Samples of exam questions

advertisement

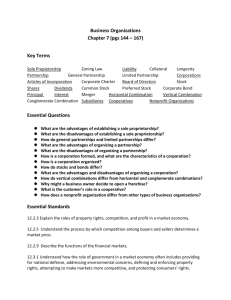

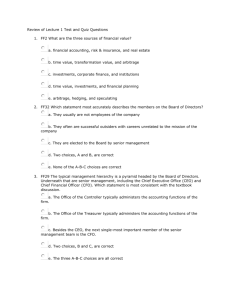

FIN 303 Samples of Possible Exam Questions (for Chapter 1) 1.) The “intrinsic value” of a firm’s stock price is: a. Always equal to its current price in the stock market. b. Is a number everyone agrees to and is posted on web sites. c. Is an estimate of the stock’s true value based on accurate risk and return data but cannot be measured precisely. d. Can be easily and accurately estimated by anyone. e. All the above. f. None of the above. (Answer: c) 2.) Suppose 4 honest individuals gave you their estimates of Stock X’s intrinsic value. If their estimates differed, which one would you have the most confidence in being accurate? a. b. c. d. e. f. Your best friend who is currently majoring in philosophy. A professional security analyst who has an excellent reputation. Your finance professor. The chief financial officer (CFO) of Company X. All the above. None of the above. (Answer: d) 3.) TIAA-CREF manages teachers’ pensions. It is the largest institutional shareholder in the United States. Prior to 1993, it responded to company poor performance by “voting with its feet”, which means it: a. Sold the company’s stock if it thought the company management was making bad decisions. b. Bought the company’s stock if it thought the company management was making bad decisions. c. Walked out of the room at the company’s stockholder meetings. d. Raised its feet instead of its hands to vote at stockholder meetings. e. All the above. f. None of the above. (Answer: a) 4.) A firm’s commitment to business ethics can be thought of as a company’s attitude and conduct toward its: a. b. c. d. e. f. employees. customers. community. shareholders. All the above. None of the above. (Answer: e) Page 1 of 3 5.) Which of the following statements is CORRECT? a. One advantage of forming a corporation is that equity investors are usually exposed to less liability than in a partnership. b. Corporations face fewer regulations than sole proprietorships. c. One disadvantage of operating a business as a sole proprietor is that the firm is subject to double taxation, at both the firm level and the owner level. d. It is generally less expensive to form a proprietorship than a corporation because, with a proprietorship, extensive legal documents are required. e. If a partnership goes bankrupt, each partner is exposed to liabilities only up the amount of his or her investment in the business. (Answer: a) 6.) Which of the following could explain why a business might choose to operate as a corporation rather than as a sole proprietorship or a partnership? a. Corporations generally face fewer regulations. b. Less of a corporation’s income is generally subject to taxes. c. Corporate shareholders are exposed to reduced liability, but this factor is offset by the tax advantages of incorporation. d. Corporate investors are exposed to unlimited liability. e. Corporations generally find it easier to raise capital. (Answer: e) 7.) The primary operating goal of a publicly-owned firm interested in serving its stockholders should be to a. b. c. d. Maximize its expected total corporate income. Maximize its expected EPS. Minimize the chances of losses. Maximize the stock price per share over the long run, which is the stock’s intrinsic value. e. Maximize the stock price on a specific target date. (Answer: d) 8.) The acquisition of a company over the opposition of its management: a. Is called a hostile takeover. b. Is a strategy used by corporate raiders. c. Is a threat that motivates managers to act in their shareholders’ best interests. d. All of the above. e. None of the above. (Answer: d) Page 2 of 3 9.) Your best friend is the CFO of Jay Inc. She just told you that her company will announce next week a huge increase in the quarterly dividend that will surely make the stock price increase next week. She tells you to buy her company’s stock immediately so you can profit. She also tells you not to tell anyone else because only she and the company’s board know about this information. If you buy, you will be: a. b. c. d. e. f. Insider trading. Committing a crime, punishable by prison time. Committing a crime, punishable by a monetary fine. Doing something unethical. All the above. None of the above. (Answer: e) 10.) Useful motivational tools that motivate managers to act in their shareholders’ best interests are: a. b. c. d. e. f. Compensation packages that include stocks and options. The threat of firing. The threat of a hostile takeover. Regulations. All the above. None of the above. (Answer: e) 11.) The person directly responsible for a company’s accounting system, raising capital, and evaluating the financial costs and benefits of major investment decisions is usually the company’s: a. b. c. d. e. f. Chairman of the Board of Directors. Chief executive officer (CEO). Chief financial officer (CFO). The shareholders. All the above. None of the above. (Answer: c) 12.) The person most responsible for a company’s strategic policies is usually the company’s: a. b. c. d. e. f. Chairman of the Board of Directors. Chief executive officer (CEO). Chief financial officer (CFO). The shareholders. All the above. None of the above. (Answer: a) Page 3 of 3