Chapter 1

advertisement

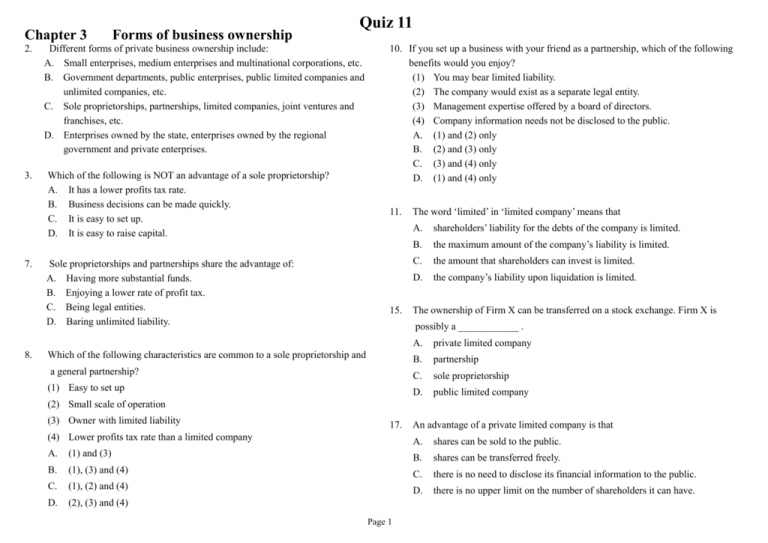

Chapter 3 2. 3. 7. 8. Forms of business ownership Quiz 11 Different forms of private business ownership include: A. Small enterprises, medium enterprises and multinational corporations, etc. B. Government departments, public enterprises, public limited companies and unlimited companies, etc. C. Sole proprietorships, partnerships, limited companies, joint ventures and franchises, etc. D. Enterprises owned by the state, enterprises owned by the regional government and private enterprises. Which of the following is NOT an advantage of a sole proprietorship? A. It has a lower profits tax rate. B. Business decisions can be made quickly. C. It is easy to set up. D. It is easy to raise capital. Sole proprietorships and partnerships share the advantage of: A. Having more substantial funds. B. Enjoying a lower rate of profit tax. C. Being legal entities. D. Baring unlimited liability. 10. If you set up a business with your friend as a partnership, which of the following benefits would you enjoy? (1) You may bear limited liability. (2) The company would exist as a separate legal entity. (3) Management expertise offered by a board of directors. (4) Company information needs not be disclosed to the public. A. (1) and (2) only B. (2) and (3) only C. (3) and (4) only D. (1) and (4) only 11. 15. The word ‘limited’ in ‘limited company’ means that A. shareholders’ liability for the debts of the company is limited. B. the maximum amount of the company’s liability is limited. C. the amount that shareholders can invest is limited. D. the company’s liability upon liquidation is limited. The ownership of Firm X can be transferred on a stock exchange. Firm X is possibly a ____________ . A. private limited company Which of the following characteristics are common to a sole proprietorship and B. partnership a general partnership? C. sole proprietorship (1) Easy to set up D. public limited company (2) Small scale of operation (3) Owner with limited liability 17. An advantage of a private limited company is that (4) Lower profits tax rate than a limited company A. shares can be sold to the public. A. (1) and (3) B. shares can be transferred freely. B. (1), (3) and (4) C. there is no need to disclose its financial information to the public. C. (1), (2) and (4) D. there is no upper limit on the number of shareholders it can have. D. (2), (3) and (4) Page 1 18. A public limited company has a board of directors elected by _________ , and it 26. Many partnerships choose to change to private limited companies because (1) more capital can be raised. (2) the tax rate is lower. (3) ownership can be transferred freely. A. (1) only B. (1) and (2) C. (2) and (3) D. (1), (2) and (3) 28. Which of the following concerning a joint venture is correct? A. There are only two companies in the venture. B. The companies must share the profit equally. C. It is formed to achieve specific purposes. D. The companies must make equal contribution to the venture. 32. What are some of the advantages of a joint venture? (1) Different knowledge and expertise possessed by companies can be shared. (2) Unilateral decision-making can be avoided. (3) Financial resources of companies can be pooled together. (4) Local markets can be protected. A. (2) and (4) B. (1) and (3) C. (1), (2) and (3) D. (1), (3) and (4) __________a separate legal existence. 19. A. preference shareholders … has B. preference shareholders … doesn’t have C. ordinary shareholders … doesn’t have D. ordinary shareholders … has Which of the following is an advantage of running a public limited company over a private limited company? A. A public limited company has a wider source of capital. B. A public limited company enjoys a lower profits tax rate. C. A public limited company must have more capital. D. A public limited company is a separate legal entity but a private limited company is not. 22. The following is the information about two firms: Firm A Firm B Source of capital Provided by the owners only Raised by issuing shares Legal identity Not a legal entity A legal entity Number of owners 15 10 Financial statements Disclosure to public not required Disclosure to public not required The forms of ownership of Firm A and Firm B are ___________ and ___________ 33. Which of the following sentences wrongly describes the relationship between a franchisor and a franchisee? respectively. A. the franchisee is required to operates its business according to the A. private limited company … partnership B. partnership … public limited company C. partnership … private limited company B. The franchisor provides management training to franchisees. D. public limited company … private limited company C. The franchisor needs to pay franchise fee to the franchisee. D. The franchisees share the cost of promotional campaigns which are carried franchisor’s requirements. out by the franchisor. Page 2 35. 36. 44. Which of the following are the advantages of becoming a franchisee? 49. In Hong Kong, an SME is defined by the Industry and Trade Department as an (1) It is easier to enter a market. enterprise with: (2) It is easier to execute his/her new business ideas. A. less than 100 employees in the non-manufacturing sector. (3) Financial support will be provided by the franchisor. B. less than 50 employees in the manufacturing sector. (4) He/She can have a lower purchasing cost. C. less than 20 employees in the non-manufacturing sector. A. (1) and (4) D. less than 100 employees in the manufacturing sector. B. (1) and (3) C. (2) and (4) D. (1), (2) and (4) only 51. following is NOT the problem related to small size that most SMEs encounter? Which of the following are the advantages of obtaining a franchise from a well-known company? (1) Receiving training and advice from the franchisor (2) Gaining full control of the business upon the payment of royalties to the franchisor (3) Setting up a new business more quickly A. (1) and (2) B. (2) and (3) C. (1) and (3) D. (1), (2) and (3) Small size is the fundamental characteristic of all SMEs. Which of the Which of the following descriptions about public enterprises and government departments is correct? A. The staff members of both bodies are civil servants. B. Public enterprises set directions independently. C. Both bodies are responsible for providing particular public services. D. Both bodies are directly controlled by the government. Page 3 A. No economies of scales. B. Wide pool of funding. C. Fail to capture market opportunities due to limited production capacity. D. Financial and personnel constraints.