall Street Journal, August 30, 1999, p. B9.) Questions 1. What changes in the marketing environment does the Schwab marketing effort reflect? How has Schwab effectively anticipated the needs of the market? 2. Draw on recent economic developments to anticipate where the next changes likely will be for Schwab. Consider what past and future events might have a substantial impact on the way it operates in the future.