Toys R Us Case

advertisement

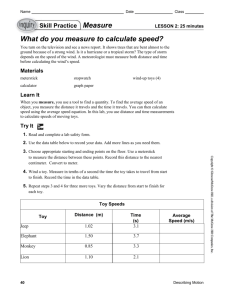

Toys “R” Us in Japan? The first TRU store was opened in Washington, D.C. in 1957 by Charles Lazarus. Three stores opened over the next 10 years and Lazarus sold his ownership stake for $7.5 million to Interstate Stores in 1966. When problems with other Interstate divisions drove the corporation into bankruptcy proceedings, Lazarus regained control in 1978 through a management-led buyout. The TRU strategy is based upon price, selection, and keeping stores in-stock. As Lazarus explained, “When a customer walks through our doors with a shopping list, we better have 95 percent of what’s on her list or we’re in trouble.” 3 The EDLP (every day low prices) strategy and in-stock image stimulates purchasing year-round instead of primarily during the Christmas season. Baby diapers and formula are sold at or below cost, in hopes of winning over new parents and keeping them as customers as their children mature. This strategy has won TRU a steadily increasing share of the retail toy market, rising to about 22 percent in 1995. TRU shifted its goals for expansion dramatically in 1983. The firm entered the children’s clothing market with Kids “R” Us and established the International Division. Joseph Baczko was recruited from his job as chief executive of the European operations of Max Factor to lead international expansion. Baczko perceived that there were increasing global opportunities in the toy business. In an article in 1986 for the industry trade magazine, Playthings, he noted that customers overseas had higher disposable income, were more educated, and had more free time. Moreover, these buyers were more price conscious and tended to prefer specialty retailers, factors that favored the international expansion of TRU.4 The first international store opened in 1984 in Canada. In 1986, TRU struck joint venture deals in Singapore and Hong Kong. The company next expanded to the United Kingdom in 1987, into Germany in 1988, and into France and Taiwan in 1989. By 1994, TRU had penetrated the Nordic countries and developed new franchise relationships with Top-Toy A/S, the leading Scandinavian toy retailer. The franchise division also led to the entry of TRU to Israel, Saudi Arabia, and the United Arab Emirates, markets which would otherwise be prohibitive because of both cultural differences and restrictive laws. TRU learned to adapt to the different competitive retail situations in each country that it entered. Different countries can have drastically different competitive environments. For example, supermarket toy sales as a percentage of all toy sales range from about 4% in the United Kingdom to 48% in France. High costs in land, labor, and distribution created problems in maintaining the TRU price and selection strategy. Low-cost retail sites proved difficult to find in England, leading TRU to try smaller store formats. In Germany, competing retailers initially pressured vendors to not sell to TRU. Nevertheless, sales increased and store expansion was rapid. Even in England, where British parents spend less on toys, the number of shoppers per store was very high. New store openings attracted 40,000 shoppers in Hong Kong and 20,000 to a one acre site in Frankfurt. International sales grew to about one-quarter of company revenues by 1994. Customer preferences can vary enormously among countries, hence TRU had to carefully control its product mix. Porcelain dolls are carried in Japan, while Germans prefer wooden ones. TRU sells a version of Monopoly in Hong Kong that replaces “Boardwalk” and “Park Place” with “Sheko” and “Repulse Bay,” and those in France stock scale models of the French high speed train. While about 70% to 80% of its European toy sales are the same items as those in America, in Japan, this number is only about 30% to 40%. TRU has constantly worked to refine the warehouse toy store concept in its home market. To better service customers, TRU linked store managers’ pay to customer service activities and tried “store within a store” or “boutique” concepts. These included Lego shops, “plush” or Stuffed Animal shops, Learning Centers, and entertainment software sections. The most successful of these was the book department, called “Books ‘R’ Us,” a joint effort with Western Publishing that requires special chairs, lights, carpets, and tables. Though it may not have as wide a selection of books as bookstores, the book department enables TRU to pick up sales from parents supplementing a toy purchase with a book having better “educational” value. As a specialty store “category killer,” TRU competes across retail categories, not just with toy stores. To better compete with discounters, in 1994 TRU developed coupon books to offer deeper price savings. A “Big Toy Book Catalogue,” a “Video Game & Electronic Toys Catalogue,” and an Internet connection were introduced as shopping aids. Additionally, the “Toy Guide for Differently Abled Kids” offers professional evaluations of toys for families of disabled children; this complements the TRU corporate giving program which focuses on improving the health care needs of children. Japan was a particularly attractive target for TRU for several reasons. Japan was the second largest toy market in the world. By the 1980s, Japan had developed a particularly high per capita income and toys sales had been growing despite the low birth rate. Spending on children was particularly high, particularly in the early years of childhood, yet toy shops in Japan tended to have small selections and high prices. Is there an opportunity for Toys R Us success in Japan? Assignment: 1. Conduct a SWOT analysis based on the information given in the case, any business insights you might already have, as well as your own imagination. 2. Make an executive business decision: Should Toy R Us make the move to Japan?